Have you ever found yourself in a situation where a will just doesn't sit right with you? It can be challenging to navigate the complex emotions and legalities that come with estate planning and inheritance disputes. In this article, we will guide you through the steps to effectively address your concerns as a beneficiary objecting to a will, offering you practical advice and essential tips. So, if you're ready to unravel this intricate process, read on for more insights!

Clear identification of the beneficiary and testator.

A beneficiary objection to a will typically involves a clear and unambiguous identification of both the beneficiary and the testator. The beneficiary, Jonathan Smith, who is identified by address at 123 Elm Street, Anytown, USA, raises concerns regarding the will executed by the testator, Margaret Johnson, residing at 456 Oak Avenue, Anytown, USA, dated March 1, 2022. This will allegedly bequeaths the majority of the estate's assets, estimated at $500,000, to an alternate beneficiary, which Jonathan believes contradicts Margaret's previous intentions discussed during conversations in early 2022. Jonathan demands transparency in the probate process, requesting access to all relevant documents including previous drafts of the will and any correspondence that might clarify Margaret's intentions. Failure to address these concerns may lead to formal legal action to resolve the dispute over the validity of the current will.

Detailed statement of objection grounds.

Beneficiaries contesting a will often cite various grounds for their objections. Common grounds include lack of testamentary capacity, where the testator (the individual who made the will) did not possess the mental ability to understand the implications of their decisions at the time of writing the will. Undue influence signifies conditions where the testator was coerced or manipulated by another party, overshadowing their free will in decision-making. Additionally, improper execution refers to failures in adhering to relevant laws, such as the absence of required witnesses or signatures per state law. Fraud can also be a basis for objection, wherein the will was obtained through deceitful practices. Lastly, specific objections may arise from contradictory prior wills or established inheritance expectations, particularly impacting family dynamics and financial distributions among heirs. Understanding these grounds is crucial for beneficiaries seeking to challenge the validity of a will.

Citation of relevant laws or statutes.

A beneficiary objection to a will often involves legal complexities, including the examination of statutes and laws governing testamentary documents. Relevant statutes may include the Uniform Probate Code (UPC), which outlines procedures for will contests, or state-specific laws such as California Probate Code Section 8250, which addresses the validity of wills and their execution requirements. It is essential to review grounds for objections, such as lack of testamentary capacity (the legal ability to make a will), undue influence (improper persuasion affecting the testator's decisions), or failure to meet statutory requirements for witnessing and signing a will, typically stipulated under laws like New York Estates, Powers and Trusts Law Section 3-2.1. Additionally, legal precedents established in cases like Hegarty v. Estate of Waugh can provide insight into judicial interpretations on will validity and the rights of contesting beneficiaries. Engaging with an attorney specializing in probate law is crucial for navigating the objection process effectively.

Request for a formal legal hearing or mediation.

Beneficiaries who feel aggrieved by the terms of a will can formally request a legal hearing or mediation to address their objections. This process often involves filing an objection with the probate court in the jurisdiction where the will is being administered. The legal framework provided by local laws will dictate the necessary procedures and timelines for this request. In many cases, beneficiaries may need to outline specific grounds for their objection, such as lack of testamentary capacity, undue influence, or improper execution of the will. Mediation may be recommended as a less adversarial approach to resolving disputes, providing a platform for all parties to express their concerns and seek a mutually agreeable resolution. Legal representation can be beneficial during this process to navigate complex estate laws and advocate for the beneficiary's rights effectively.

Contact information for further correspondence.

Beneficiaries of estates often face complexities during the probate process, particularly when objections to the contents of a will arise. Clear communication through written correspondence is essential. Contact information should include full legal names, mailing addresses, telephone numbers, and email addresses of all parties involved. This ensures that legal notifications reach intended recipients, allowing for prompt responses and further discussions about the circumstances surrounding the will in question. Accurate identification of the estate, including the deceased's full name, date of death, and case number, can facilitate smoother communication and documentation exchanges among beneficiaries, legal representatives, and estate planners.

