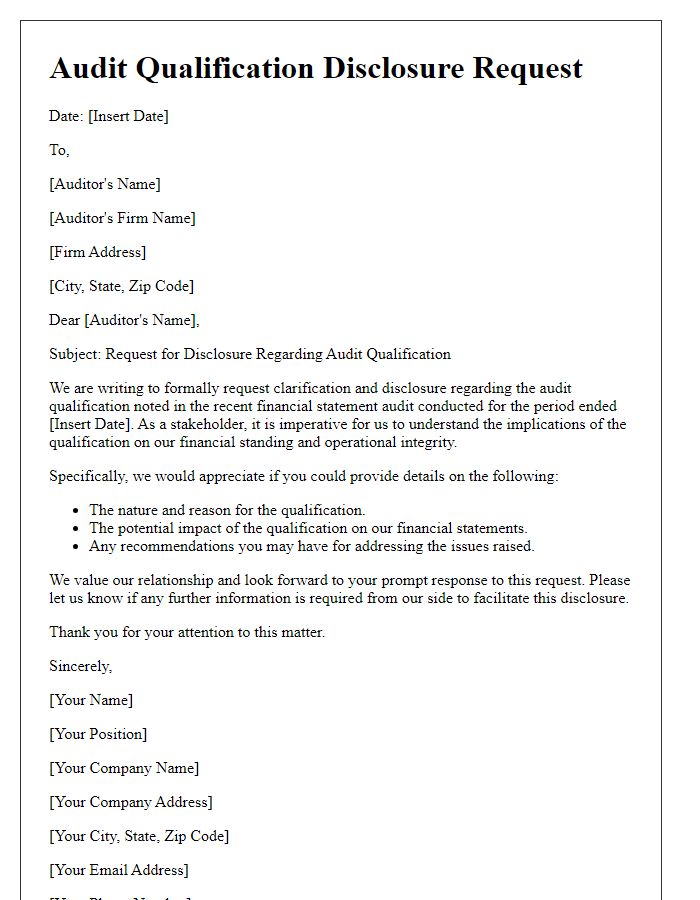

Are you looking for clarity on audit qualifications? Understanding the intricacies of audit qualifications can seem daunting, but it's essential for ensuring transparency and accountability in financial reporting. Whether you're a seasoned professional or just starting out, knowing the right letter template can make all the difference in effectively communicating your needs. Dive in and discover the nuanced details that can help you navigate this important aspect of financial managementâread on for more!

