When it comes to ensuring the integrity of your financial records, a financial audit is a crucial step in maintaining transparency and accountability. By authorizing a financial audit, you're not just abiding by regulations; you're also reinforcing trust among stakeholders and employees alike. This process can illuminate areas for improvement while highlighting your organization's strengths. Ready to dive deeper into the steps and best practices for preparing an effective financial audit authorization letter?

Company Information

Company financial audits require detailed authorization to ensure compliance with regulatory standards and internal policies. Audit authorization documents typically include corporate information such as the company's legal name, registered address, and tax identification number (TIN) for identification purposes. This information establishes the company's legitimacy and facilitates communication between the auditors and the organization. Additionally, the document must outline the scope of the audit, including the financial period under review, which often spans fiscal years like 2022 or multi-year evaluations. Including the names and titles of key authorized personnel, such as the Chief Financial Officer (CFO) or the Audit Committee Chair, ensures accountability and clarity in the audit process, ultimately supporting the integrity of financial reporting practices.

Audit Scope

The audit scope outlines the specific areas and processes that the financial audit will examine. It includes the evaluation of financial statements prepared in compliance with Generally Accepted Accounting Principles (GAAP), focusing on the fiscal year ending December 31, 2023. The audit will assess internal controls over financial reporting, ensuring adherence to regulations such as the Sarbanes-Oxley Act (SOX). Key financial accounts, including cash, accounts receivable, and inventory, will be reviewed in detail to validate accuracy and integrity. Additionally, the audit will cover compliance with relevant laws and guidelines established by the Financial Accounting Standards Board (FASB). Findings will be documented and reported, aiming to enhance transparency and accountability within the organization.

Authorization Details

Authorization for financial audits is essential for maintaining transparency and accountability within organizations. This document outlines the scope of the audit, covering financial statements, operational efficiency, and compliance with regulations such as Generally Accepted Accounting Principles (GAAP). Specific dates, like the financial year ending December 31, 2023, should be included to contextualize the timeframe of the audit. This authorization typically involves key parties, including the Chief Financial Officer (CFO) and external auditing firms such as Deloitte or Ernst & Young, ensuring an unbiased examination of financial records. Important details, such as access to historical data, electronic financial systems, and the requirement for cooperation from all departments, are crucial for auditors to perform a thorough evaluation. The formal approval not only instills confidence among stakeholders but also aligns with regulatory requirements, fortifying the organization's reputation in the financial market.

Contact Person

Financial audits require approval from the designated contact person within an organization to ensure compliance and transparency. The contact person, often a Chief Financial Officer (CFO) or Internal Audit Manager, plays a pivotal role in coordinating with auditors, facilitating access to financial records, and providing necessary documentation. Clear communication regarding timelines, expectations, and authorization limits is essential for a smooth audit process. Additionally, the contact person acts as a point of communication for any questions or clarifications needed by the audit team during the review, ensuring that all inquiries are addressed promptly. This structured approach helps maintain the integrity of financial reporting and supports the organization in adhering to regulatory requirements.

Confidentiality Statement

Financial audit processes require stringent confidentiality to protect sensitive information. Entities such as corporations and nonprofit organizations must ensure that third-party auditors sign a confidentiality statement prior to access. This statement typically includes terms that safeguard proprietary information, including financial records, client data, and operational details. Violation of confidentiality can lead to legal repercussions and loss of trust. The confidentiality statement also delineates the duration of confidentiality obligations, often spanning five years post-audit, ensuring continued protection of sensitive information. Furthermore, enforcement measures, such as legal action or penalties, are outlined to uphold the integrity of the confidentiality agreement.

