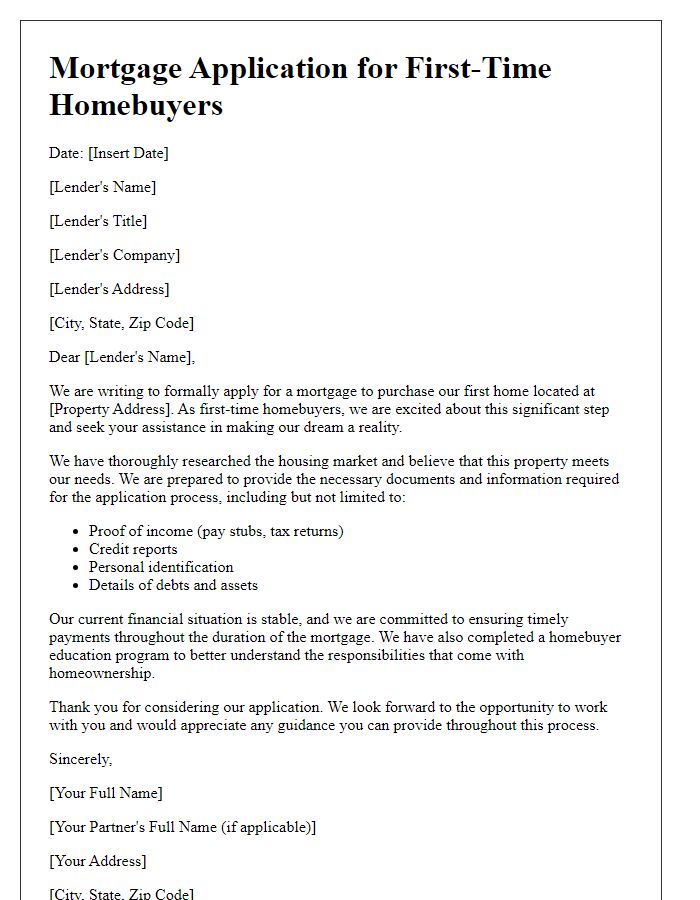

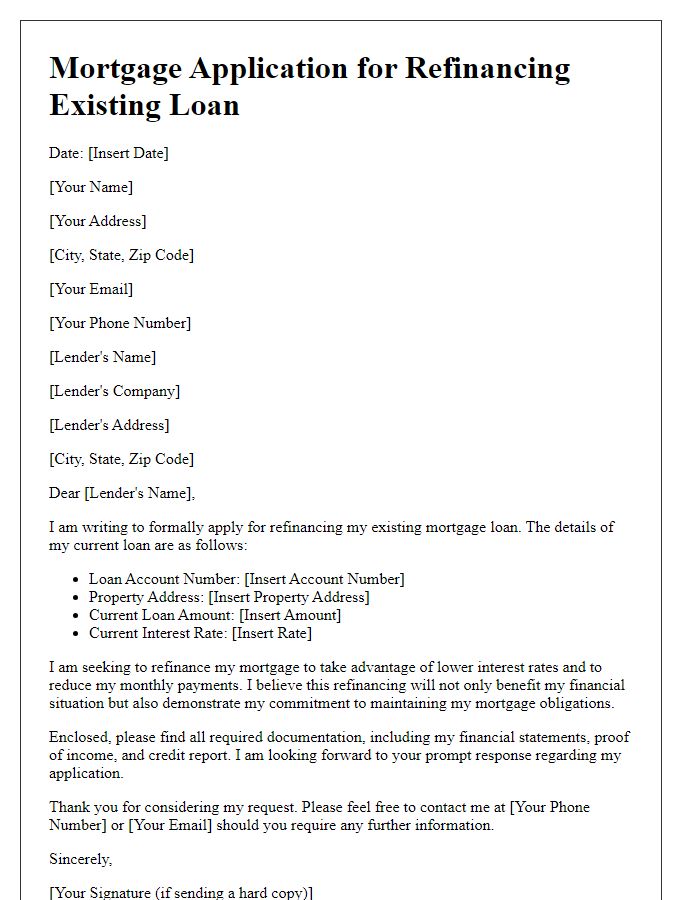

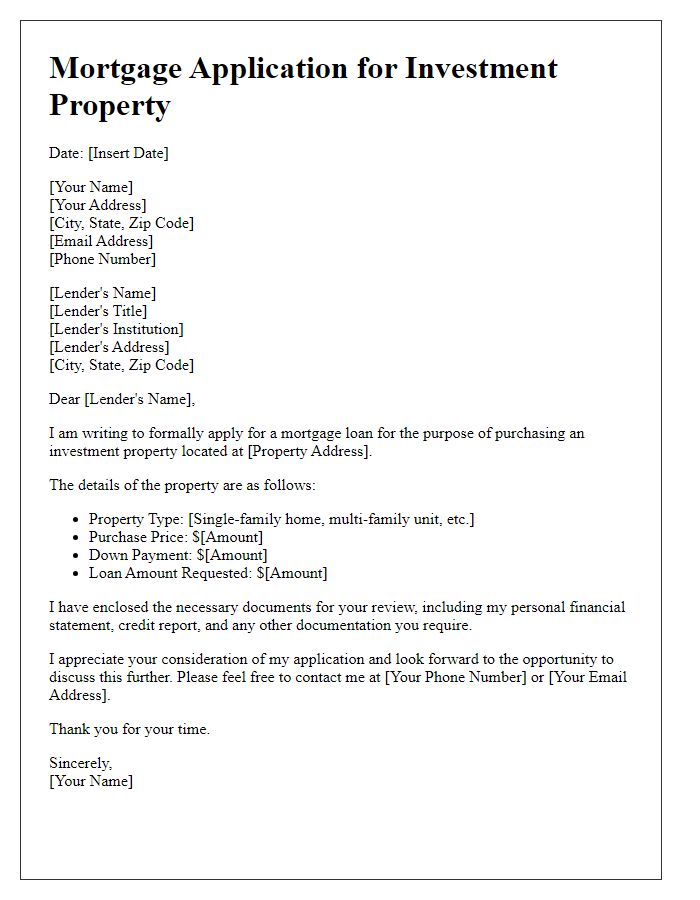

Are you ready to take the exciting step toward home ownership? When applying for a mortgage, having the right letter template can make all the difference in your journey. A well-crafted letter not only communicates your intentions clearly but also showcases your financial readiness to potential lenders. Ready to learn more about creating a compelling mortgage application letter?

