Are you considering applying for a loan but unsure of how to structure your letter? Crafting a clear and compelling loan application letter can significantly impact your chances of approval. In this guide, we will break down the essential components you need to include, ensuring that your request stands out to lenders. Keep reading to uncover valuable tips and a ready-to-use template that will make your application process a breeze!

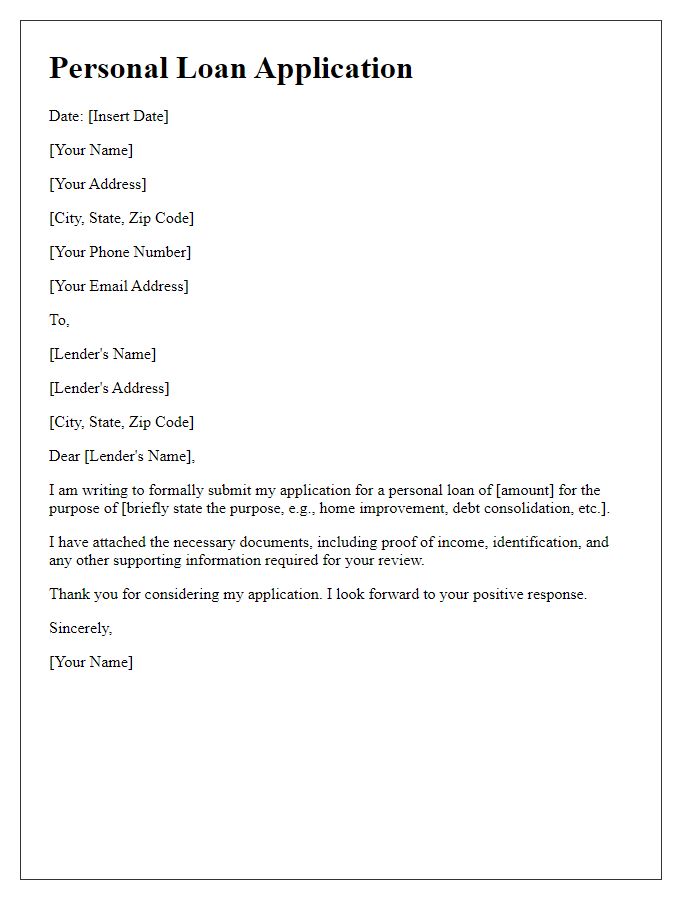

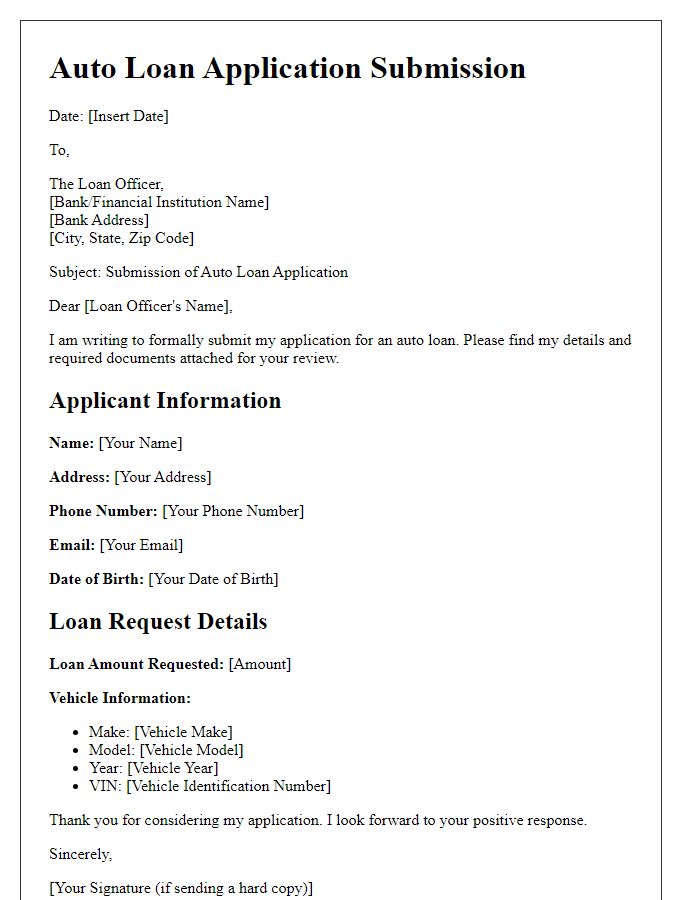

Clear Applicant Information

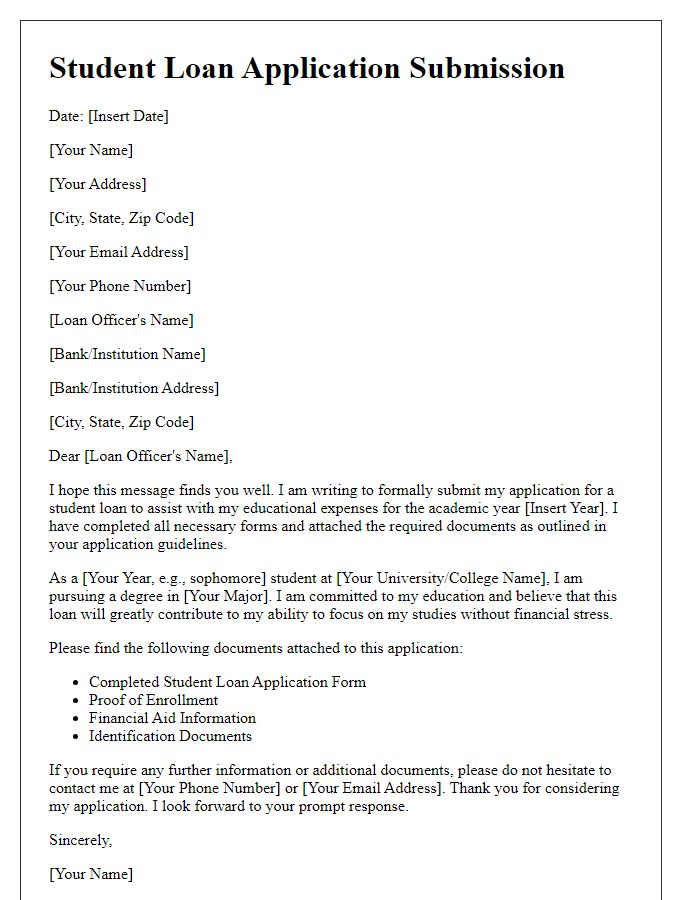

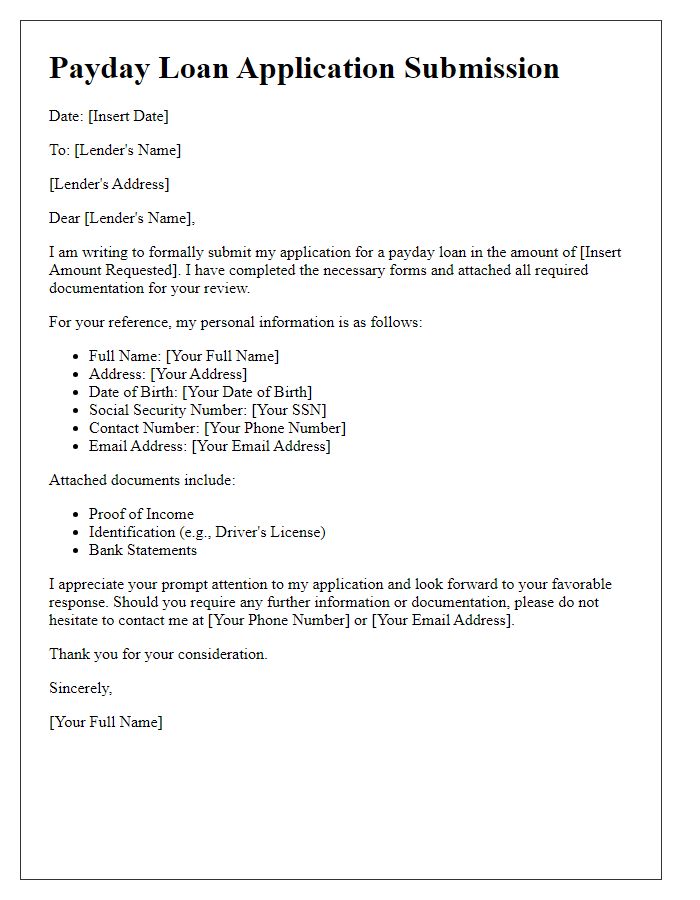

Clear applicant information is crucial in loan application submission to ensure accurate processing. Personal details include the applicant's full name, date of birth, and social security number, which help verify identity. Contact information should consist of the current residential address, phone number, and email address for communication regarding the application status. Financial information includes employment status, income details, and existing debts, which provide lenders with insights into the applicant's financial stability. Additionally, information on the loan amount requested and the purpose of the loan, such as home purchase, education, or debt consolidation, helps lenders assess eligibility and risk.

