Are you looking to streamline your financial audit reconciliation process? A well-structured letter template can be a game-changer, ensuring clarity and efficiency in your communications. Whether you're addressing discrepancies or confirming balances, having a reliable format at your fingertips can save you time and reduce stress. Dive in to discover a practical letter template that can simplify your reconciliation efforts and enhance your financial accuracy!

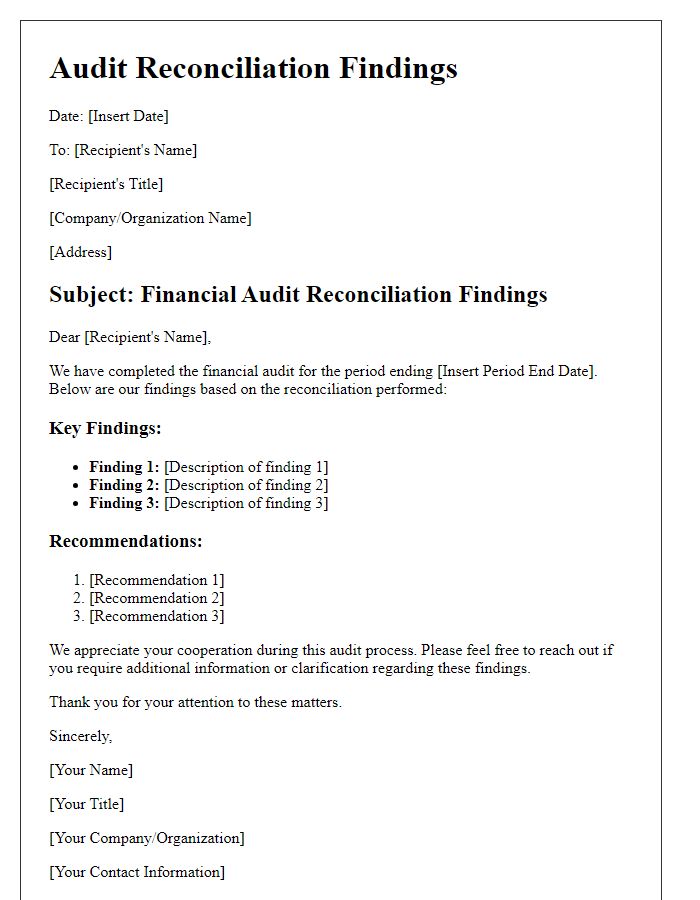

Clear subject line

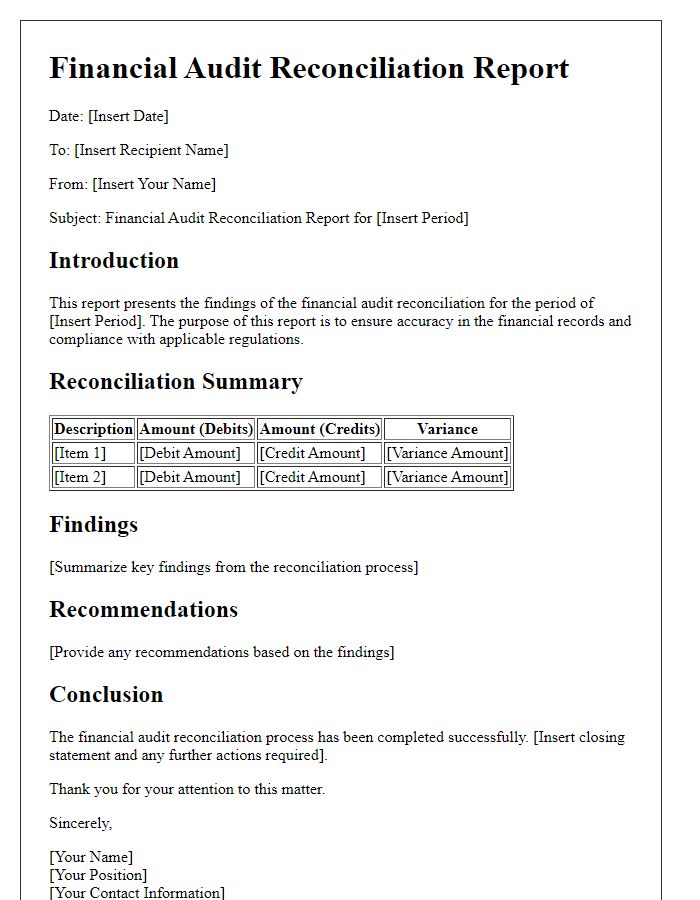

Comprehensive financial audit reconciliation involves thoroughly comparing financial records to ensure accuracy and consistency. Essential documents include balance sheets, profit and loss statements, and bank statements, which are examined for discrepancies. Relevant audits, such as the annual tax audit conducted by certified public accountants (CPAs), typically review fiscal years, ensuring compliance with regulations established by the Financial Accounting Standards Board (FASB). Key metrics, such as cash flow ratios and operating margins, are analyzed for financial health indicators. The reconciliation process aims to maintain integrity in financial reporting, essential for stakeholders, including investors, regulatory bodies, and management.