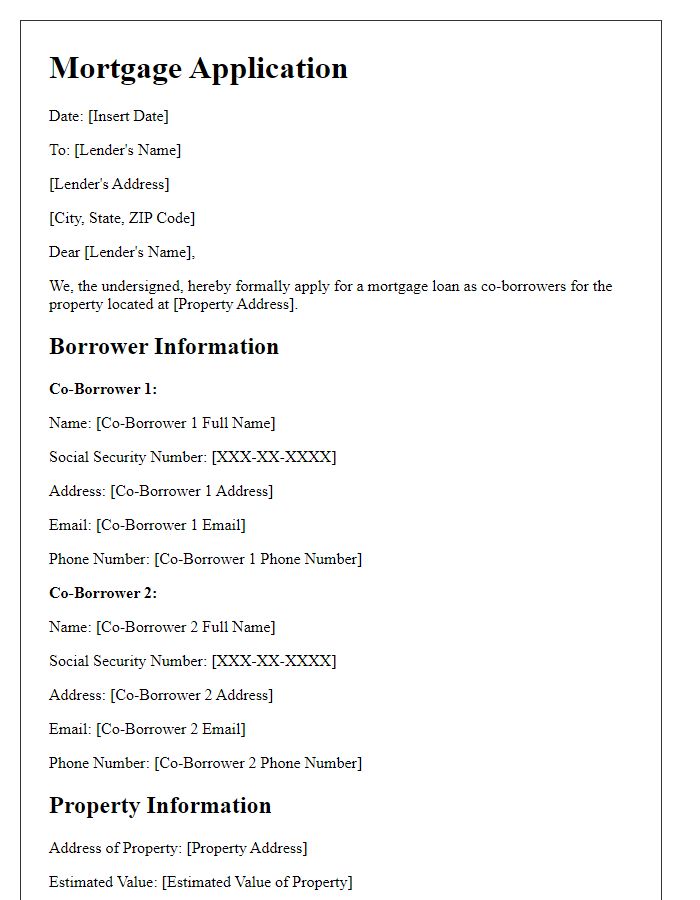

Borrower's personal details

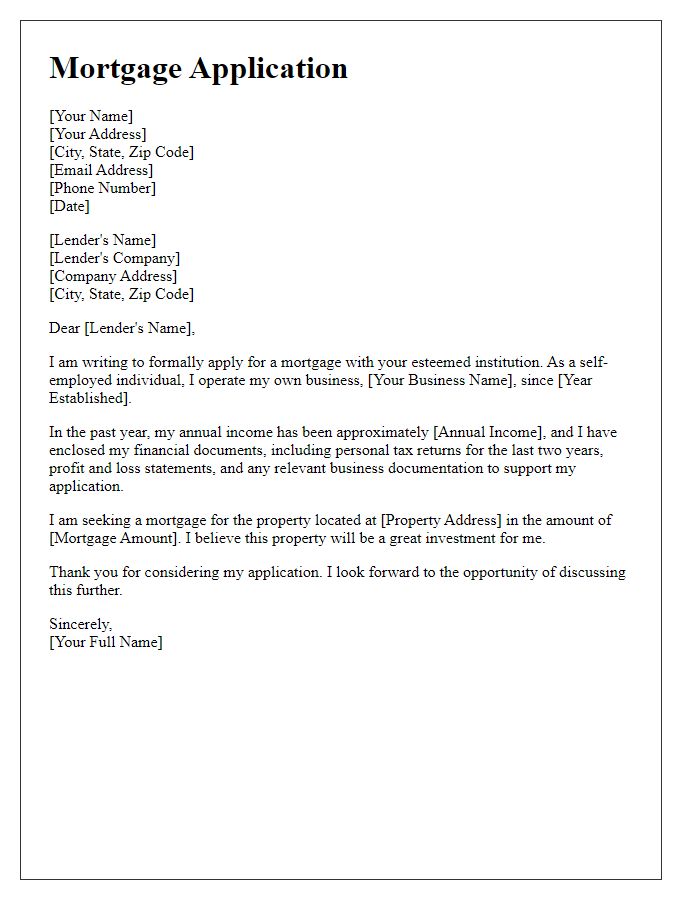

When initiating a property mortgage application, essential personal details about the borrower are required for proper processing. This includes the full legal name of the borrower, street address comprising the house number, street name, city, state, and postal code, which provides a clear geographical context. Date of birth is crucial, helping lenders assess eligibility and risk. The social security number (or equivalent identification number in other countries) serves as a unique identifier for credit checks. Employment information includes job title, company name, workplace address, and duration of employment. Financial details such as gross monthly income, number of dependents, and overall debt-to-income ratio provide a comprehensive view of the borrower's financial stability. Lastly, contact information such as a mobile number and email address ensures effective communication throughout the mortgage application process.

Property details and description

The property located at 123 Maple Avenue, Springfield, encompasses a charming two-story single-family home built in 2010. This residence boasts a total of 2,500 square feet of living space that includes four bedrooms and three bathrooms, with spacious layouts designed for modern family needs. Key features include a renovated kitchen equipped with stainless steel appliances, granite countertops, and custom cabinetry, enhancing both functionality and aesthetic appeal. The property is situated on a 0.25-acre lot, featuring a well-manicured garden, a wooden deck for outdoor entertainment, and a two-car garage. This neighborhood, known for its excellent school district and proximity to community parks, offers a tranquil environment for families. The local median home price in this area is approximately $350,000, reflecting the desirable nature of this location and investment potential.

