Are you looking to streamline the process of requesting a beneficiary accounting review? Crafting the perfect letter can not only ensure clarity but also foster a smooth communication flow with the necessary parties. In this article, we'll explore an effective letter template that highlights key details to make your request stand out. So, read on to discover how to draft a compelling request for your beneficiary accounting review!

Recipient's full name and address

A beneficiary accounting review request details financial transactions related to a trust or estate. This request often includes specific information such as the recipient's full name, address, and any relevant account or reference numbers associated with the trust or estate. These reviews are important for ensuring transparency and accuracy in financial reporting, especially when dealing with complex legal documents and fiduciary responsibilities. Proper documentation is crucial to verify that all beneficiaries have received equal treatment under legal stipulations and that financial distributions are aligned with the terms of the trust or estate plan.

Subject line: "Request for Beneficiary Accounting Review

Beneficiary accounting reviews are essential for assessing financial accuracy within organizations, particularly in nonprofit institutions like hospitals or charitable organizations. Regular audits of beneficiary accounts help identify discrepancies or financial inaccuracies, ensuring compliance with regulatory frameworks such as the Financial Accounting Standards Board (FASB) guidelines. These reviews typically encompass a detailed examination of transactions related to individual beneficiaries, verifying proper fund allocation and utilization. Additionally, an efficient review process can uncover potential mismanagement or fraud, safeguarding institutional integrity and protecting donor trust. Timely communication regarding review requests, often initiated via formal subject lines in emails, facilitates collaboration between finance teams and external auditors, thus upholding financial transparency.

Personal account details and beneficiary information

Beneficiary accounting review requests require detailed personal account information and beneficiary data for accurate processing. This includes full name of the beneficiary, account number (unique identifier within the financial institution), Social Security Number (for tax purposes and verification), relationship to the account holder, and contact information (such as phone number and email address). Additional documentation may be required, such as proof of identification (government-issued ID) and evidence of the beneficiary's eligibility. Accurate and comprehensive details ensure timely assessment and compliance with regulatory requirements. Accurate beneficiary data aids in effective communication and resolution of any issues that may arise during the review process.

Specific request for review and deadline

Beneficiary accounting reviews are crucial for ensuring transparency and accuracy in financial management. The review aims to assess account balances and transaction histories associated with beneficiaries, ensuring compliance with regulatory standards (such as the Generally Accepted Accounting Principles, GAAP). A specific request for review should include key documents, such as account statements and transaction records, focusing on discrepancies or irregularities. Deadlines for submitting the review request should be clear, often provided within a timeframe of 30 days from the date of distribution to ensure timely evaluation and necessary corrections. Providing contact information for follow-up inquiries can enhance communication and efficiency during the review process.

Contact information for follow-up and clarification

Beneficiary accounting review requests often require clear and detailed communication to ensure all necessary information is accurately conveyed. Key components include the identification of both the requesting party and the beneficiary, specific details about the accounts in question, pertinent dates, and relevant financial figures. Accurate contact information is essential for effective follow-up and clarification. This should include telephone numbers, email addresses, and alternative contacts, ensuring that any issues arising from the request can be promptly addressed. Providing clarity in every aspect fosters transparency and expedites the review process.

