Navigating the world of mergers and acquisitions can feel overwhelming, but it doesn't have to be! In this article, we'll break down the essential components of a well-crafted inquiry letter that can open doors to new opportunities. Whether you're looking to merge with another company or seek potential acquisition targets, understanding the nuances of this process is key. Ready to dive in and learn more about creating effective letters for M&A inquiries?

Introduction and Executive Summary

A strategic merger and acquisition (M&A) inquiry can significantly reshape the competitive landscape within industries. The target company, noted for its robust market position and innovative product offerings in technology, has demonstrated consistent revenue growth, averaging 20% annually. The acquirer, a global leader headquartered in New York, seeks to enhance its portfolio through synergistic opportunities that could result in cost savings and expanded customer base. Industry trends indicate a growing demand for integrated solutions, particularly in sectors such as artificial intelligence and cloud computing, highlighting potential revenue streams worth billions. Key objectives of this inquiry involve assessing compatibility between corporate cultures, evaluating financial health and identifying potential risks that may arise during the integration process. This strategic move aims to leverage combined resources to drive sustainable long-term growth and profitability for stakeholders involved.

Strategic Fit and Synergy Potential

Strategic fit is crucial in merger and acquisition scenarios, where companies aim to achieve complementary strengths. Identifying synergy potential can lead to improved operational efficiency and enhanced market position. Financial metrics, such as projected revenue growth, cost savings due to economies of scale, and increased market share, play a significant role in evaluating these opportunities. For instance, technology firms merging in Silicon Valley often seek capabilities in artificial intelligence and cloud computing, optimizing innovation and service delivery. Cultural alignment between organizations also impacts integration success, with employee retention and satisfaction emerging as critical factors in maintaining productivity levels post-merger. Understanding these dynamics can facilitate a smoother transition, ultimately driving long-term value creation.

Financial Overview and Valuation Metrics

A comprehensive financial overview is crucial for assessing the viability of a merger and acquisition (M&A) inquiry. Key metrics such as EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), revenue growth rates, and profit margins provide insights into the target company's operational efficiency. Valuation techniques, including Discounted Cash Flow (DCF) analysis and Comparable Company Analysis (Comps), offer a framework for determining fair market value. Market capitalization and enterprise value calculations help stakeholders gauge the relative worth of the businesses involved. Additionally, examining recent transactions in the same industry, such as the $2 billion acquisition of Company X by Company Y, can provide context for valuation benchmarks. Profitability ratios, such as return on equity (ROE) and net profit margin, reveal the financial health and competitiveness of the target company. Understanding these metrics enables informed decision-making in the M&A process.

Due Diligence and Compliance Considerations

Merger and acquisition activities demand thorough due diligence and strict compliance to ensure successful integration and minimize risks. Due diligence refers to the comprehensive investigation and analysis of a target company's operations, financial statements, legal obligations, and overall market position. Key compliance considerations involve adherence to regulatory frameworks such as the Sarbanes-Oxley Act or the Federal Trade Commission's antitrust regulations. Evaluating historical performance metrics, corporate governance structures, and potential liabilities provides insight into the company's viability. In addition, assessing cultural compatibility between merging organizations is crucial for achieving synergies post-acquisition. Elements like workforce morale, management styles, and operational practices can significantly impact integration success. Therefore, a well-structured due diligence plan coupled with robust compliance measures is essential for minimizing unexpected hurdles in the merger and acquisition process.

