Are you looking to request a partial distribution as a beneficiary? Crafting the right letter can make a significant difference in how smoothly your request is processed. In this article, we will guide you through a simple yet effective template to ensure your letter is clear and professional. So, let's dive in and explore how to put your best foot forward in your request!

Full beneficiary and account information

Beneficiaries of financial accounts, such as 401(k) plans or trust funds, must provide complete identification details to facilitate a partial distribution request process. Essential information includes full legal name, address, date of birth, Social Security number, and account number for accurate identification. Financial institutions, governed by regulations from the Internal Revenue Service (IRS) and the Department of Labor, require this information to ensure compliance and secure processing. The request form must also specify the desired partial distribution amount, ensuring clarity on the portion of funds being withdrawn. Accurate completion and submission to the designated financial authority expedite the distribution process, while safeguarding beneficiaries' rights.

Specific distribution amount or percentage

Beneficiary partial distribution requests often arise during estate settlements or trust management. A partial distribution request allows beneficiaries to receive a specific amount or percentage of their entitled distribution prior to final settlement. This process typically involves completing necessary forms and submitting them to the estate administrator or trustee. Documentation might include the legal name of the trust or estate, case number, and a detailed outline of the requested distribution amount or percentage (for example, 25% of the total trust value). Understanding the guidelines and regulations surrounding partial distributions is crucial; these rules vary by jurisdiction and can impact the overall estate valuation. Beneficiaries should clarify any tax implications related to receiving a partial distribution, especially if the estate is subject to federal or state taxes.

Reason or purpose for distribution request

Beneficiary partial distribution requests often arise from specific circumstances. For instance, a beneficiary may seek funds for essential medical expenses related to a serious illness or for educational costs, such as tuition fees, at recognized institutions like community colleges or universities. Other common purposes could include purchasing a primary residence in a designated area with high property values, covering unexpected personal emergencies, or assisting with caregiving expenses for aging relatives. Each request should outline the financial needs with precise amounts and relevant documentation to substantiate the urgency and necessity of the distribution, ensuring that trustees or responsible parties understand the context and justification for the request.

Compliance with legal and tax regulations

A beneficiary partial distribution request involves the legal and tax implications connected to estate planning. Beneficiaries, individuals entitled to inherit assets from a decedent's estate, must comply with various regulations set by agencies like the Internal Revenue Service (IRS). Proper documentation (Form 706 for estate tax, for example) must be prepared to ensure compliance with federal tax laws. Each state may have specific statutes governing distributions, necessitating adherence to local probate code. Additionally, tax implications from distributions, including potential gift tax (up to $17,000 in 2023 without triggering taxation), must be taken into account. Consulting with estate attorneys, tax professionals, and financial advisors can provide clarity and ensure that distributions occur without legal complications.

Contact information for follow-up

Beneficiary partial distribution requests can involve complex legal and financial details. Key components include the beneficiary's full name, address, and contact number for communication. Documentation often requires the submission of a government-issued ID number, such as Social Security Number, to verify identity. Distribution requests are typically sent to the trust or estate administrator, with a clear outline of the requested amount, references to specific account numbers, and the reason for the partial distribution, ensuring compliance with legal stipulations. It is crucial to provide follow-up contact information, ensuring timely responses from the governing body overseeing the distribution process.

