When it comes to managing your finances, reconciling your bank statement is an essential task that ensures everything aligns with your records. It's not just about balancing numbers; it's about gaining clarity and control over your financial situation. Many people find this process daunting, but with the right approach and tools, it can be simplified and even satisfying. Curious about how to streamline your bank statement reconciliation? Keep reading for helpful tips and a handy letter template!

Accurate Data Collection

Accurate data collection is essential for bank statement reconciliation, ensuring financial integrity. Regularly analyzing account transactions, such as deposits, withdrawals, and fees, from financial institutions like Bank of America or Chase enhances accuracy. Typically, businesses should compare their internal records against monthly statements to identify discrepancies. Reconciliation involves verifying key figures, including transaction dates, amounts, and reference numbers, to prevent errors. Utilizing accounting software, such as QuickBooks or Xero, can streamline this process by automating data entry and generating reconciling reports. Establishing internal controls, like dual authorization for significant transactions, can also bolster accuracy during reconciliation efforts.

Detailed Transaction Breakdown

Bank statement reconciliation involves a meticulous examination of financial records against bank statements to ensure accuracy. Each transaction, including deposits, withdrawals, and fees, must be documented with specific dates, amounts, and descriptions. For instance, a deposit of $4,200 on November 5, 2023, may reflect a client payment, while a withdrawal of $1,150 on November 15, 2023, could represent a vendor invoice payment. Additionally, bank fees, such as a $30 monthly service charge imposed on November 30, 2023, should be included. Addressing discrepancies in transactions ensures that the business's accounting records align with the actual bank balance, supporting accurate financial reporting and accountability.

Confirmation of Statement Period

Bank statement reconciliation involves verifying the financial records of an entity against the bank's records. This process typically covers a specific statement period, such as January 1 to January 31, 2023. This period is critical as it allows for a thorough comparison of transactions, including deposits and withdrawals, to identify any discrepancies. A bank statement includes essential details like transaction dates, descriptions, amounts, and balances, providing a clear picture of account activity. Accurate reconciliation ensures proper financial reporting and compliance with regulatory standards, which are crucial for maintaining transparency and trust in an organization's financial health.

Discrepancy Identification

Bank statement reconciliation involves reviewing financial records to ensure that the balances match between the bank statement and the internal accounting records. Discrepancies in this process can arise from numerous factors such as unauthorized transactions, data entry errors, or timing differences between transactions. For instance, a company may notice a discrepancy of $500 when comparing their internal ledger with the statement from Bank of America dated September 30, 2023. This difference may stem from an outstanding check issued on September 25, 2023, which has not yet cleared the bank. Additionally, unexpected bank fees or interest income not recorded in the internal ledger can lead to confusion. Accurate identification and documentation of these discrepancies are crucial for maintaining financial integrity and ensuring accurate reporting in compliance with standards set by the Financial Accounting Standards Board (FASB).