Letter Template For Beneficiary Objection To Will Samples

Letter template of beneficiary objection to will due to undue influence.

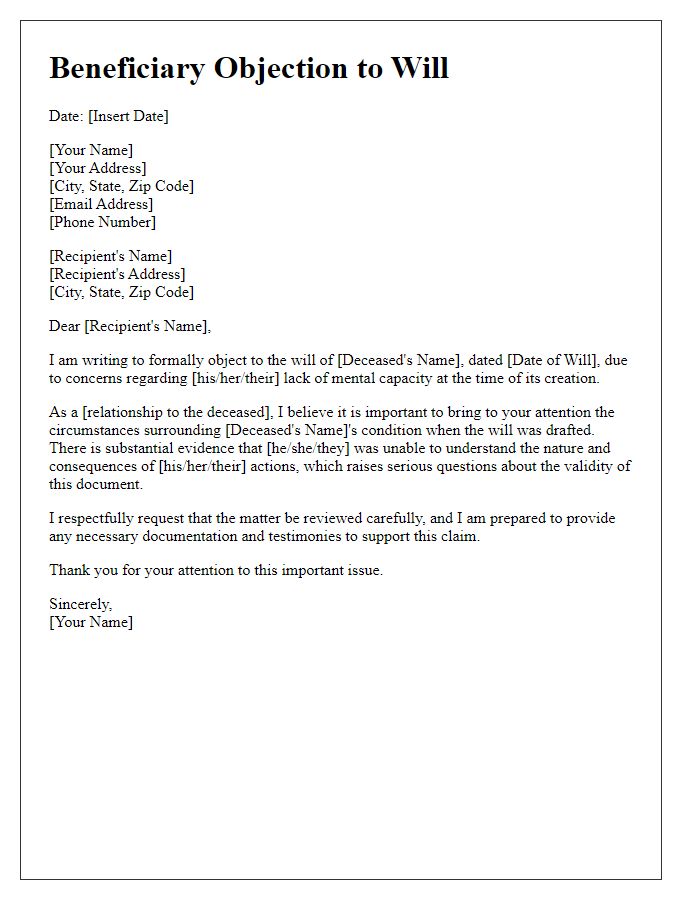

Letter template of beneficiary objection to will based on lack of capacity.