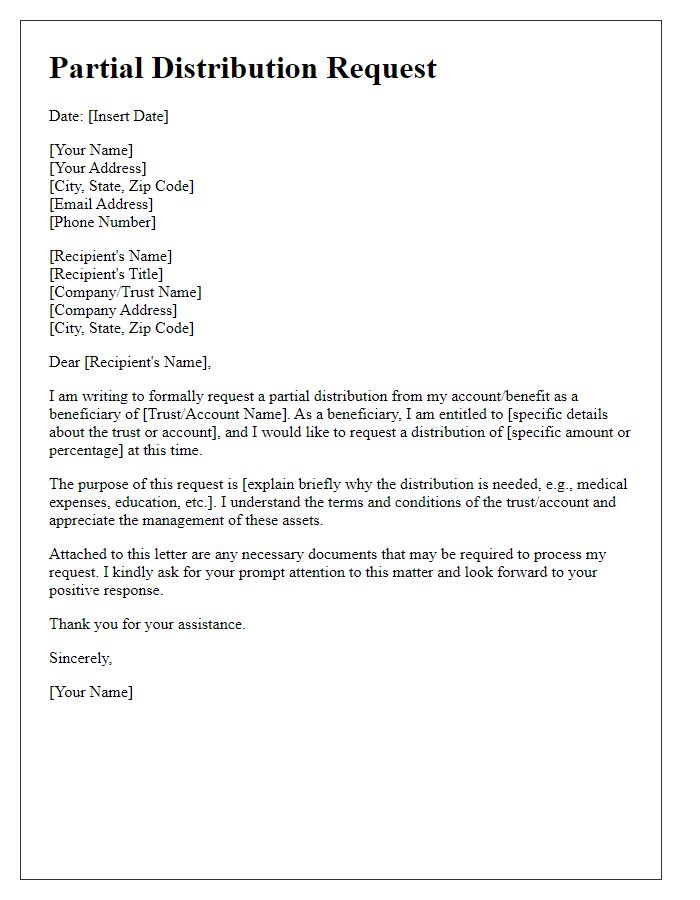

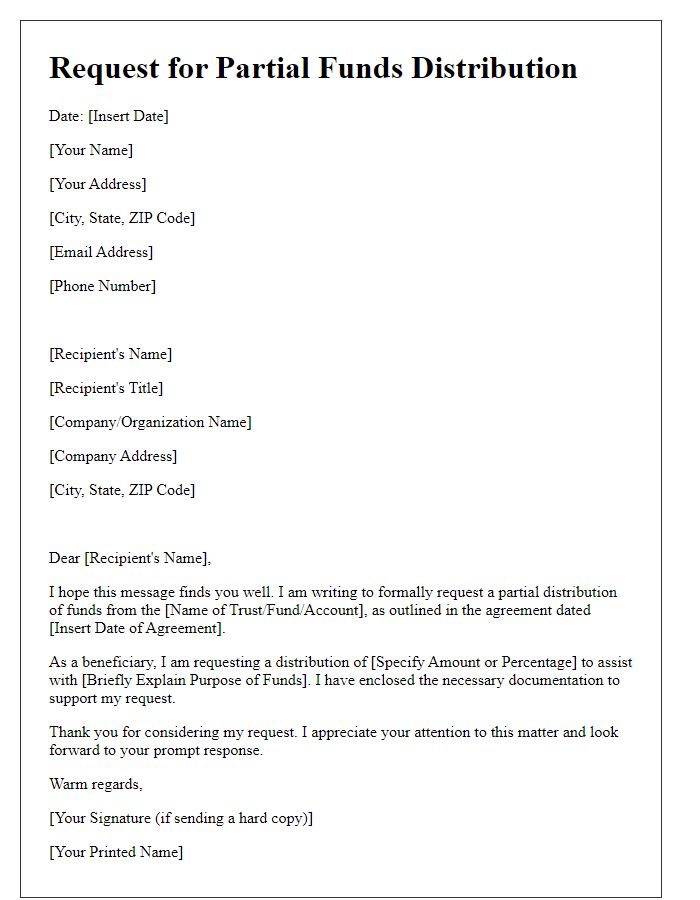

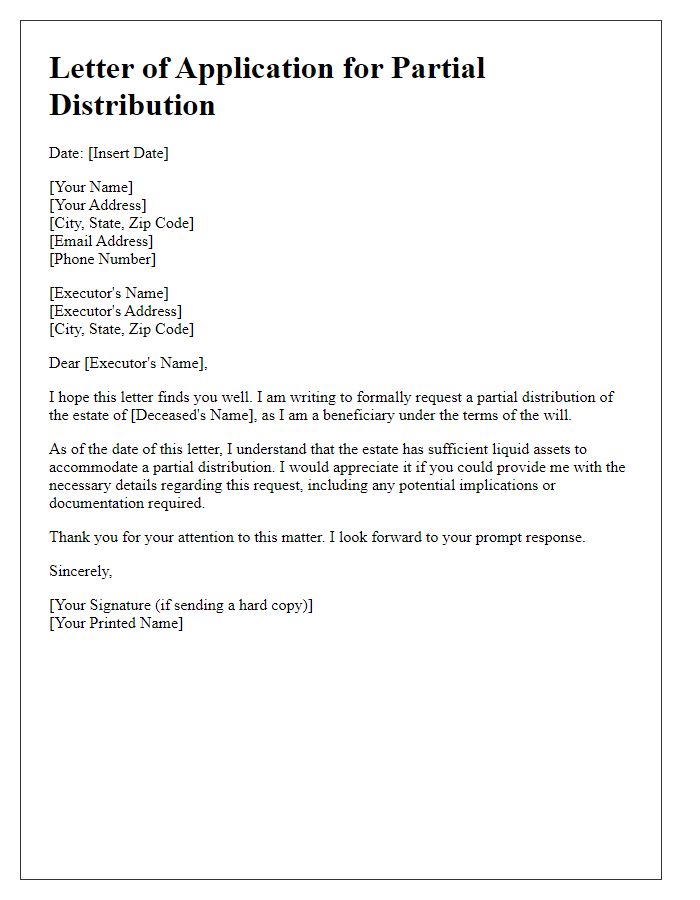