Purpose of Loan

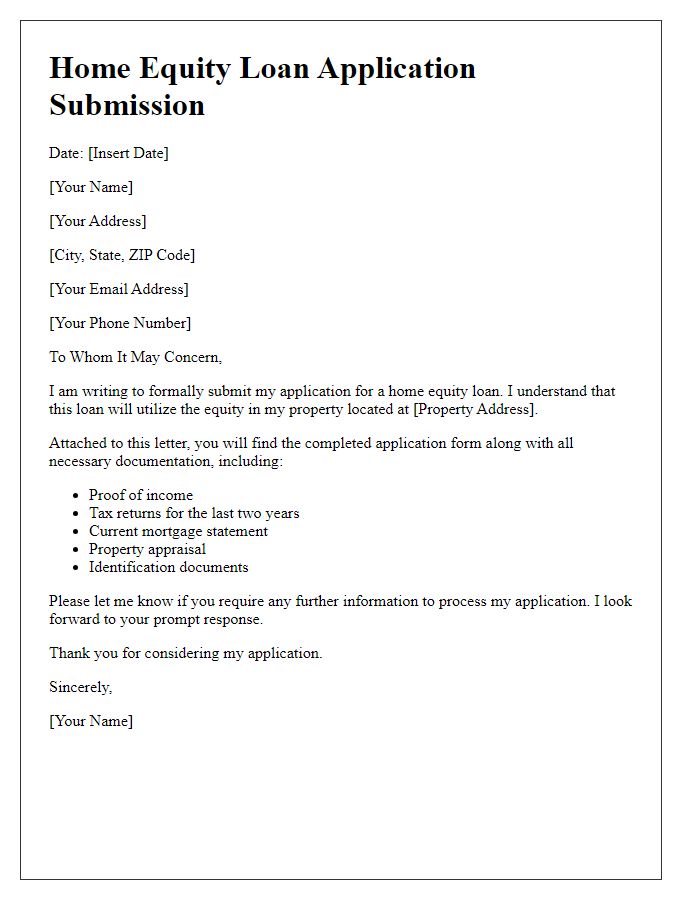

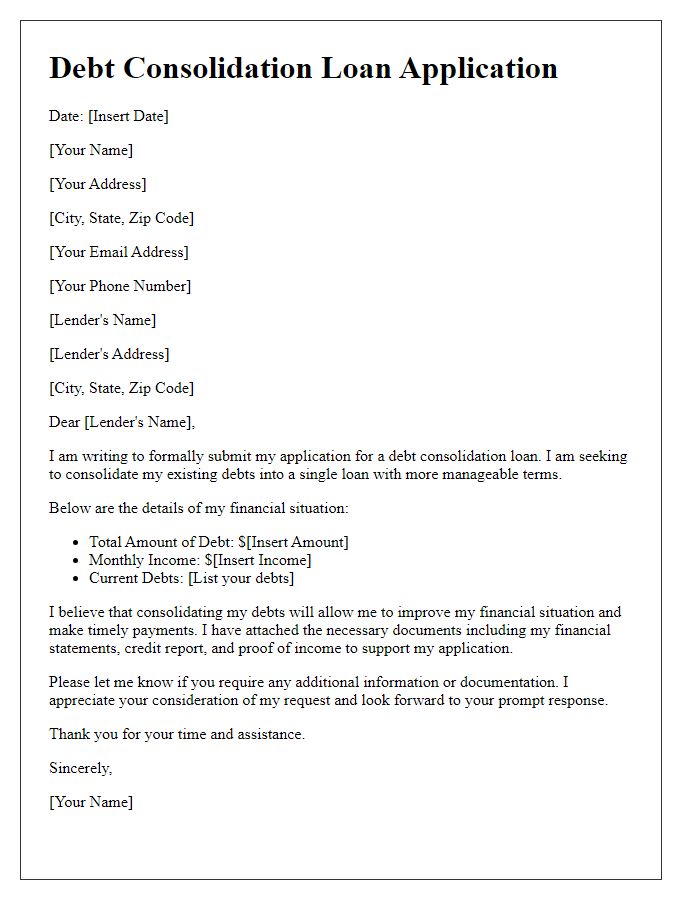

Many individuals seek loans for various purposes including home renovations, education expenses, and debt consolidation. Home renovations often require substantial funding, averaging around $10,000 to $50,000 depending on the extent of the work needed. Education expenses, particularly for higher education institutions such as universities or vocational schools, can total anywhere from $20,000 to upwards of $100,000 over a four-year period. Debt consolidation loans help streamline multiple debts into a single loan, often reducing interest rates and monthly payments, ultimately improving financial stability. Each of these purposes has unique considerations, impacting the loan amount, interest rate, and repayment terms tailored to the borrower's financial situation and goals.

Loan Amount Requested

The loan application process requires meticulous attention to detail, particularly regarding the requested loan amount. For example, potential borrowers often specify exact figures, frequently ranging from $5,000 to $50,000, depending on financial needs such as home renovations, educational expenses, or starting a small business. This figure should clearly indicate the intended purpose, which will help lenders assess eligibility and risk. Providing