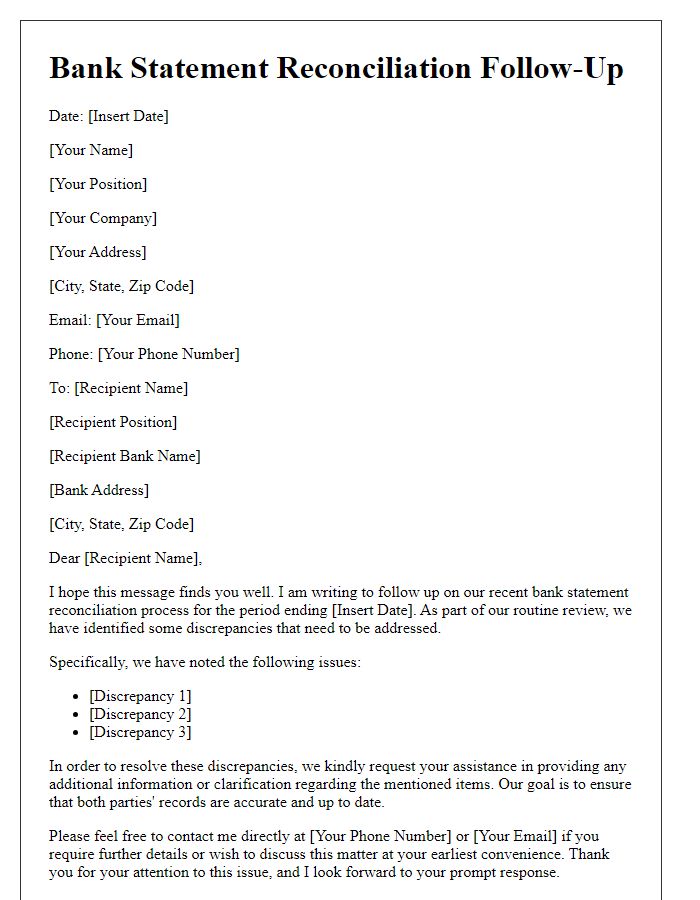

Contact Information for Follow-up

Bank statement reconciliation involves comparing the bank statement, which summarizes a financial institution's activities, against personal financial records to ensure accuracy in accounting. Reconciliation typically focuses on identifying discrepancies in transaction amounts, dates, or balances. Maintaining up-to-date contact information is crucial for timely follow-up on any issues discovered during the reconciliation process. This information can include customer service numbers for specific banks, email addresses for account inquiries, and contact names within the bank's support services, allowing for efficient communication regarding any discrepancies. Proper reconciliation processes are essential for financial accuracy, preventing potential fraud, and ensuring reliable financial planning.

