Are you looking to streamline your financial transactions without the hassle? A credit card authorization request letter can simplify the process, ensuring all parties are on the same page. Whether you're managing expenses for a business trip or handling purchases on behalf of a family member, this template will guide you in crafting your request efficiently. Join us as we explore how to create the perfect authorization letter and make your financial dealings smoother.

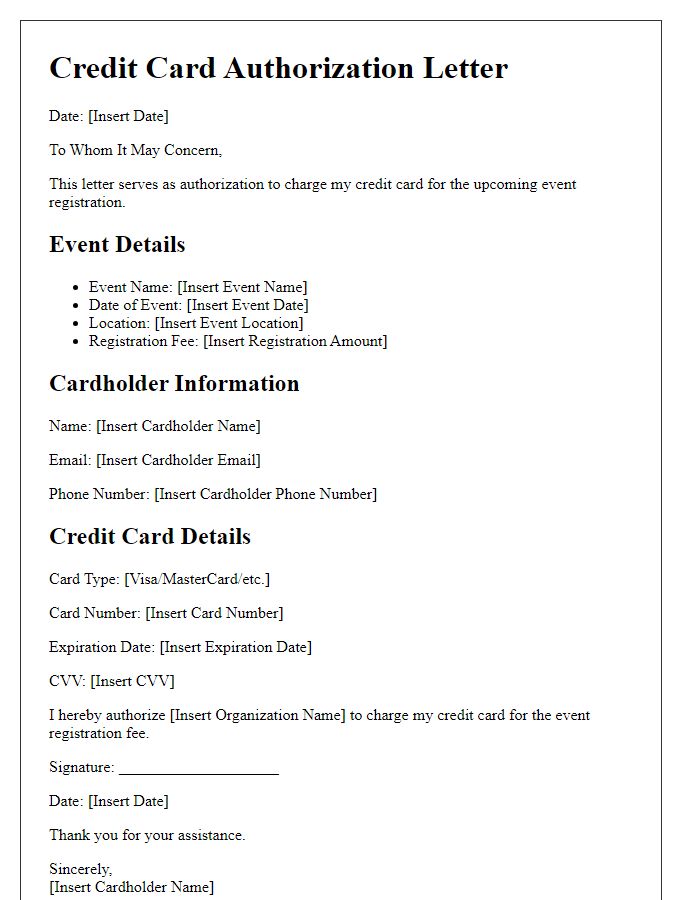

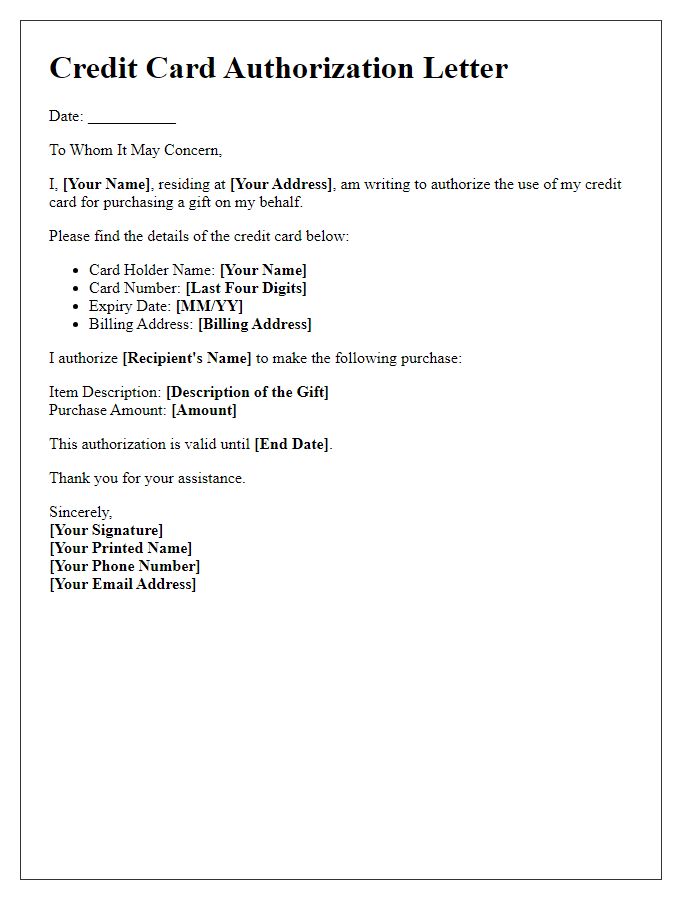

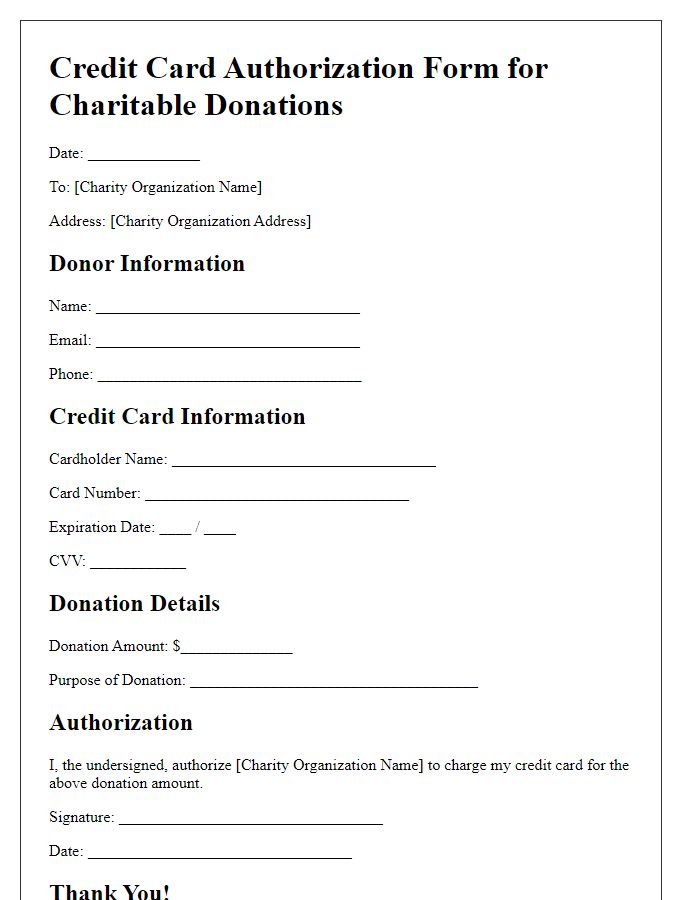

Cardholder Information

Credit card authorization requests require detailed and accurate cardholder information to ensure the transaction's security and compliance. The cardholder's full name, as it appears on the card, is crucial for verification. Additionally, the card number, typically consisting of 16 digits, must be included for processing. Expiration dates, usually formatted as MM/YY, provide confirmation of the card's validity. The CVV (Card Verification Value), a three or four-digit number found on the back of the card, is vital for fraud prevention. Moreover, the billing address, which includes the street address, city, state, and ZIP code, is necessary to match the information on file with the issuing bank. All this information ensures the processing of the credit card transaction is smooth and secure.