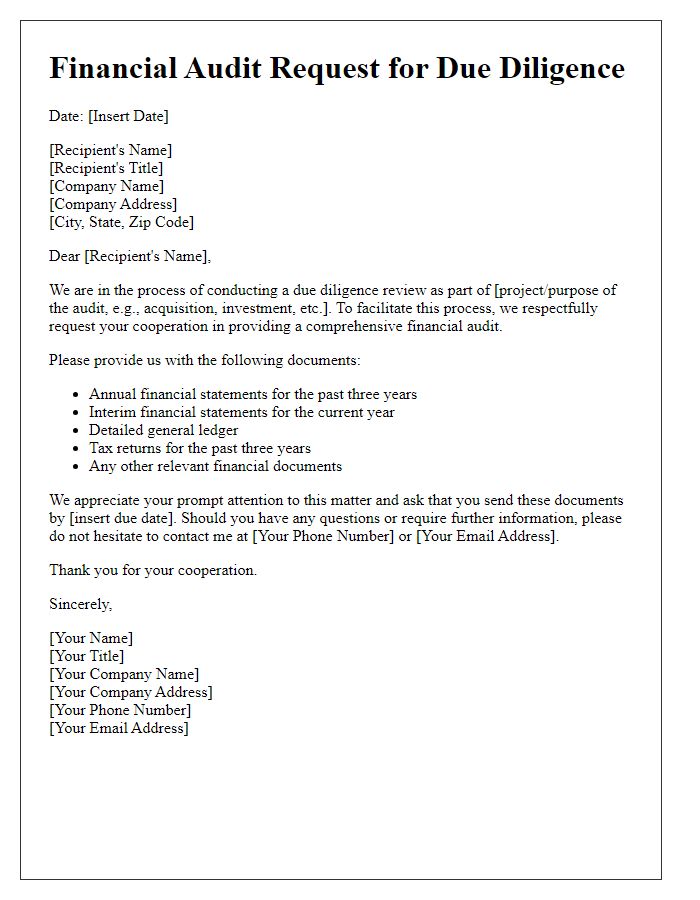

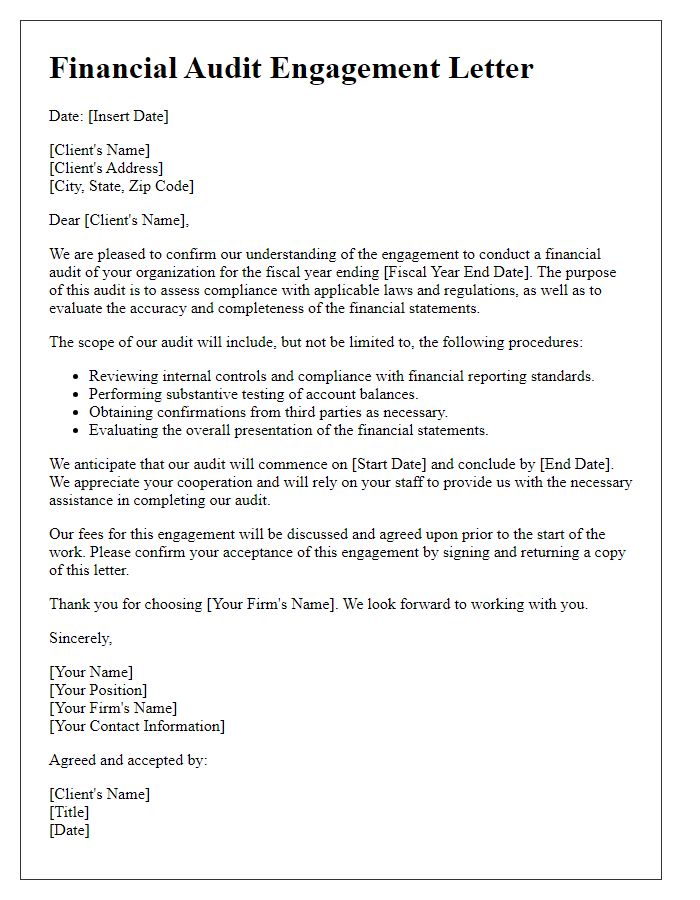

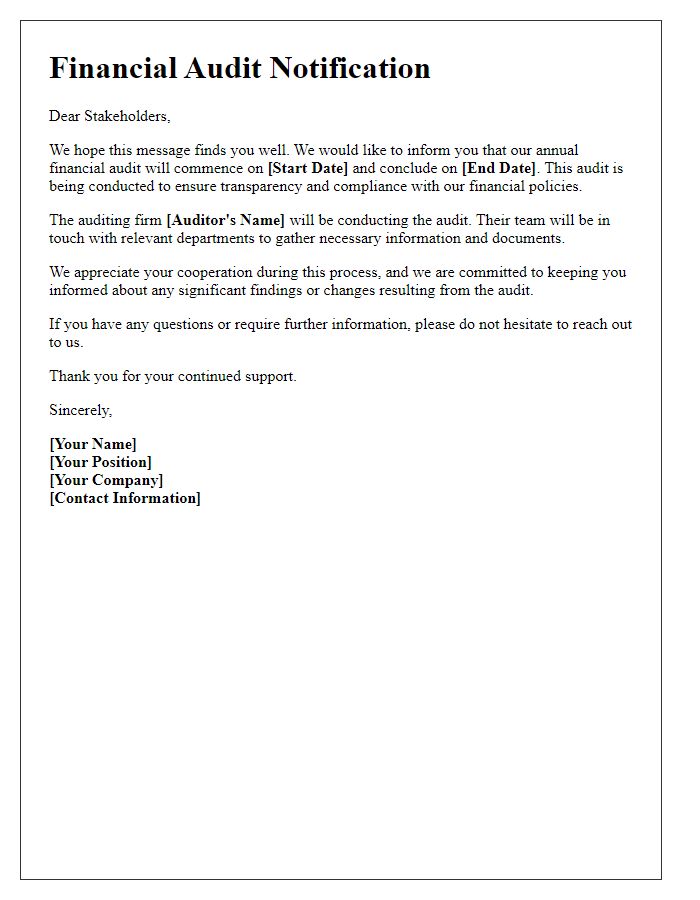

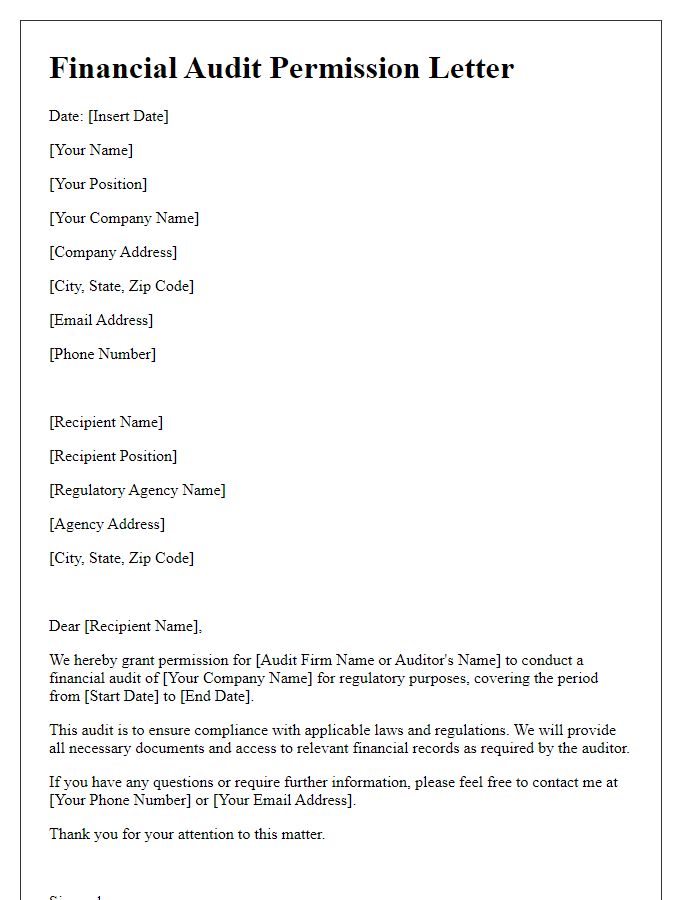