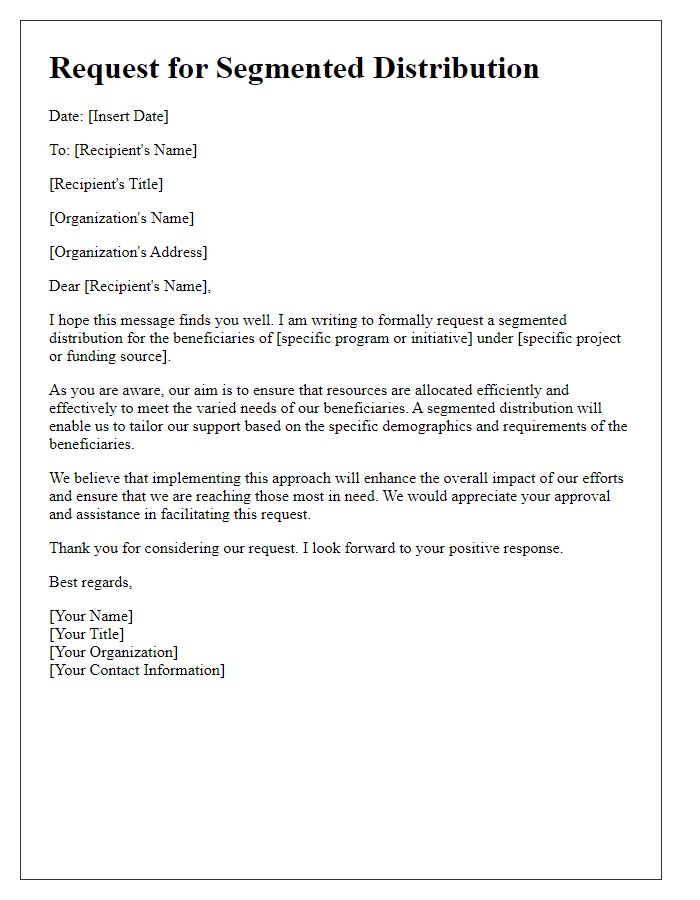

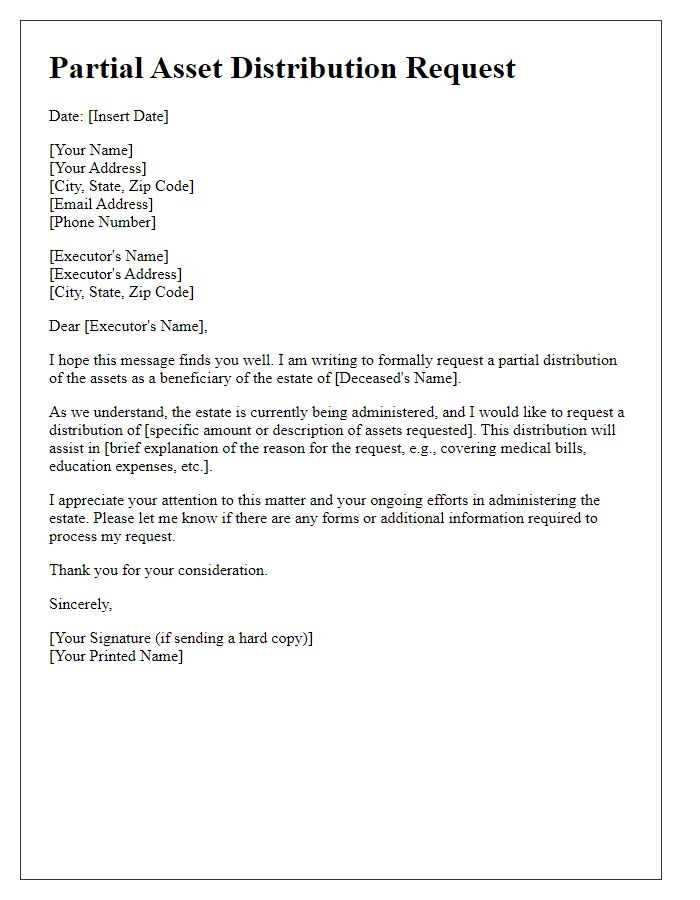

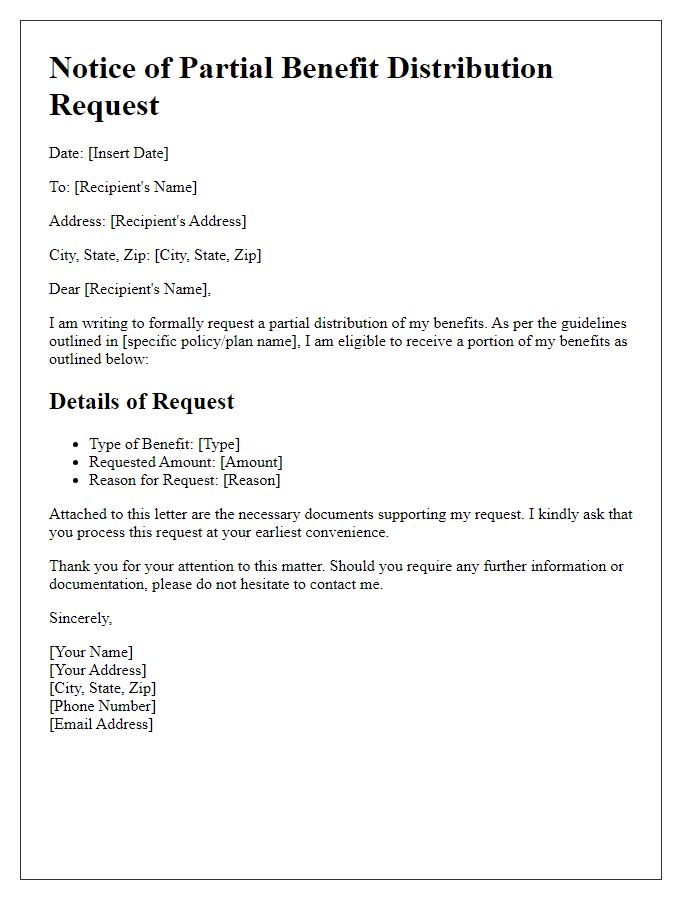