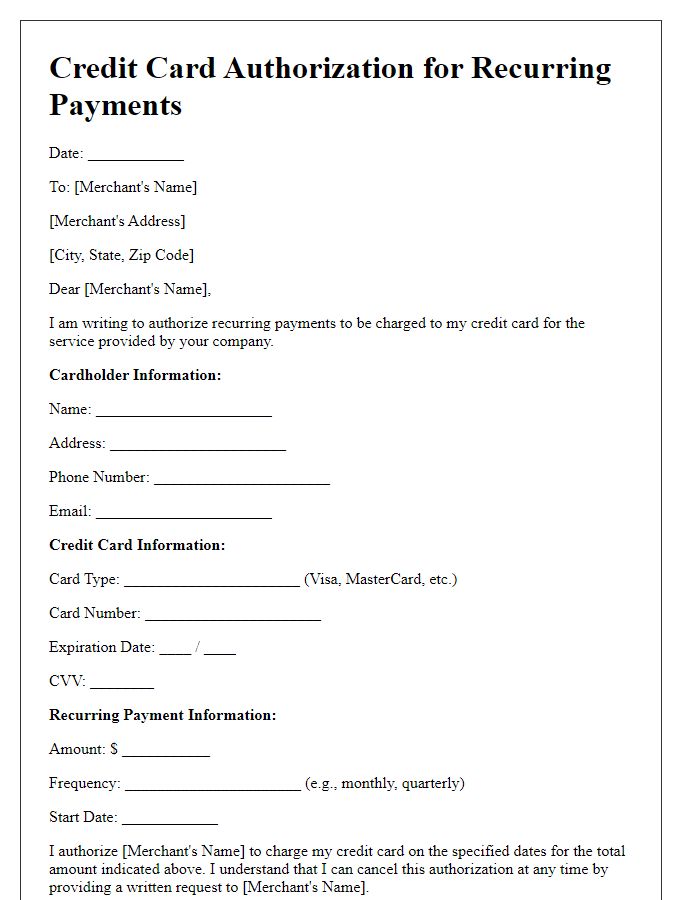

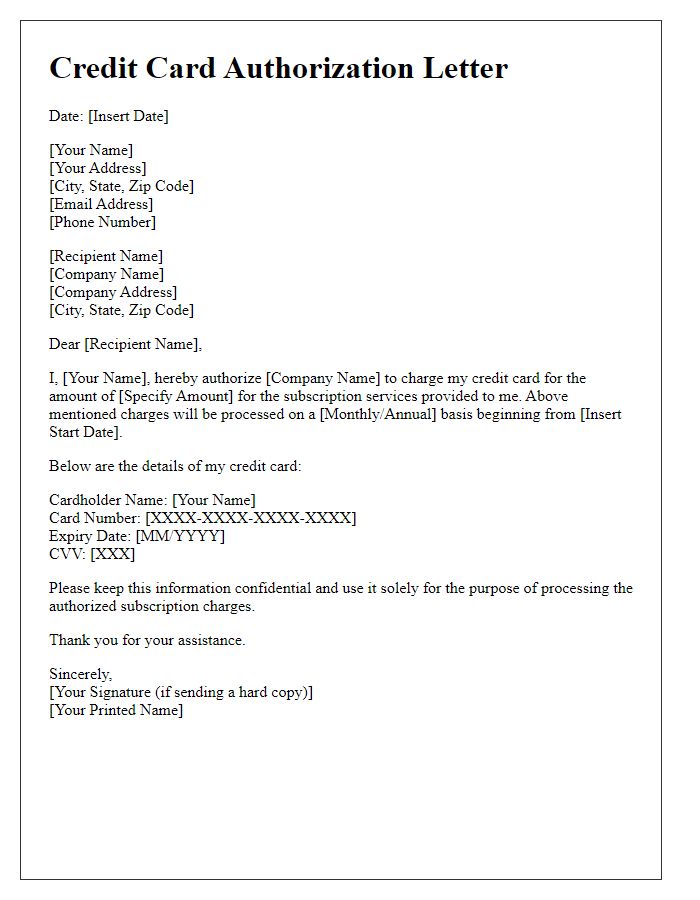

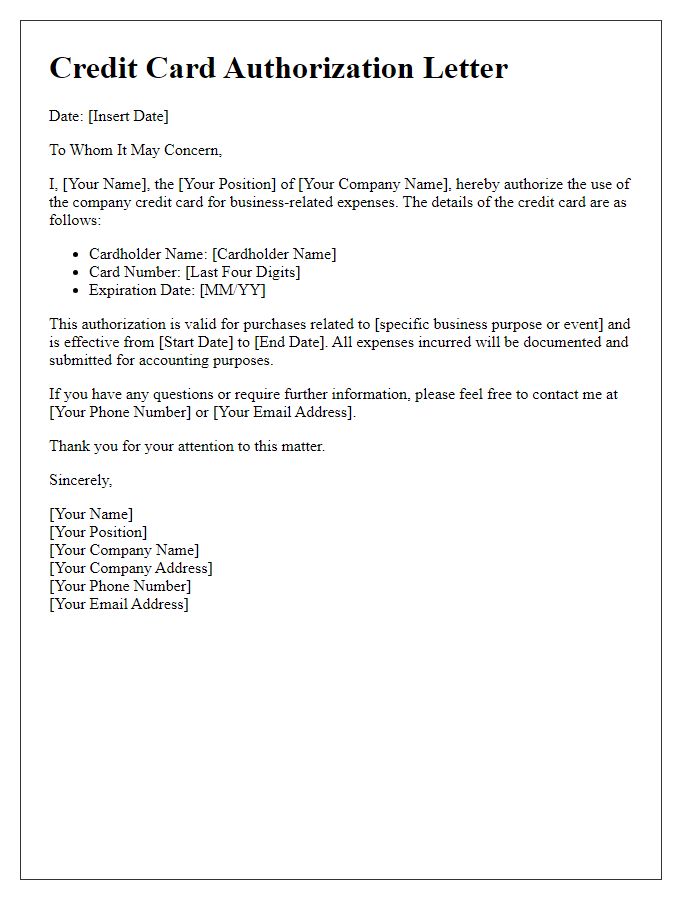

Authorized User Details

The credit card authorization request process entails detailing essential information about authorized users. Authorized users, such as family members or employees, must be clearly identified to facilitate secure transactions. Key details include the user's full name, relationship to the primary cardholder, and specific rights associated with the card use. Often, users might be required to provide identification, such as a driver's license number or Social Security number, to verify their identity. Additionally, documenting the time period during which the authorization is valid, as well as any transaction limits, is crucial for maintaining financial security and preventing unauthorized use of the card. Proper organization of this information aids in prompt processing by financial institutions and ensures compliance with company policies.

