Are you ready to unlock the potential of your hard-earned savings? When your fixed deposit matures, it's the perfect opportunity to reassess your financial goals and make informed decisions about your next steps. In this article, we'll guide you through the essential points to consider as you navigate the maturity process, ensuring you make the most of your investment. So, let's dive in and explore how to turn your maturity into a financial advantage!

Clear Subject Line

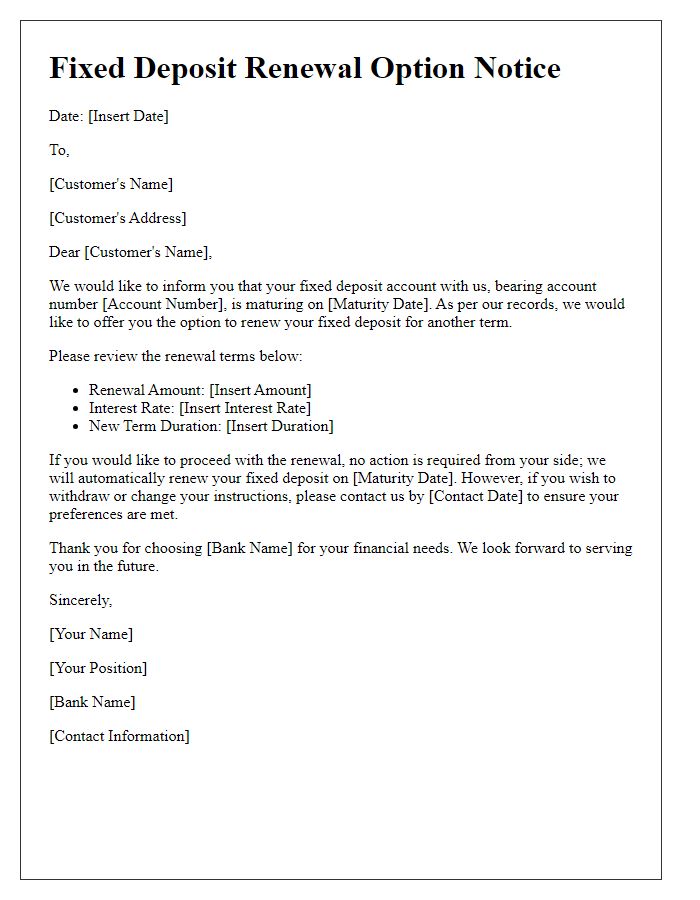

Fixed deposit maturity notification serves to remind account holders of the upcoming expiration of their investment term. This notification typically specifies the fixed deposit account number, maturity date, and accrued interest amount. In many cases, banks will provide options for reinvestment or withdrawal, along with required actions that customers need to take post-maturity. Timely communication ensures customers can manage their funds effectively, potentially maximizing their investment returns while avoiding penalties or missed opportunities.

Account Details

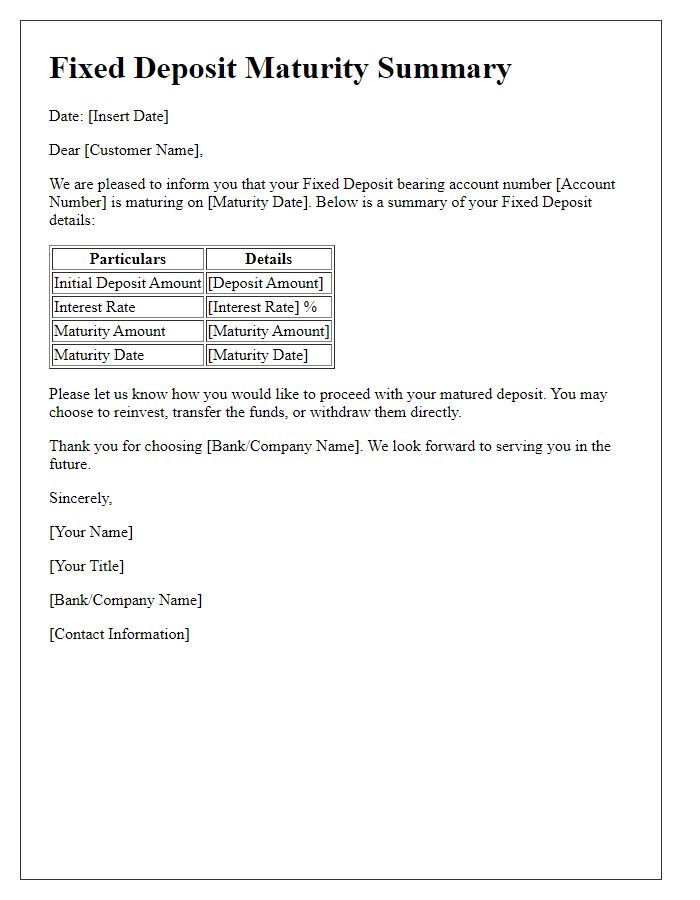

Fixed deposits can generate significant returns for investors over time, often ranging from 5% to 7% annual interest depending on the financial institution. Upon maturity, such as on January 15, 2024, investors need to be informed regarding their account details, including reference number 123456 and amount of $10,000. Notifications are typically sent via email or physical mail by the bank, detailing the maturity date and options for reinvestment or withdrawal. Timely communication assists investors in making informed decisions regarding their financial planning and future investments.

Maturity Date

Fixed deposit maturity signifies the completion of a financial investment period in a bank or financial institution. The maturity date, often a pivotal milestone, can vary from a few months to several years, depending on the chosen term. Upon reaching the maturity date, typically indicated in the investment agreement, account holders should receive notifications to facilitate the withdrawal or reinvestment of funds. Customers must consider prevailing interest rates at maturity for optimal reinvestment options. Financial entities may also offer features like automatic reinvestment plans, allowing seamless transitions of funds into new fixed deposit accounts.

Interest Rate and Amount

Fixed deposit maturity notifications are essential for investors looking to manage their finances effectively. Upon maturity, an amount of INR 100,000 invested at an annual interest rate of 6% over a tenure of five years will yield a total of INR 130,000, including principal and interest. Understanding the fixed deposit terms and conditions is crucial, especially concerning the processing time required for the disbursement of funds. Banks like State Bank of India or HDFC Bank typically send these notifications via email or SMS, detailing the maturity date, interest accrued, and the options available for reinvestment or withdrawal. Timely action on such notifications can significantly enhance financial planning strategies.

Contact Information

Fixed deposit maturity notifications are essential communications for financial institutions and their clients. Clients typically receive information regarding the maturity date, interest amount accrued, and renewal options for traditional bank fixed deposits (FDs). Notifications should include contact details, such as phone numbers (often local service numbers), email addresses, and office locations (branch names or headquarters) for any customer service inquiries. Timely reminders ensure clients can make informed decisions about their investments and manage their finances effectively, particularly as fixed deposit amounts generally reach thousands or even millions of currency units depending on individual wealth.

Comments