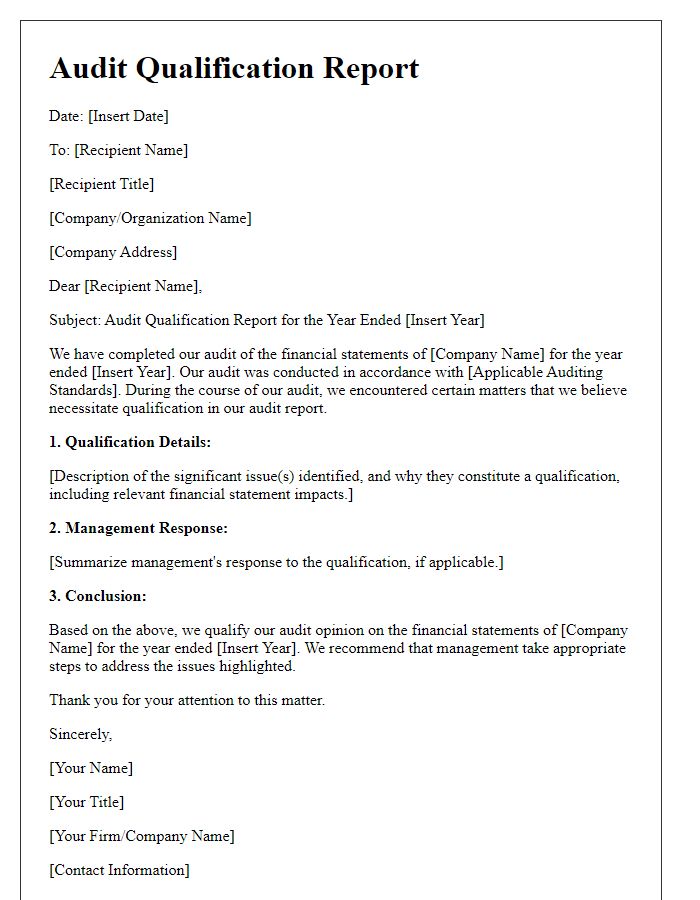

Company Name and Address

A formal audit qualification report highlights concerns raised during the appraisal of financial statements at Company XYZ, located at 123 Business Lane, Commerce City, CA 90210. The report identifies several discrepancies in financial reporting practices, specifically a lack of adherence to Generally Accepted Accounting Principles (GAAP) in 2022 financial statements. Notable figures include a gross revenue report totaling $2.5 million against unsubstantiated expense claims of $500,000. Furthermore, internal controls over financial reporting were deemed inadequate, raising significant risks of misstatements or fraud detection. The external auditors, ABC Auditing Firm, urge management to implement corrective actions at the earliest to enhance the reliability of future audits.

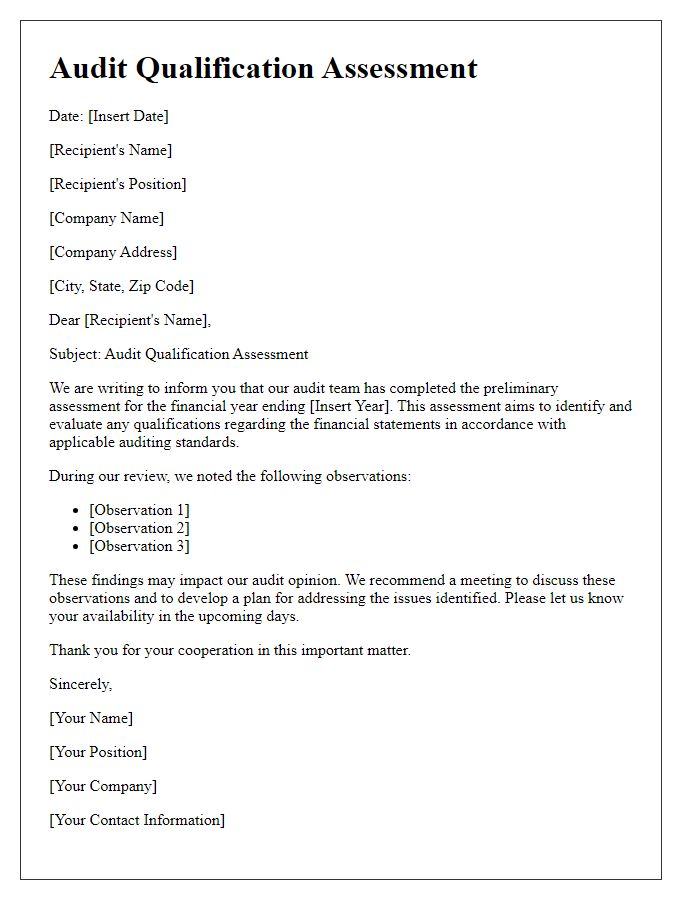

Date of Audit and Reporting Period

The audit conducted on October 15, 2023, assessed the financial statements for the reporting period spanning January 1, 2022, to December 31, 2022. This comprehensive evaluation involved reviewing revenue recognition practices, expense allocations, and compliance with accounting standards, specifically GAAP (Generally Accepted Accounting Principles). The audit aimed to identify any potential discrepancies or irregularities in financial reporting that could affect stakeholders' perception, highlighting the importance of transparency and accuracy in corporate governance. Key findings, including areas requiring improvement, were documented and discussed with management to ensure corrective actions are implemented effectively.