Letter Template For Beneficiary Partial Distribution Request Samples

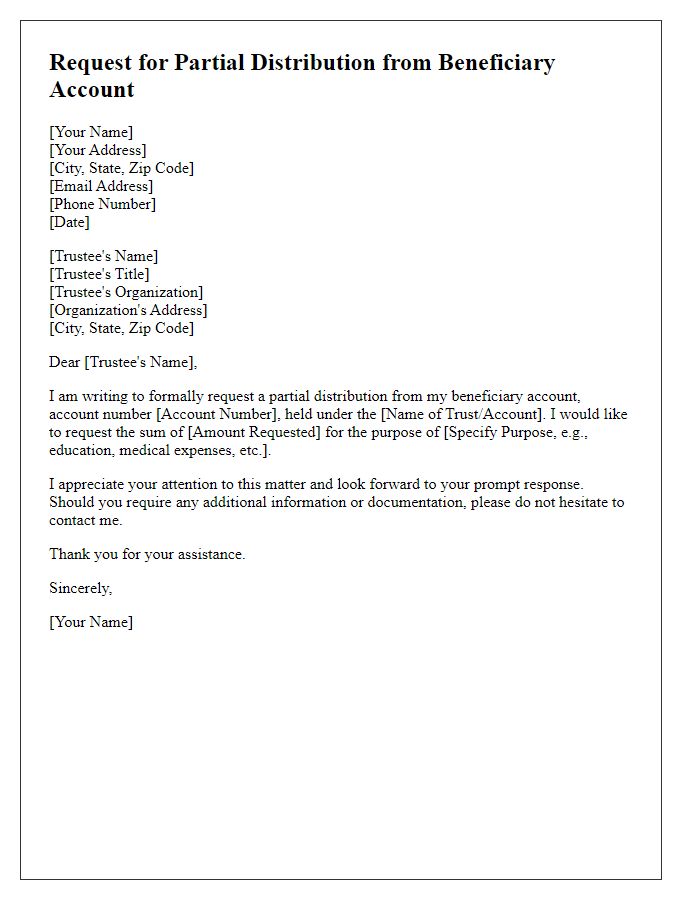

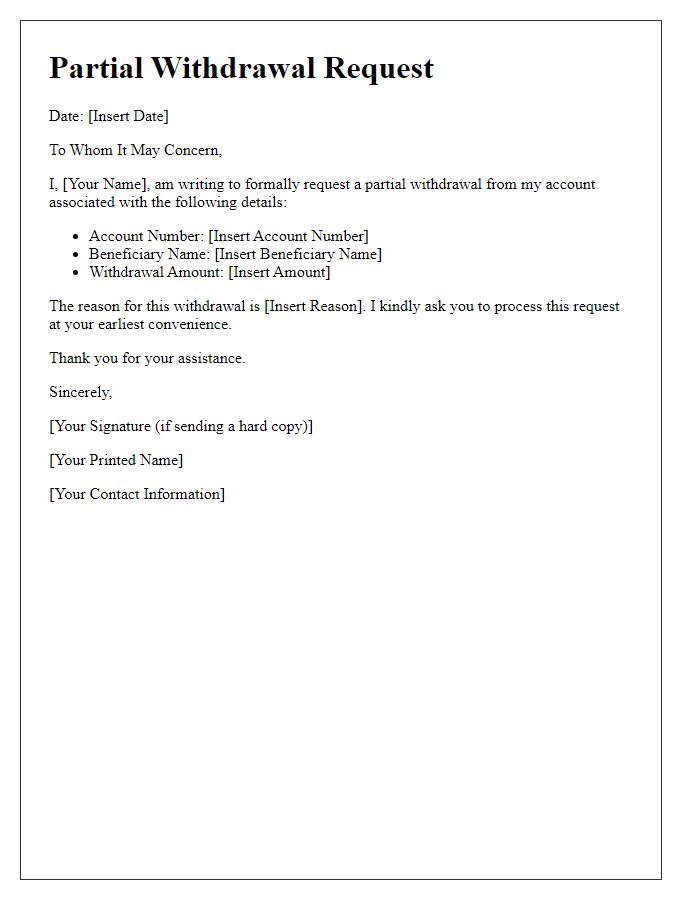