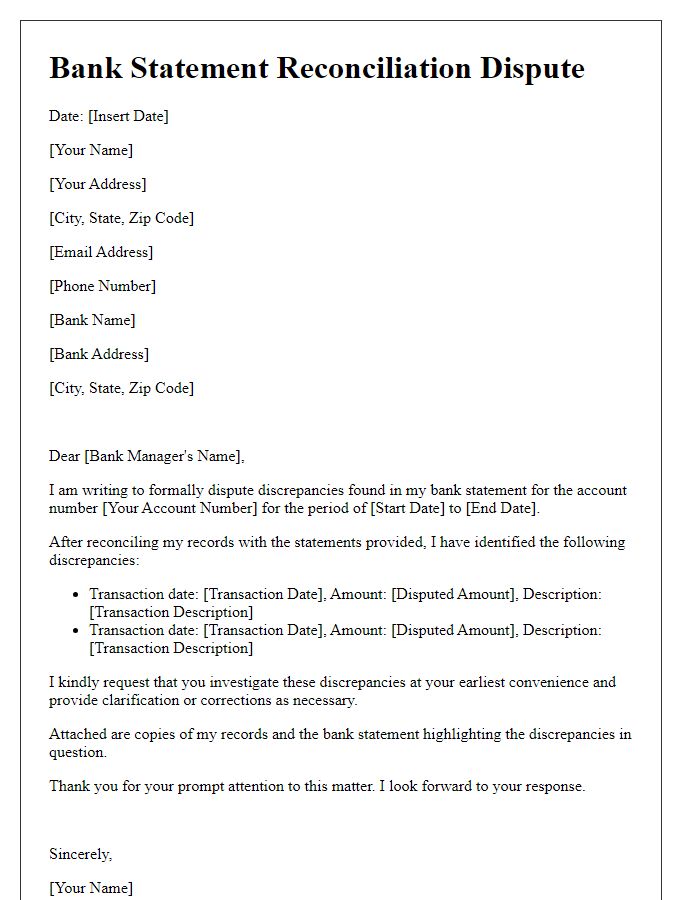

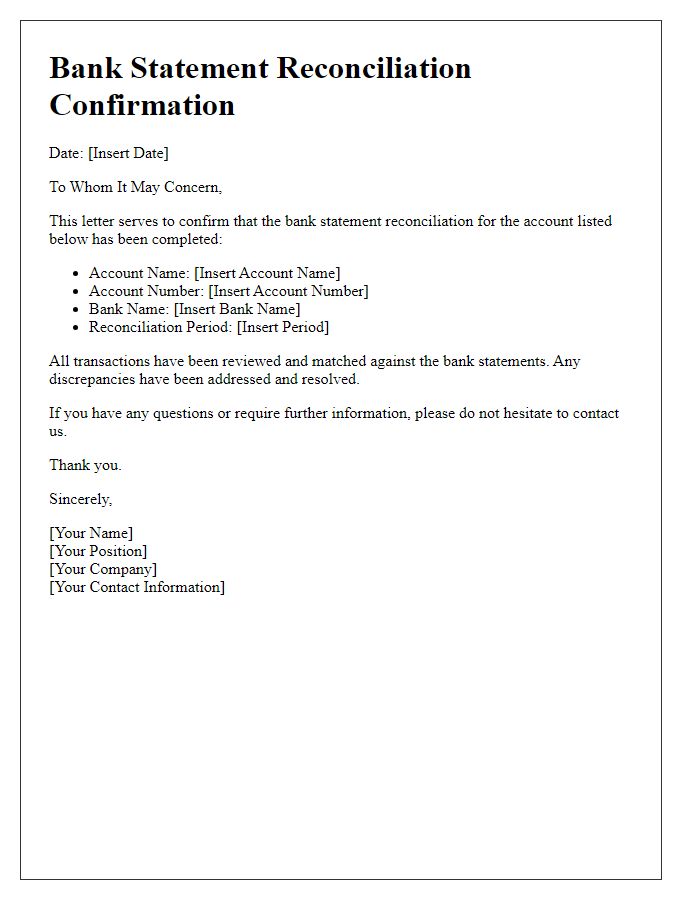

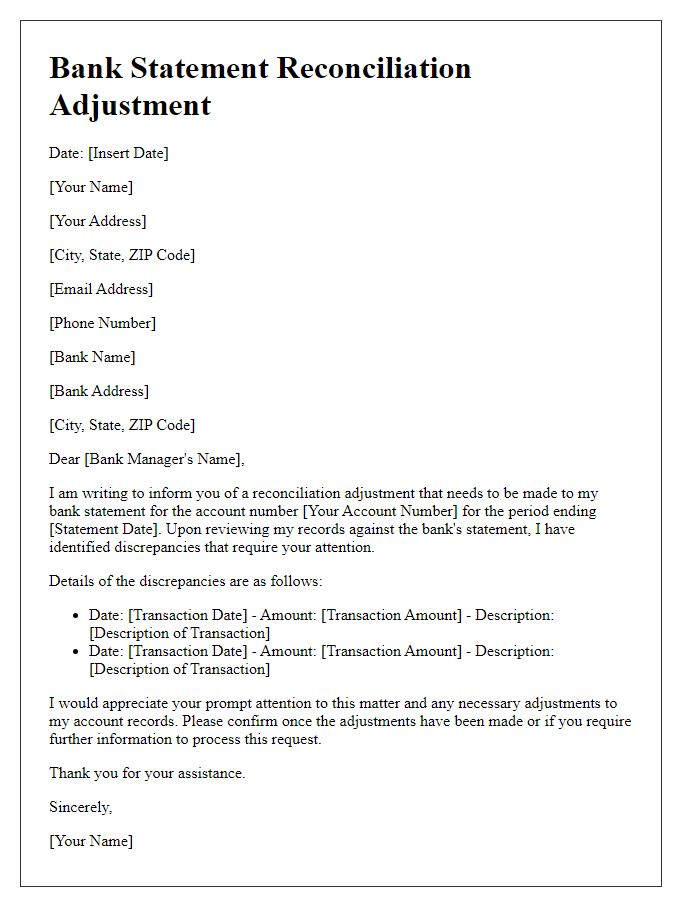

