Thank you for your generous contribution to our charity! Your support plays a vital role in helping us achieve our mission and make a real difference in the lives of those we serve. We truly appreciate your commitment to our cause, and we want you to know that every donation counts. Want to learn more about how your donation will impact our work? Read on!

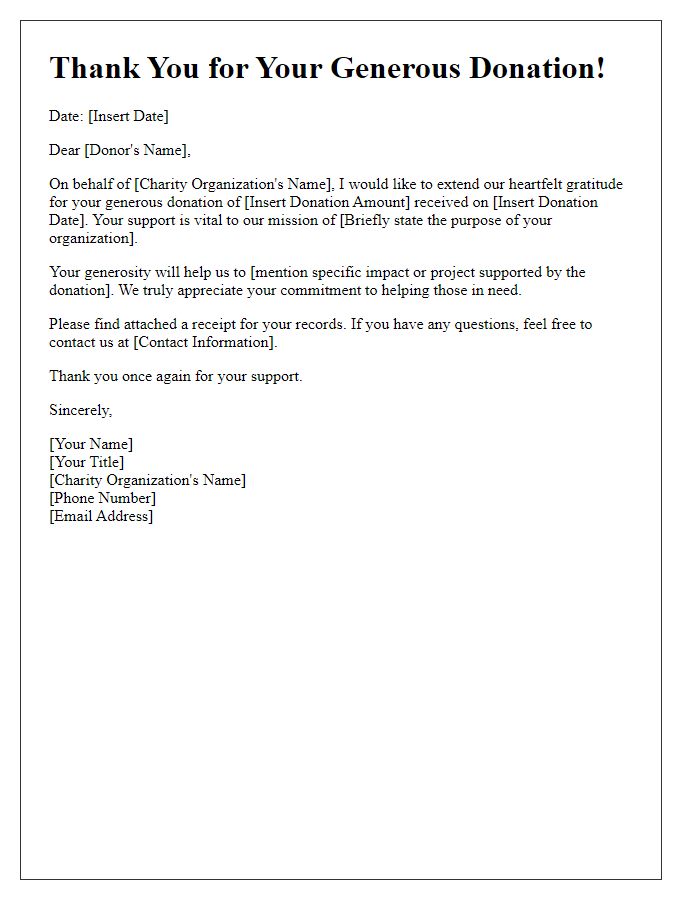

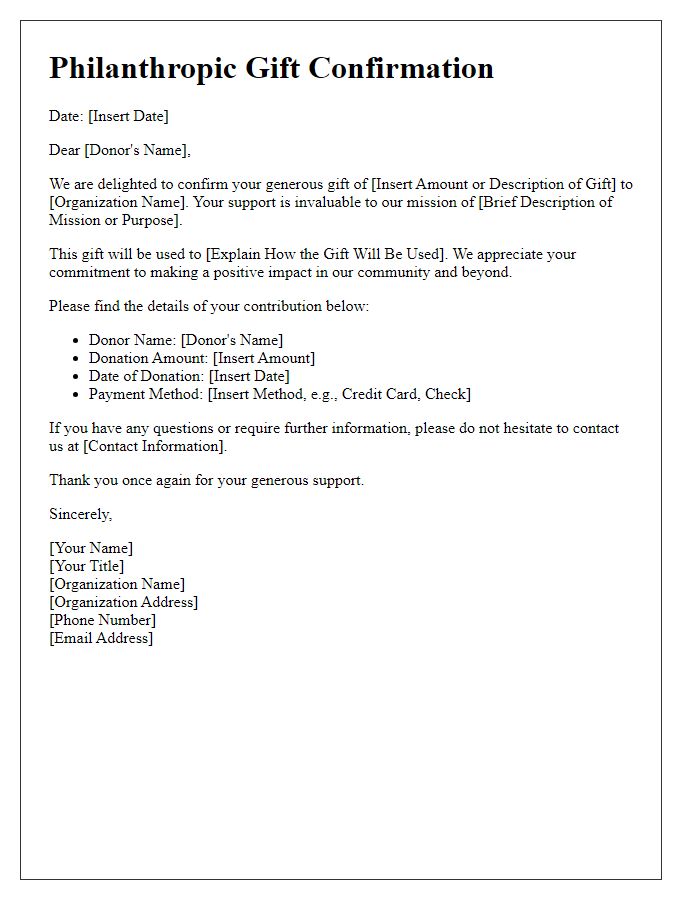

Donor's name and contact information

Charitable contributions play a crucial role in supporting non-profit organizations and their missions. Donor acknowledgment letters confirm receipt of donations, providing essential details like the donor's name, contact information, and the date of the contribution. This confirmation serves as valuable documentation for tax purposes, as the Internal Revenue Service (IRS) requires recognition of donations over $250 for individuals to claim charitable deductions. Additionally, well-structured acknowledgment letters, including the organization's name and mission statement, reinforce donor relationships and highlight the impact of their generosity, ultimately encouraging future contributions.

