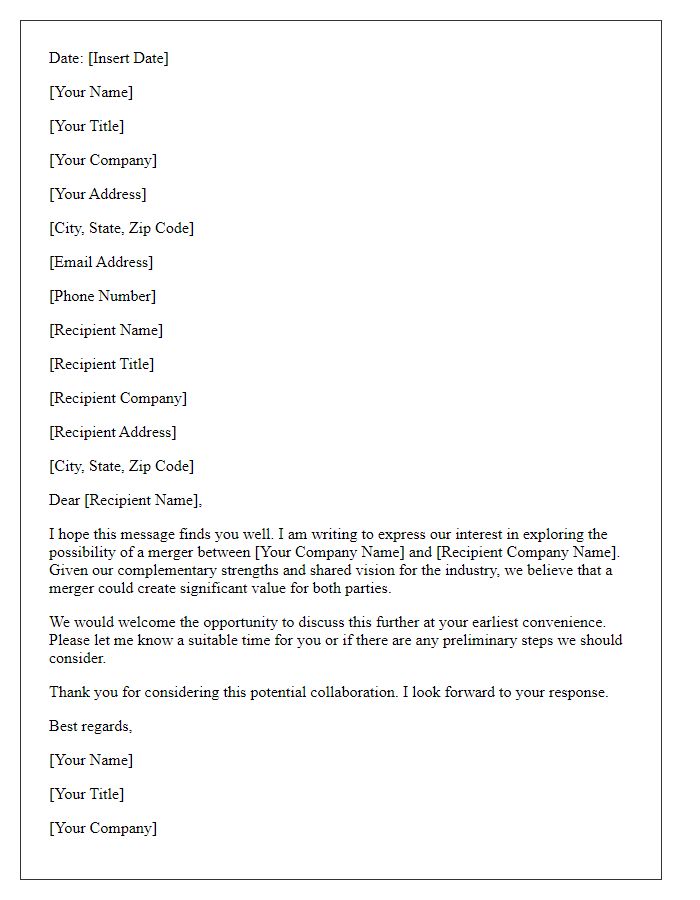

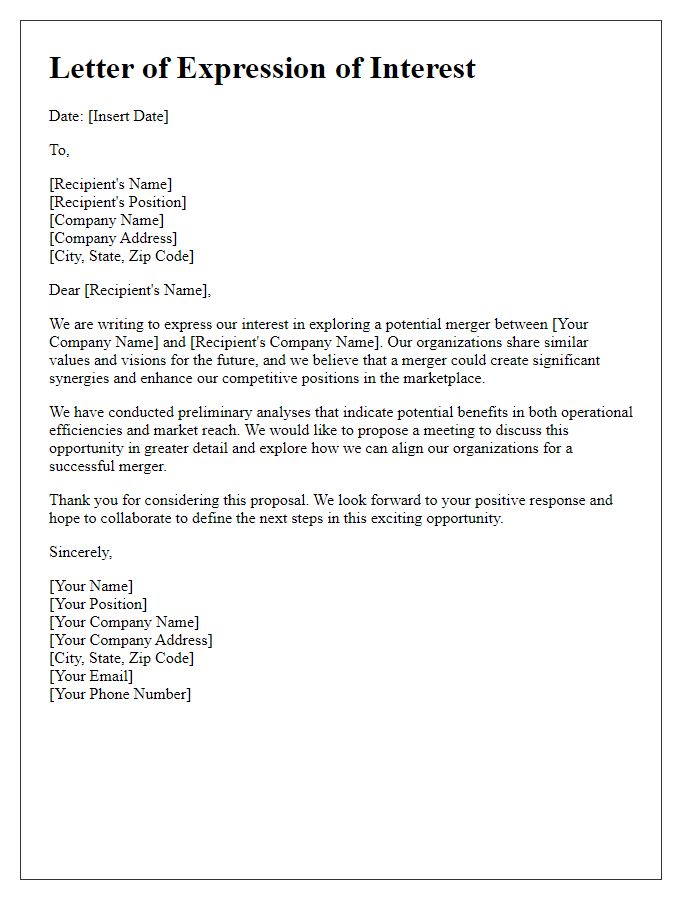

Are you considering taking your business to the next level through a merger? Initiating a conversation about merging businesses can feel daunting, but it presents an exciting opportunity for growth and collaboration. In this article, we'll break down essential tips and a sample letter template that will help you effectively communicate your proposal and ensure an open dialogue. Join us as we explore how to navigate this critical step in your business journey!