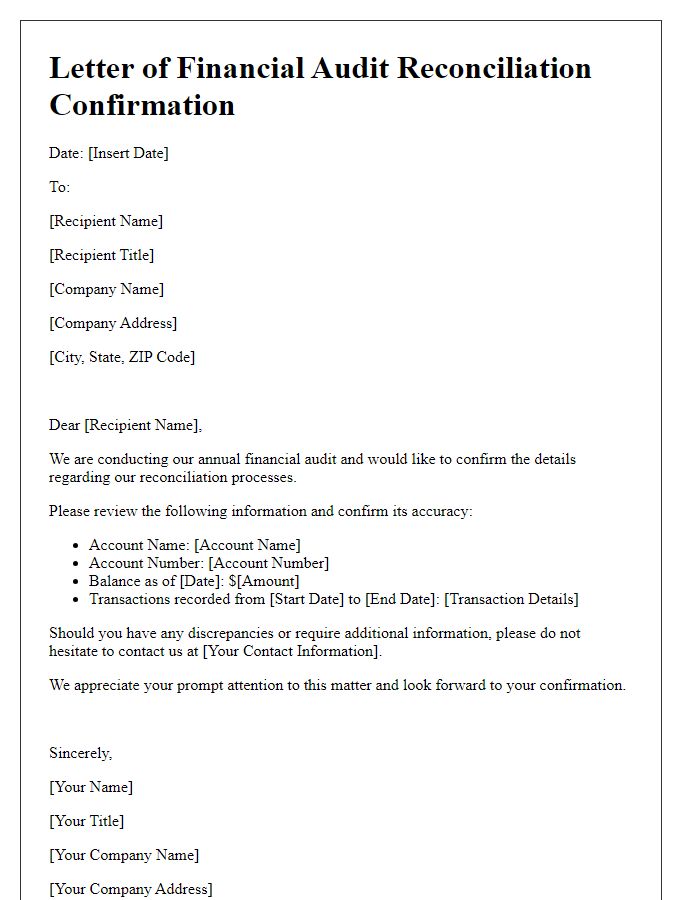

Recipient's full details

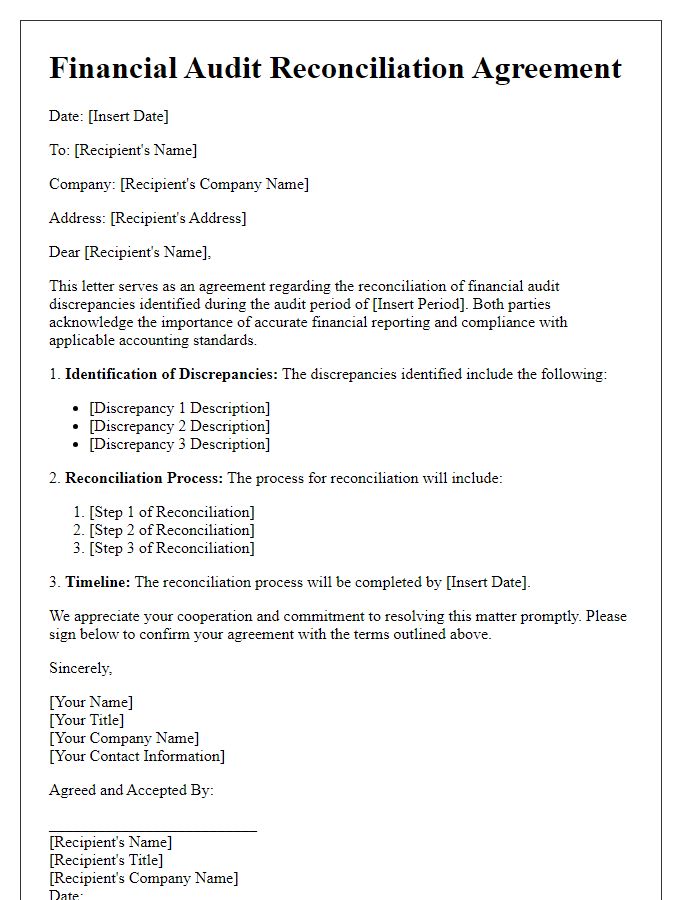

Recipient's details are crucial in ensuring the transparency and accuracy of financial audit reconciliation processes. This includes the recipient's full name (such as John Doe), organization name (like XYZ Corporation), complete mailing address (including street, city, state, and ZIP code), and relevant contact information (phone number and email address). Accurate recipient details not only streamline communication but also facilitate effective follow-up during discrepancies in financial reports, regulatory compliance, and ensuring that all correspondence reaches the appropriate person within the organization.

