Are you navigating the complexities of estate planning and feeling overwhelmed? You're not alone! Many people find it challenging to ensure their assets are distributed according to their wishes while also considering tax implications and family dynamics. In this article, we'll explore key steps to enhance your estate planning diligence, providing practical tips and insights to make the process smootherâso keep reading to discover more!

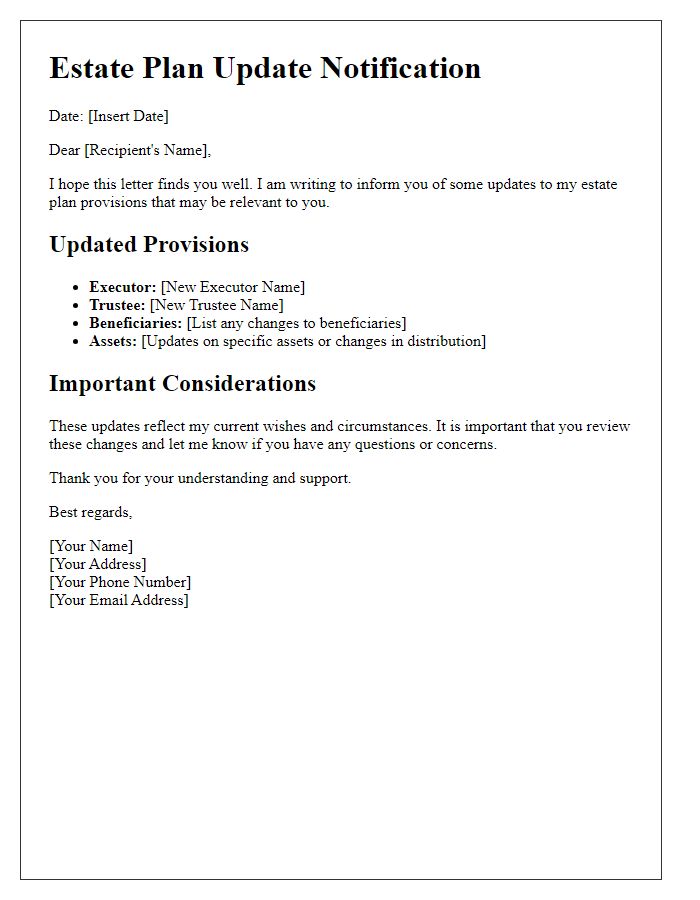

Client Information Verification

Client information verification is crucial for estate planners to ensure accurate and effective estate management. This process involves collecting identifying details such as full names, Social Security numbers, addresses, and contact numbers. Birth dates (especially if clients are approaching significant age milestones) and marital statuses are also essential for determining inheritance rights. Documentation such as wills, trusts, and power of attorney forms should be reviewed, along with asset inventories, including properties, bank accounts, and investments. Additionally, understanding the client's family dynamics, such as the presence of dependents or potential heirs, is vital for establishing a comprehensive estate plan that reflects the client's wishes. Accurate verification safeguards against legal complications and enhances the estate planning process.

Asset Inventory Documentation

Asset inventory documentation plays a vital role in estate planning, ensuring a comprehensive understanding of an individual's wealth distribution. An accurate asset inventory should include real estate properties, such as homes or commercial buildings located in high-value areas like Manhattan, which can appreciate significantly over time. Personal properties such as vehicles, jewelry, art collections, and collectibles should also be cataloged, often including estimated market values for clarity. Financial assets, including bank accounts, stocks, retirement accounts like 401(k)s or IRAs, and life insurance policies, require meticulous detail to ascertain liquidity and beneficiary designations. Critical documents such as wills, trusts, and powers of attorney should be organized alongside the asset inventory to facilitate smooth transitions of wealth and ensure that the estate aligns with the individual's wishes. Regular updates to this documentation are essential, especially following significant life events such as marriage, divorce, or the acquisition of new assets.

