Are you navigating the complex waters of a not-for-profit audit engagement? It can feel overwhelming, but understanding the key components can simplify the process. From ensuring compliance with regulations to presenting transparent financial statements, an effective audit keeps your organization accountable and enhances donor trust. Dive into our article to discover essential tips for a seamless audit experience!

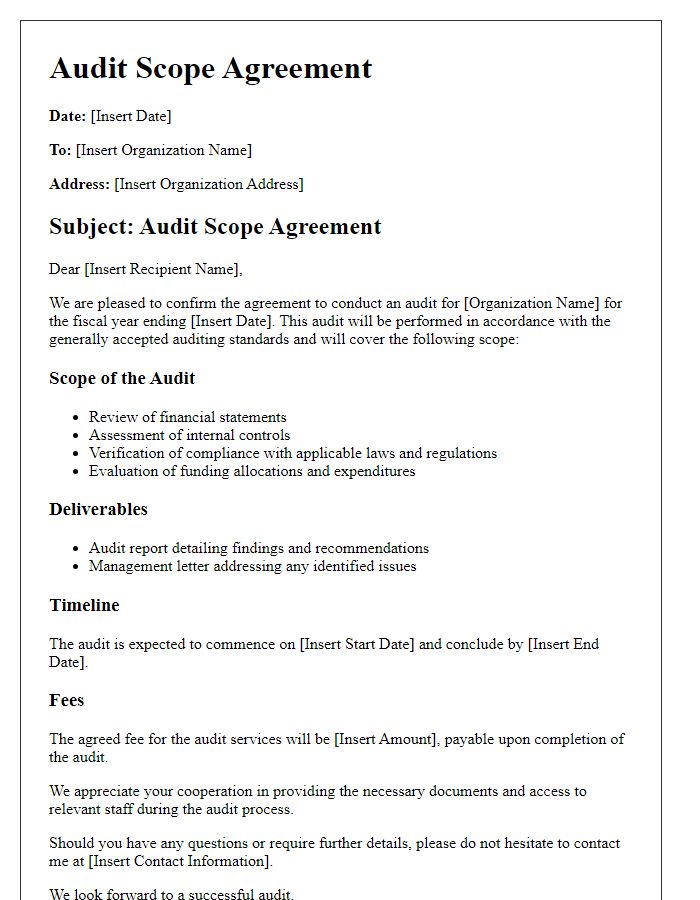

Audit Scope and Objectives

The audit scope encompasses the financial statements of the not-for-profit organization, including the balance sheet, statement of activities, and cash flow statement for the fiscal year ending December 31, 2023. Objectives focus on assessing compliance with Generally Accepted Accounting Principles (GAAP), ensuring accurate financial reporting, and verifying adherence to regulations applicable to non-profit entities. Evaluations will include analysis of various revenue streams, such as donations, grants (state and federal), and membership fees, totaling approximately $1.5 million. Additionally, asset verification, including fixed assets valued at $700,000, will be conducted. A review of internal controls will aim to ensure effectiveness in safeguarding organizational resources, particularly in areas susceptible to fraud or misuse. The audit will also examine the allocation of program expenses, which should constitute at least 75% of total expenditures, in alignment with the organization's mission and goals.

Responsibilities of Management and Auditors

Management holds crucial responsibilities during the audit engagement for not-for-profit organizations, ensuring the accuracy of financial statements and compliance with applicable laws and regulations. This includes maintaining internal controls to mitigate errors and misstatements within the financial reporting process. Auditors, on the other hand, are tasked with evaluating these financial statements' fairness, conducting thorough examinations of financial records, and assessing the effectiveness of internal controls. They must also remain independent and objective, providing an unbiased opinion on whether the financial statements present a true and fair view of the organization's financial position. These collaborative efforts aim to enhance transparency, accountability, and trust within not-for-profit sectors, ultimately ensuring that funds are utilized effectively in achieving their social missions.

Audit Deliverables and Timeline

The audit engagement timeline for a not-for-profit organization typically spans several phases, including planning, execution, and reporting, with key deliverables assigned to each phase. The planning phase involves a preliminary assessment to establish the scope of the audit, identify key risks, and develop an audit strategy, usually completed within the first month. The execution phase includes fieldwork, where auditors will review financial statements, internal controls, and compliance with relevant laws, often lasting four to six weeks. Critical deliverables during this stage include the draft audit report and management letter, outlining any identified deficiencies and recommendations for improvement. The finalization of the audit report, presenting the auditor's opinion on the financial statements, is typically concluded within two weeks after fieldwork, aligning with required submission deadlines, such as those established by the IRS for Form 990 filing. Regular communication with board members and stakeholders ensures transparency and addresses any concerns throughout the engagement process.