Purpose and Intent

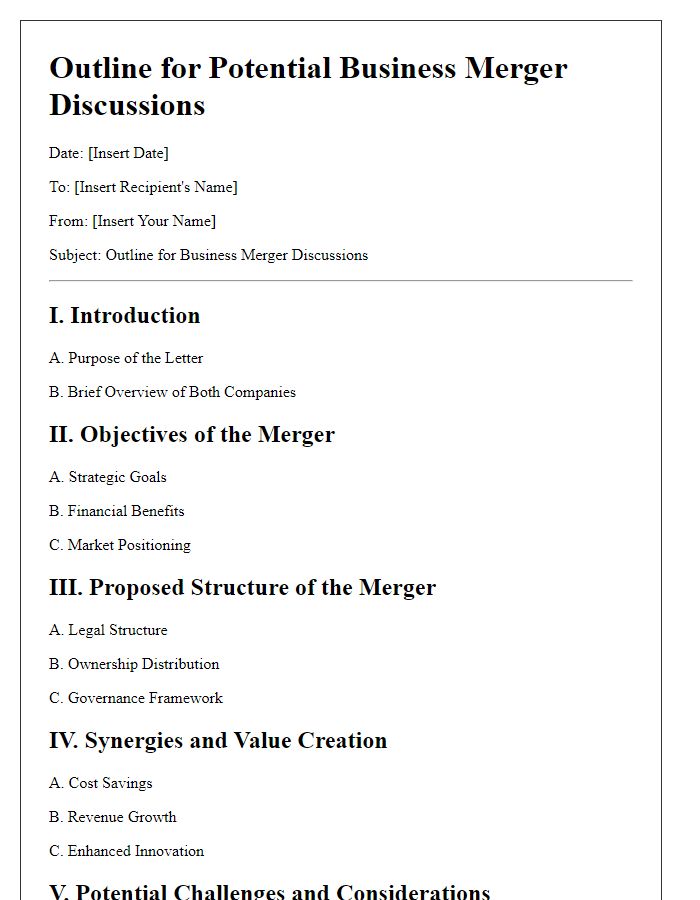

Initiating a business merger discussion requires clarity regarding the purpose and intent. A merger aims to combine two distinct entities, such as Company A and Company B, to create synergies, enhance market share, and improve overall competitiveness. The intent focuses on leveraging complementary strengths, such as technological innovations at Company A and a robust distribution network at Company B, aiming for increased operational efficiency. Key considerations may involve financial performance metrics, projected revenue growth, employee retention rates, and brand alignment strategies. Establishing a clear framework for collaboration fosters open communication, minimizes potential conflicts, and streamlines the due diligence process essential for a successful merger agreement.

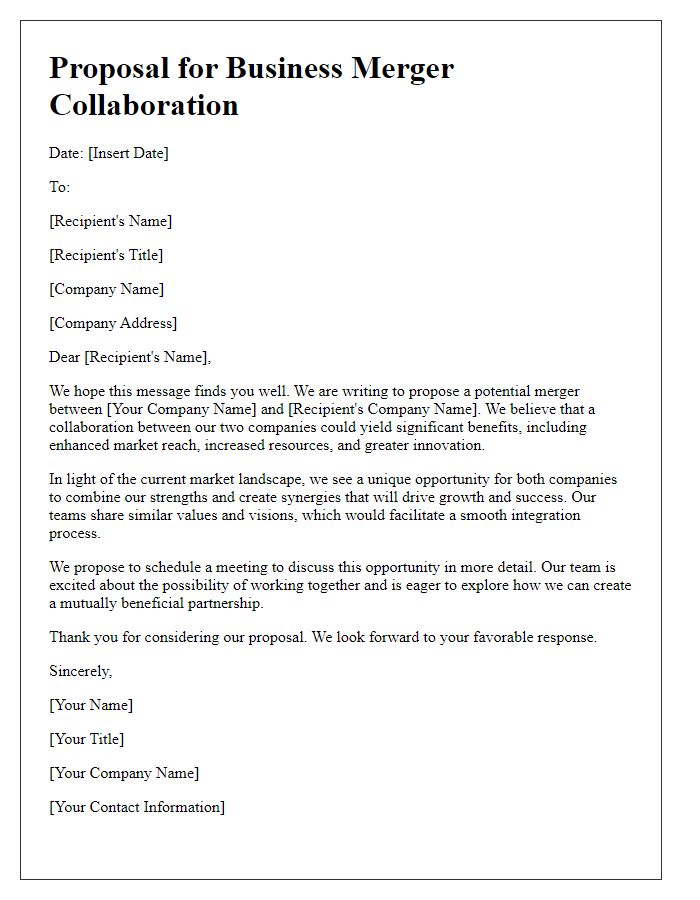

Strategic Alignment

Strategic alignment in business mergers involves synchronizing the goals and operational strengths of two companies to enhance overall market competitiveness. Mergers between firms, such as Company A in the technology sector and Company B in renewable energy, can create synergies in innovation and resource allocation. For instance, a merger can lead to increased research and development funding, which could exceed 20 million dollars annually, fostering breakthrough technologies. Geographic expansion becomes possible as resources are pooled, enabling access to new markets such as the European Union, where demand for sustainable solutions is rapidly rising. Collaborations can also improve supply chain efficiencies, reducing costs by up to 15%, while fostering a unified company culture that combines the best practices from both organizations.

