Are you ready to take the first steps towards securing a mortgage loan? Understanding the ins and outs of mortgage information can seem overwhelming, but it doesn't have to be! In this article, we'll break down essential details that every beneficiary should know to make informed decisions for their financial future. So, grab a cup of coffee and dive in to discover valuable insights!

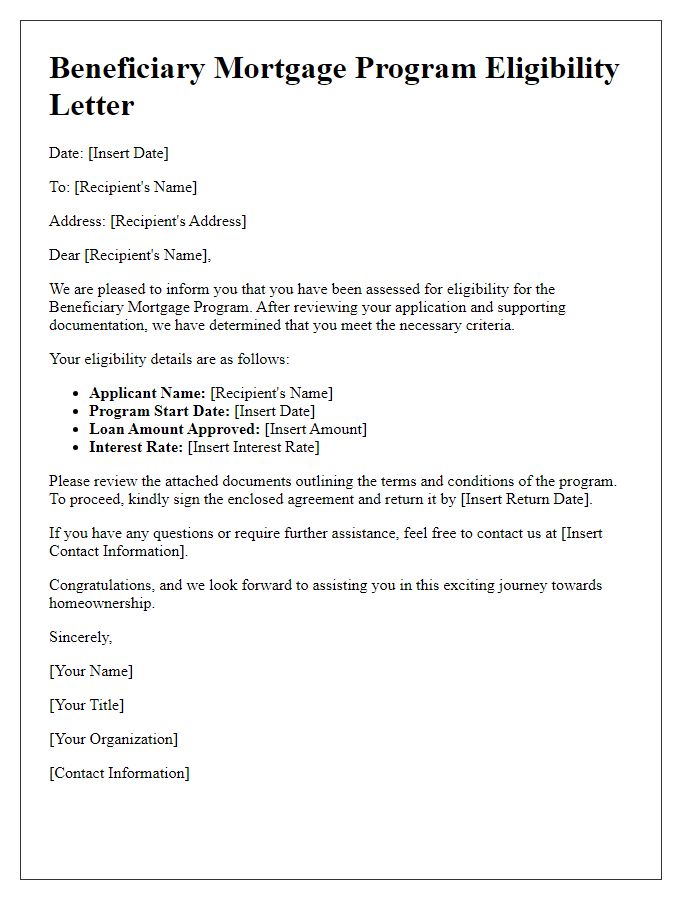

Beneficiary's Full Name and Contact Information

Beneficiary mortgage loans play a crucial role in providing financial assistance to individuals seeking to purchase a home or refinance their existing mortgage. Detailed information about the beneficiary is essential for processing, including the beneficiary's full name, which identifies the individual responsible for the loan, and contact information, such as phone numbers and email addresses, ensuring effective communication throughout the loan approval process. Accurate and up-to-date contact details facilitate timely notifications regarding loan terms, interest rates, and repayment schedules, ensuring that beneficiaries remain informed about their mortgage obligations. Proper documentation is paramount in these transactions, as it directly impacts loan approval rates and the overall experience of the beneficiary in navigating the complexities of mortgage financing.

