When it's time to navigate the complexities of managing an estate, having a solid authorization letter for the executor is essential. This letter serves as an official declaration that the appointed executor has the legal authority to handle all necessary matters related to the estate. With clear language and specific details, it not only streamlines the process but also ensures peace of mind for all involved. Curious to learn how to craft the perfect authorization letter for your executor? Keep reading!

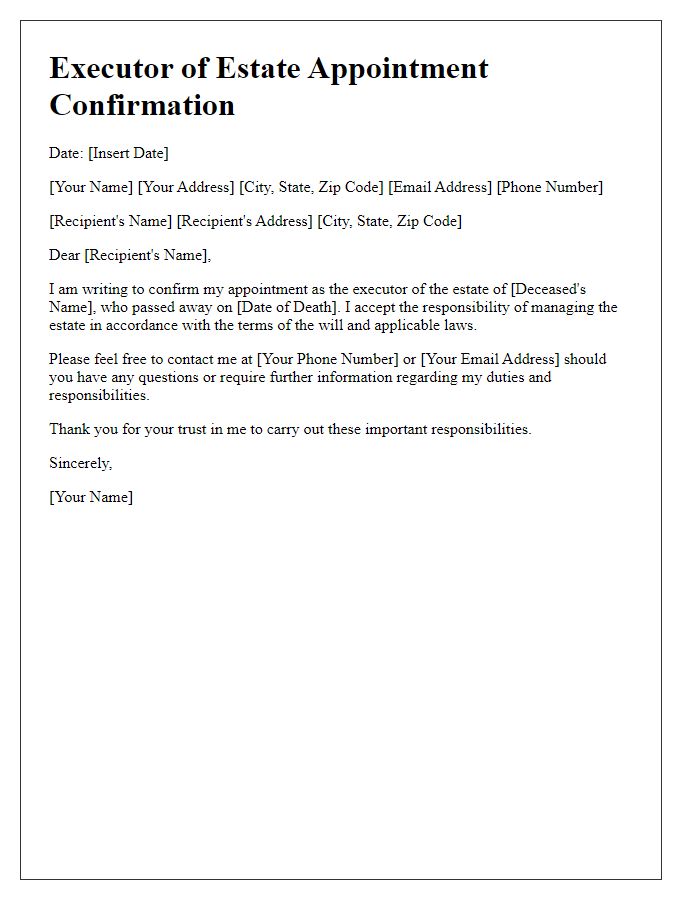

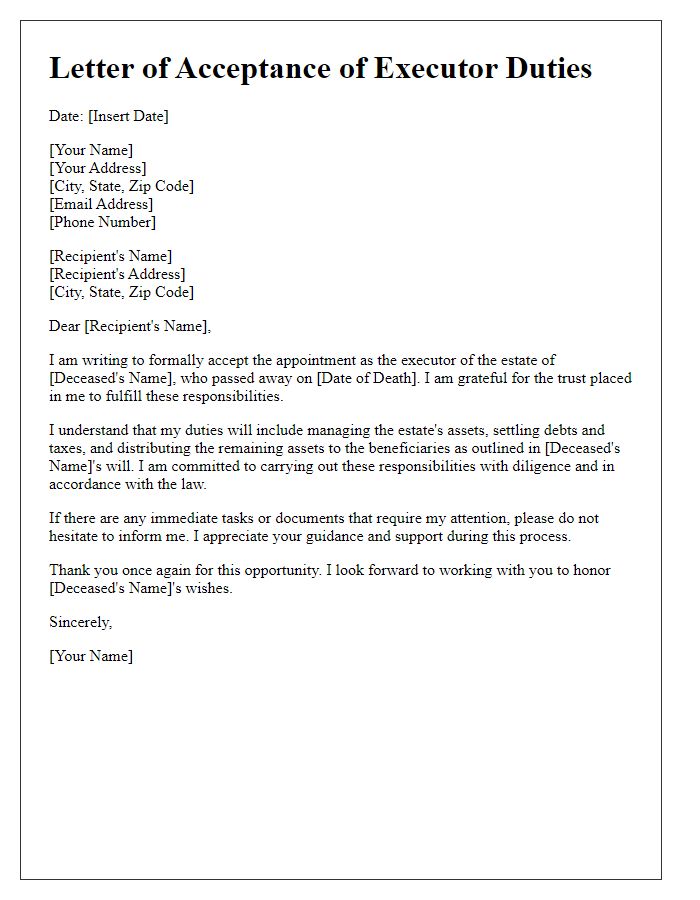

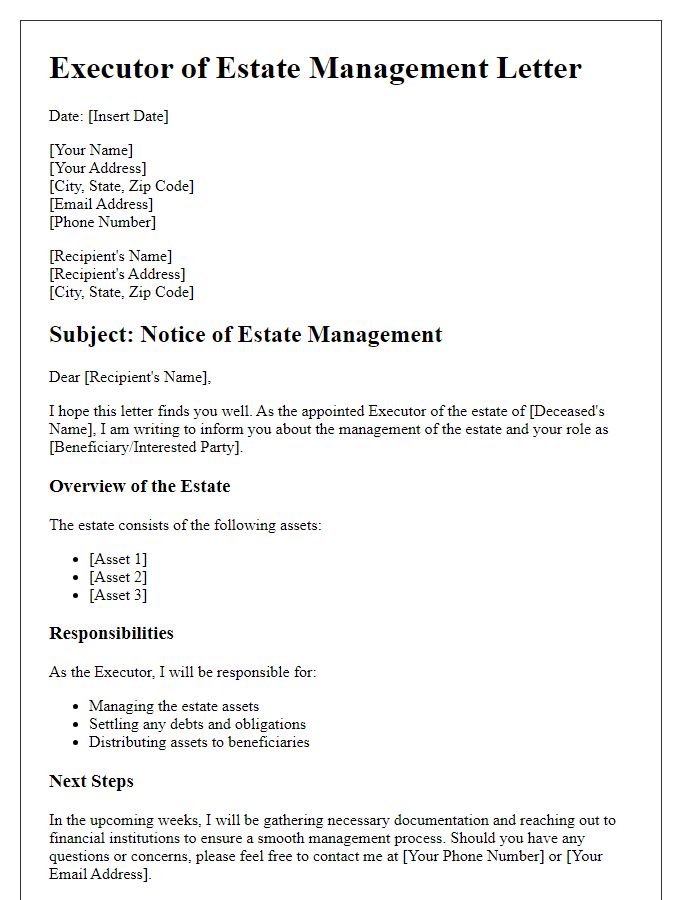

Contact Information

The executor of an estate, appointed through a will or by the probate court, must provide comprehensive contact information for effective communication and administration of the estate. Essential details include the full name (e.g., John Doe), mailing address (e.g., 123 Main Street, Springfield, IL, 62701), email address (e.g., johndoe@email.com), and phone numbers (e.g., +1-555-123-4567). Additionally, any alternate contacts, such as a legal advisor (e.g., Attorney Jane Smith, 456 Elm Street, Springfield, IL, 62701, janesmithlaw@email.com), can facilitate the estate's management. Providing accurate and up-to-date information ensures that beneficiaries and interested parties can reach the executor efficiently during the probate process.

