Are you navigating the complex world of import/export transactions? Crafting a solid authorization letter can streamline your dealings and ensure compliance with regulations. In this article, we'll break down how to create a clear and effective letter that covers all necessary details, making your transactions smoother and more efficient. Ready to simplify your import/export process? Read on to discover essential tips and a handy template!

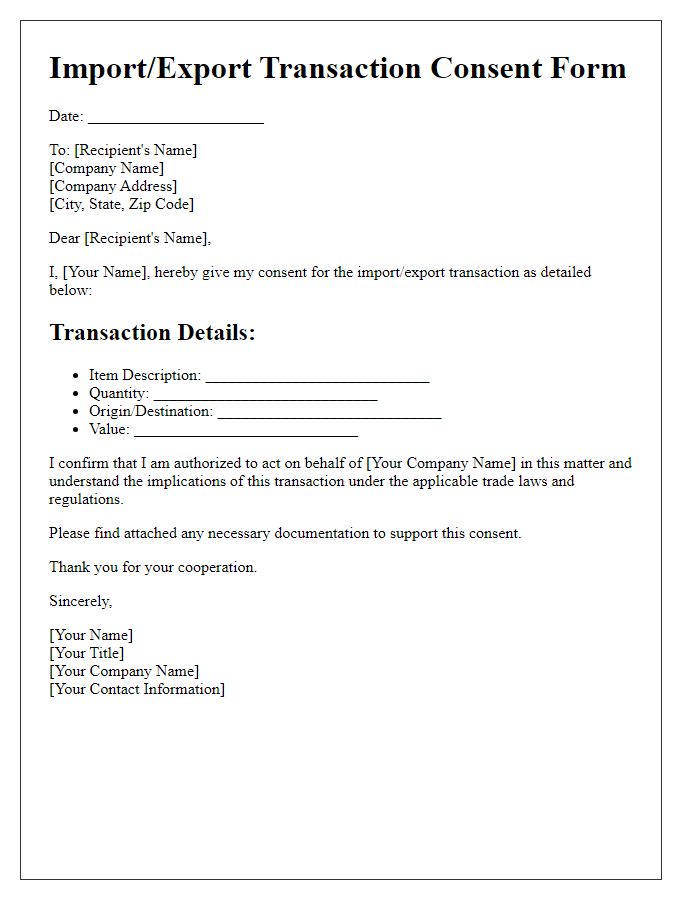