Key Benefits

Initiating a business merger discussion presents numerous key benefits for involved entities. Enhanced market reach can be achieved, resulting in an increased customer base and higher sales potential. Operational efficiencies may arise from shared resources, such as technology platforms, which streamline processes and reduce overhead costs. Additionally, a merger can foster innovation by combining diverse expertise and perspectives from both organizations, ultimately leading to more robust product development. Financial strength improves, allowing for better access to capital markets and opportunities for strategic investments. Strengthened competitive positioning against industry rivals can be realized, creating a formidable presence in key sectors. Furthermore, combined marketing efforts can amplify brand visibility, attracting new clients while retaining existing ones. Comprehensive analyses often indicate that successful mergers generate long-term value, sustaining growth and profitability in dynamic market conditions.

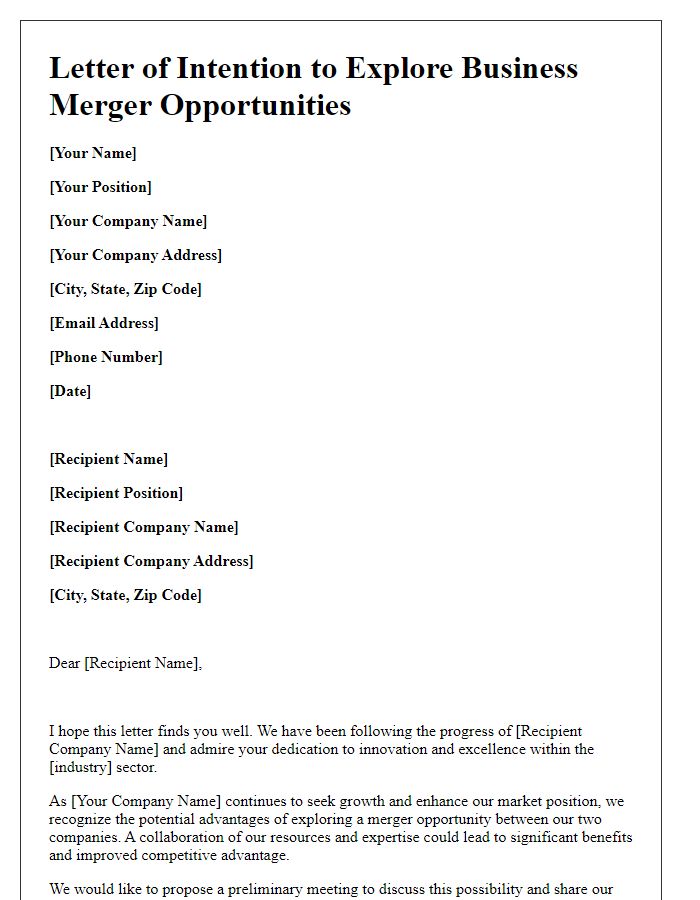

Confidentiality Assurance

In a business merger discussion, maintaining confidentiality is crucial for protecting sensitive information. Companies involved in negotiations often utilize Non-Disclosure Agreements (NDAs) to ensure that proprietary data, financial statements, and strategic plans are safeguarded. For instance, during a merger between two technology firms, the exchange of trade secrets vital for product development must be tightly controlled. By implementing clear confidentiality protocols, both parties can foster trust and encourage open dialogue about potential synergies, valuation assessments, and integration strategies. Such measures prevent information leaks that could influence stock prices or damage reputations, particularly in high-stakes mergers in markets like Silicon Valley or Wall Street, where information is closely monitored by analysts and competitors.

Next Steps and Meetings

The initiation of business merger discussions between two companies, such as Company A and Company B, requires strategic planning and clear communication. Key stakeholders, including executives and board members, should convene for a preliminary meeting to outline merger objectives, evaluate synergies, and identify potential challenges. Establishing a timeline for discussions is essential, with proposed dates for follow-up meetings to assess progress and address any arising concerns. Documentation, including financial statements and market analyses, must be prepared for review, ensuring all parties have a comprehensive understanding of each other's operations. Engaging legal and financial advisors early in the process will aid in navigating regulatory requirements and ensuring compliance with merger laws, such as the Hart-Scott-Rodino Act. Setting clear next steps, such as drafting a memorandum of understanding (MOU) and scheduling due diligence sessions, will facilitate a smooth merger process.

Comments