Are you a landlord preparing to welcome new tenants into your property? Understanding the screening process is crucial for ensuring a smooth rental experience. In this article, we'll explore the importance of tenant screening authorization letters and how they can protect your investment. Join us as we break down everything you need to know about crafting the perfect screening authorization letter.

Personal Information Request

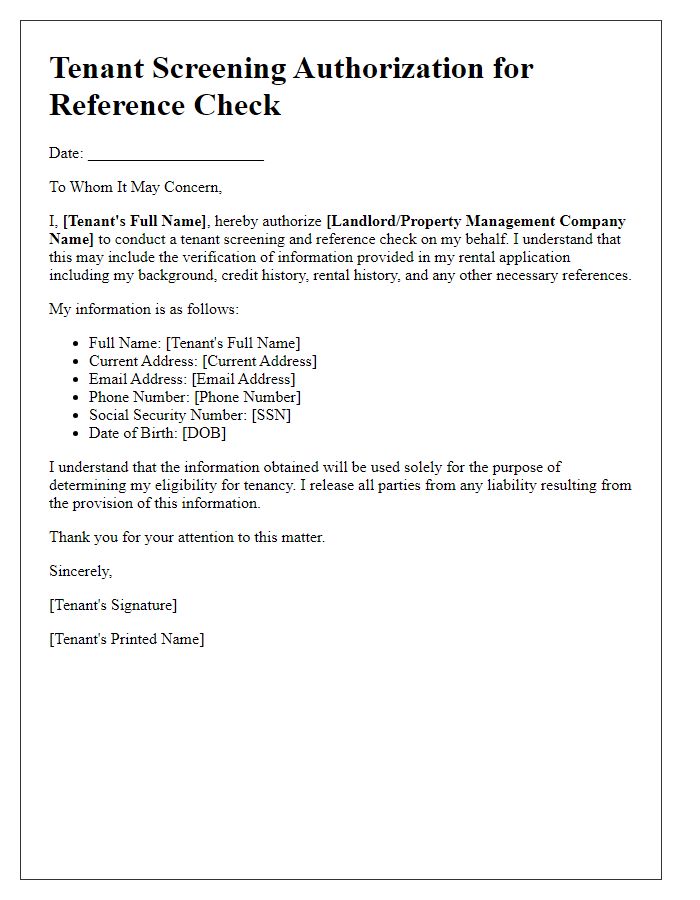

Tenant screening authorization allows landlords to obtain critical personal information from prospective tenants. This screening process typically involves checking credit history, rental history, and background checks to assess the tenant's reliability in managing rental obligations. Key data points include Social Security numbers, current and previous addresses, employment verification, and references (such as previous landlords). Consent from the tenant is legally required, ensuring compliance with the Fair Credit Reporting Act (FCRA) guidelines. Unauthorized access to this sensitive information can lead to legal repercussions, emphasizing the need for clear authorization procedures.