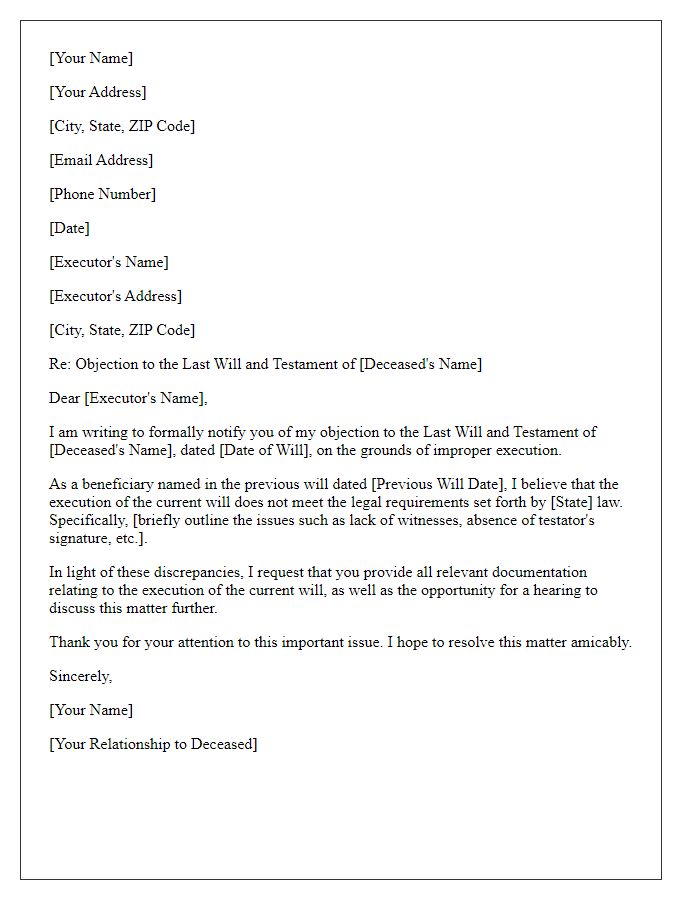

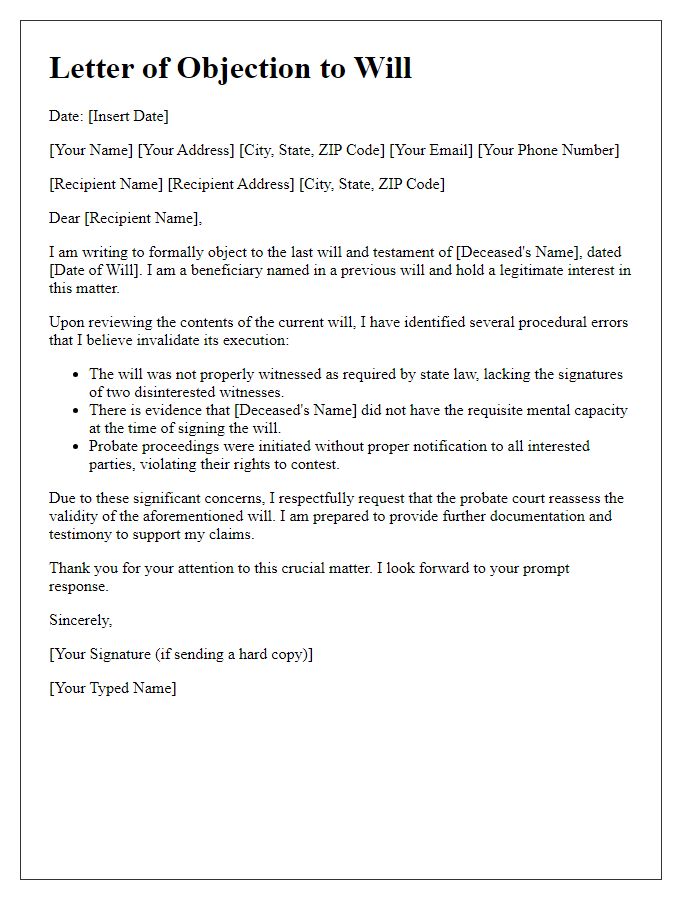

Letter template of beneficiary objection to will citing improper execution.