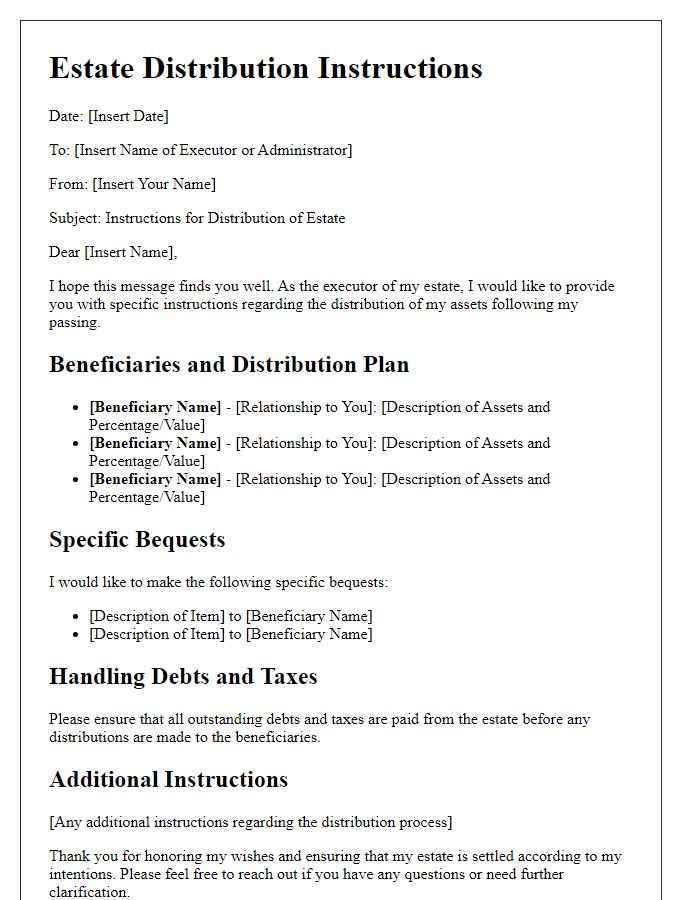

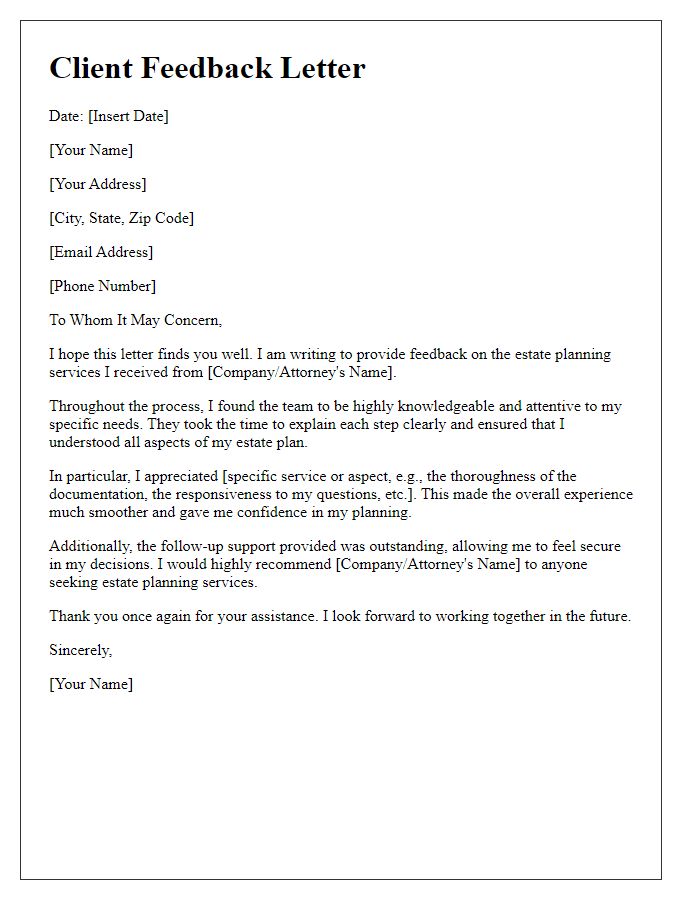

Beneficiary Designation Review

Beneficiary designations play a crucial role in estate planning, particularly concerning the transfer of assets such as retirement accounts, life insurance policies, and trust funds. Regular reviews of beneficiary designations are essential to ensure that these designations reflect the current wishes of individuals, especially after significant life events like marriage, divorce, or the birth of children. For instance, the Internal Revenue Service (IRS) regulations stipulate that inherited IRAs bypass probate, making accurate beneficiary designations critical for beneficiaries. Errors or outdated designations can lead to unintended distributions and tax implications, thus necessitating periodic consultations with estate planners to safeguard interests. Estate planners should also verify that primary and contingent beneficiaries are correctly listed across all accounts, including accounts held with financial institutions such as Fidelity Investments or Charles Schwab. This diligence helps to maintain clarity and control over asset distribution upon an individual's passing, facilitating a smoother transition and minimizing disputes among heirs.