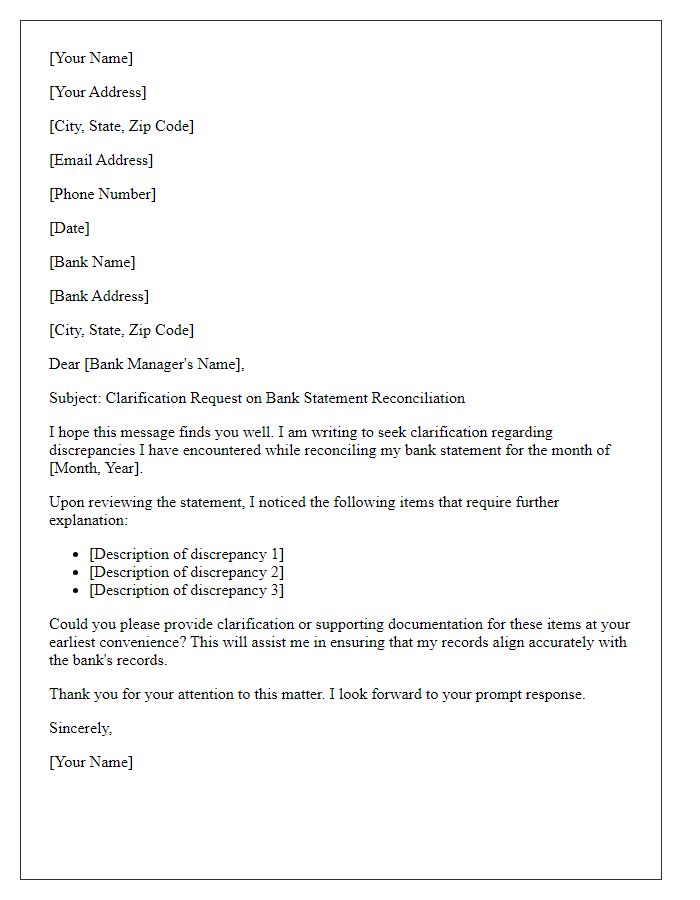

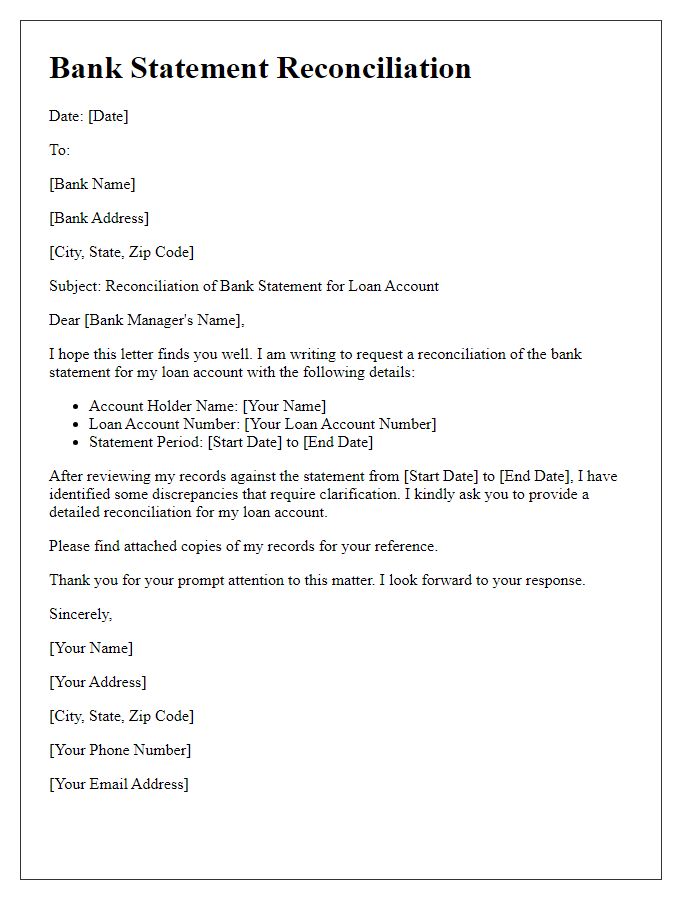

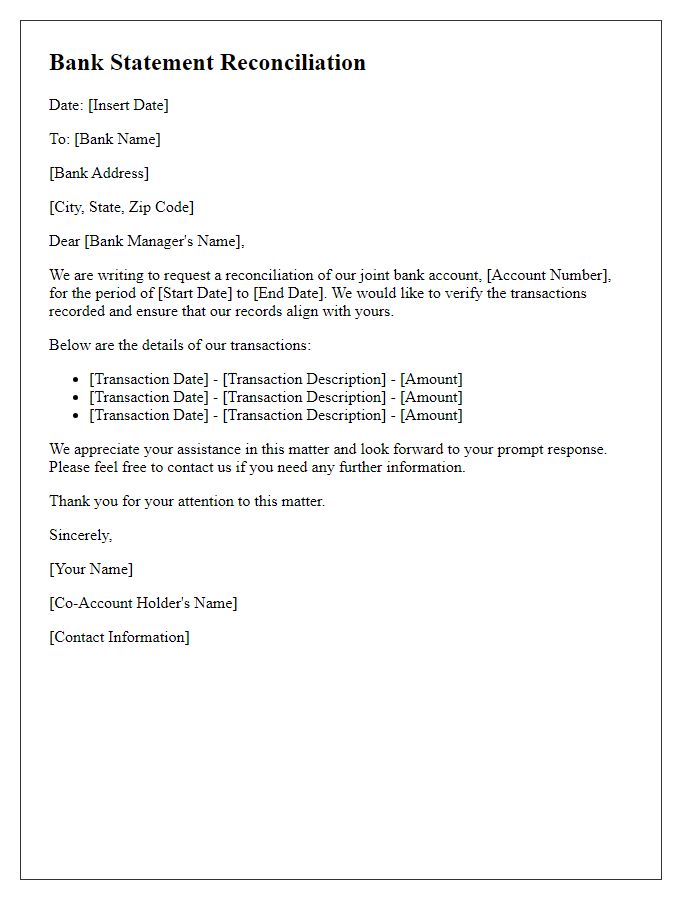

Letter Template For Bank Statement Reconciliation Samples