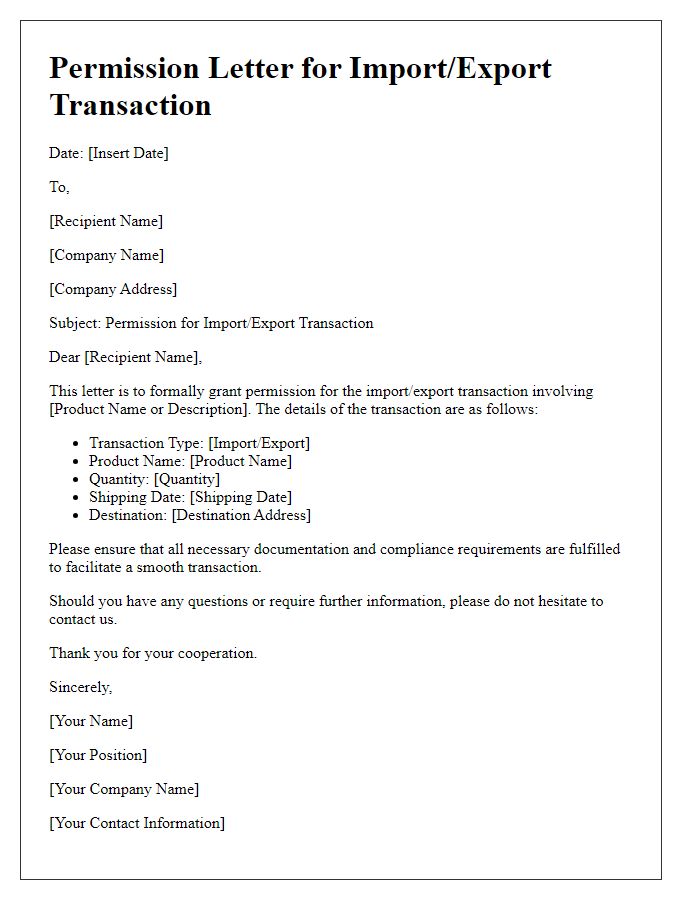

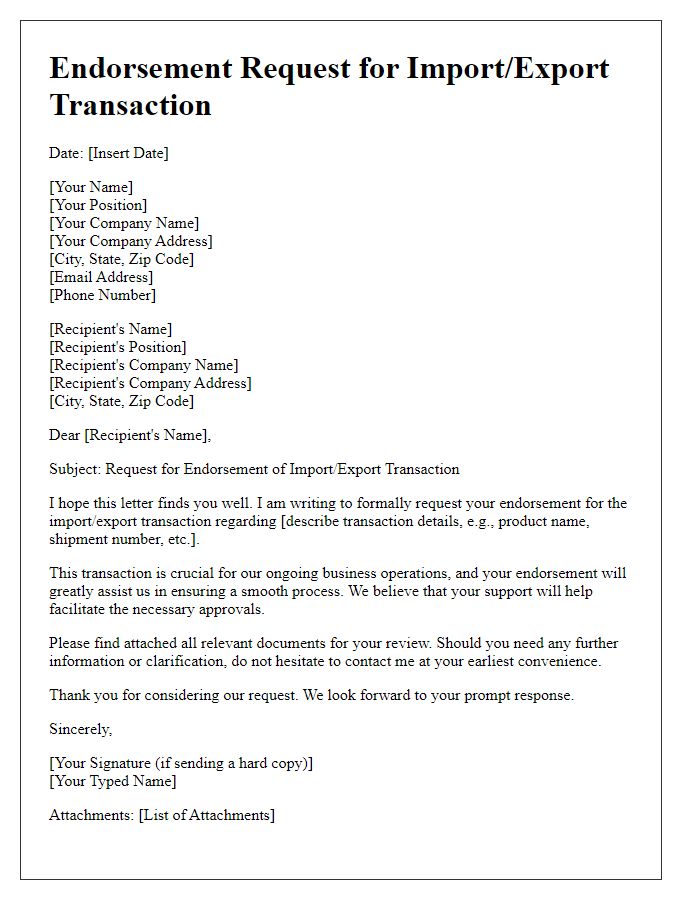

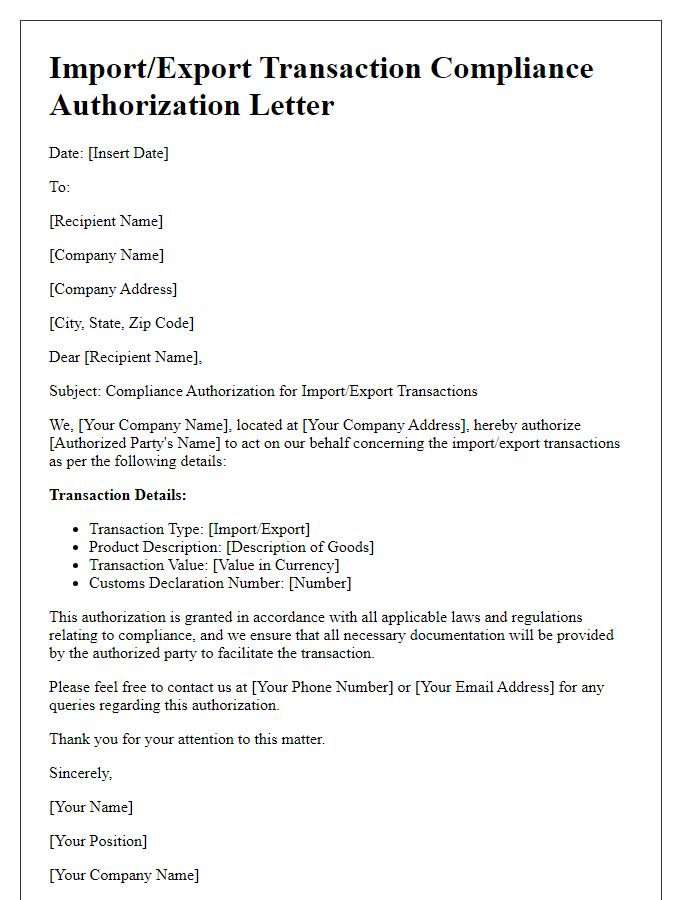

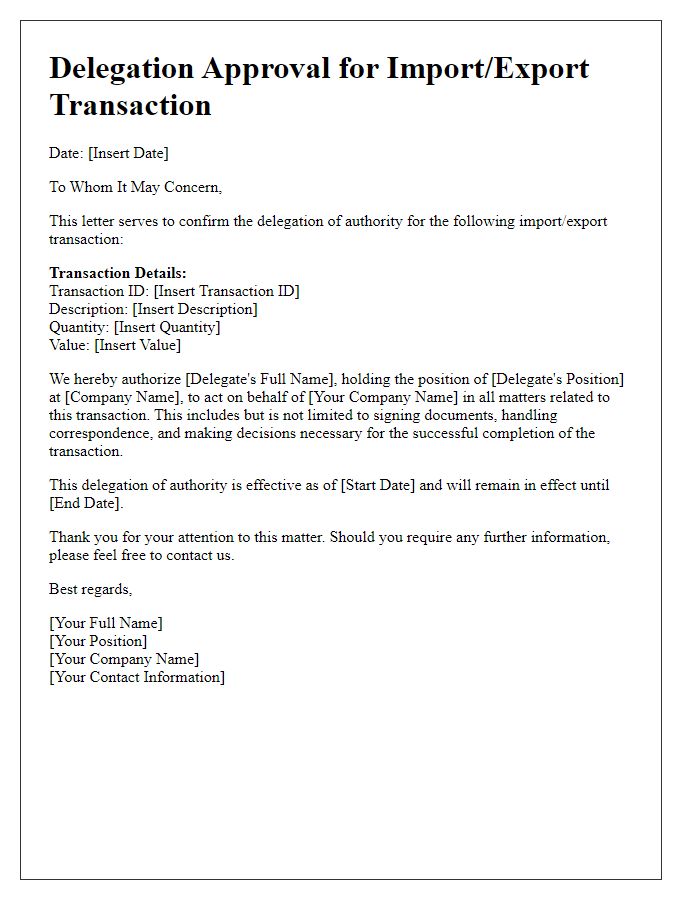

Parties' Details

Import/export transaction authorization requires precise identification of involved entities to ensure compliance and facilitate smooth operations. The primary party, the exporter, located in New York City, typically holds a valid Export License issued by the U.S. Department of Commerce. Meanwhile, the importer, situated in Tokyo, Japan, often possesses an Importer of Record (IOR) identification number, which confirms their legitimacy in international trade. Additionally, the transaction may involve freight forwarders or customs brokers, vital agents in logistics, ensuring all paperwork aligns with local and international regulations. The clear delineation of contact information, such as telephone numbers and email addresses, for each party is crucial for effective communication throughout the transaction process.