Ethical Compliance and Confidentiality

A not-for-profit audit engagement requires stringent adherence to ethical compliance standards and confidentiality protocols, particularly in the context of organizations like 501(c)(3) charities. Auditors must ensure transparency and integrity in financial reporting, addressing potential conflicts of interest that may arise. Strict safeguards must be established to protect sensitive information, including donor identities and financial transactions, in accordance with regulations such as the Sarbanes-Oxley Act. Ethical guidelines necessitate that auditors maintain independence and verify that contributions are disclosed accurately, upholding the trust of stakeholders, including grant providers and community members. Potential breaches of confidentiality can lead to significant legal repercussions and can damage the reputations of both the auditing firm and the not-for-profit entity involved.

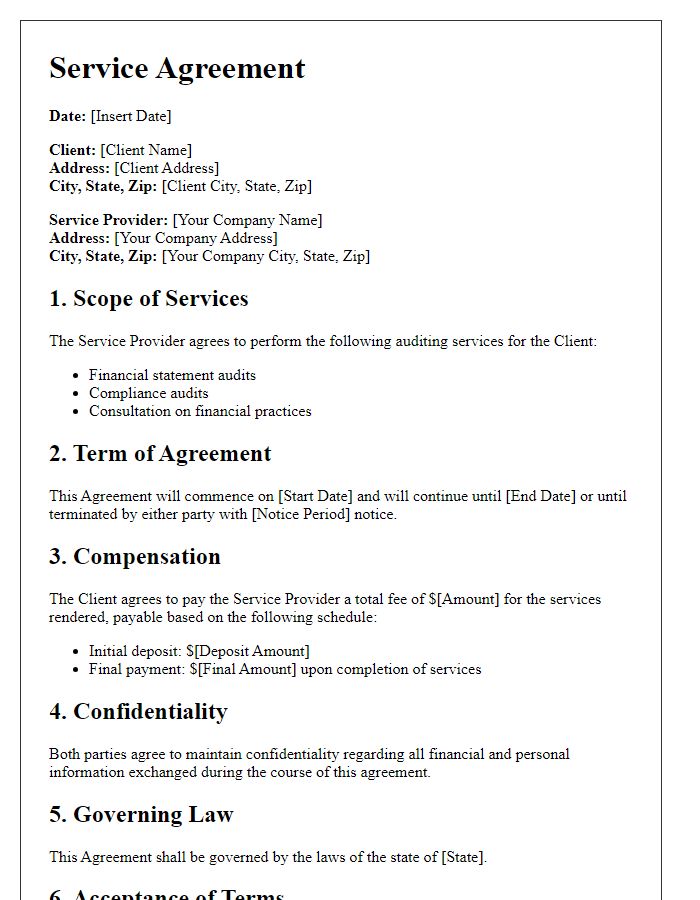

Fee Structure and Payment Terms

The fee structure for a not-for-profit audit engagement typically includes a detailed breakdown of costs associated with various audit activities, such as preliminary assessments, fieldwork, and report preparation. For instance, hourly rates may range from $100 to $300, depending on the experience of the auditors and the complexity of the organization's financials. Payment terms generally stipulate that an initial retainer (often 20% of the estimated fees) is due upon engagement, with the remainder payable in installments aligned with key project milestones. Invoices may be issued monthly, highlighting services rendered within that period, along with any additional expenses incurred during the audit process. Timely payment is often emphasized to ensure the continuity and efficiency of audit services, with potential late fees outlined for overdue balances, ensuring compliance with established financial protocols.