Letter template of request for partial distribution from beneficiary account

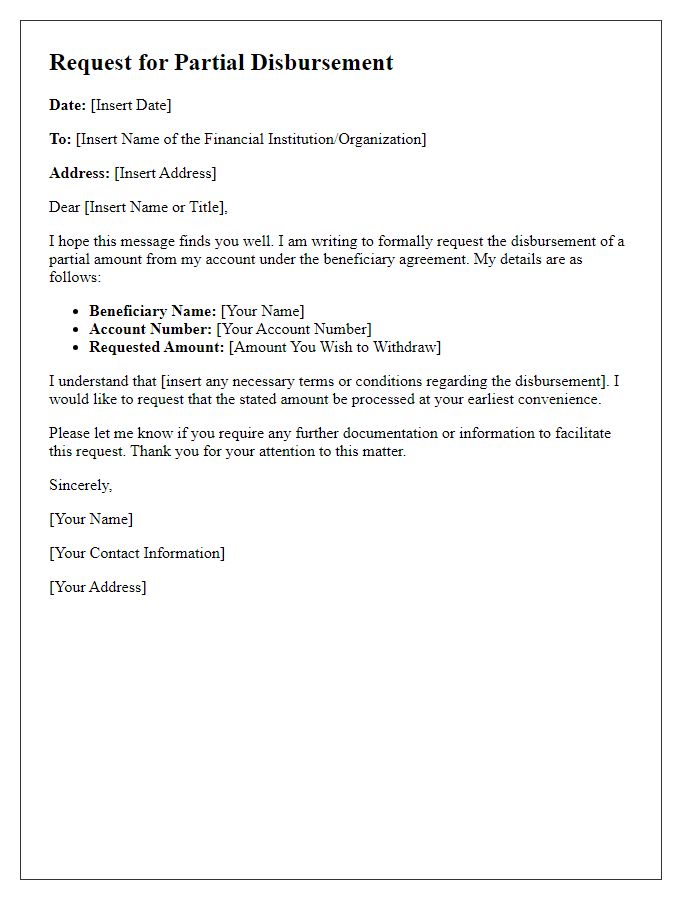