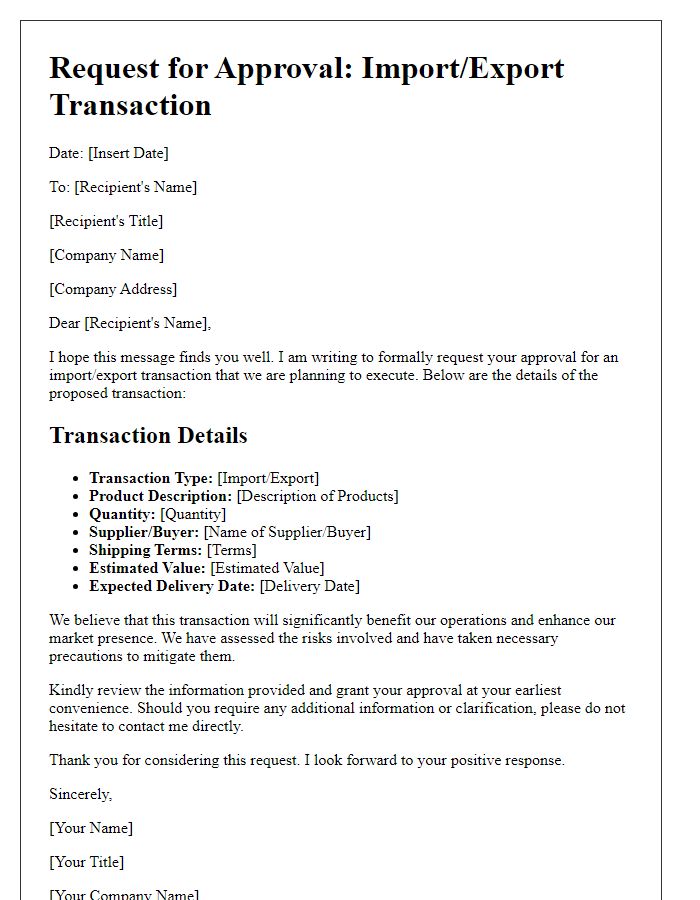

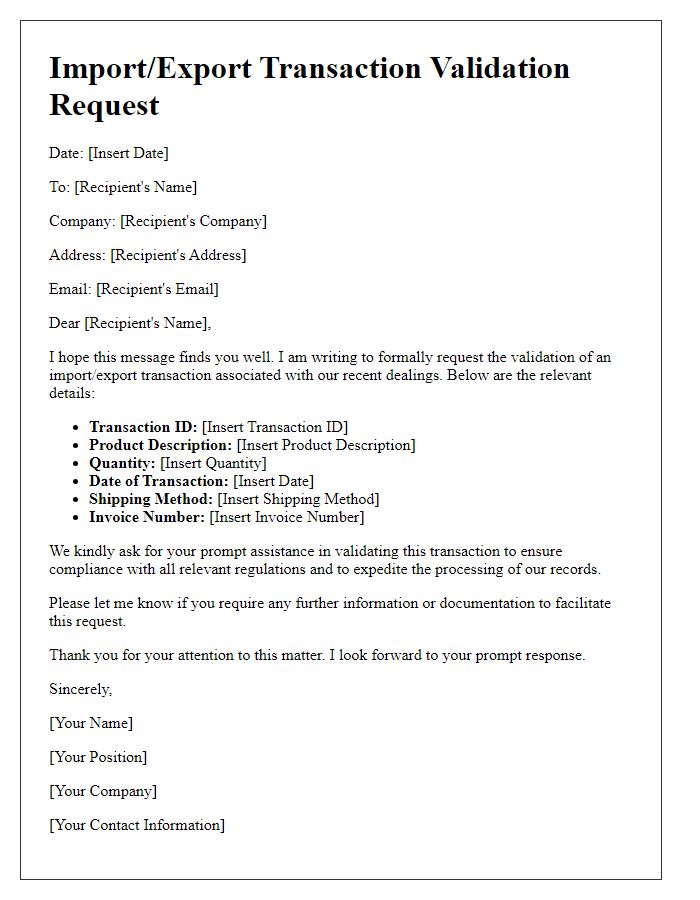

Transaction Description

The import/export transaction authorization process involves several key elements. The transaction typically includes the exchange of goods between countries, with specific details such as the product type, quantity, and value outlined in shipping documents. For example, a shipment of 500 units of electronic devices valued at $50,000 being exported from Hong Kong to Canada may require approval from relevant customs authorities. Customers must ensure compliance with international trade regulations, which may include obtaining an Export License or meeting import quotas. The transaction description should encompass crucial information such as the Harmonized System (HS) code classification, the origin of goods, and any applicable tariffs. These details ensure transparency and facilitate smooth customs clearance, ultimately impacting the efficiency of the supply chain.