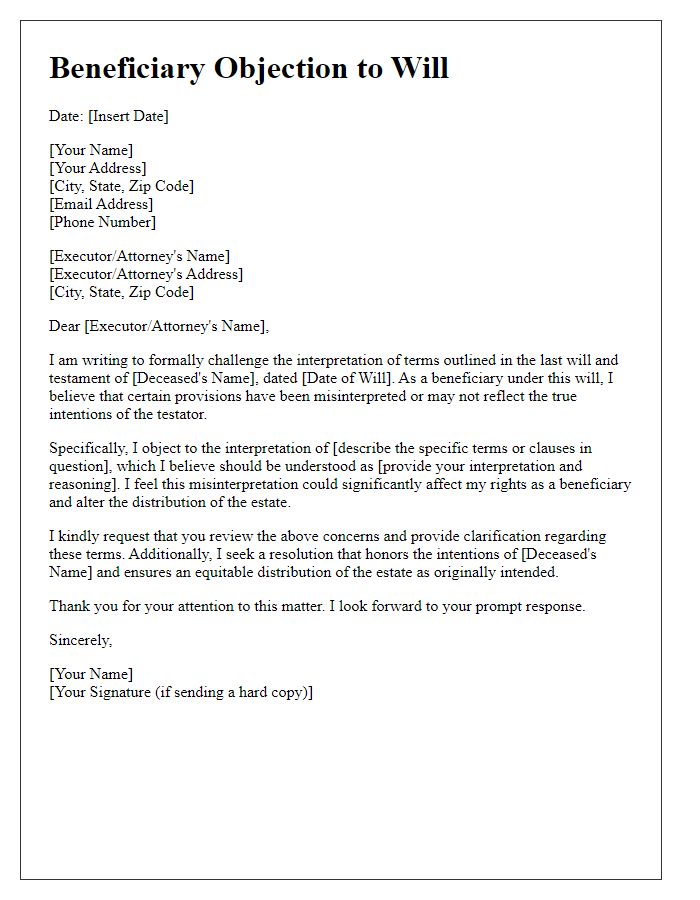

Letter template of beneficiary objection to will challenging the interpretation of terms.

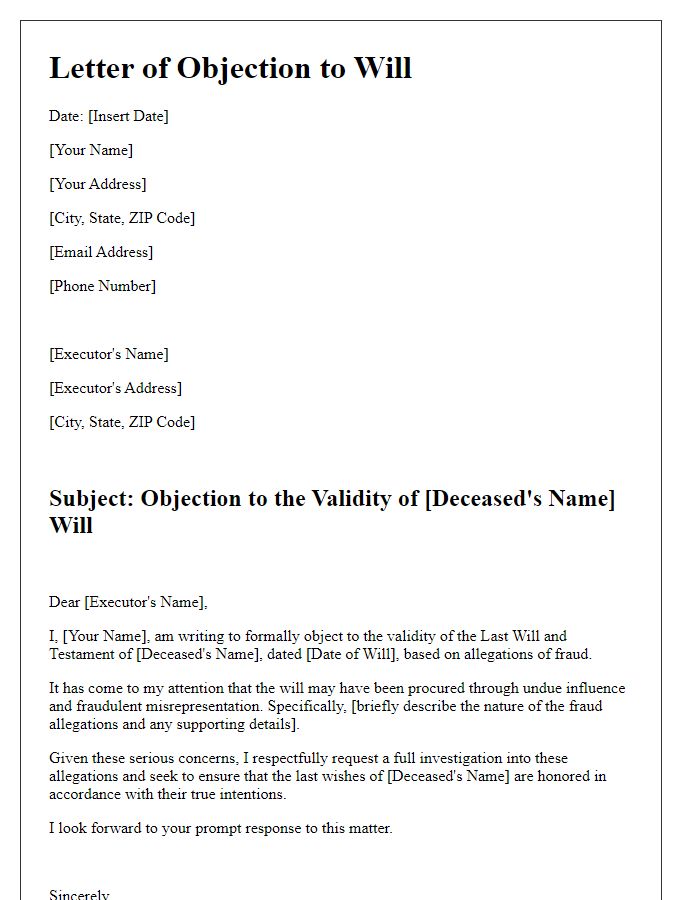

Letter template of beneficiary objection to will regarding fraud allegations.

