Are you feeling overwhelmed by the complexities of tax documents and the authorization process? You're not alone! Many individuals find themselves needing a clear pathway to access important financial information. In this article, we'll guide you through a simple letter template for tax document access authorization that makes the process straightforward and stress-freeâso let's dive in!

Contact Information

Accessing tax documents requires a clear understanding of the contact information aspects involved in the authorization process. Personal identification details such as full name, Social Security number (SSN), and address are critical for verification. Access must include a reliable phone number (preferably a direct line) to facilitate communication regarding document requests and status updates. Email addresses serve as an effective method for receiving notifications related to document availability. Including additional identifiers, such as previous tax filing years or tax identification numbers (TIN), enhances the accuracy and speed of the authorization process. Ensuring all contact information is accurate supports a seamless interaction with tax authorities.

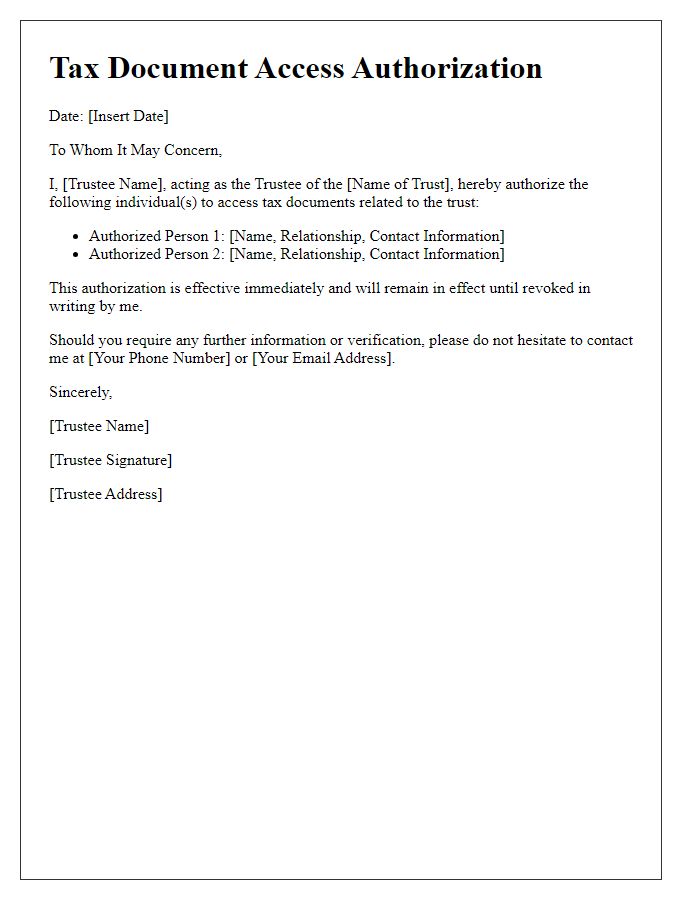

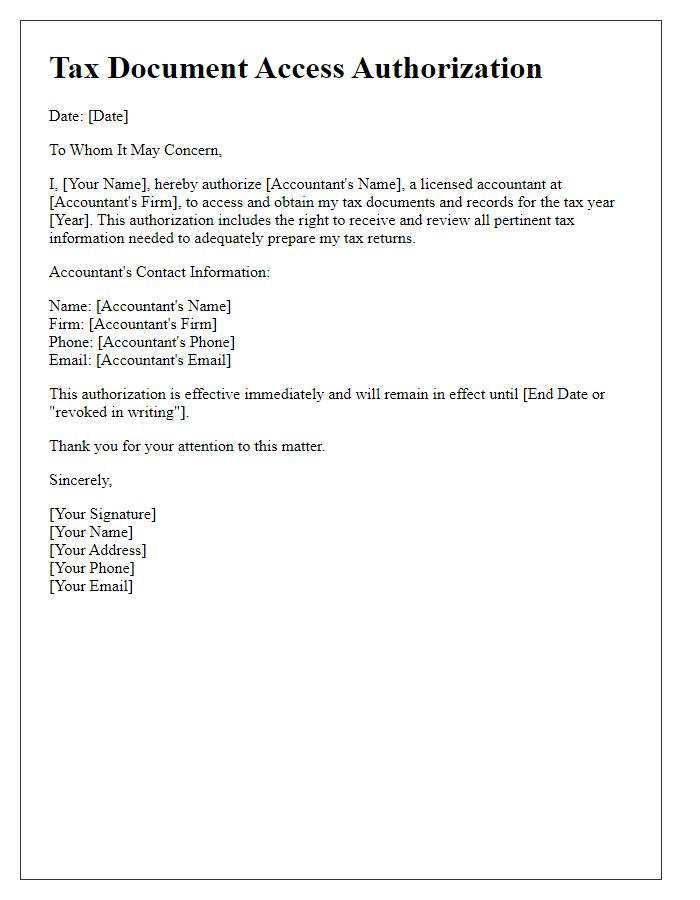

Authorization Statement

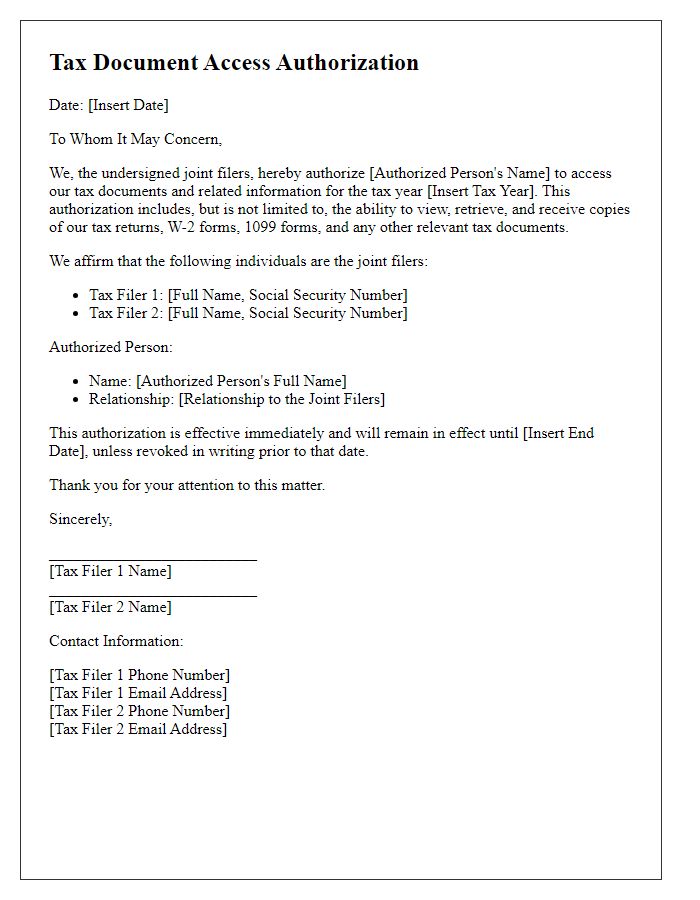

The authorization statement for tax document access outlines the permission granted to an individual or entity to access sensitive tax information. This may involve confidential documents such as W-2 forms, 1099 statements, and tax returns submitted to the Internal Revenue Service (IRS). The designated representative, potentially a tax professional or accountant, is allowed to obtain, inspect, and discuss these documents, ensuring compliance with both federal laws and regulations governing the privacy of taxpayer information. Specific identification requirements may include full name, Social Security number, and contact information of both the taxpayer and the authorized individual, with an explicit expiry date for the authorization, typically set at the conclusion of the tax filing season.