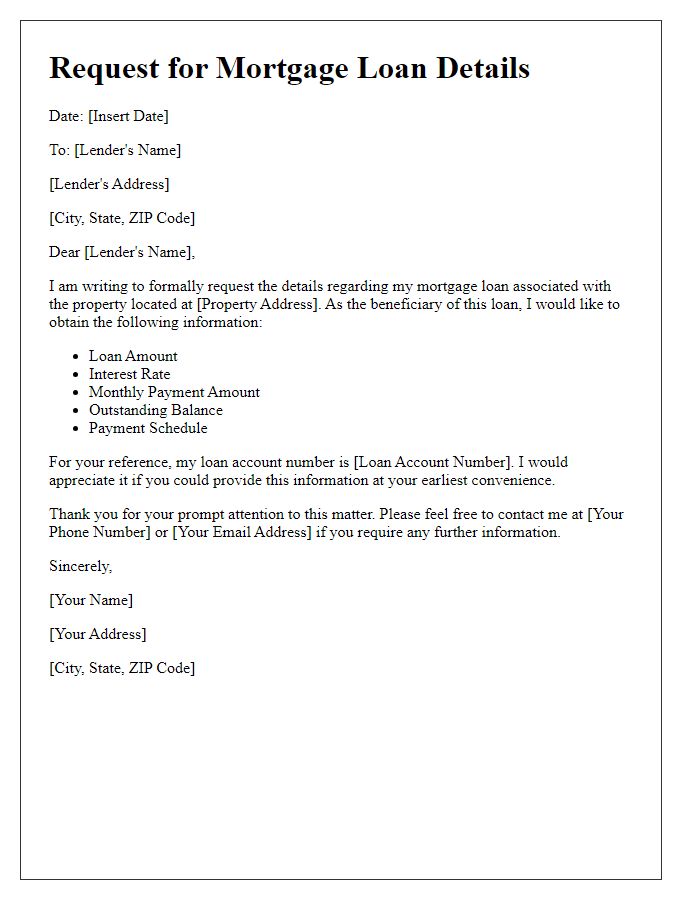

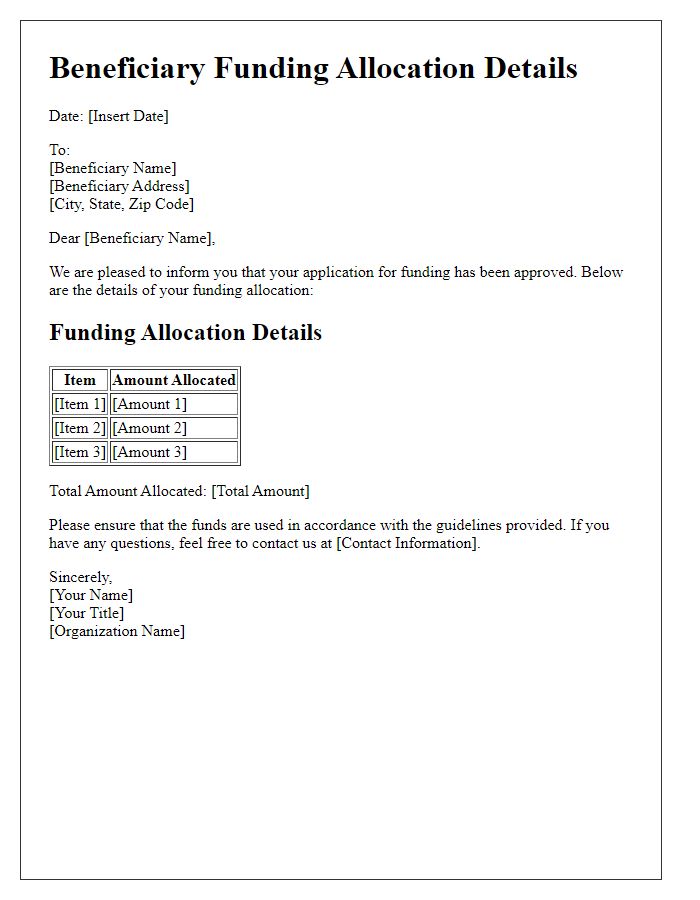

Loan Account Number and Details

Beneficiary mortgage loans typically involve significant financial data, such as account numbers, terms, and financial responsibilities. A mortgage loan account number (often a unique identifier) allows tracking monthly payments and interest rates over the agreed loan duration. Detailed information related to the mortgage includes principal amount, interest rate (fixed or adjustable), payment schedule, and loan term, typically spanning 15 to 30 years. Understanding these details is crucial for managing obligations and maintaining accurate records. Additional elements encompass the lender's name, loan servicer contact information, and any applicable fees. This information serves as a foundation for effective financial planning and ensures proper communication with lenders.