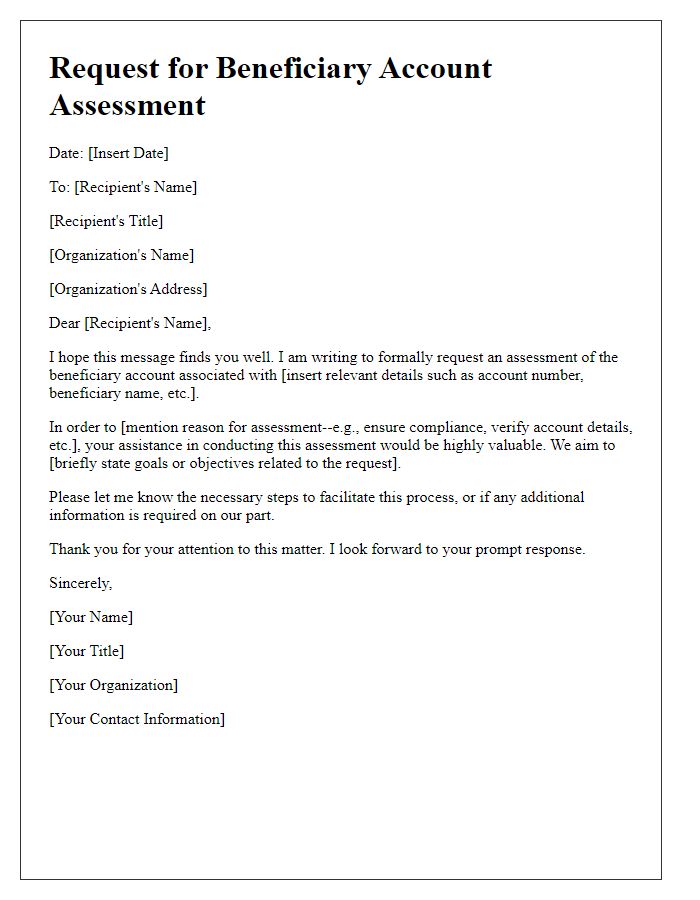

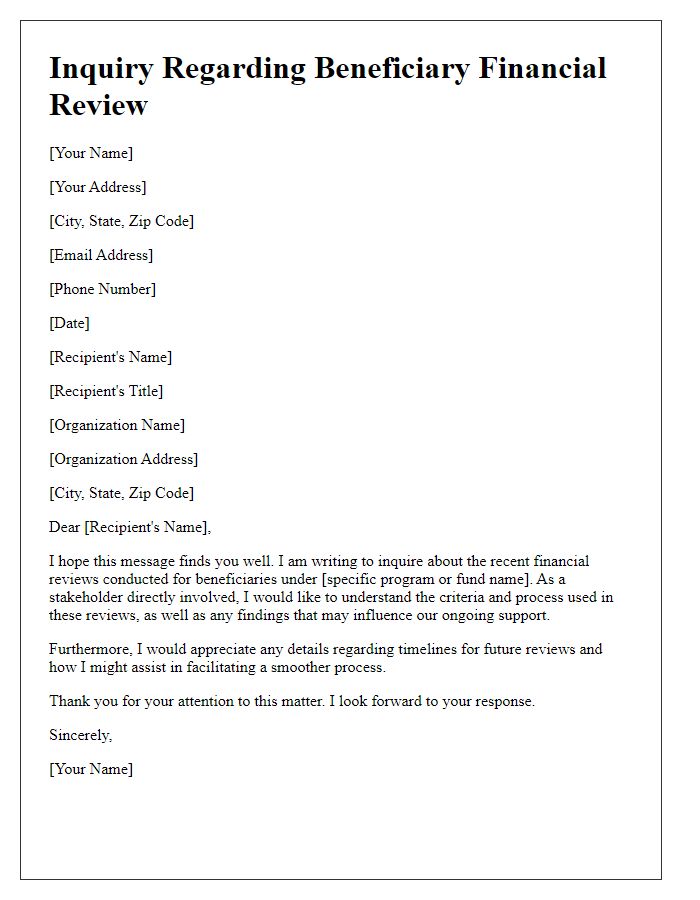

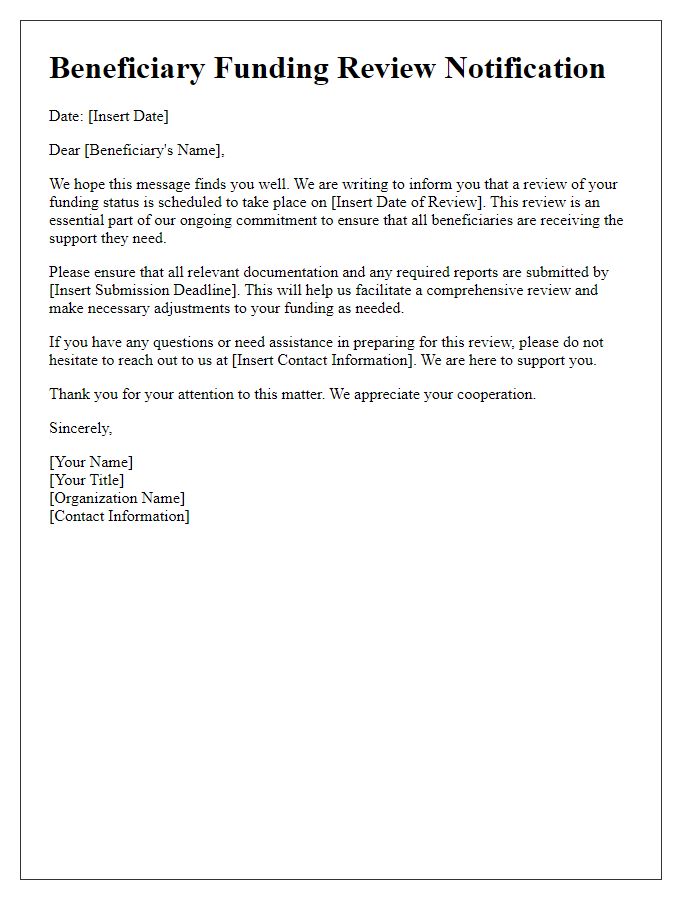