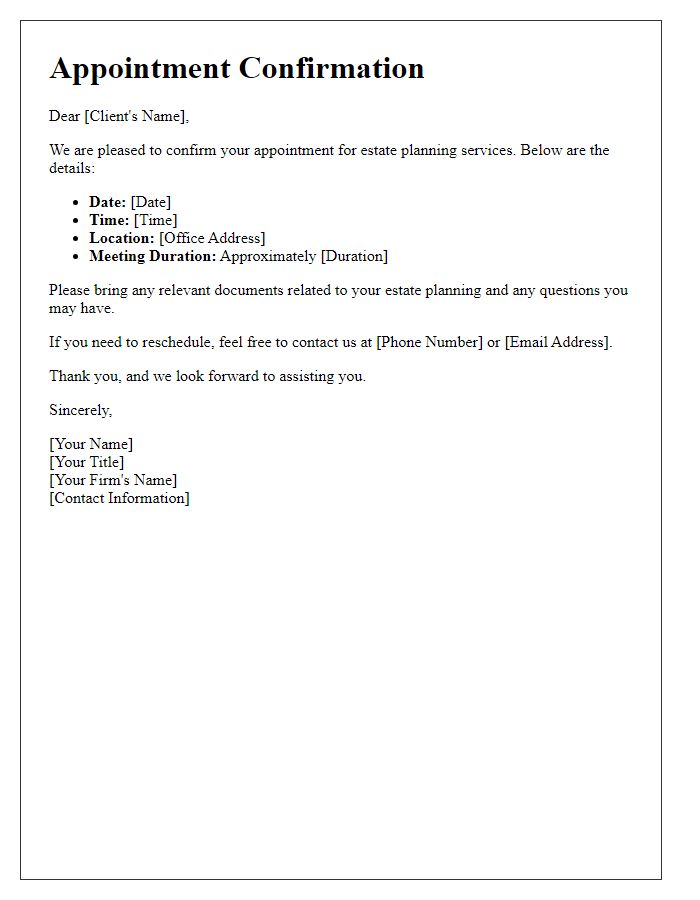

Legal Compliance Check

Estate planners conduct legal compliance checks to ensure that all documents and processes align with state laws and regulations governing wills, trusts, and estate management. This includes reviewing key documents like wills, healthcare directives, and powers of attorney for adherence to legal requirements, such as signatures, witnesses, and notarization. A thorough examination of asset documentation, including real estate deeds in places like California and Florida, is essential to confirm proper title transfers and beneficiary designations. Additionally, compliance with federal laws, such as the Internal Revenue Code on estate taxes, is critical in avoiding penalties or legal disputes. Tracking changes in legislation at both state and federal levels, especially significant reforms like the Tax Cuts and Jobs Act of 2017, ensures that estate plans remain compliant and effective.

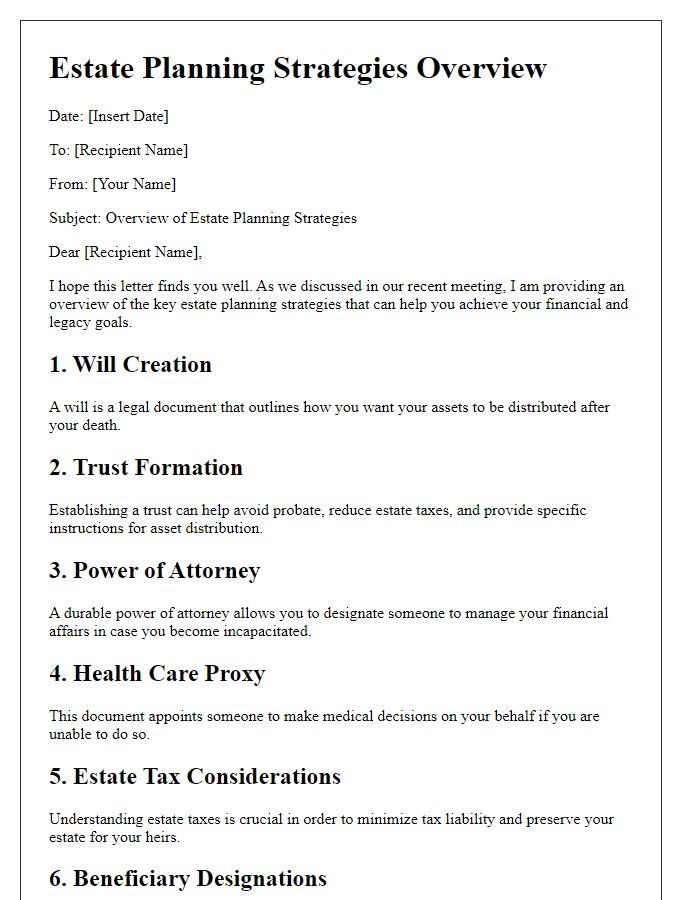

Risk Assessment and Mitigation

Estate planning involves meticulous risk assessment and mitigation strategies designed to safeguard assets for beneficiaries. Identifying potential risks such as tax liabilities, legal disputes, and market volatility is crucial. Utilizing tools like irrevocable trusts can help shield assets from estate taxes, whereas detailed beneficiary designations ensure intended distributions. Regular reviews of the estate plan, especially after significant life events like marriage, divorce, or the birth of a child, maintain alignment with current laws and personal wishes. Engaging professionals, such as certified financial planners or estate attorneys, provides expertise in customizing strategies that reflect individual circumstances and state-specific regulations.

Comments