Concise introduction and purpose

A financial audit reconciliation is a critical process that ensures the accuracy and consistency of financial records among various sources. This procedure involves comparing internal financial statements and reports with external statements such as bank statements and supplier invoices. The primary purpose of this reconciliation process is to identify discrepancies in account balances, ensure compliance with regulatory standards, and provide assurance to stakeholders regarding the integrity of financial reporting. Accurate reconciliation helps in maintaining transparency, supporting better financial decision-making, and facilitating the timely preparation of financial statements.

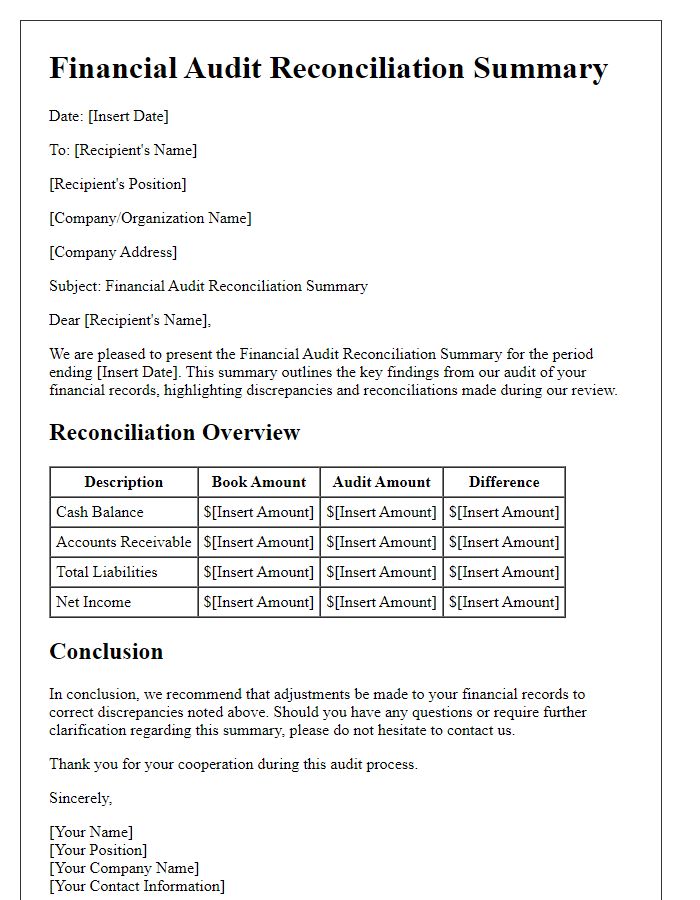

Detailed explanation of discrepancies

In financial audit reconciliations, discrepancies often arise due to various factors such as data entry errors, timing differences, or unrecorded transactions. For instance, an account balance discrepancy of $15,000 may occur when the bank statement from Chase Bank, dated October 31, 2023, does not align with the general ledger balance for the same date. Additionally, unrecorded transactions, such as outstanding checks totaling $5,000 or deposits in transit of $10,000, can create significant variances. Furthermore, review of vendor invoices reveals discrepancies where a $2,500 discrepancy is attributed to a misposted entry for supplier ABC Corporation, highlighting the need for meticulous tracking and verification. Accurate reconciliations are essential for maintaining transparency and compliance with regulatory bodies, such as the Securities and Exchange Commission (SEC).

Action items and deadlines

The financial audit reconciliation process involves detailed examination and verification of financial statements, ensuring accuracy and integrity of data. Common action items during this process include confirming outstanding transactions, such as unpaid invoices from vendors or received payments from clients, which may date back several months. Deadlines for these confirmations are typically set within two weeks following the initial audit review, ensuring timely resolution of discrepancies. Additional tasks may involve reconciling bank statements with internal records, requiring analysis of transactions over a specified period, often the previous fiscal year, to identify any anomalies. Documentation such as receipts and invoices must be organized and submitted by designated team members, usually within three weeks, to facilitate smoother audits. This rigorous process ultimately aims to uphold compliance with regulations, particularly the Generally Accepted Accounting Principles (GAAP), while enhancing financial transparency and accountability within organizations.

Comments