Specific Documents Access

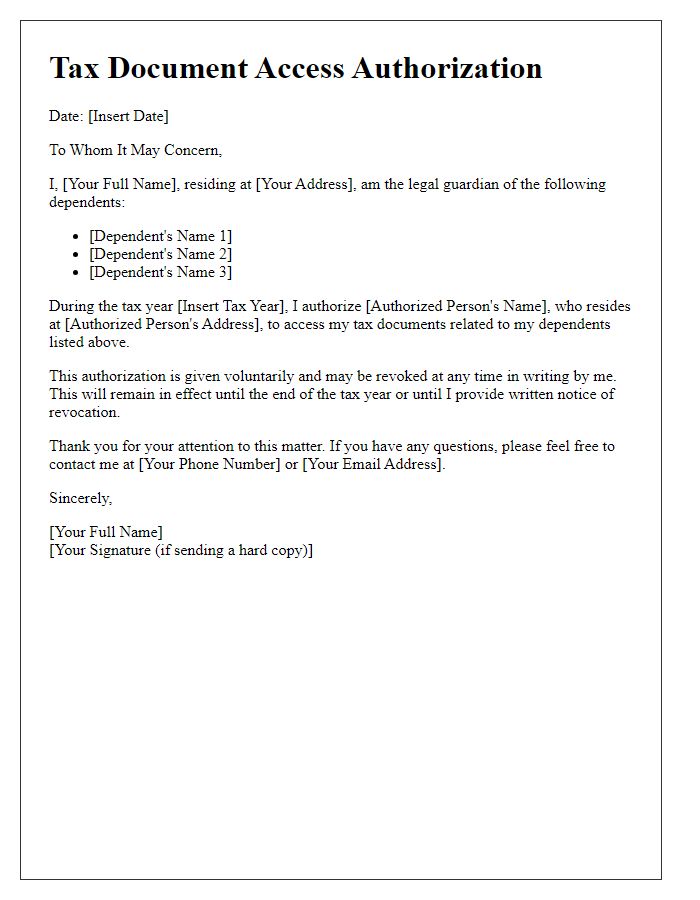

Access authorization for specific tax documents involves granting permission to individuals or entities to review sensitive financial information. Taxpayers must designate a representative through a formal written request, specifying documents such as W-2 forms, 1099 forms, or tax returns. The designated agent could be a Certified Public Accountant (CPA) or a tax attorney. It's essential to include the taxpayer's Social Security Number or Tax Identification Number for identification purposes. This document must be signed and dated, sometimes requiring notarization, depending on state regulations. Maintaining security and confidentiality is crucial in these transactions, given the sensitive nature of tax information.

Duration of Access

Tax document access authorization grants specific individuals limited permissions to view sensitive financial records related to tax filings. This authorization typically specifies a defined duration, such as six months or one year. The period may begin from the date of signing the authorization document. Individuals authorized to access these records are often tax advisors or legal representatives, essential for compliance with federal regulations. Access involves reviewing data like income statements, deductions, and other financial information necessary for accurate tax preparation. Ending the access period ensures that confidential information remains secure and is only shared with trusted entities determined by the individual taxpayer.

Signature and Date

The process of granting access to tax documents involves several key components, including authorization forms and official signatures. Tax documents, such as W-2s and 1099s, contain sensitive information that requires secure handling. In the United States, the Internal Revenue Service (IRS) mandates that specific forms, like Form 8821, be completed for third-party access. Dates indicated on these forms are crucial, as they determine the validity of the authorization. It's important to ensure the signature is clear and matches the name on the tax documents to prevent any discrepancies or delays in processing. Each part of this process holds significant importance in maintaining compliance and safeguarding personal financial information.