documentation of income, monthly expenses, and credit history further enhances the application process, demonstrating financial responsibility and the ability to repay the loan. Additionally, including local market conditions or economic factors relevant to the financial request can strengthen the application's credibility.

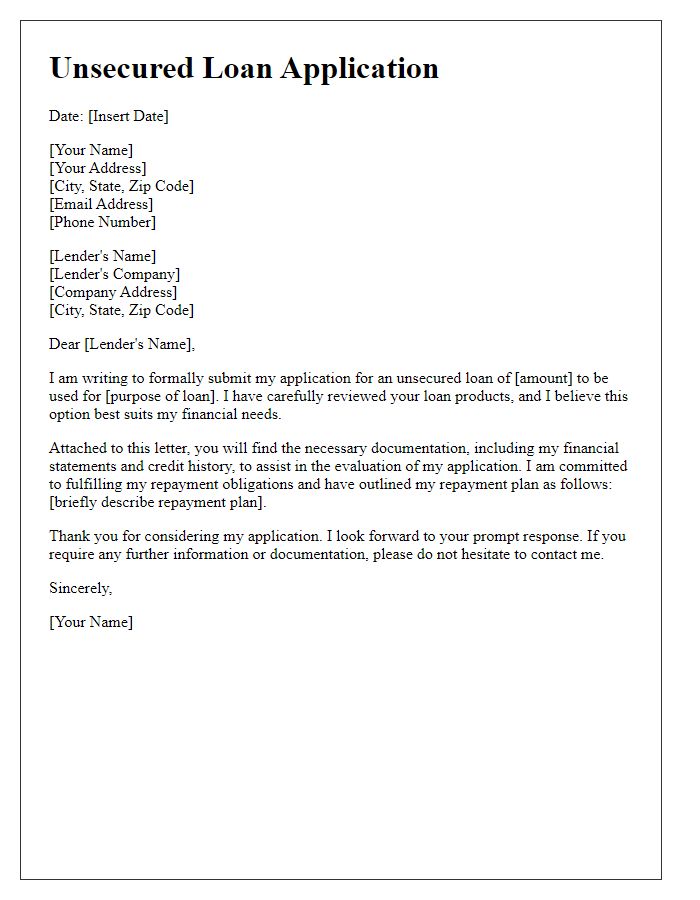

Repayment Plan

A comprehensive repayment plan is a crucial aspect of any loan application, detailing the scheduled payments and terms for repayment to the lender. This plan typically includes the loan amount, interest rate (which can range from 3% to 10% depending on the lender), monthly payment amounts, and the total loan term (usually 12 to 60 months). Detailed timelines outline payment due dates, beginning with the first repayment after the grace period (commonly 30 to 90 days post-disbursement) and specify consequences for missed payments, which may involve late fees or increased interest rates. The budget breakdown also highlights other financial commitments, ensuring sufficient funds are allocated each month (recommended 30% of monthly income) to maintain on-time payments without jeopardizing essential living expenses. All components create a clear and transparent repayment strategy, boosting confidence in the borrower's commitment to future financial responsibilities.

