Are you navigating the complexities of compliance audits? Understanding the ins and outs of these essential assessments can feel overwhelming, but it's crucial for maintaining organizational integrity and efficiency. In this article, we'll break down the steps to effectively communicate a compliance audit notification, ensuring all parties are informed and prepared. So, let's dive in and explore how to craft a seamless letter that sets the tone for a successful audit process!

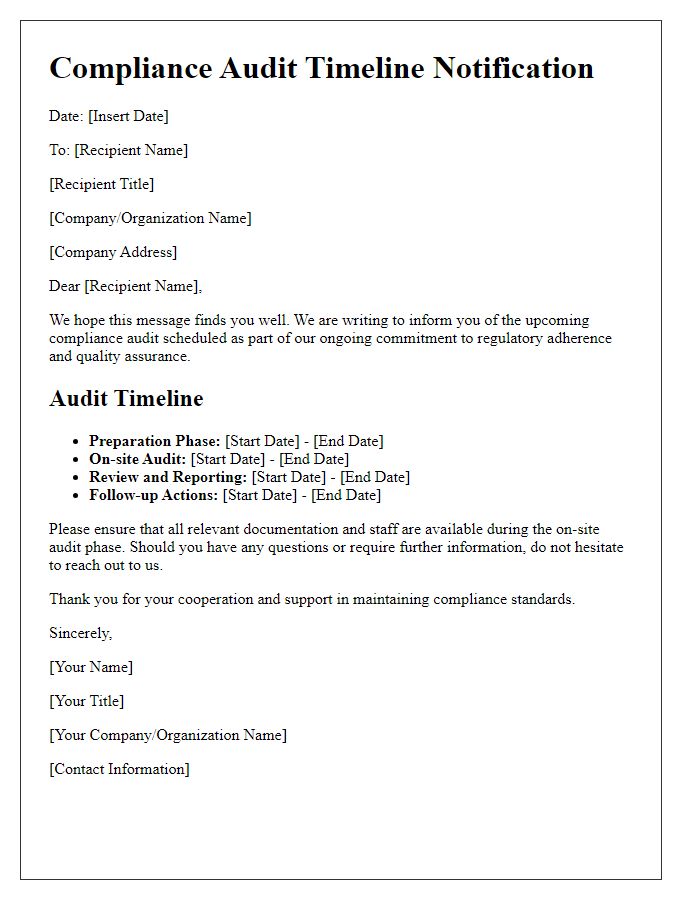

Subject Line

Compliance audits are vital for ensuring adherence to established regulations and standards within organizations, such as the Sarbanes-Oxley Act for financial reporting or the General Data Protection Regulation (GDPR) for data protection. Notifications regarding these audits often include specific dates (like October 15, 2023) when the audit process will commence, detailing the involved departments (such as finance or IT) and auditors (such as external firms like Deloitte), which will assess compliance levels. Anticipated outcomes may focus on areas like risk management, operational effectiveness, or policy adherence, emphasizing the importance of communication and collaboration among all departments to facilitate a thorough evaluation.

Introduction and Purpose

The compliance audit notification serves to inform stakeholders about the upcoming examination of adherence to established regulations and standards within the organization. This audit is designed to evaluate processes related to financial practices, operational effectiveness, and risk management, ensuring alignment with industry-specific guidelines such as the Sarbanes-Oxley Act for publicly traded companies or the General Data Protection Regulation (GDPR) for data protection. Conducted by a certified external auditing firm, this thorough assessment will take place from November 1 to November 15, 2023, at the headquarters located in Austin, Texas. The primary objective is to identify areas for improvement and ensure compliance across all departments, thereby safeguarding the organization's integrity and reputation in the market.

Audit Scope and Objectives

A compliance audit aims to evaluate adherence to regulatory requirements, organizational policies, or industry standards. The scope of such an audit typically encompasses financial records, operational processes, and risk management practices relevant to compliance. Objectives include identifying gaps in compliance, assessing internal controls, and ensuring legal obligations are met to mitigate liabilities. Essential documents reviewed during the audit may consist of contracts, transaction logs, and policy manuals. The audit's findings can provide guidance for necessary improvements, help enhance operational efficiency, and promote a culture of accountability within the organization.

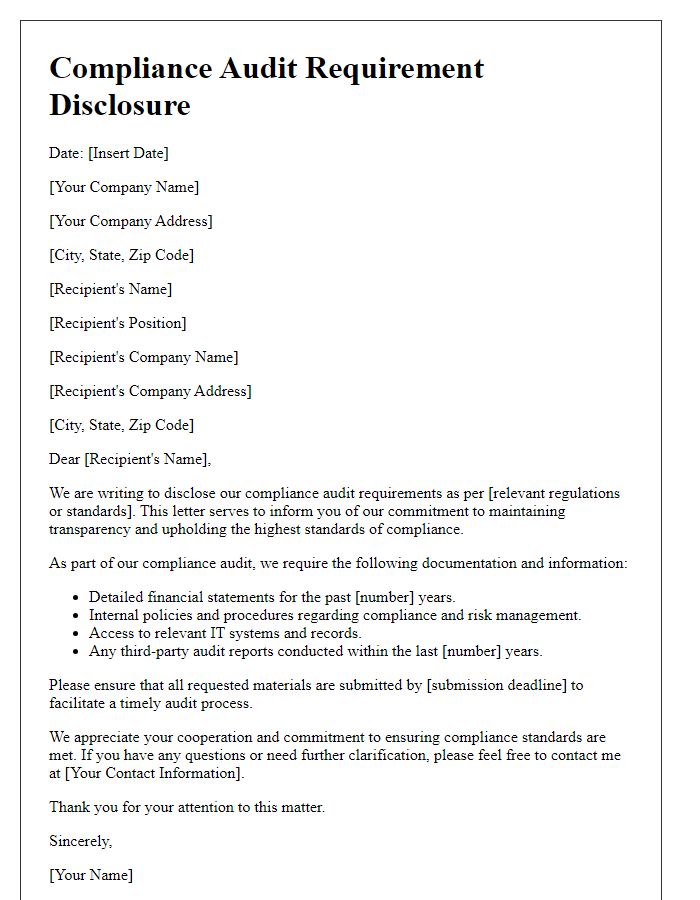

Required Documentation and Information

Compliance audits require meticulous documentation to ensure adherence to regulatory standards and internal policies. Key documents include financial records such as balance sheets and income statements, typically spanning the fiscal year, along with operational manuals that detail procedures within organizations located in various regions. Employee training records, showcasing compliance with industry-specific regulations, are essential for verifying the knowledge level of staff. Additionally, contracts with third-party vendors should be reviewed, emphasizing service-level agreements and adherence to legal requirements in the contract's jurisdiction. Timely submission of this data is crucial, as it allows auditors to conduct thorough assessments, ensuring all aspects meet the required compliance thresholds.

Contact Information and Deadlines

A compliance audit notification system includes essential contact information and clear deadlines crucial for maintaining regulatory standards. Audit coordinators typically provide their names, phone numbers, and email addresses, ensuring prompt communication across departments. Regulatory compliance deadlines often vary depending on the industry; for financial institutions, submissions may be required quarterly, while healthcare organizations might adhere to semi-annual reporting schedules. Failure to meet these deadlines can result in penalties or loss of certifications, impacting organizational integrity and operations. Detailed timelines and specific checkpoints must be regularly communicated to ensure all stakeholders are informed and prepared.

Comments