Are you looking to express your gratitude for the smooth processing of your insurance claim? Writing a letter to convey your satisfaction can be a heartfelt way to acknowledge the support you received throughout the process. From prompt responses to compassionate service, these experiences can make all the difference when navigating a claim. Join us as we delve into a detailed template that will guide you in crafting the perfect letter of appreciation!

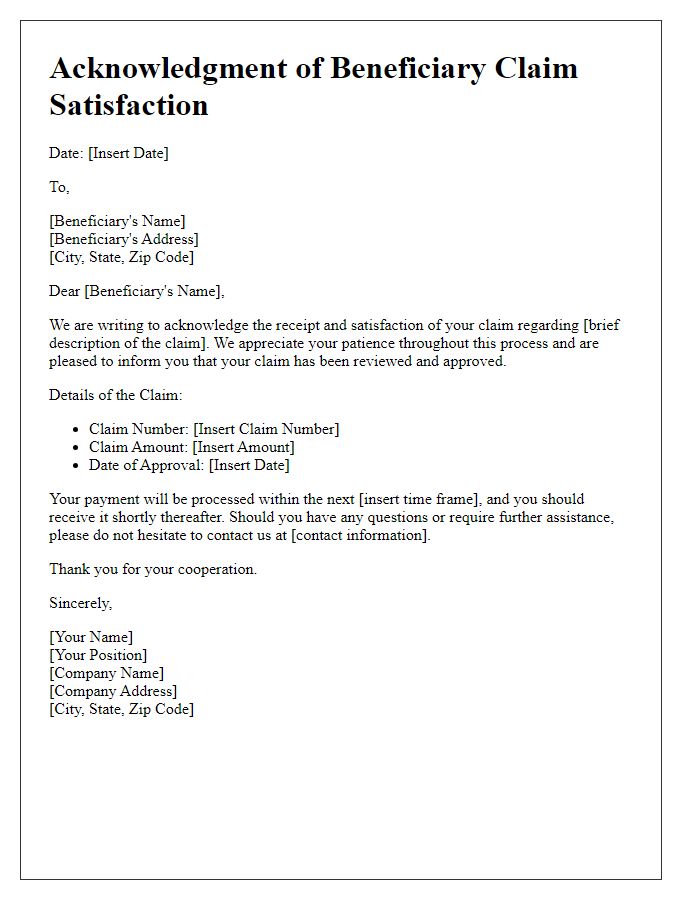

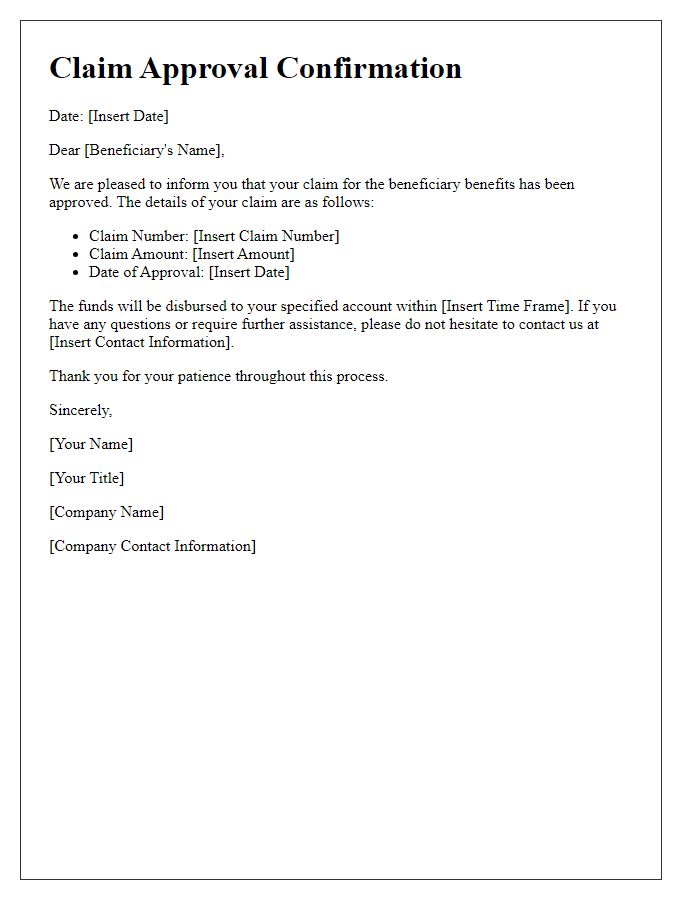

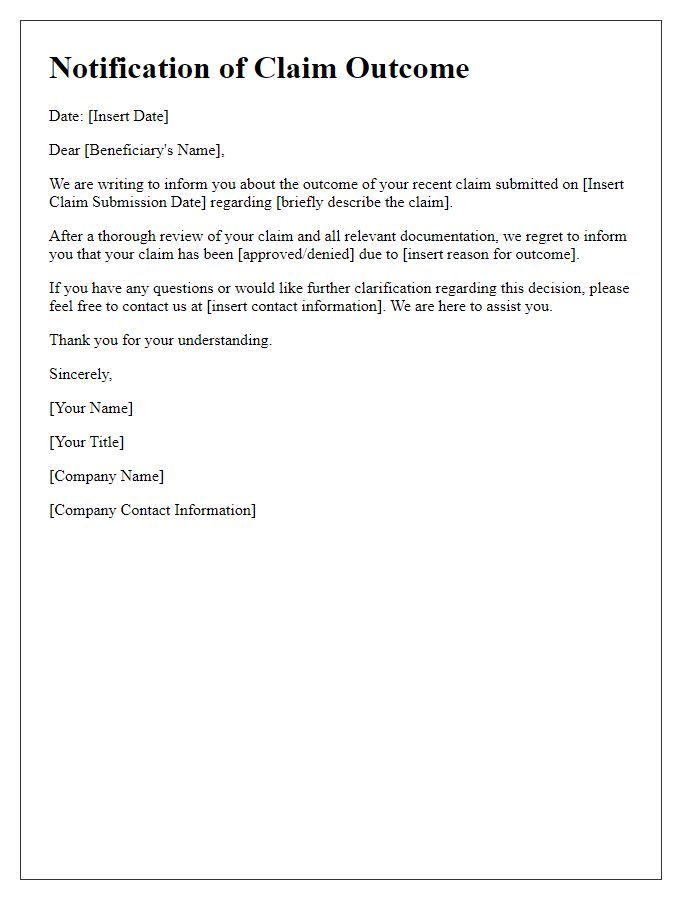

Personalized Greeting

Beneficiary satisfaction surveys are crucial for understanding the effectiveness of claim processes in insurance or financial services. Surveys typically include metrics such as time to process claims, clarity of communication, and overall satisfaction ratings (on a scale of 1 to 10). Feedback gathered often highlights areas for improvement and celebrates successes, allowing organizations to enhance their services. Personalized communication when reaching out to beneficiaries can increase response rates and foster a sense of being valued. For example, using the beneficiary's name and referencing specific claims can lead to more insightful responses and a better understanding of their experience.

Clear Claim Summary

Beneficiary satisfaction in claim processing is essential for ensuring trust in insurance services. A clear claim summary should include vital details such as claim number (a unique identifier for tracking), incident date (when the claim event occurred), policy number (the specific policy covering the claim), and the total claim amount approved (the financial compensation awarded). Additionally, a breakdown of expenses covered (such as medical costs, property damage, and lost wages) should be provided for transparency. Timeliness of processing (number of days taken from claim submission to approval) can also significantly impact beneficiary satisfaction levels. Clear communication regarding any outstanding documentation or final payment timelines fosters a more positive experience for beneficiaries navigating the claims process.

Assurance of Full Compensation