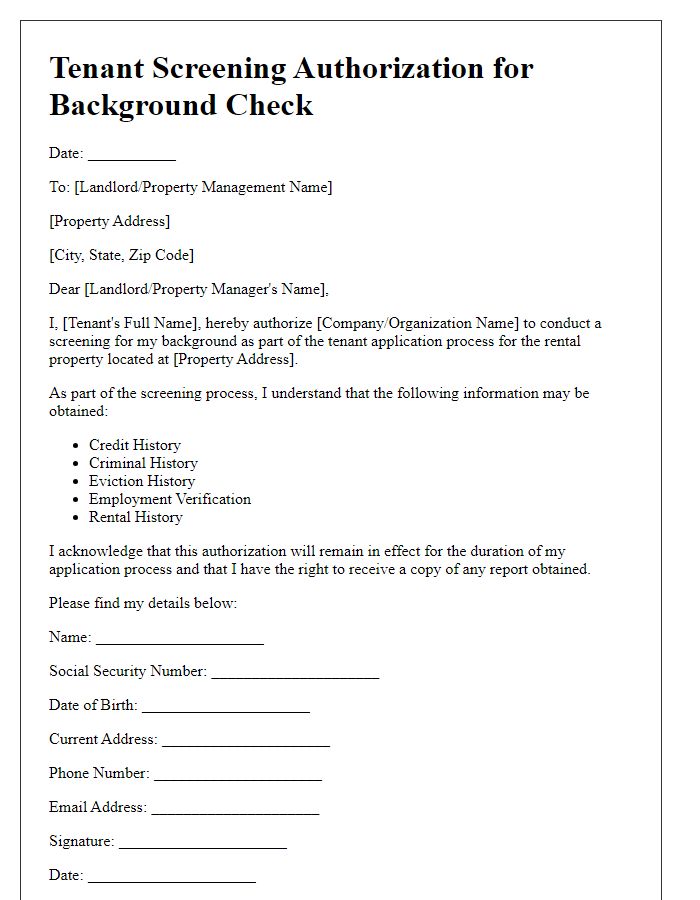

Consent for Background Check

Tenant screening authorization is crucial for landlords seeking to ensure prospective tenants meet specific criteria. This process typically includes a consent form for a background check, which can reveal important information about an applicant's rental history, credit score (often ranging from 300 to 850), and criminal record (if applicable, involving felonies or misdemeanors). The consent form should outline the reasons for the background check, such as maintaining community safety, the integrity of the rental property, and the financial reliability of tenants. Additionally, state laws often dictate specific requirements for obtaining consent, including providing a notice of adverse action if the application is denied based on the findings. Providing clarity regarding how long the information will be retained (commonly 7 years) can foster transparency in the rental process.

Employment and Income Verification

Tenant screening authorization for employment and income verification is a crucial process in rental agreements. Prospective tenants typically submit personal information for assessment. Landlords or property management companies verify employment details, such as job title, salary (often requiring documentation like pay stubs or tax returns), and duration of employment (usually confirming at least six months of continuous work). This verification helps ensure tenants have stable income sources that can support monthly rent payments. Accurate checks reduce risks of rent defaults, provide assurance of financial reliability, and promote a healthy landlord-tenant relationship. Instances of fraud, including falsified income statements, can be minimized through this thorough verification process.