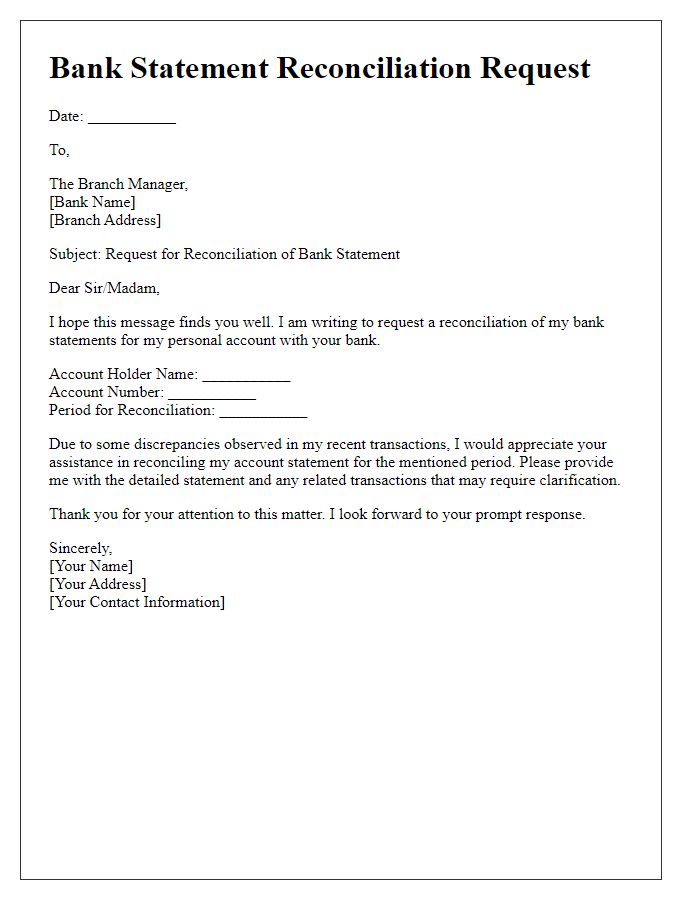

Letter template of bank statement reconciliation request for personal accounts

Comments