Beneficiaries of insurance claims must navigate proceedings to ensure complete compensation from providers. The claims process involves multiple stages, often requiring detailed documentation, such as medical reports, accident details, and financial records, to substantiate the claim. In particular, the requirement for authenticating evidence ensures that claims are not only legitimate but also accurately represent the losses incurred. Insurers might negotiate settlements, which should reflect the full scope of damages, including both economic losses and emotional distress. The jurisdiction of the claim process, typically governed by state insurance regulations, plays a crucial role in determining compensation levels. Beneficiary satisfaction hinges on timely processing and transparent communication with insurance adjusters, emphasizing the importance of understanding policy terms and coverage limits. Effective advocacy may involve appeals or further negotiations to secure rightful compensation, especially in complicated cases that involve substantial amounts of damage.

Contact Information for Further Assistance

Beneficiary satisfaction with insurance claims can significantly impact their overall experience, particularly in complex cases. When claimants face obstacles during the process, clear contact information is essential for obtaining further assistance. Providing dedicated support lines, such as a toll-free number for inquiries (1-800-123-4567), an official email address (support@insurancetype.com), or a specific department webpage, can facilitate communication. Moreover, listing the working hours (Monday to Friday, 9 AM to 5 PM EST) helps beneficiaries know when to reach out for help. Accessibility through social media platforms, like Twitter or Facebook, enhances engagement and allows for real-time responses to questions. Ensuring these contact methods are easily found on claim acknowledgment letters encourages claimants to seek assistance promptly and improves overall satisfaction.

Expression of Gratitude and Commitment

Beneficiary satisfaction with insurance claims contributes significantly to overall trust in financial institutions. Acknowledging successful claims, such as life insurance payouts following the passing of a policyholder, fosters transparency and enhances customer relationships. Events like claim approvals typically take about 7 to 14 days, depending on the complexity of claims, and ensuring timely communication throughout this period is vital. Commitment to improving service quality involves regular feedback solicitation through surveys, facilitating continuous betterment of the claims process. By implementing technology-driven solutions, like mobile apps for tracking claim statuses, companies can boost beneficiary experiences and satisfaction rates, ultimately reinforcing brand loyalty.

Comments