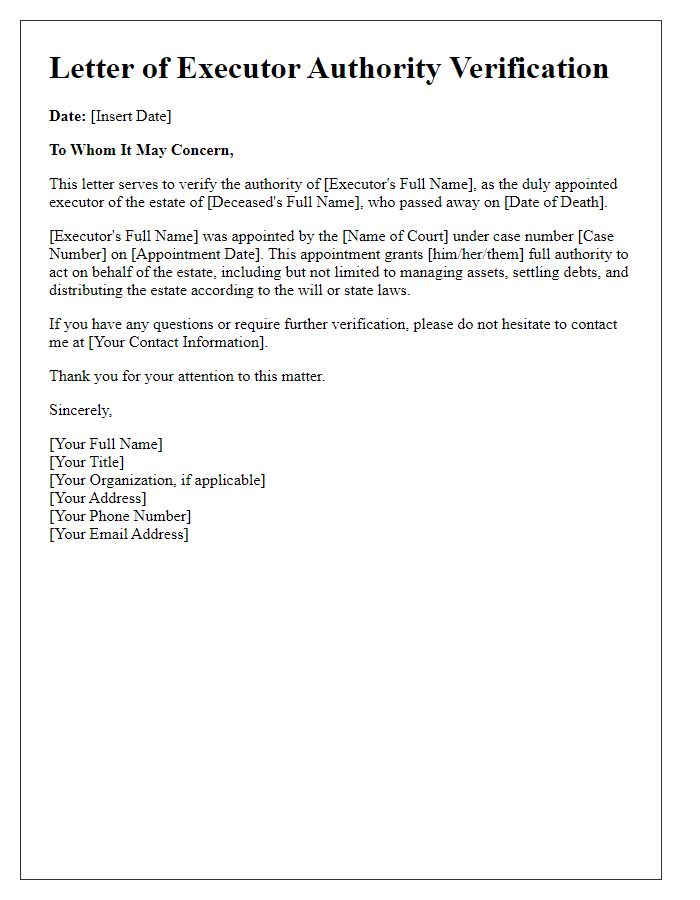

Estate Details

The executor of an estate holds a critical role in managing and distributing the assets of a deceased individual's estate, often referred to as probate. For example, an estate may include real estate valued at $300,000 located in Los Angeles, California, as well as personal items such as jewelry and vehicles, totaling another $50,000. This executor typically has the authority granted by the deceased's will or, in the absence of one, through court appointment. Responsibilities include paying valid debts, filing necessary tax returns, and ensuring compliance with state probate laws, which can vary significantly. An authorization letter may include pertinent names, dates, and relevant legal citations, providing clear evidence of the executor's authority to act on behalf of the estate at institutions like banks, insurance agencies, and the court system.