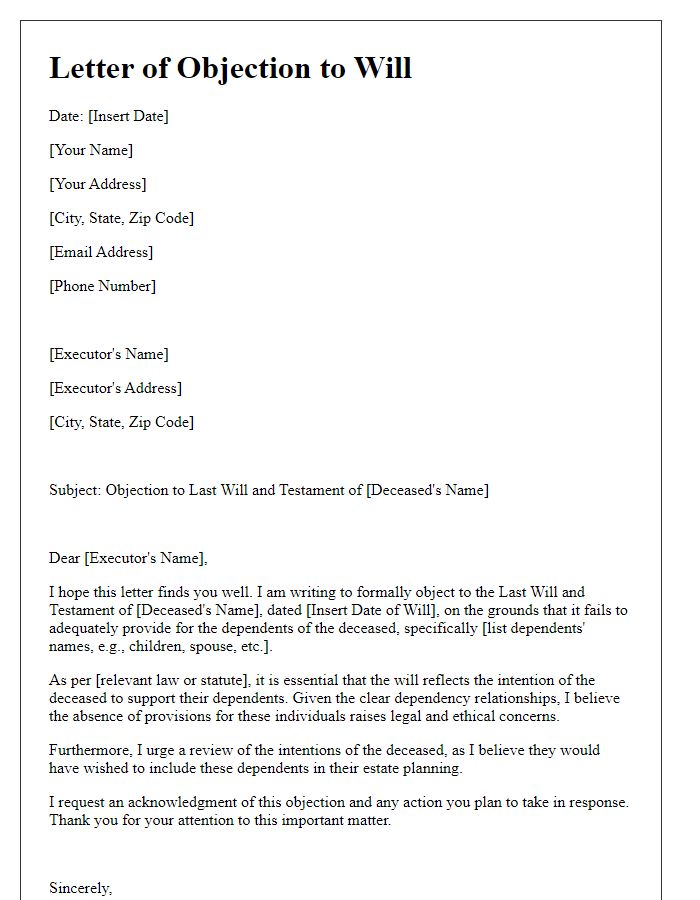

Letter template of beneficiary objection to will for failure to include dependents.

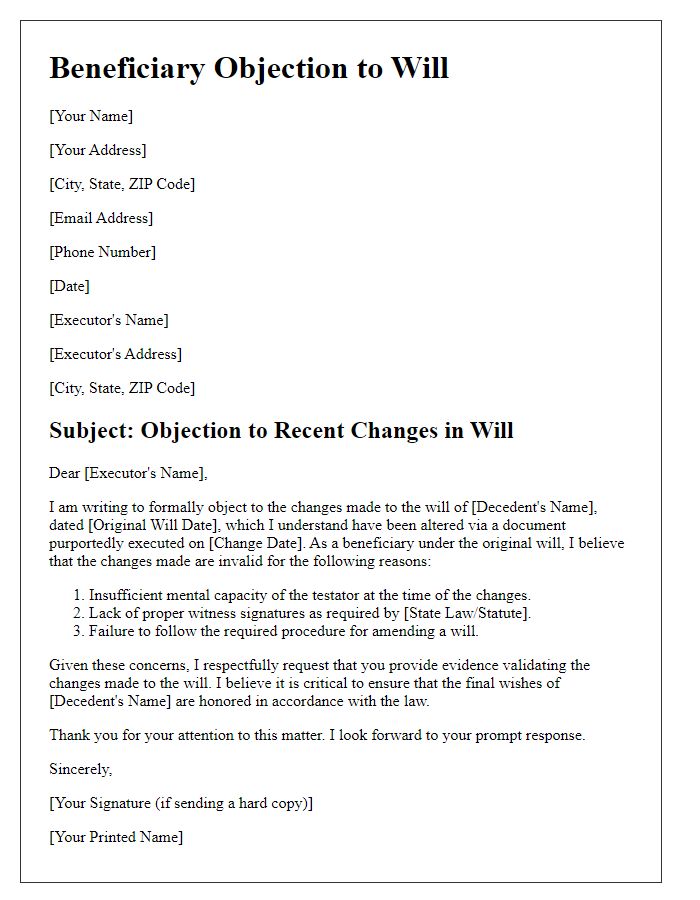

Letter template of beneficiary objection to will asserting changes were not valid.