Letter Template For Financial Audit Authorization Samples

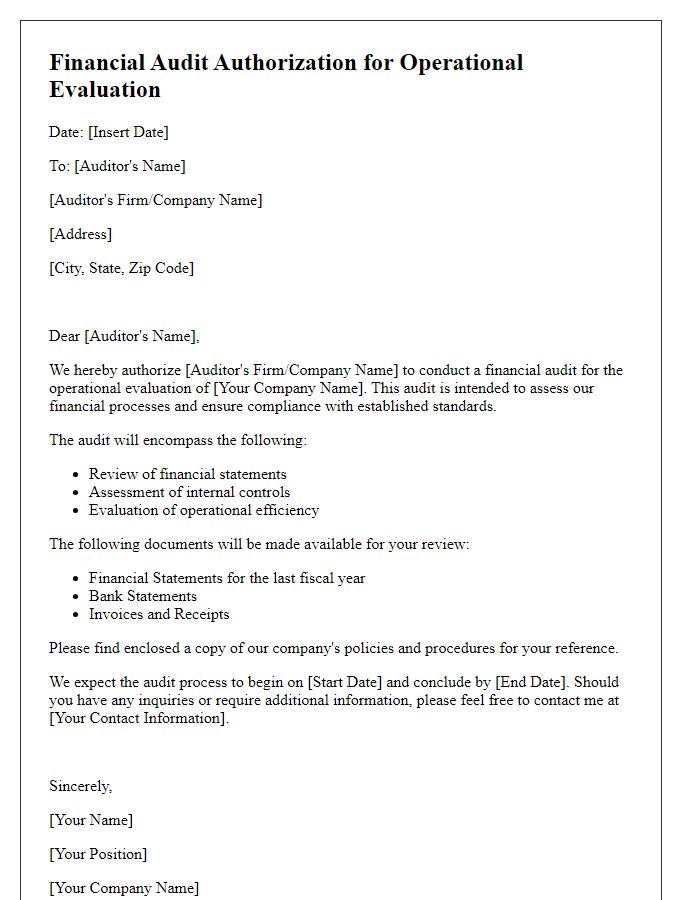

Letter template of financial audit authorization for operational evaluation

Comments