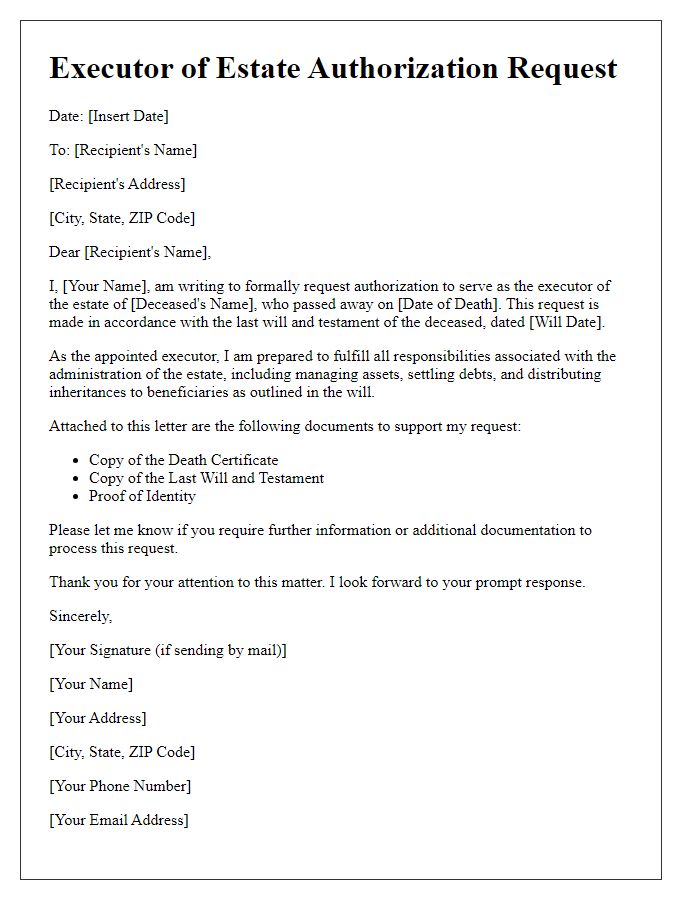

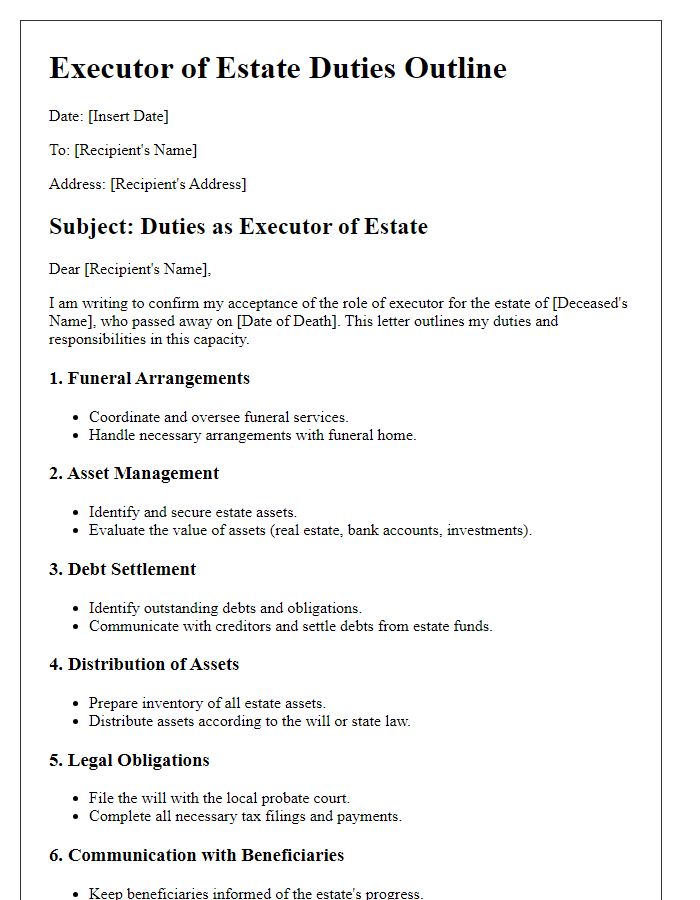

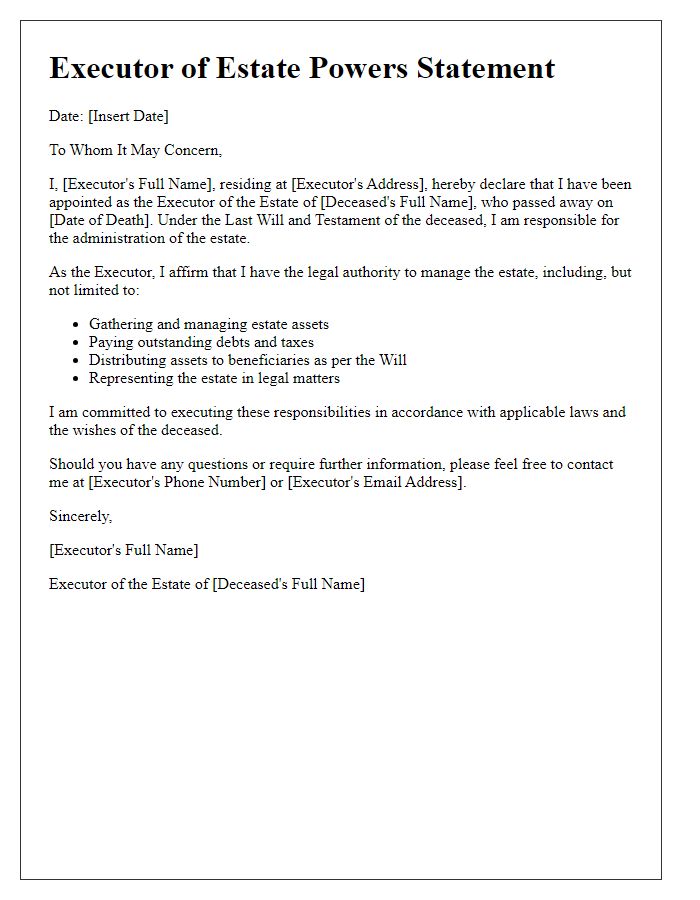

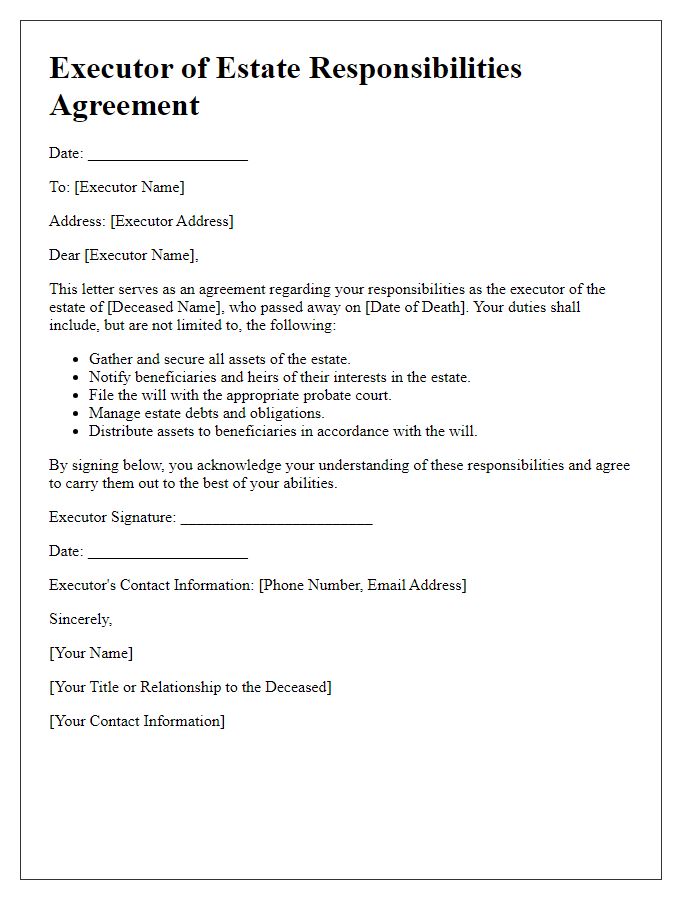

Executor's Authority and Duties

An executor of an estate holds significant responsibilities, including managing the deceased person's assets, settling debts, and distributing inheritances according to the will. The authority granted to an executor typically includes the power to collect, inventory, and safeguard estate assets, which may range from bank accounts and real estate properties to personal belongings. Executors must also handle tax filings and payments related to the estate, often involving the IRS and state revenue departments. Typically, executors are appointed through the probate court in their local jurisdiction, such as the County Court in Los Angeles, California, ensuring legal compliance during the administration process. The timeline for completing these duties can vary significantly, often extending from six months to several years depending on the estate's complexity. Proper documentation, including the Letters Testamentary, is essential for the executor to legally transact on behalf of the estate.