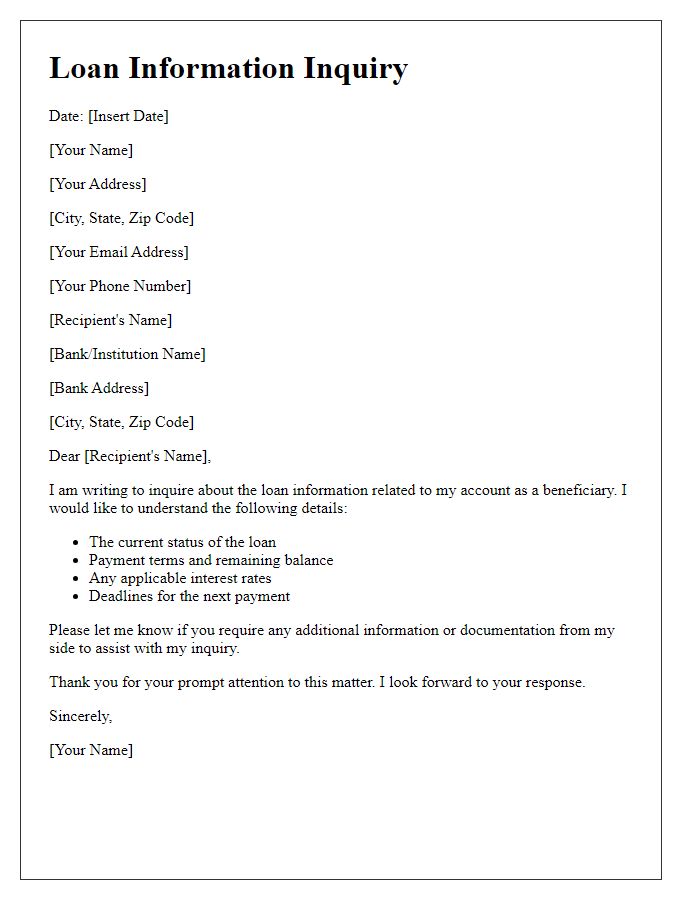

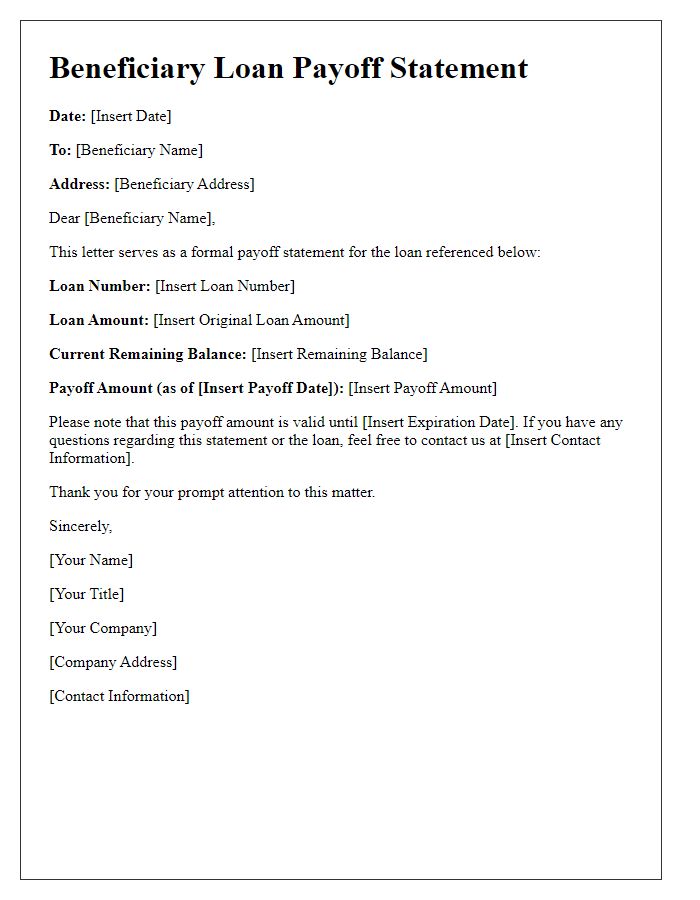

Purpose of the Notification or Correspondence

Beneficiary mortgage loans enable individuals to secure financial assistance for purchasing property, typically within a residential context. Notifications regarding these loans often include essential details about loan terms, interest rates, and repayment schedules. Loan amounts can vary significantly, with averages around $200,000 in the United States housing market. Correspondence may outline important timelines, such as 30-day closing periods, and requirements for documents like proof of income or asset verification. Additionally, any updates pertaining to interest rate changes--affected by Federal Reserve decisions--could greatly impact monthly payments. This communication helps beneficiaries make informed decisions regarding their financial commitments.