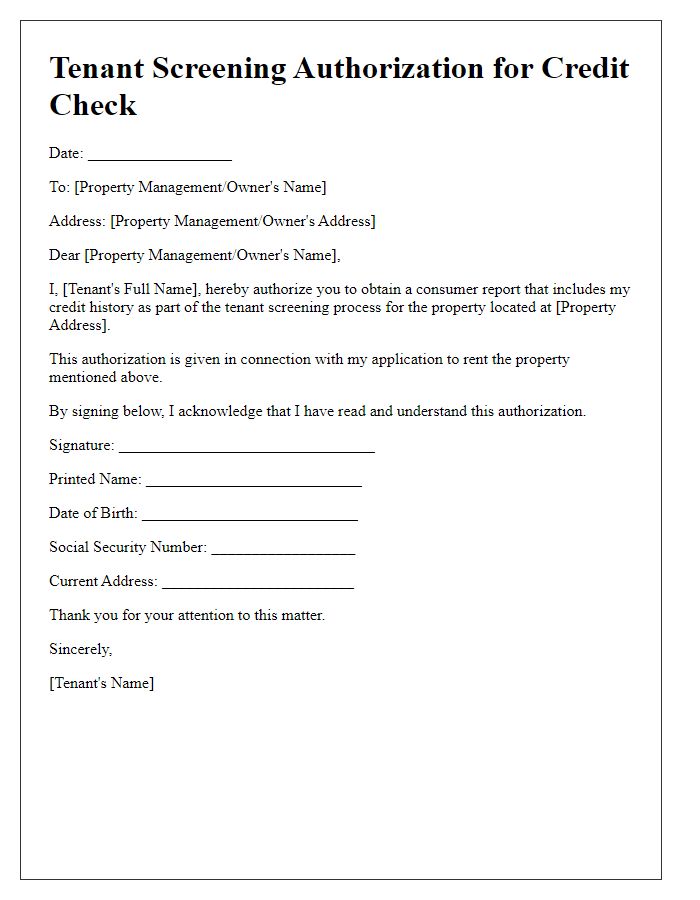

Rental and Credit History Authorization

Tenant screening authorization involves a significant process where landlords or property management companies evaluate potential tenants. Important aspects include rental history (previous residences, payment record, lease agreements) and credit history (credit scores, outstanding debts, payment history). Information is often gathered from credit bureaus like Experian, TransUnion, and Equifax, which assess financial behavior, influencing decision-making for renting apartments in urban areas like New York City. The authorization typically requires the prospective tenant's personal details (full name, Social Security number, date of birth) and consent for background checks, helping property owners mitigate risks associated with non-payment and lease violations.

Disclosure of Screening Criteria

Tenant screening plays a crucial role in the rental process, ensuring that landlords select responsible and reliable tenants. Screening criteria often include various factors such as credit history, rental history, income verification, and criminal background checks. For instance, a minimum credit score (typically 620 or higher) may be required, while consistent rental payments over the last three years could be considered favorable. Some landlords may also evaluate income, often stipulating that total monthly income should exceed three times the rent amount. Additionally, landlords should disclose any specific policies regarding previous evictions or felony convictions, as these can significantly impact the eligibility of potential tenants. Overall, clear disclosure of screening criteria fosters transparency and helps establish trust between landlords and prospective tenants.