Letter Template For Tax Document Access Authorization Samples

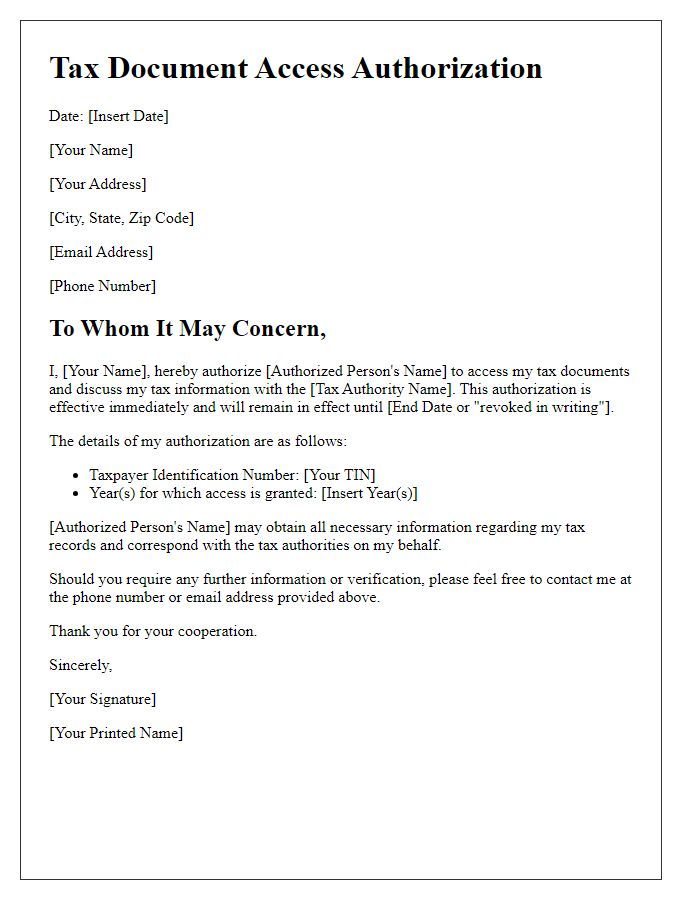

Letter template of Tax Document Access Authorization for Individual Taxpayer

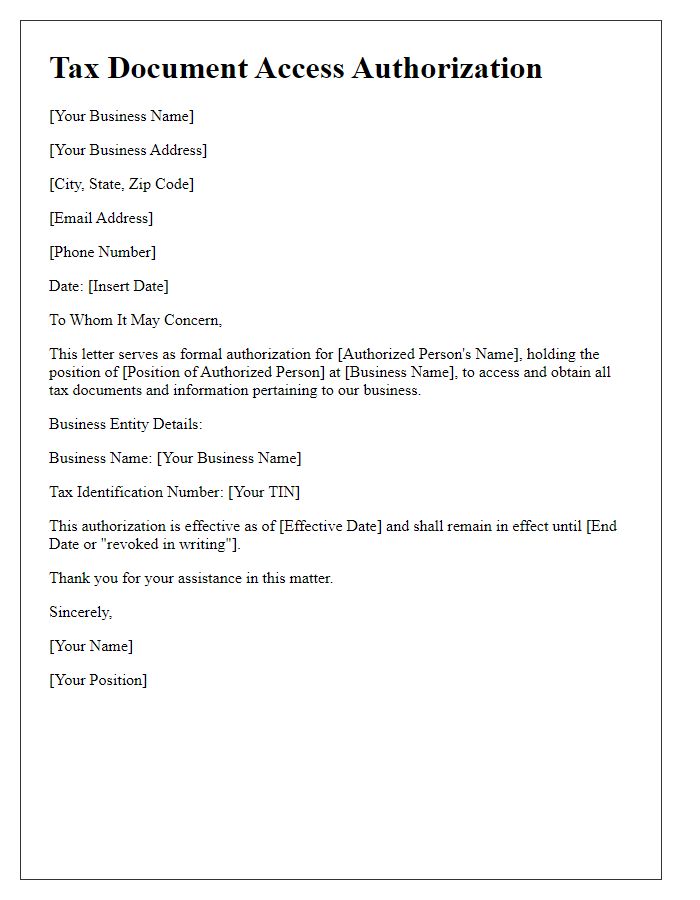

Letter template of Tax Document Access Authorization for Business Entity

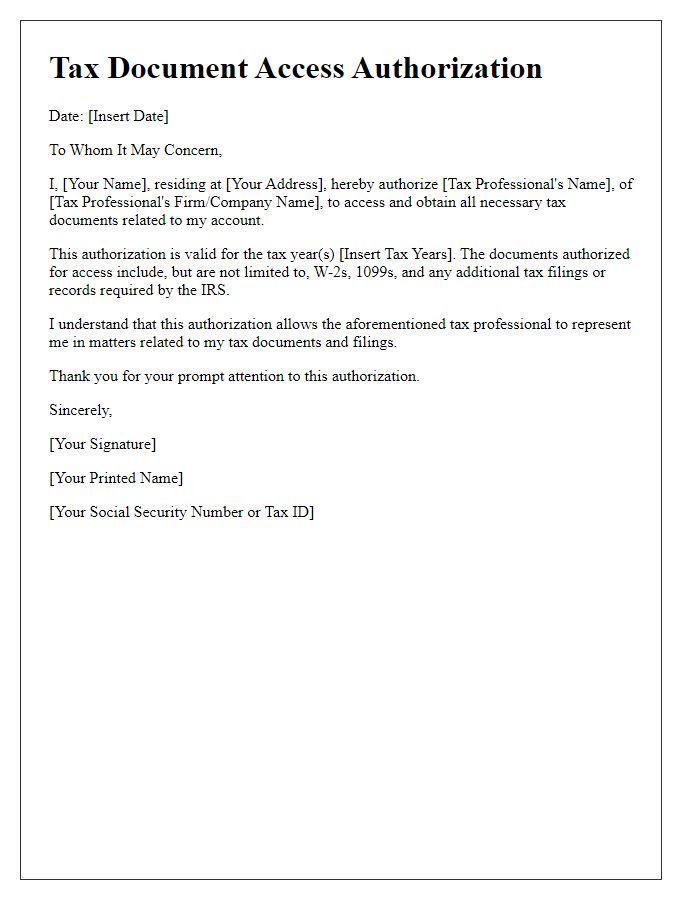

