Are you looking to inform people about a change in your bank details? Crafting a clear and concise notification letter is essential to ensure everyone is updated without confusion. In this article, we'll provide you with a handy template to communicate this important information effectively. Let's dive into the details and make this transition seamless for you!

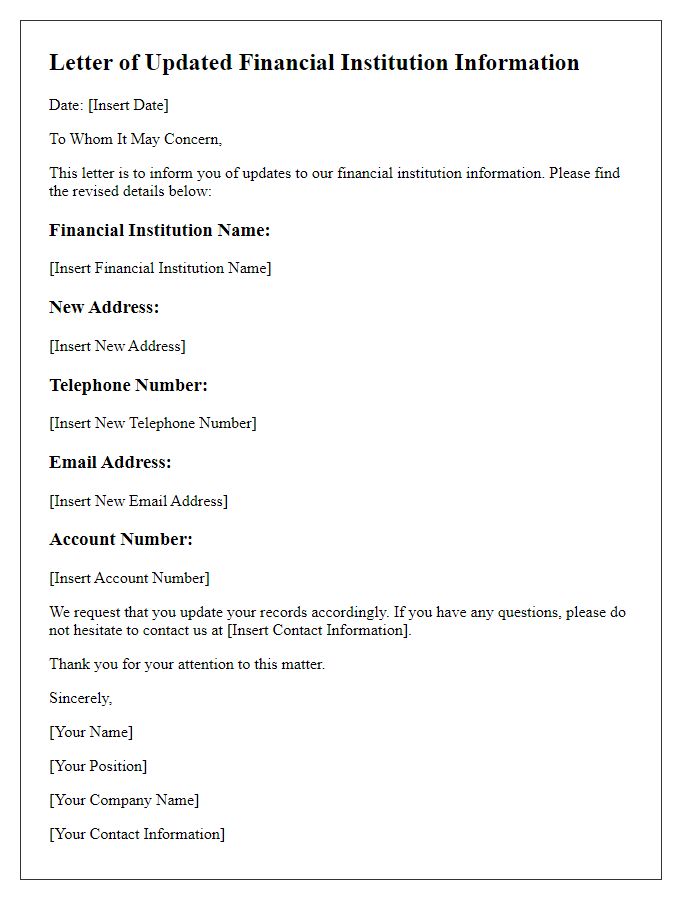

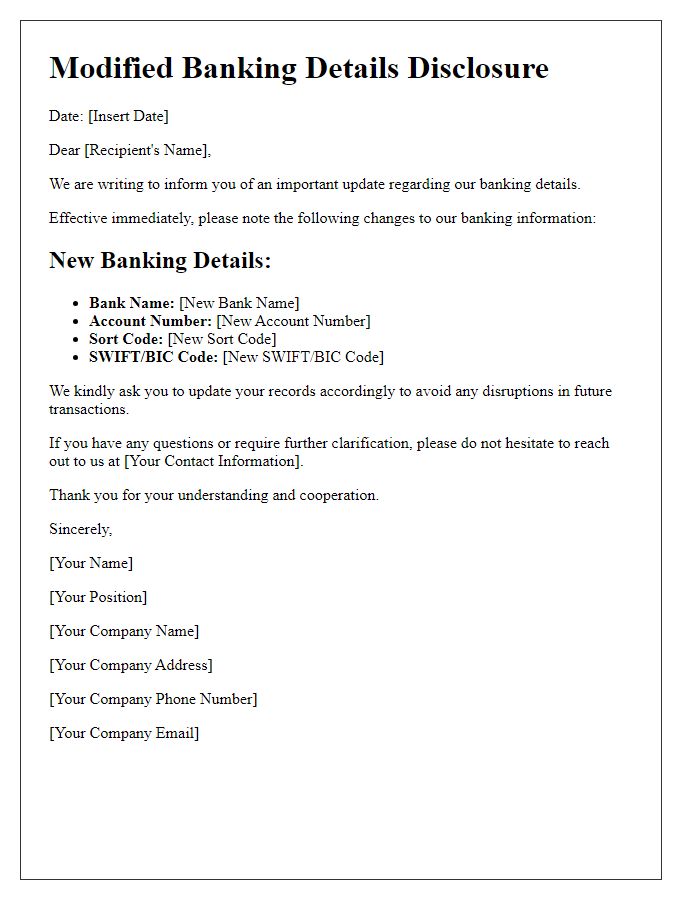

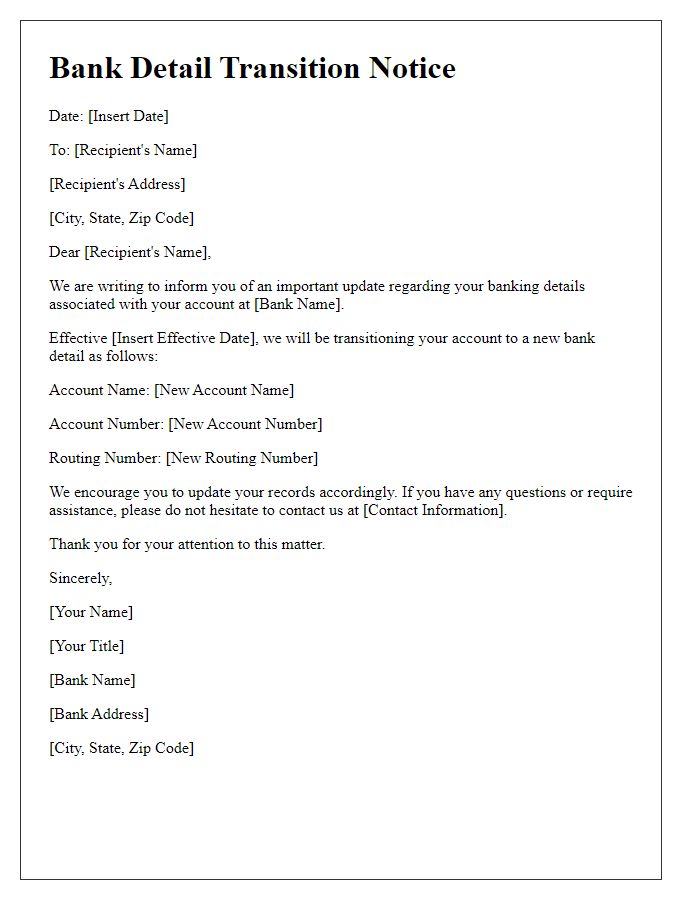

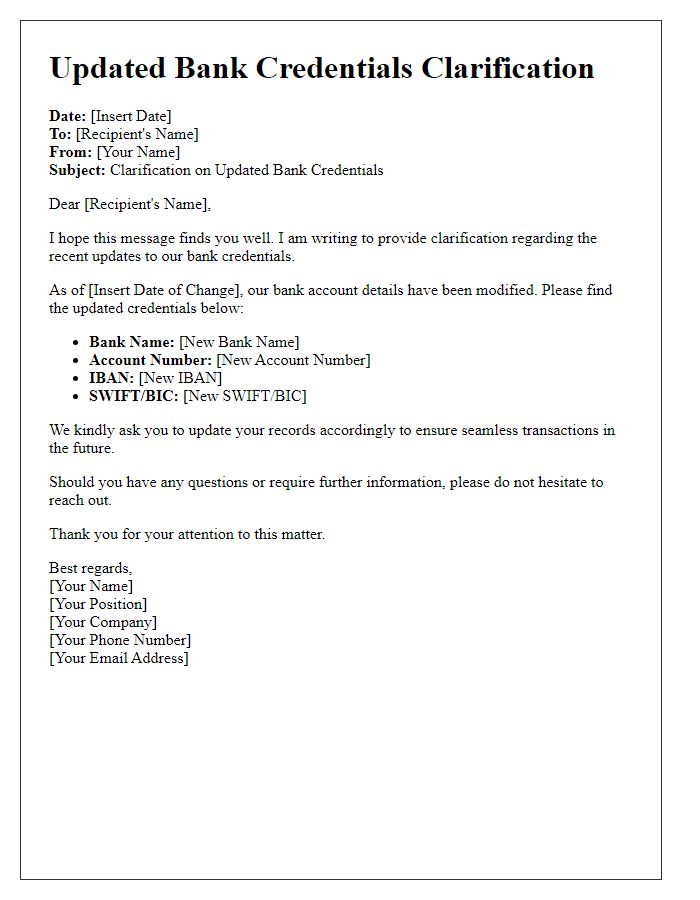

Professional tone

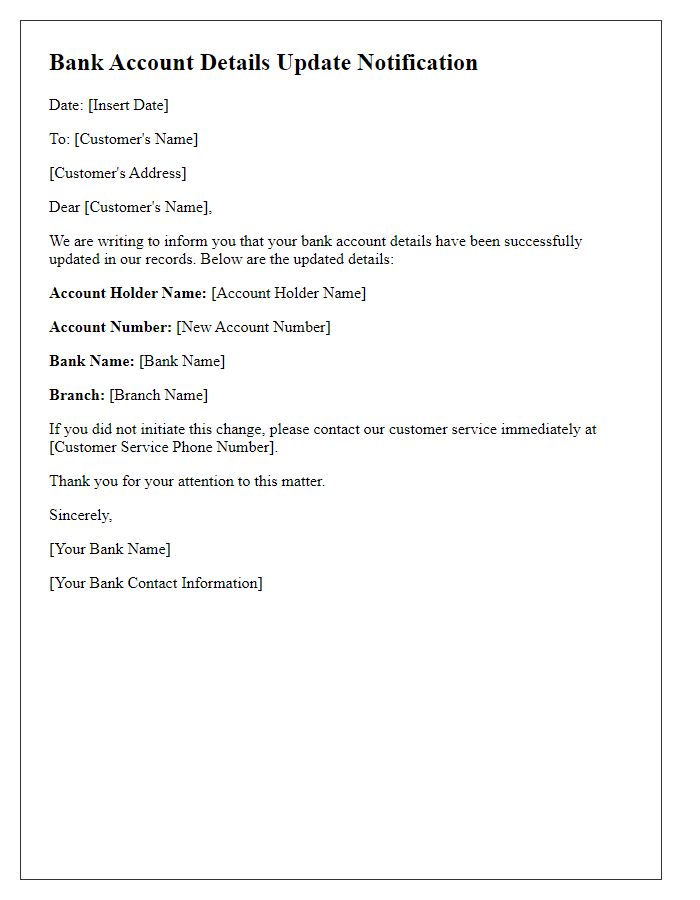