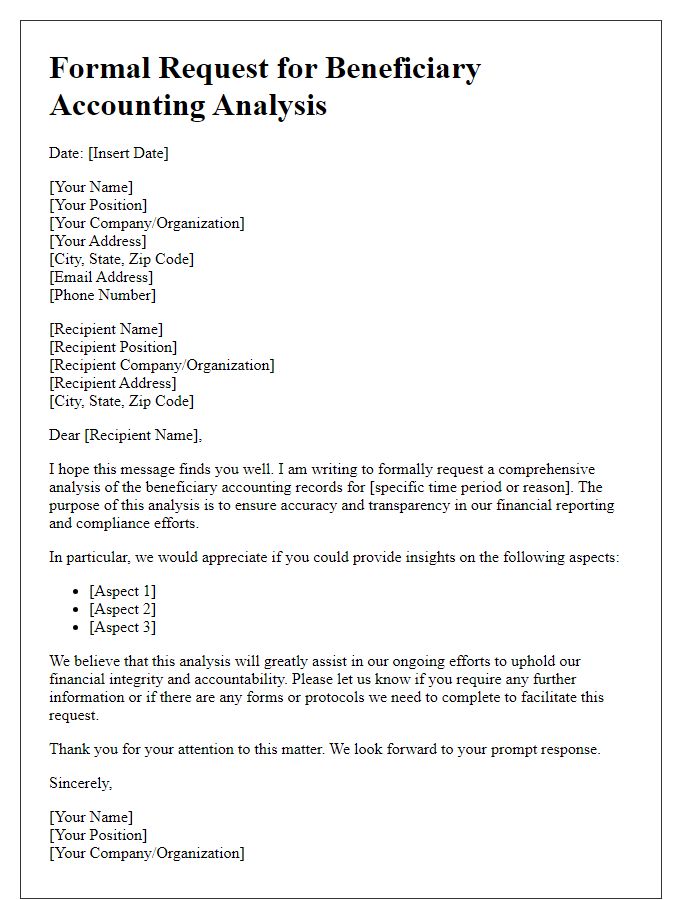

Letter Template For Beneficiary Accounting Review Request Samples

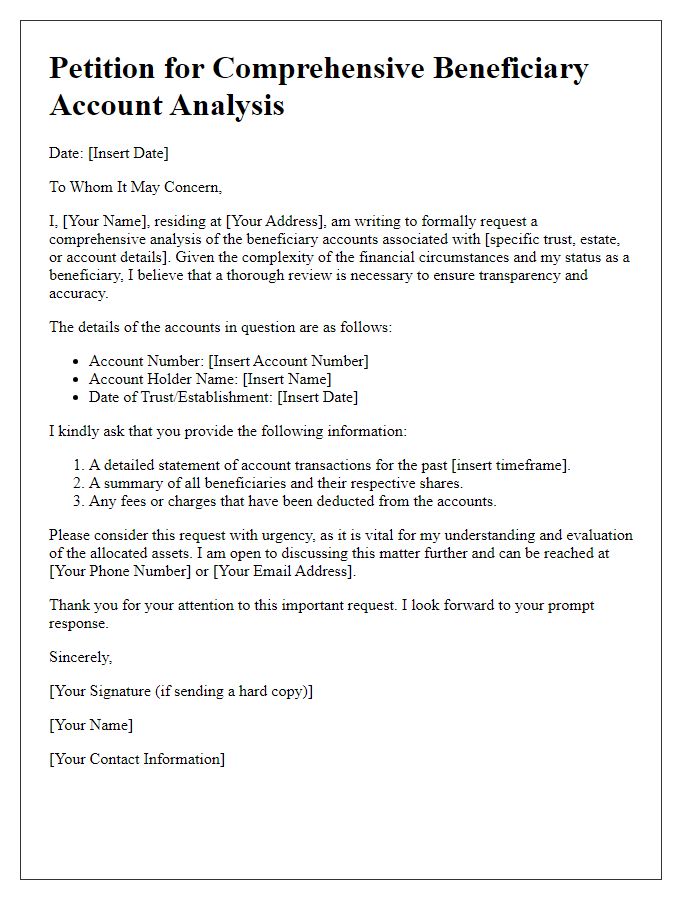