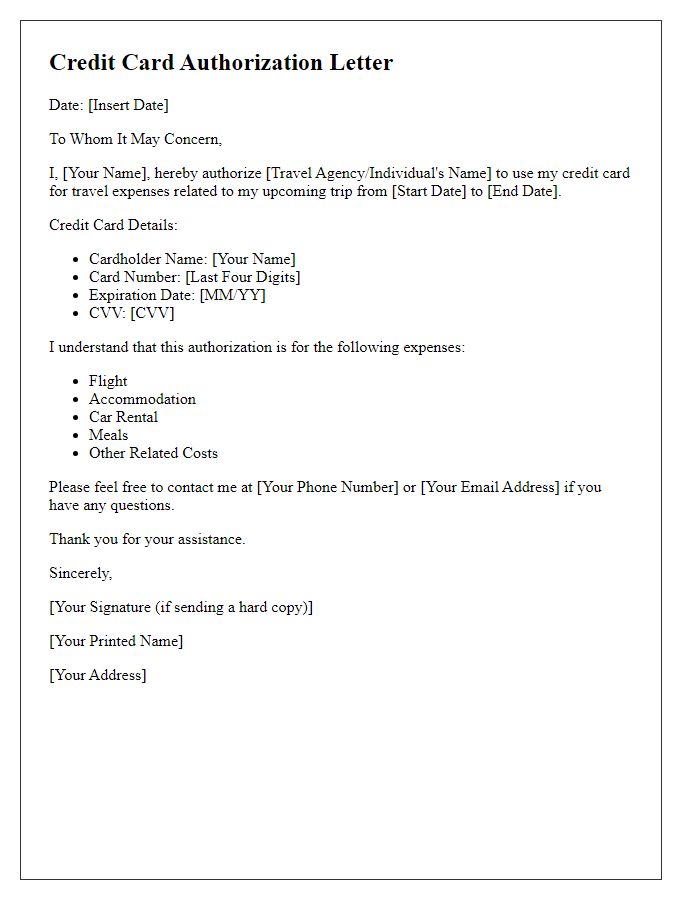

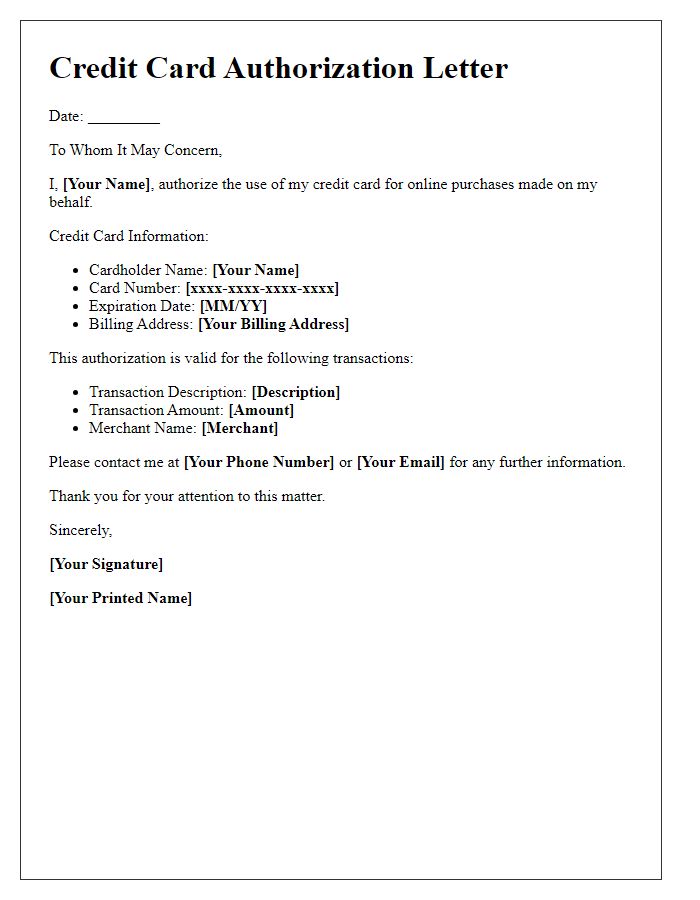

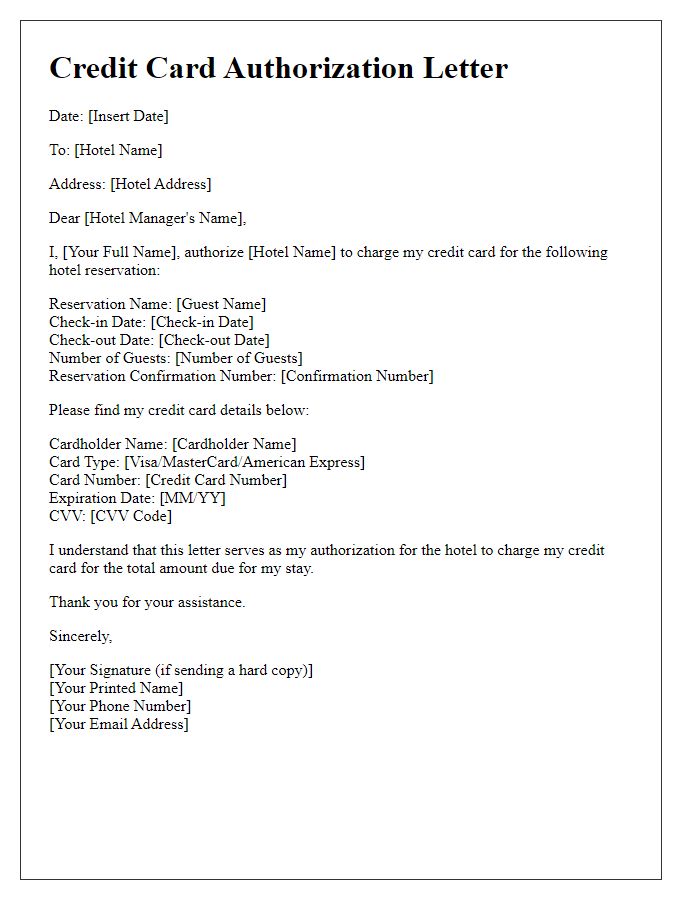

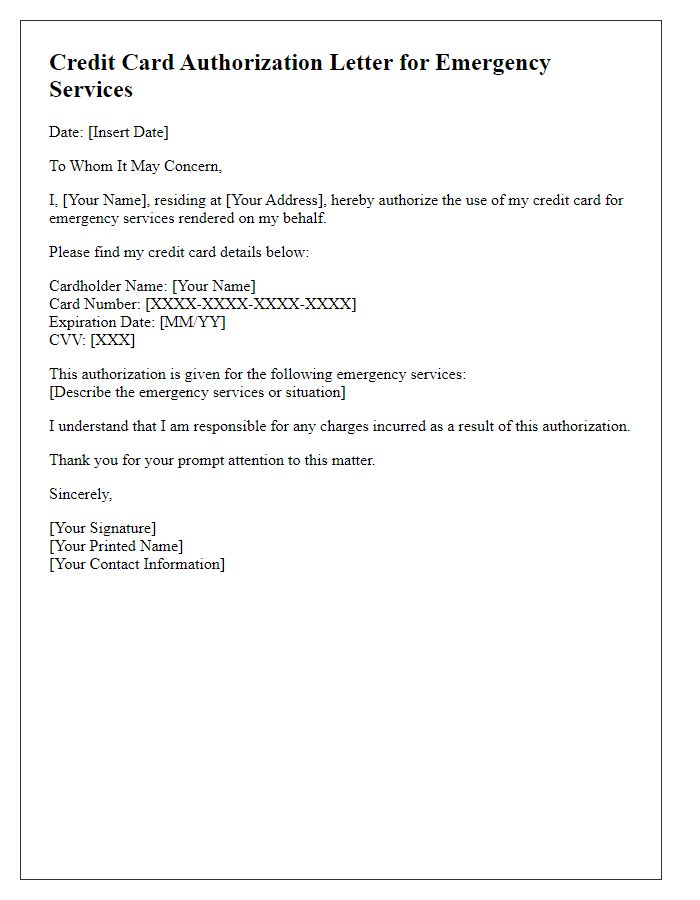

Explicit Authorization Statement

Credit card authorization requests require explicit consent from the cardholder, ensuring that financial transactions are conducted with transparency and security. The authorization statement typically includes essential details like the cardholder's name, card number, expiration date, and the specific amount to be charged. Clear disclosure of the purpose of the transaction, such as subscription services or one-time purchases, is critical. Additionally, compliance with Payment Card Industry Data Security Standards (PCI DSS) safeguards both the cardholder's sensitive information and the merchant's liability. Proper documentation, including the date and signature lines for the cardholder's consent, is necessary to validate the authority granted for processing charges.

Payment Limitations and Duration

Credit card authorization requests often focus on payment limitations and duration for transactions. A credit limit often defined by the issuing bank sets the maximum amount allowed for purchases. This limit can vary based on the card type, issuer policies, and the consumer's creditworthiness. The authorization process checks available credit and may also consider transaction duration, with many card companies typically approving charges for a 24 to 72-hour window. If a transaction exceeds 72 hours, merchants may need to re-initiate authorization. Understanding these parameters is essential for ensuring smooth transaction processes for both consumers and merchants.

Contact Information for Verification

A credit card authorization request is crucial for transaction verification and protection against fraudulent activity. Detailed contact information for verification, including the cardholder's full name, billing address, phone number, and email address, is essential. Additionally, the last four digits of the credit card number serve as a reference point. Prompt communication between the merchant and the cardholder facilitates swift authorization, especially for high-value purchases exceeding $500. Properly verifying this information ensures secure transactions, protects both parties, and streamlines payment processing, particularly in e-commerce environments.

Comments