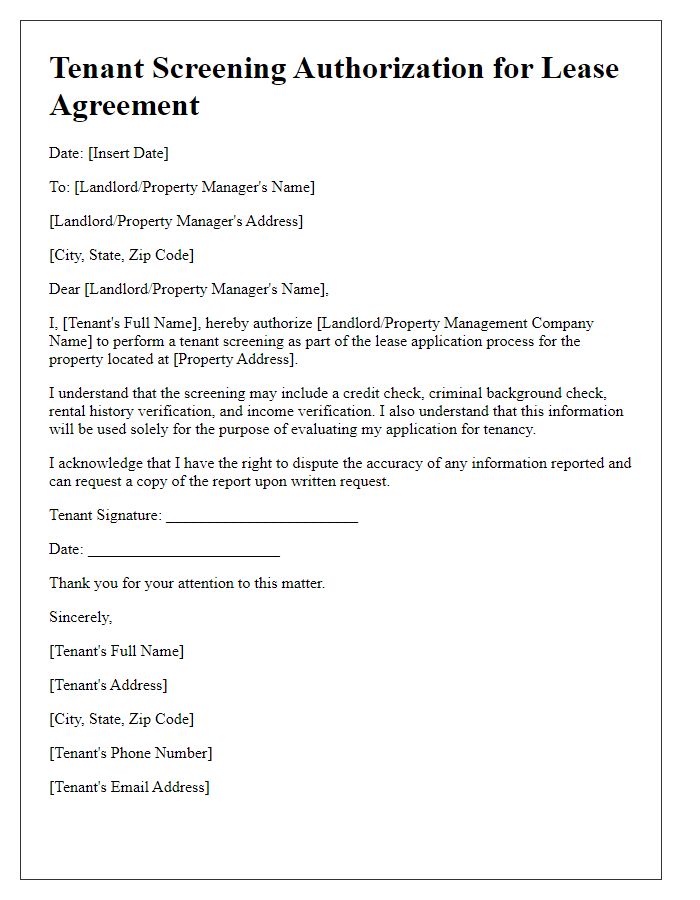

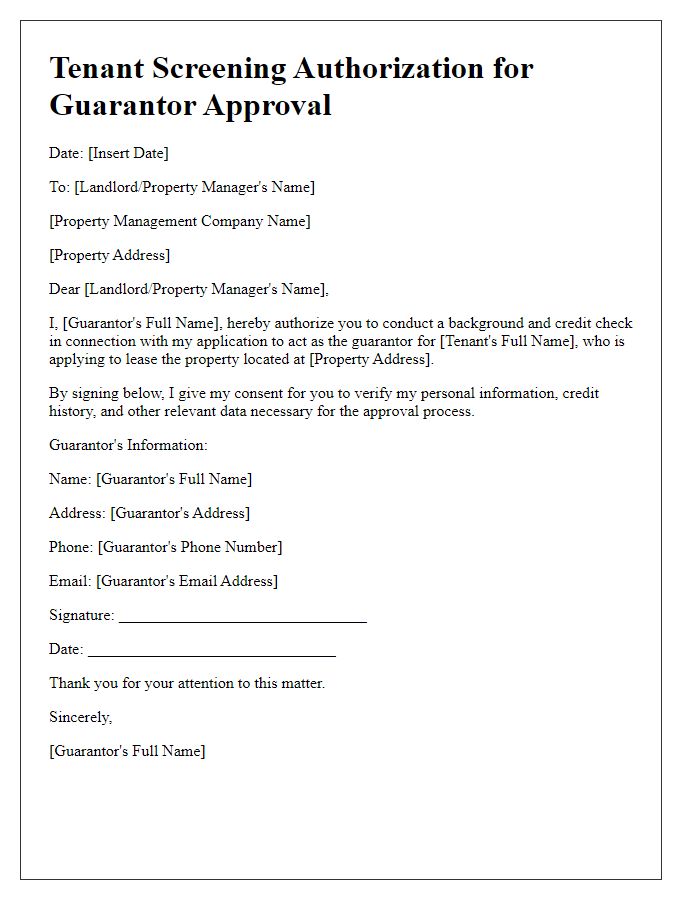

Letter Template For Tenant Screening Authorization Samples

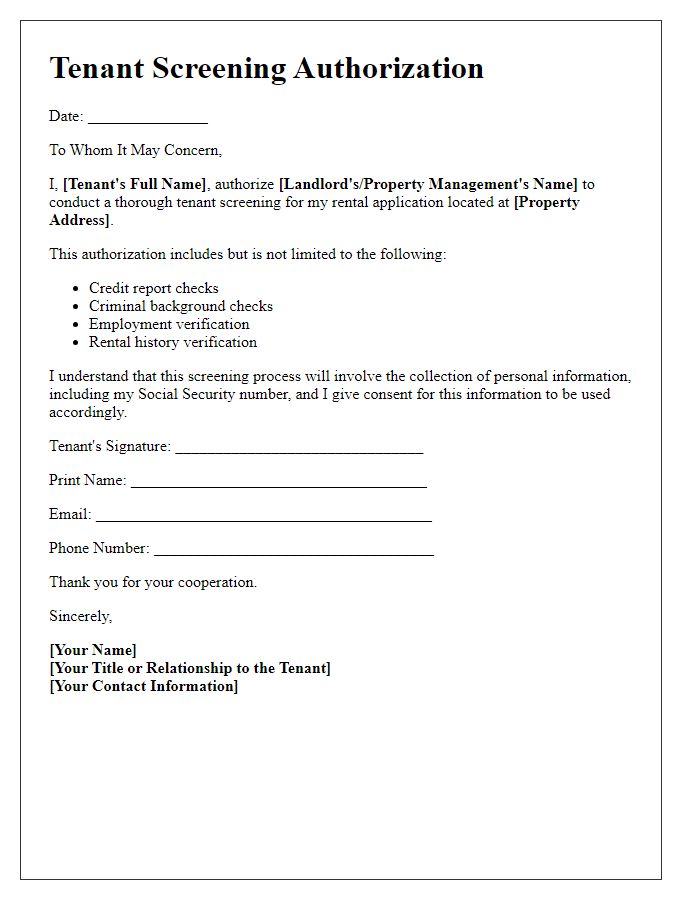

Letter template of Tenant Screening Authorization for Rental Application