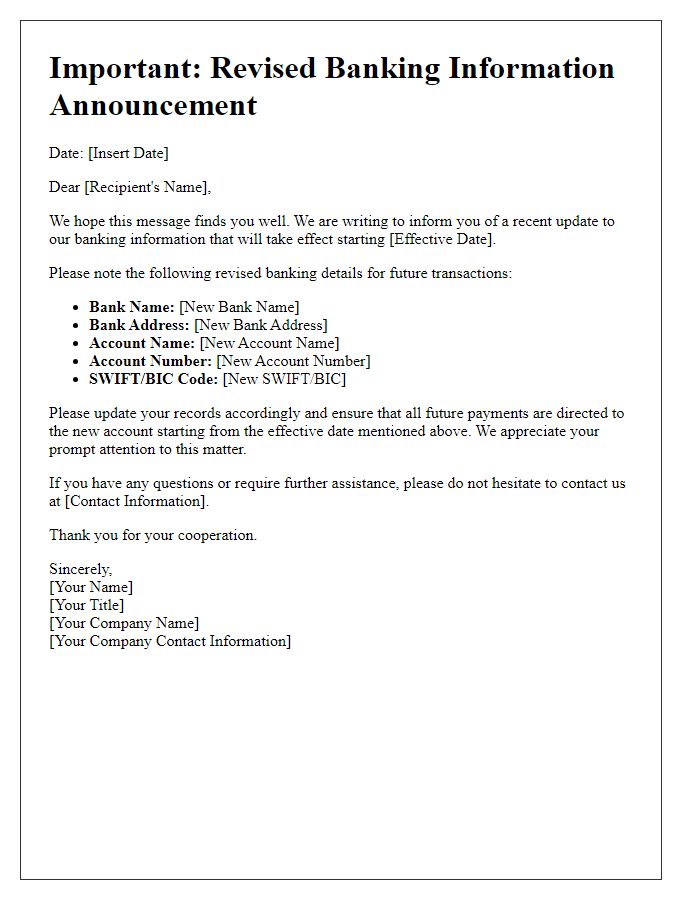

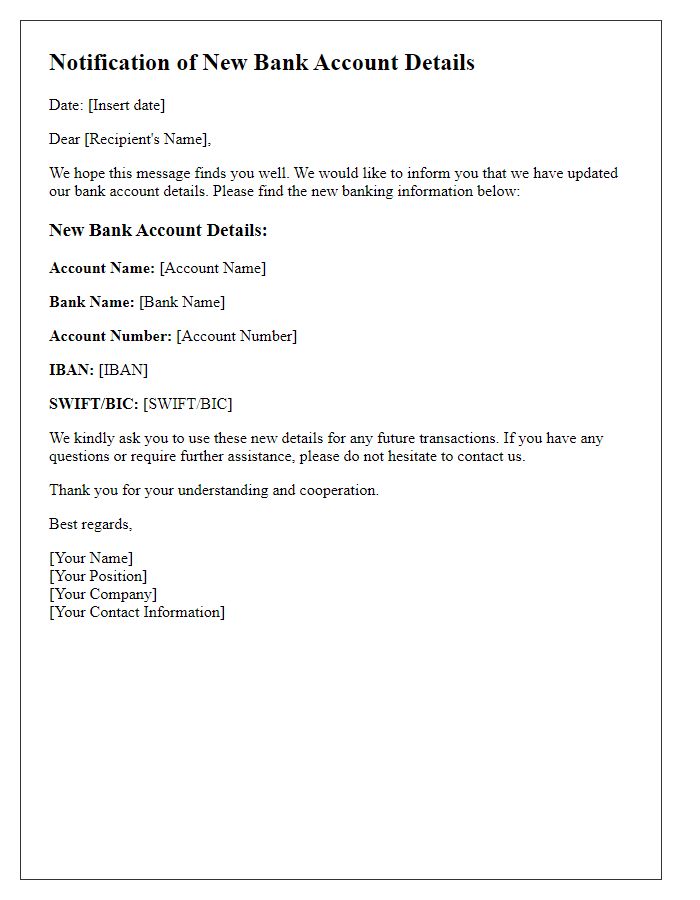

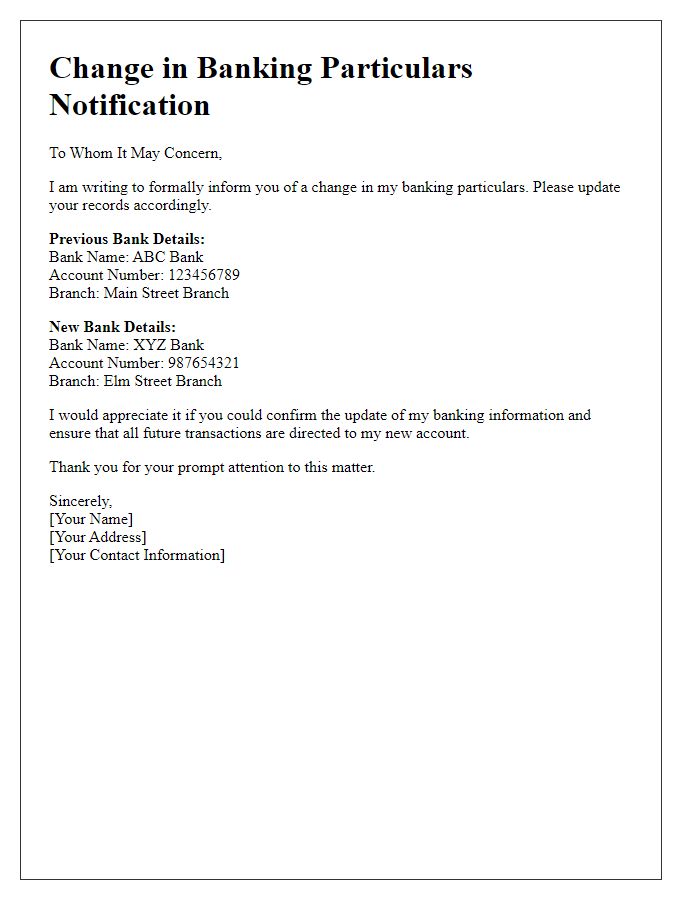

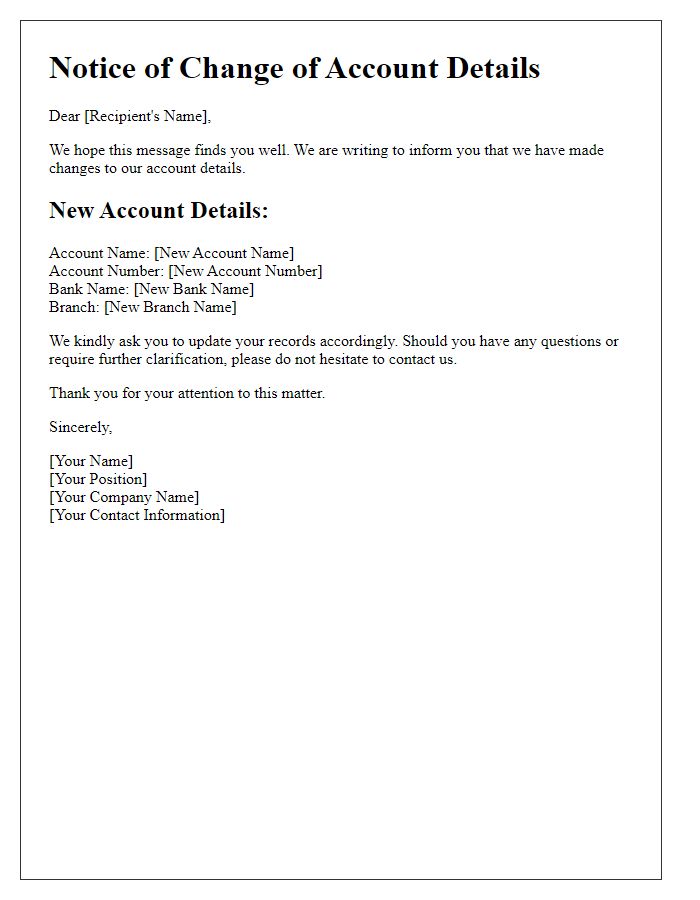

A company's update regarding bank account information often requires attention to detail and clear communication. A letter informing stakeholders about changes in financial management needs to specify the previous bank account details, the new bank account details, and the effective date of the change. Methods of contact for verification or queries should be indicated, ensuring transparency and trust. This is especially pertinent for organizations operating in finance or performing transactions regularly, including vendors, suppliers, and partners. Confirmation of receipt and compliance with the new banking information must be encouraged to avoid any disruption in financial operations.