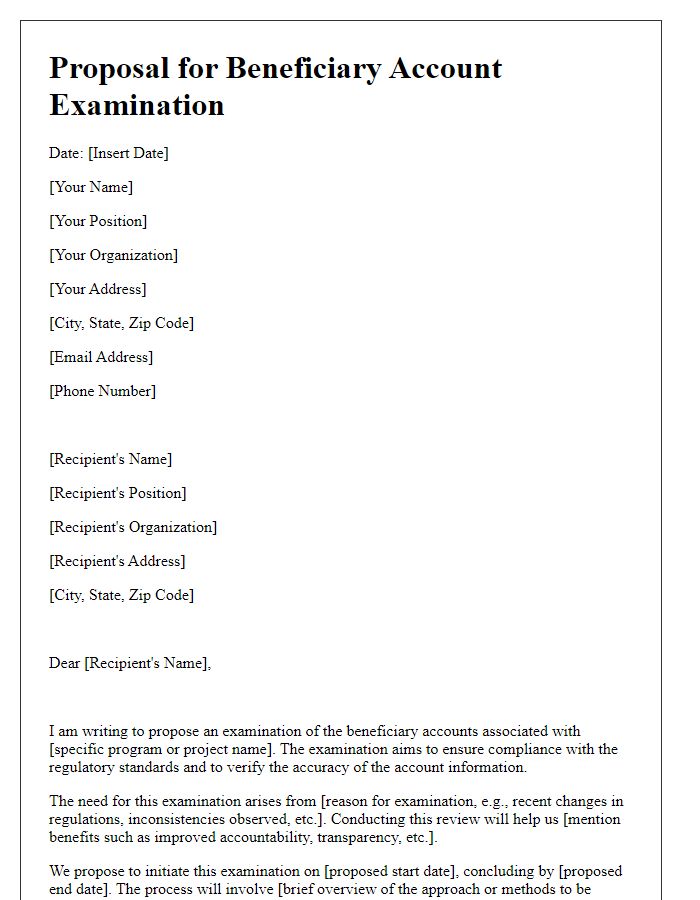

Letter template of petition for comprehensive beneficiary account analysis

Comments