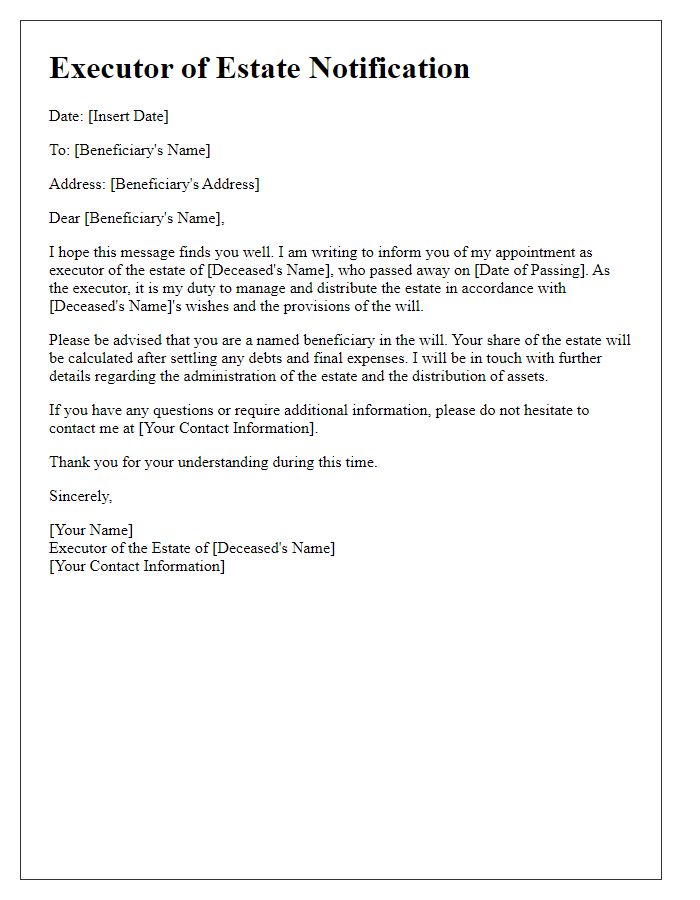

Beneficiary Information

The executor of an estate holds a crucial role in managing the distribution of assets and ensuring that the deceased's wishes are respected. Beneficiary information is essential, encompassing identities such as names, relationships to the deceased, and contact details (address, phone number, email). Each beneficiary's entitlement percentage or specific assets allocated must be documented to prevent disputes. Accurate records assist the executor in compiling the estate's inventory and addressing tax obligations (important for estates exceeding certain values per jurisdiction). Additionally, any conditions stipulated in the deceased's will, such as age requirements or milestones, must be meticulously noted to ensure compliance with the legal framework governing inheritance.

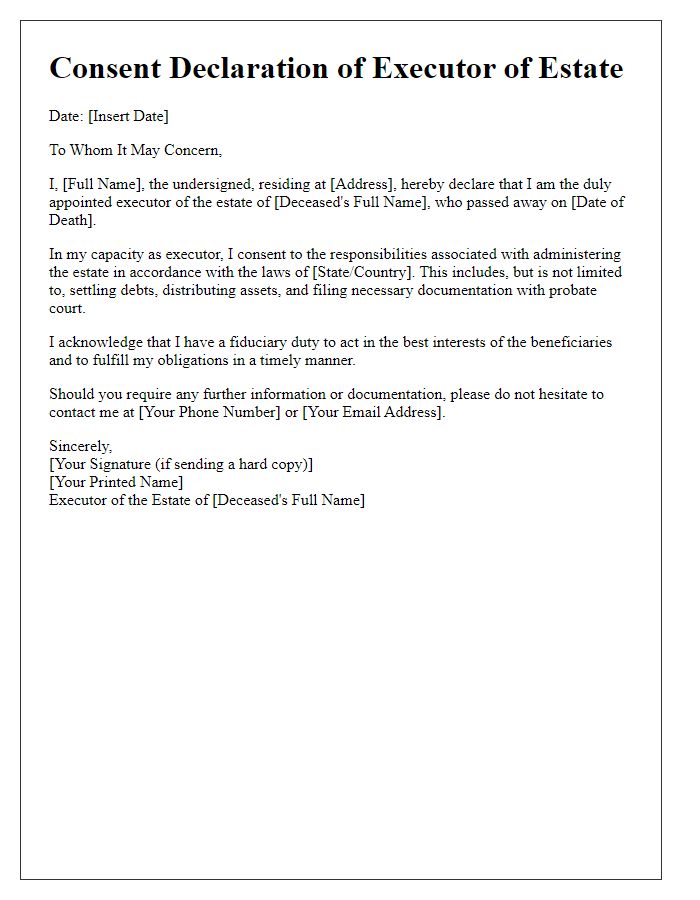

Legal and Financial Considerations

The executor of an estate is entrusted with significant legal and financial responsibilities following the death of an individual, ensuring the administration of the deceased's will (a legal document outlining distribution of assets). Key considerations include compliance with state probate laws (specific regulations governing the validation of a will) and overseeing the inventory process of assets (evaluating property, bank accounts, and personal belongings). Executors must also settle outstanding debts (financial obligations owed by the estate) and distribute remaining assets to beneficiaries (individuals designated to receive portions of the estate), adhering to the terms set forth in the will. Tax obligations, such as estate taxes (government levies on the transfer of property), must be managed efficiently to avoid penalties. Executors may need to collaborate with legal professionals or financial advisors to navigate these complexities, ensuring the estate is settled in accordance with the law and the deceased's wishes.

Comments