Clear subject line

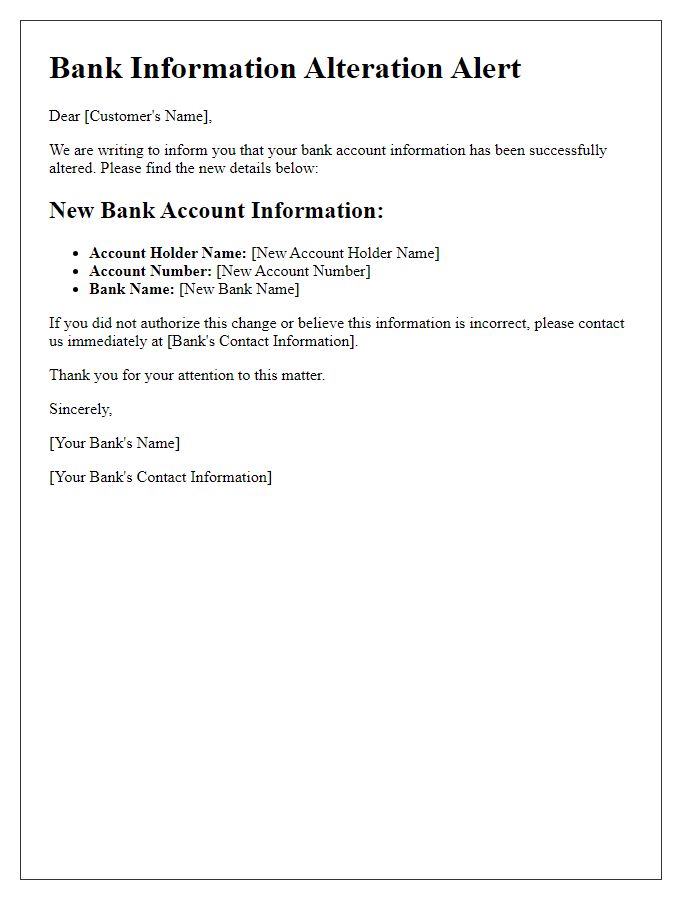

Notifying Change of Bank Details requires attention to sensitive financial information. Updated banking information can include account numbers, bank names, and routing numbers, thus ensuring secure transactions. Effective communication is crucial to prevent issues like missed payments or incorrect deposits. Clear guidelines on how to verify the changes is essential, perhaps suggesting direct contact numbers or secure links. Maintaining confidentiality during this process is paramount, especially if personal identification details are shared.

Updated bank information

Updating bank details is essential for maintaining accurate financial transactions. This can occur in various contexts, such as changing accounts due to better interest rates or switching banks for improved services. Informing relevant parties like payroll departments or vendors about updated bank account information, including account number and routing number, ensures seamless transactions without interruption. Timing is critical; notifying stakeholders promptly, preferably 30 days before the next transaction, minimizes potential disruptions. Secure delivery methods, such as encrypted emails, are necessary to protect sensitive information. Proper documentation of the update request also strengthens financial integrity and accountability in transactions.

Effective date of change

Effective January 15, 2024, all payments and transactions will be processed through the new bank account at Global Trust Bank (account number 123456789). Previous banking information at National Savings Bank will no longer be valid for incoming or outgoing payments. This change aims to streamline financial operations and enhance security. All clients and partners must update their records to ensure seamless processing of transactions. Contact details for any inquiries regarding this update are available on our website.

Contact information for queries

Changing bank details can impact payment processing for businesses and individuals. Proper communication ensures seamless transitions. Key information includes updated account numbers, bank names, and routing numbers to avoid payment errors. Notifying all relevant parties promptly mitigates disruptions. Ensure contact information for queries is clear, providing phone numbers and email addresses for support. Maintain a record of notifications sent, noting dates and recipients. This documentation aids in tracking responses and confirming changes. Effective communication fosters trust and ensures ongoing transactions remain uninterrupted.

Comments