Auditor's Opinion and Basis for Qualification

The auditor's opinion indicates a significant concern regarding the financial statements of Company XYZ for the fiscal year ending December 31, 2022. The qualifications stem from insufficient supporting documentation regarding revenue recognition practices, particularly relating to transactions exceeding $1 million with key clients in the technology sector. Additionally, discrepancies noted in inventory valuation raise questions about compliance with Generally Accepted Accounting Principles (GAAP). Specific accounts, including Accounts Receivable and Inventory, lack adequate reconciliation, leading to potential misstatements in reported earnings. This qualification underscores the need for improved internal controls and robust documentation practices to enhance the reliability of financial reporting.

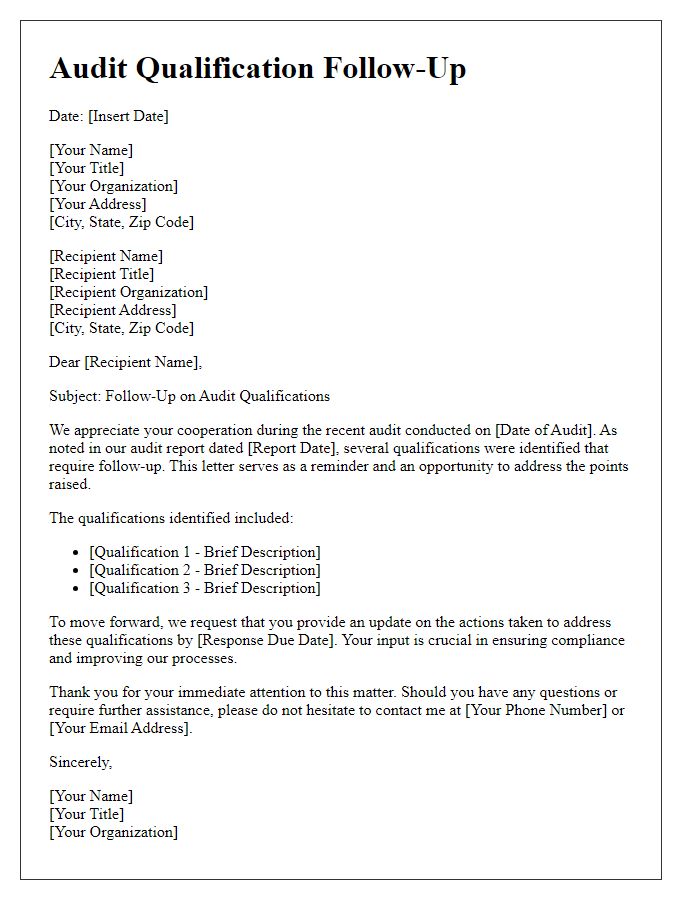

Key Audit Issues and Findings

Key audit issues and findings during the recent assessment of financial statements revealed significant discrepancies in asset valuation methodologies applied by XYZ Corporation. The inventory valuation, particularly concerning raw materials and finished goods, was found to be overstated by approximately 15%, impacting total asset figures significantly. Furthermore, revenue recognition practices did not align with the Generally Accepted Accounting Principles (GAAP), leading to an inflated revenue figure of about $500,000 for Q2 2023. This misrepresentation raised concerns regarding the integrity of financial reporting. Additionally, internal controls related to cash handling were inadequate, exposing the organization to potential fraud risks. The lack of documented procedures and review processes contributed to inconsistencies in cash receipts and disbursements. These findings underscore the necessity for remedial actions to enhance accuracy and transparency in financial reporting.