Donation amount and purpose

A charitable donation confirmation serves as an acknowledgment of a generous contribution, often detailing the donation amount and its intended purpose. For example, a donation of $500 to Feed the Children, a prominent organization dedicated to alleviating child hunger, can be appreciated by providing details such as the specific programs supported. This amount might fund nutritious meals for 200 children in need across various impoverished regions in the United States. The confirmation document should emphasize the impact of the donation, ensuring that donors feel valued and informed about how their contributions will be utilized to enact positive change within the community. Additionally, a tax-deductible statement reinforces the financial benefit to the donor and encourages future giving.

Charity's acknowledgment and gratitude

Charity organizations rely heavily on donations for their ongoing projects and support for individuals in need. When a donor contributes, it's crucial for the charity to send a formal acknowledgment letter to express gratitude. This letter typically includes key details such as the donor's name, the amount donated, and the date of the contribution. Charities often highlight the specific programs that will benefit from the donation, like food distribution or educational initiatives, to emphasize the impact on the community. Additionally, providing tax information related to the donation can assist the donor with tax deductions. Personal notes from beneficiaries or success stories might also be included to create a deeper emotional connection. Such acknowledgments play a crucial role in strengthening relationships with donors, encouraging future support, and fostering a sense of community involvement.

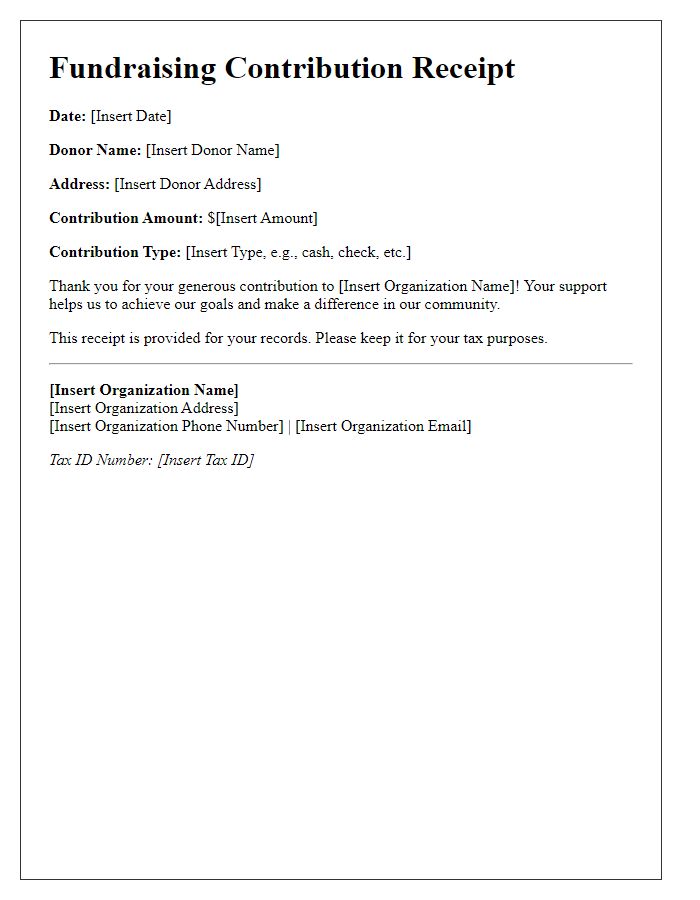

Tax receipt and legal acknowledgment

Donations made to registered charities play a pivotal role in funding important initiatives. A tax receipt serves as an official document, often provided by organizations like 501(c)(3) charities in the United States, confirming a donation made by an individual or corporation. This receipt, typically issued within the calendar year of the contribution, outlines the donation amount and the charity's IRS identification number. Legal acknowledgment of the donation is crucial for both the donor and recipient, ensuring compliance with tax laws. In addition, this official record assists donors in itemizing deductions on tax returns, contributing to the overall transparency and accountability of charitable giving.

Contact for further engagement or queries

Charity organizations often send confirmation receipts to acknowledge donations, detailing the contribution amount, date, and specific fund allocation. Contact information for further engagement typically includes a dedicated email address or phone number, allowing donors to inquire about their impact, volunteer opportunities, or additional ways to assist the cause. An organization based in New York, like the American Red Cross, emphasizes transparency and encourages donors to engage actively, fostering a community of support for initiatives ranging from disaster relief to health services. Such communication strengthens donor relationships and inspires further commitment to charitable efforts.

Comments