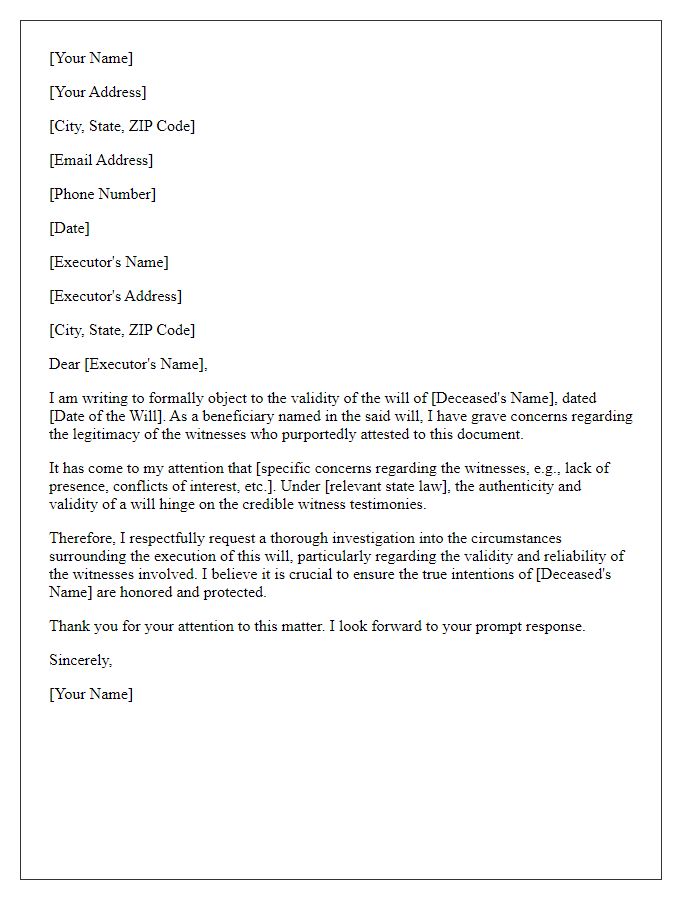

Letter template of beneficiary objection to will questioning the validity of witnesses.

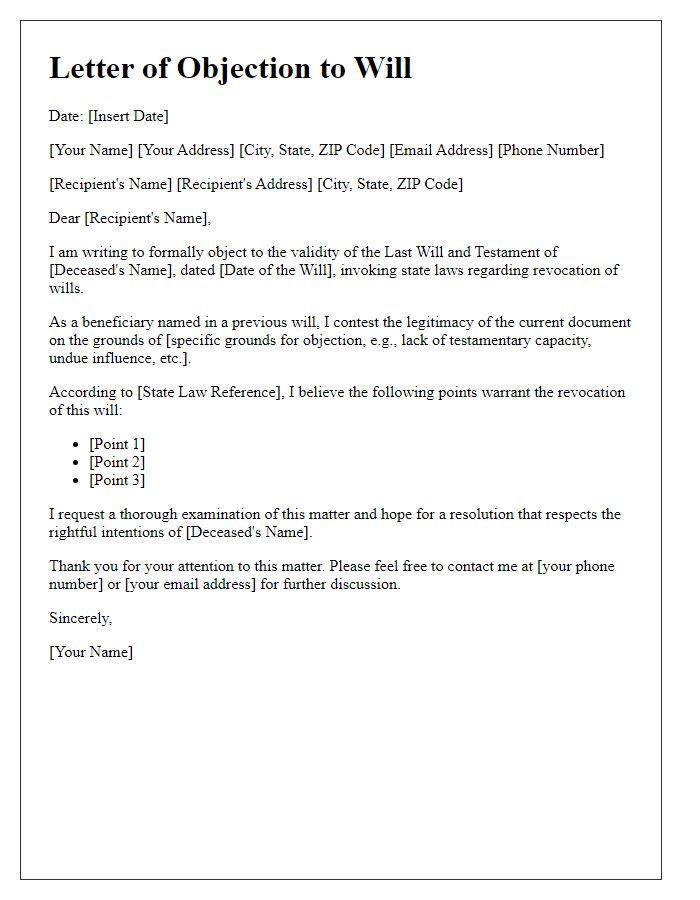

Letter template of beneficiary objection to will invoking state laws for revocation.

Comments