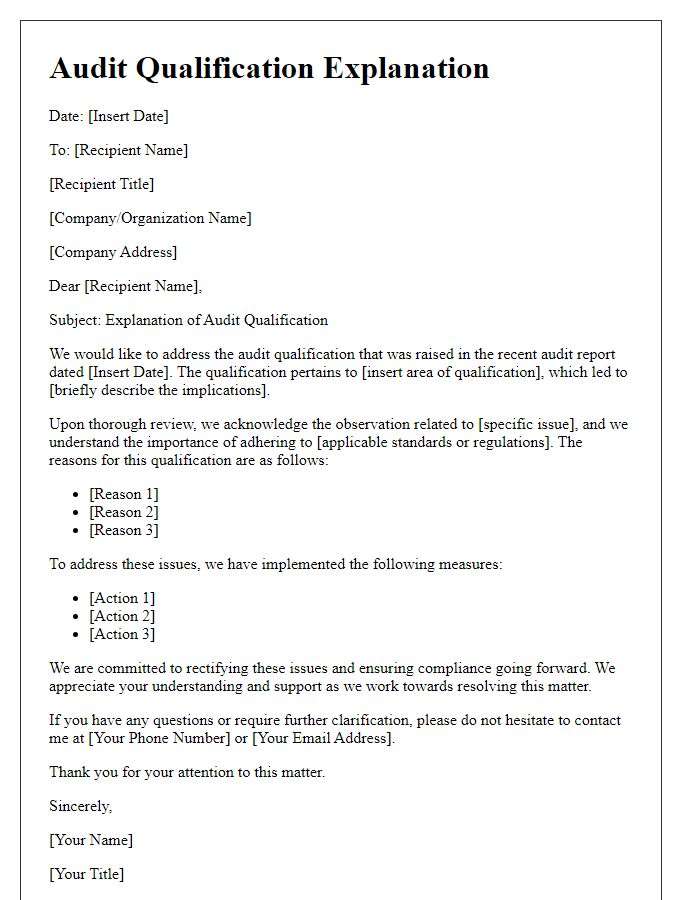

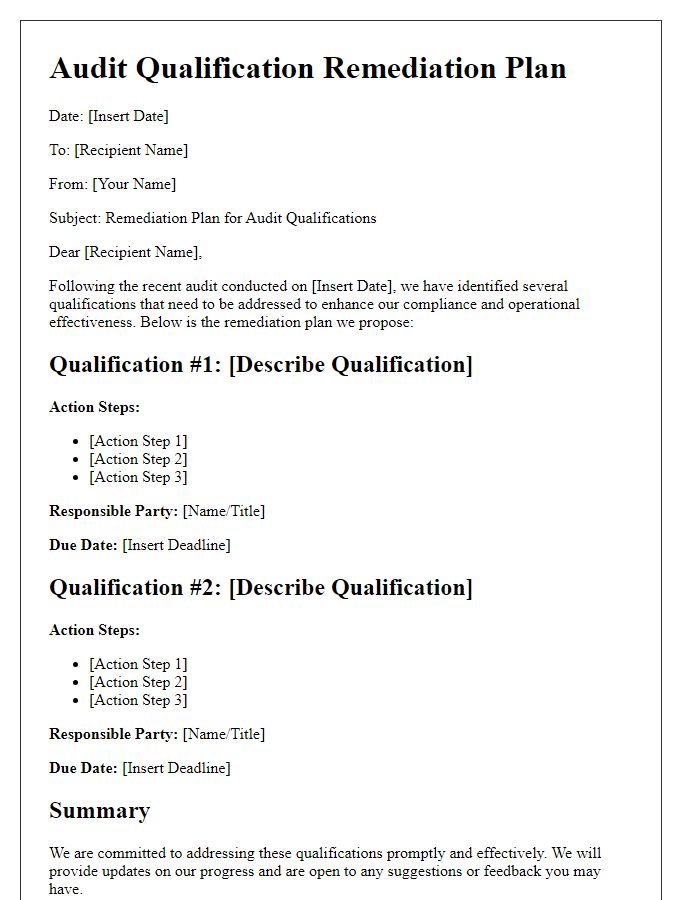

Recommendations and Management's Response

Audit qualifications often arise during financial assessments and evaluations, indicating discrepancies or concerns regarding adherence to accounting standards or operational policies. Recommendations typically address areas of improvement, such as implementing stricter internal controls or enhancing financial reporting accuracy. Management's response should specifically outline how they plan to address each recommendation, including timelines, responsible parties, and necessary resources. For example, if an audit finds discrepancies in financial statement preparation, management might commit to revising their processes by instituting additional staff training and upgrading software systems to better ensure compliance with Generally Accepted Accounting Principles (GAAP). Clear documentation of these actions fosters accountability and enhances transparency in financial practices.

Comments