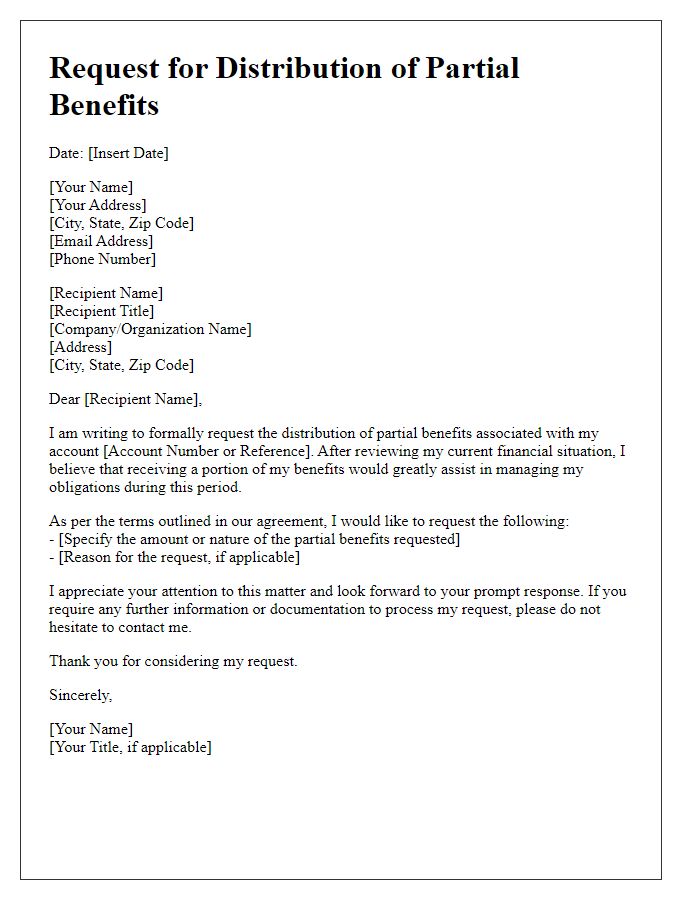

Letter template of beneficiary request for disbursement of partial amount

Comments