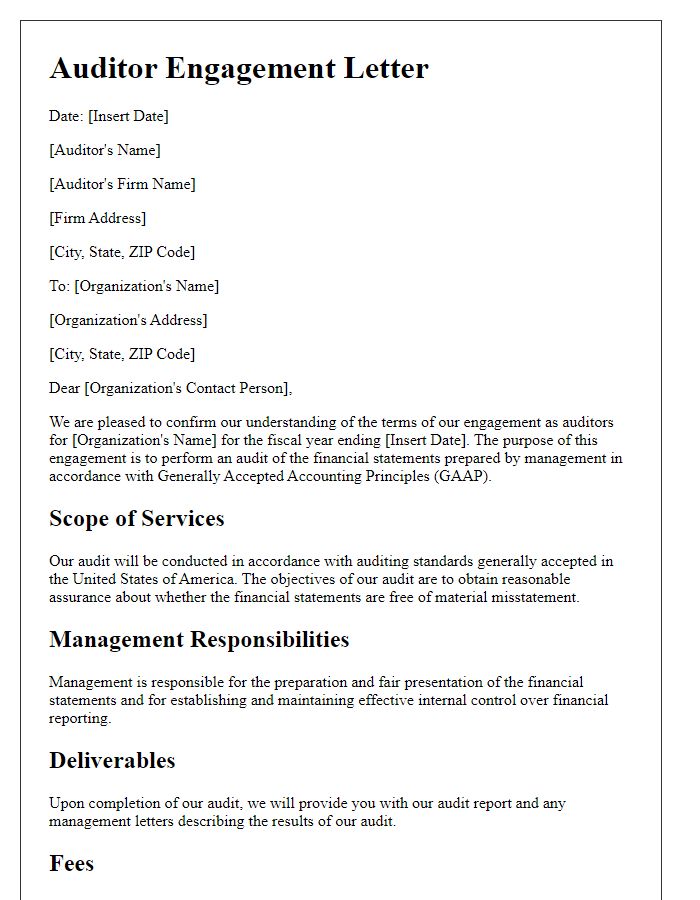

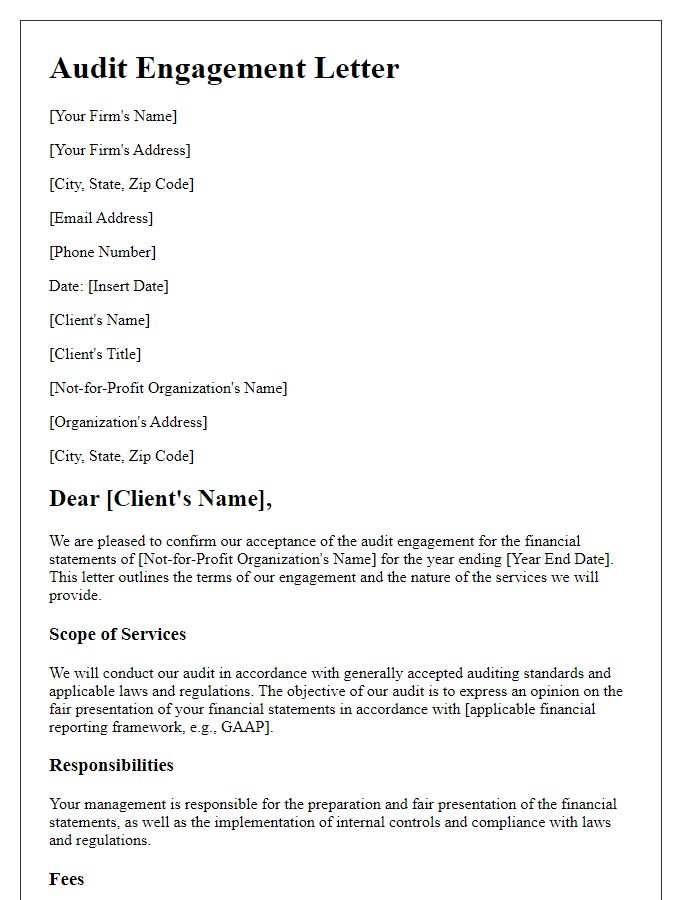

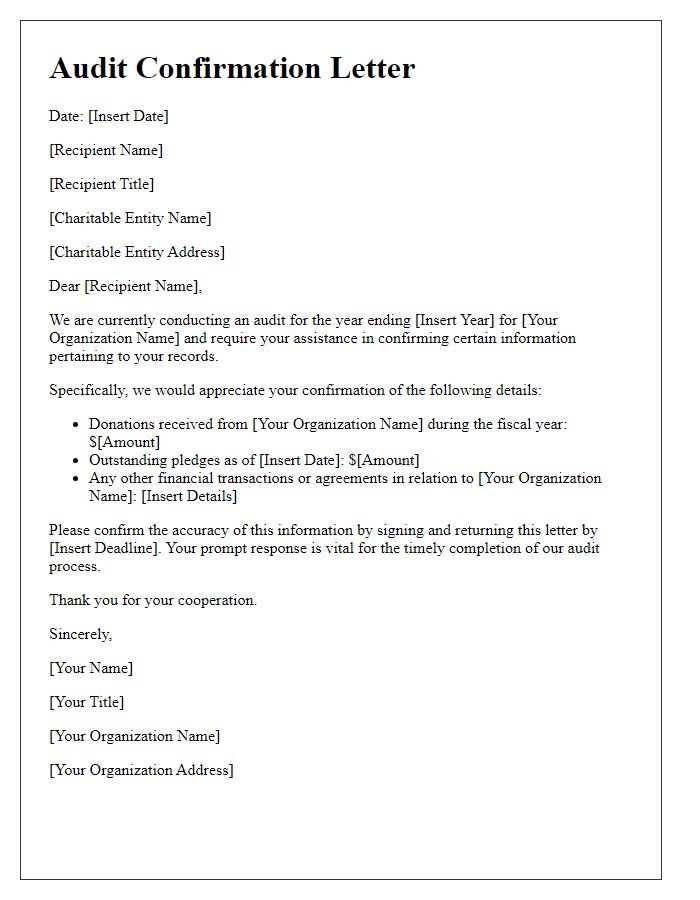

Letter Template For Not-For-Profit Audit Engagement Samples

Letter template of auditor engagement for community service organizations

Comments