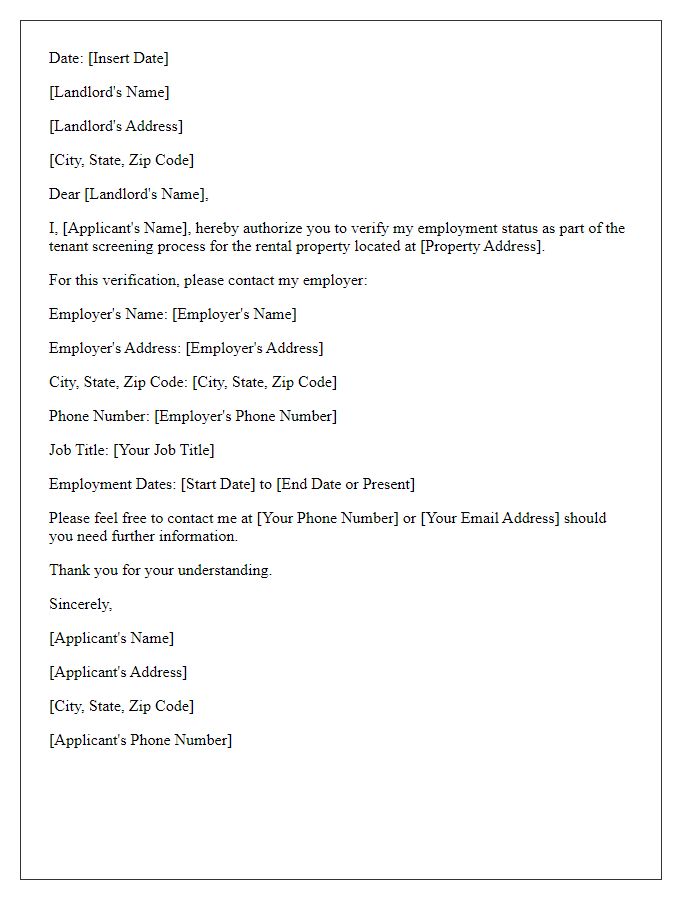

Letter template of Tenant Screening Authorization for Employment Verification

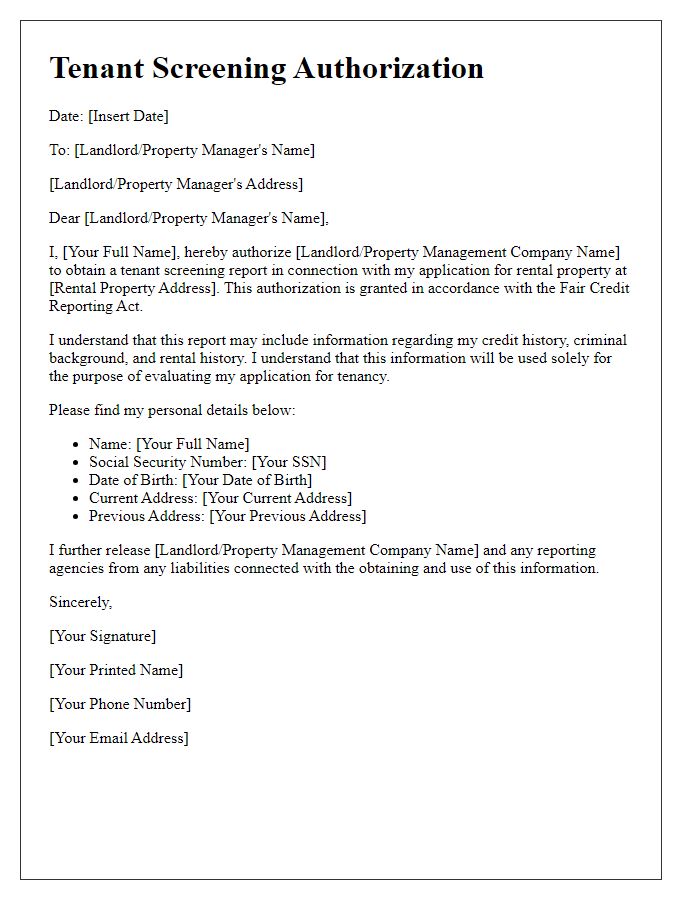

Letter template of Tenant Screening Authorization for Security Deposit Processing