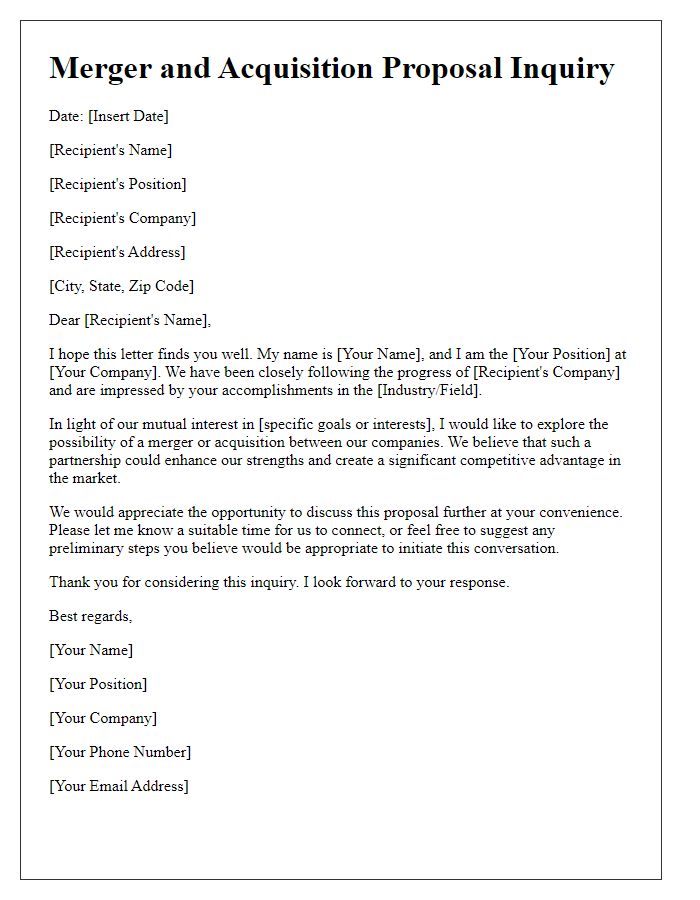

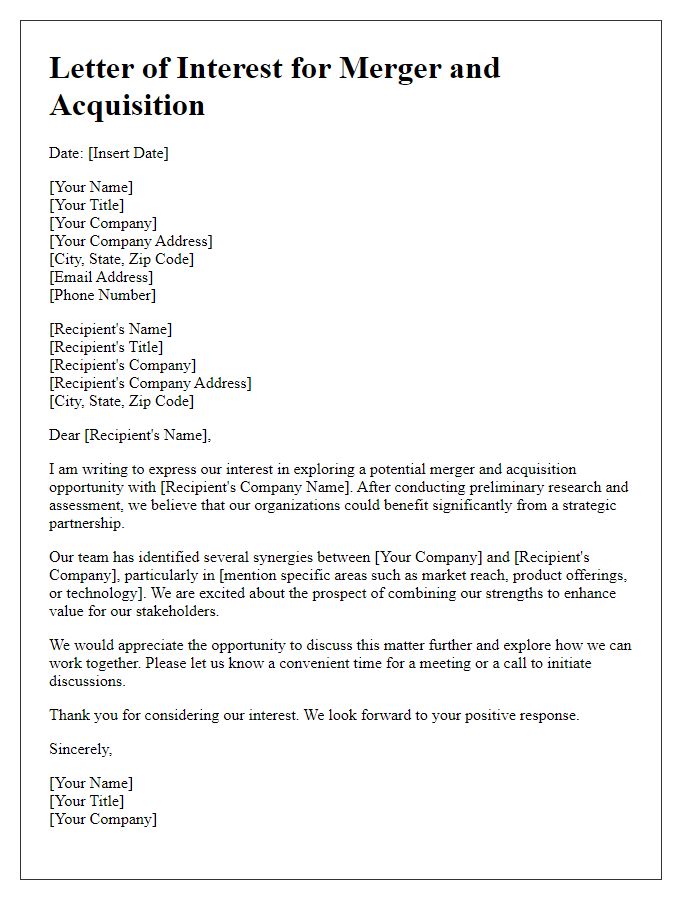

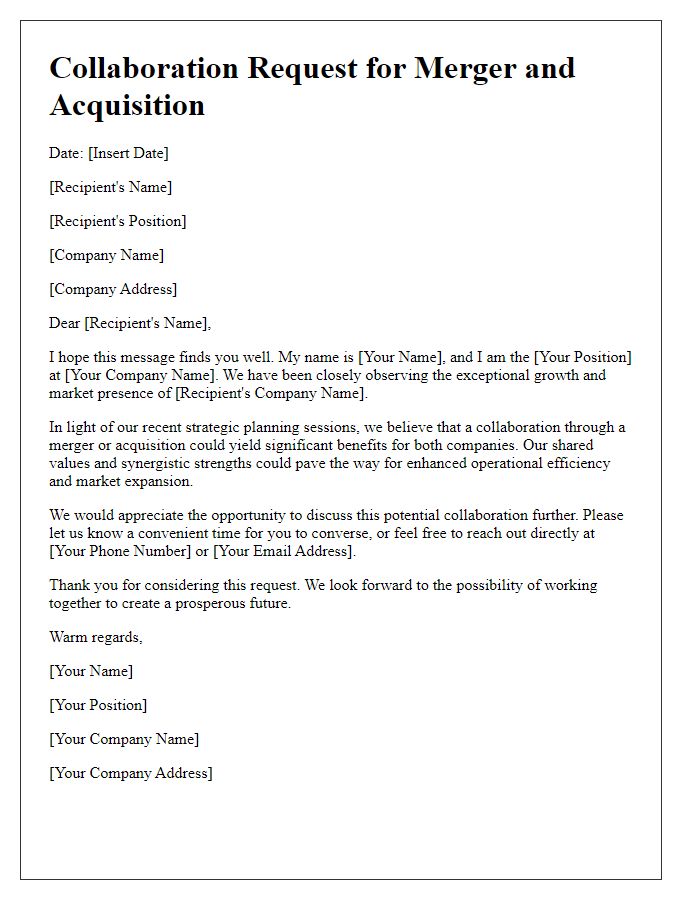

Contact Information and Next Steps

In the complex landscape of mergers and acquisitions (M&A), proper communication and defined next steps play a crucial role in facilitating the transaction process. Key players in this field include investment banks, legal advisors, and corporate executives. Establishing clear contact information, such as email addresses and phone numbers, ensures that all parties can easily connect throughout the due diligence phase, which can span several weeks or even months. During this period, critical documents, including financial statements and legal agreements, should be exchanged to assess the viability of the merger or acquisition. Furthermore, outlining the next steps--such as setting up meetings, conducting valuations, or scheduling announcements--can streamline the process, fostering a collaborative environment between the merging entities, ultimately leading to a more efficient transition. The New York Stock Exchange (NYSE) and Securities and Exchange Commission (SEC) often oversee these transactions to ensure compliance with regulatory standards and protect shareholder interests.

Comments