Letter template of Tax Document Access Authorization for Tax Professional

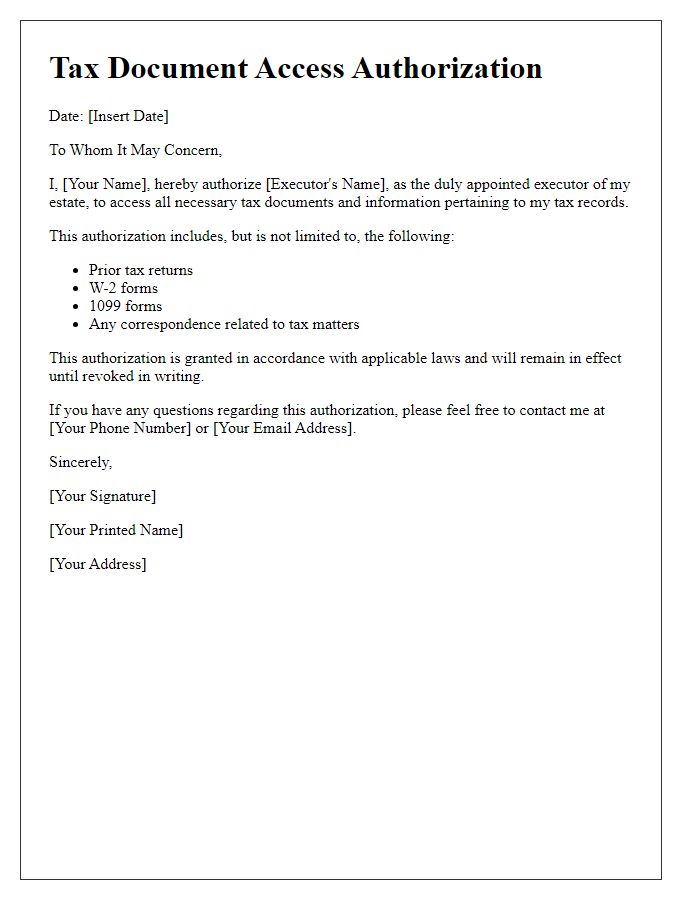

Letter template of Tax Document Access Authorization for Estate Executor

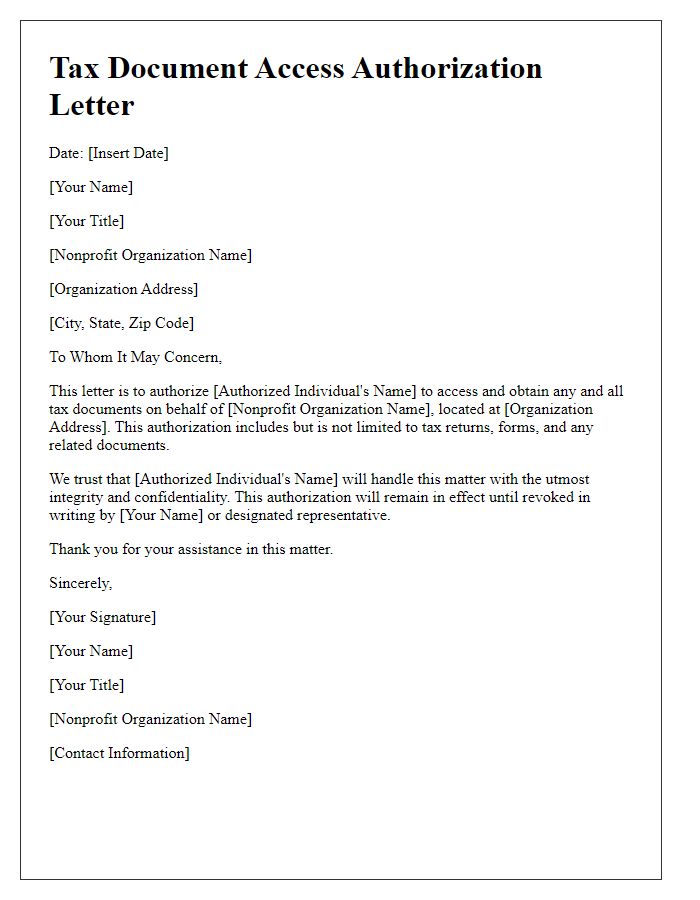

Letter template of Tax Document Access Authorization for Nonprofit Organizations

Comments