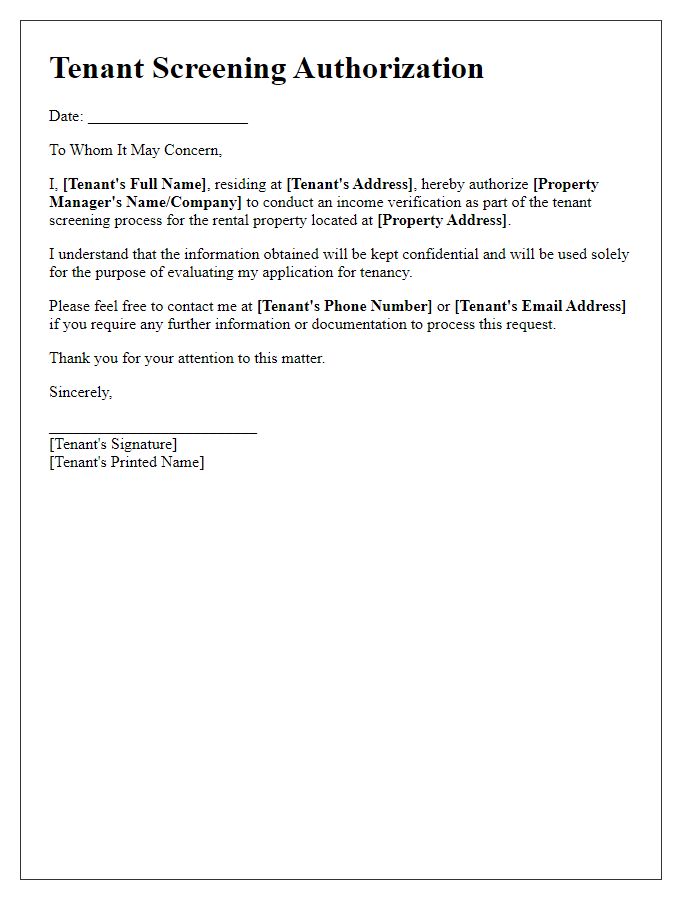

Letter template of Tenant Screening Authorization for Income Verification

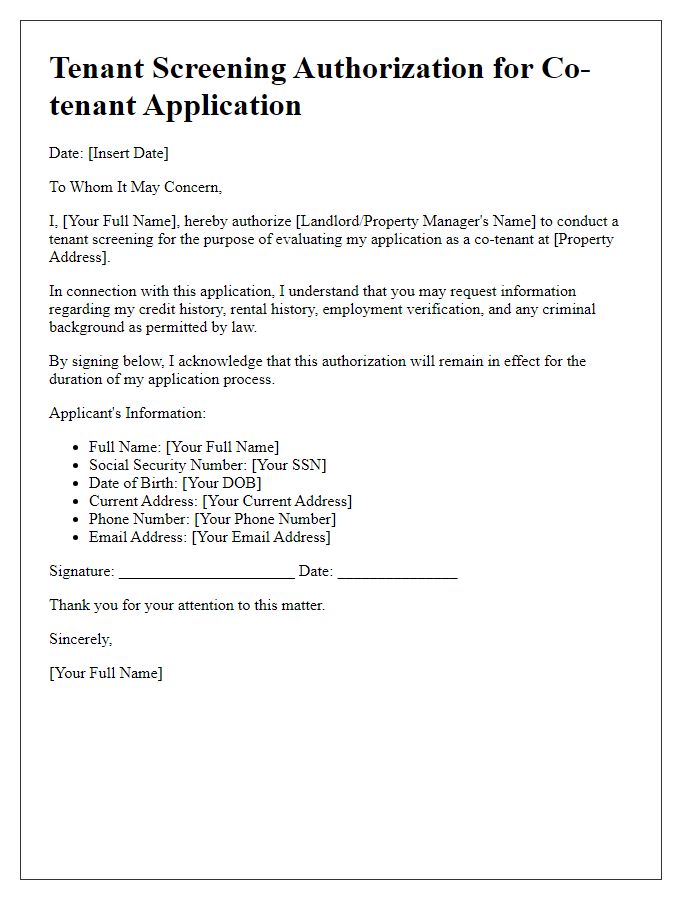

Letter template of Tenant Screening Authorization for Co-tenant Application

Comments