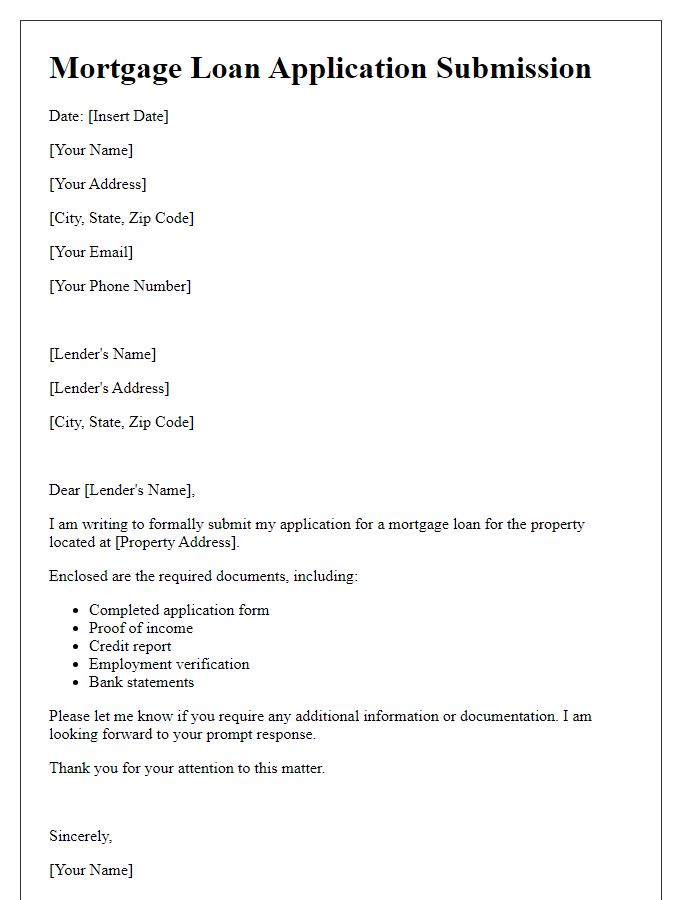

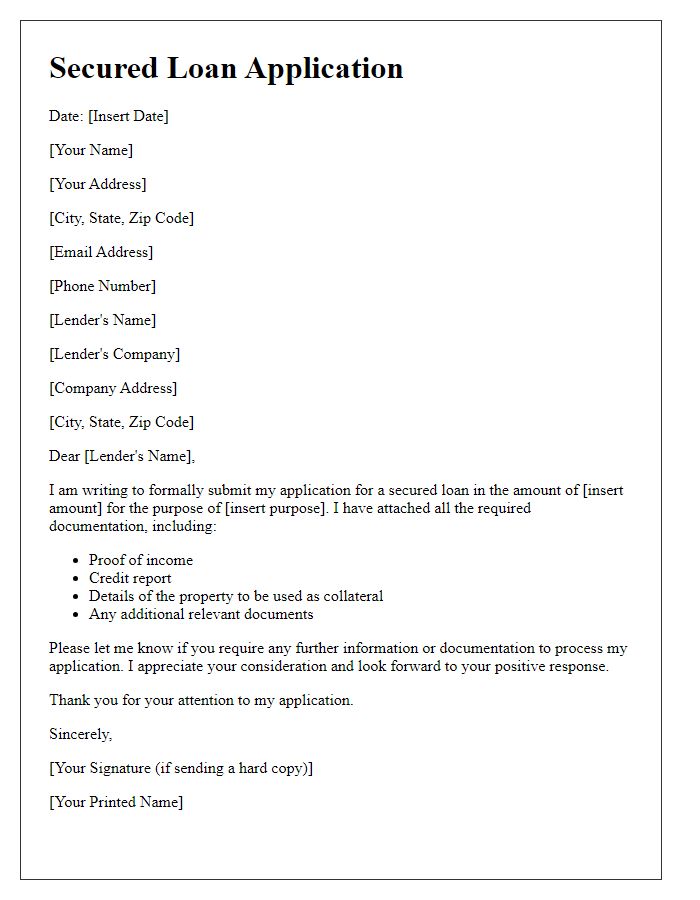

Supporting Documentation

Submitting a loan application requires comprehensive supporting documentation to ensure approval. Essential documents include income verification (such as pay stubs or tax returns), credit reports showing credit scores (which influence interest rates), and employment verification letters from employers. Additionally, borrowers must provide proof of assets, such as bank statements or investment account summaries, highlighting available funds. For secured loans, documentation for collateral (like property deeds or vehicle titles) is crucial. Financial responsibility may also require a detailed debt-to-income ratio analysis, assessing monthly debt obligations against income. Proper organization and clarity enhance the review process for lending institutions.

Comments