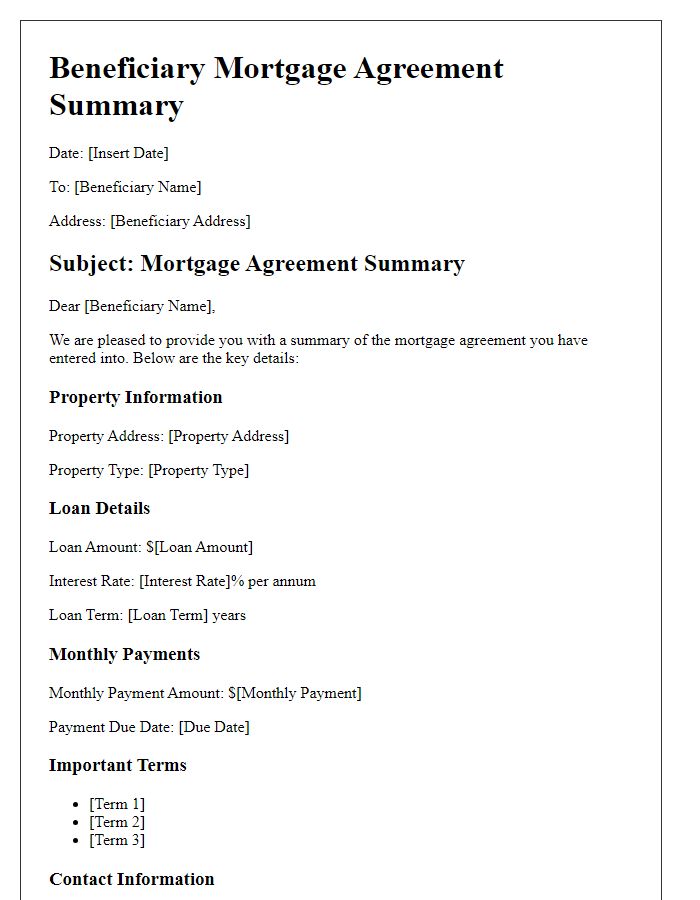

Terms and Conditions of the Mortgage Loan

Mortgage loans, crucial for home financing, typically come with specific terms and conditions that outline the responsibilities of both borrowers and lenders. These terms often include the loan amount, interest rate, and repayment period, which can range from 15 to 30 years. Monthly payments usually include principal and interest, alongside property taxes and homeowners insurance. Certain conditions, like default clauses, may lead to foreclosure, granting lenders rights over the collateral property. Borrowers must also be aware of prepayment penalties, affecting early loan payoff options. Understanding these details is essential for sustainable homeownership and financial planning.

Borrower's Rights and Obligations

Borrowers of mortgage loans must understand their rights and obligations under the Home Mortgage Disclosure Act (HMDA), which mandates transparency in lending practices across the United States. Key rights include the ability to receive a Good Faith Estimate (GFE) outlining costs, the right to request and receive a copy of the loan documents prior to closing, and the obligation to receive clear communication regarding loan terms. Borrowers must fulfill obligations such as making timely payments, maintaining sufficient homeowner's insurance, and adhering to the terms stated in the loan agreement. Failure to comply with the payment schedule can result in foreclosure proceedings, impacting credit scores significantly. It is crucial for borrowers to keep accurate records of communications with lenders and seek legal advice when necessary to understand their standing throughout the life of the mortgage.

Comments