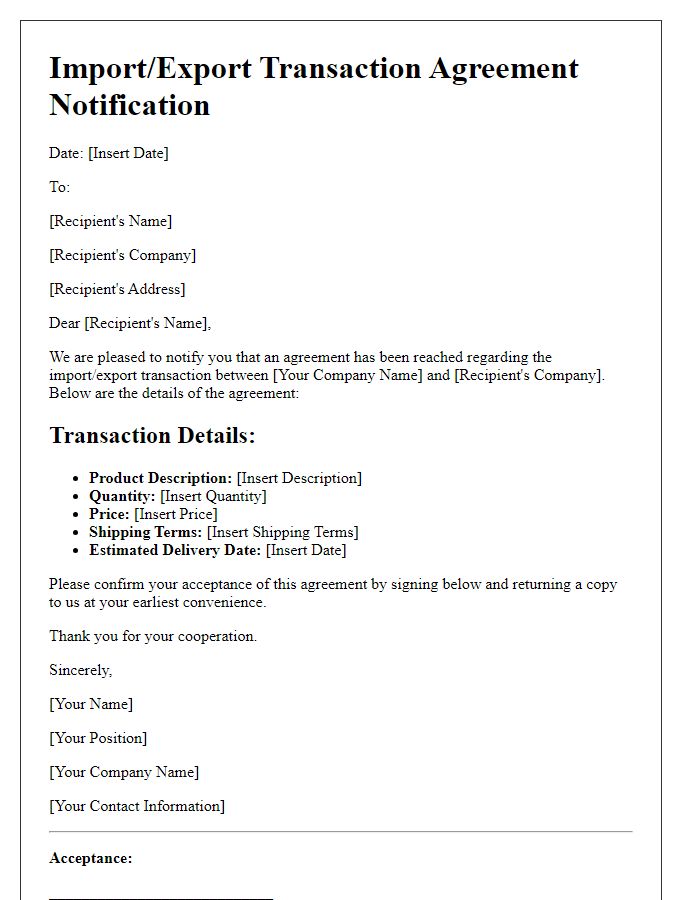

Authorization Terms

Authorization terms for import/export transactions are critical to ensuring compliance with trade regulations and safeguarding the interests of all parties involved. These terms typically define the scope of authorized transactions, delineating the specific types of goods (e.g., electronics, textiles, perishables) permitted for import or export. It includes vital information regarding the involved parties, such as their legal business names, addresses, and tax identification numbers. Payment methods (such as letters of credit or advance payments) are stipulated alongside timelines for transactions, ensuring timely execution. Additional requirements may encompass compliance with local customs regulations in specific jurisdictions (such as those mandated by the US Customs and Border Protection for shipments entering the United States) and adherence to international trade agreements (like the North American Free Trade Agreement). This authorization framework enhances transparency while minimizing risks associated with fraudulent activities in the global marketplace.

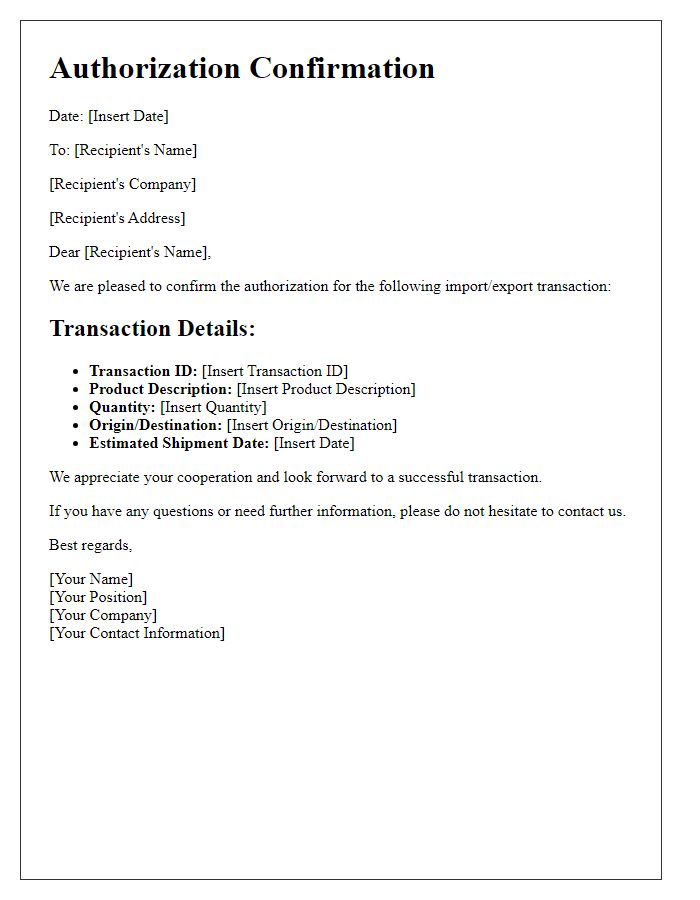

Signature and Date

Commercial transactions involve strict procedures, especially in import and export operations. Authorized signatures ensure compliance with legal requirements. For instance, a transaction authorization form might require the signatures of executive officers or legal representatives, typically accompanied by the date of acknowledgment. This date indicates when the authorization became effective, often vital for tracking shipments and adhering to customs regulations. Each signature affirms the agreement to the terms and conditions outlined in the transaction documentation, facilitating smoother trade processes. The absence of these elements could lead to delays or legal complications.

Contact Information

An import/export transaction authorization document typically requires detailed contact information for all involved parties. This includes the name of the importing or exporting company along with the registered address, which might be located in major trade hubs like New York City (USA) or Shanghai (China). Additionally, the contact information should detail the name and title of a responsible representative, oftentimes a logistics manager or compliance officer, providing their direct phone number, often starting with a country code (like +1 for the USA), and email address. Accurate contact information ensures efficient communication throughout the import/export process, facilitating coordination with customs officials and freight forwarders based in international ports such as Los Angeles or Rotterdam. Important information may also include the company's tax identification number and any relevant compliance certifications specific to the type of goods being traded, such as FDA approval for medical devices or USDA certification for agricultural products.

Comments