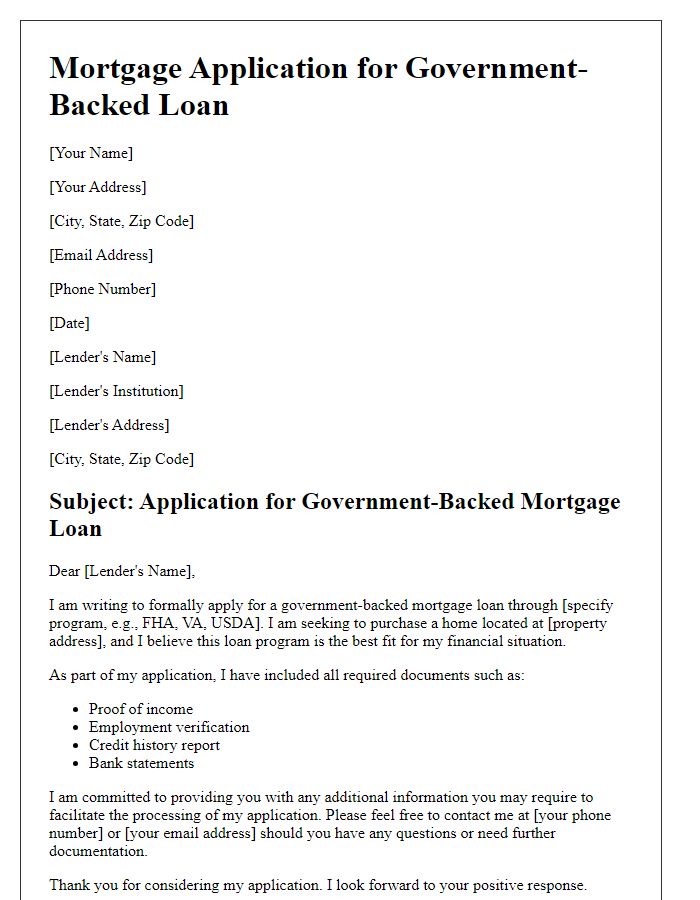

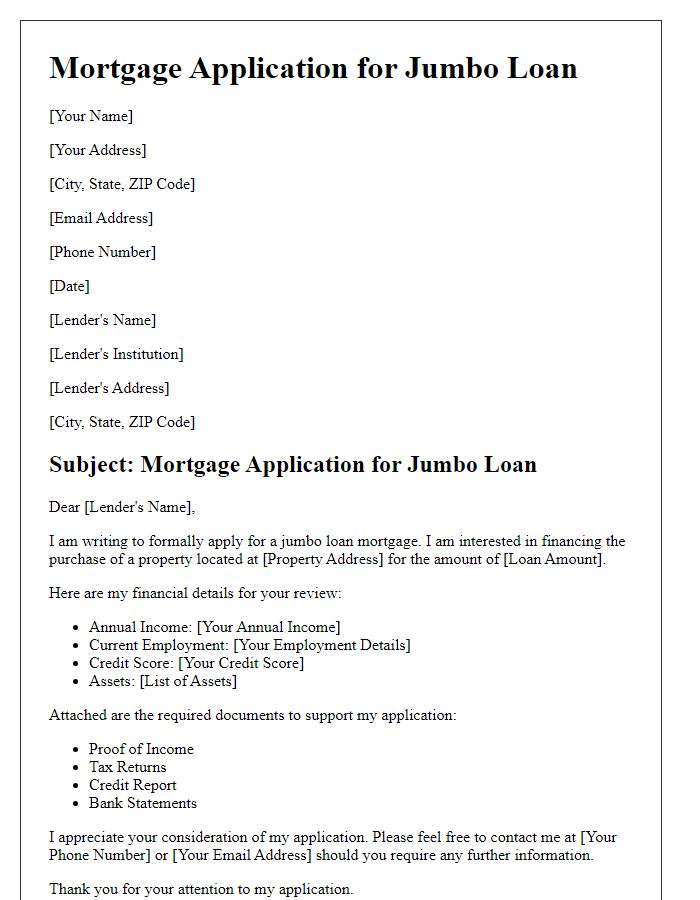

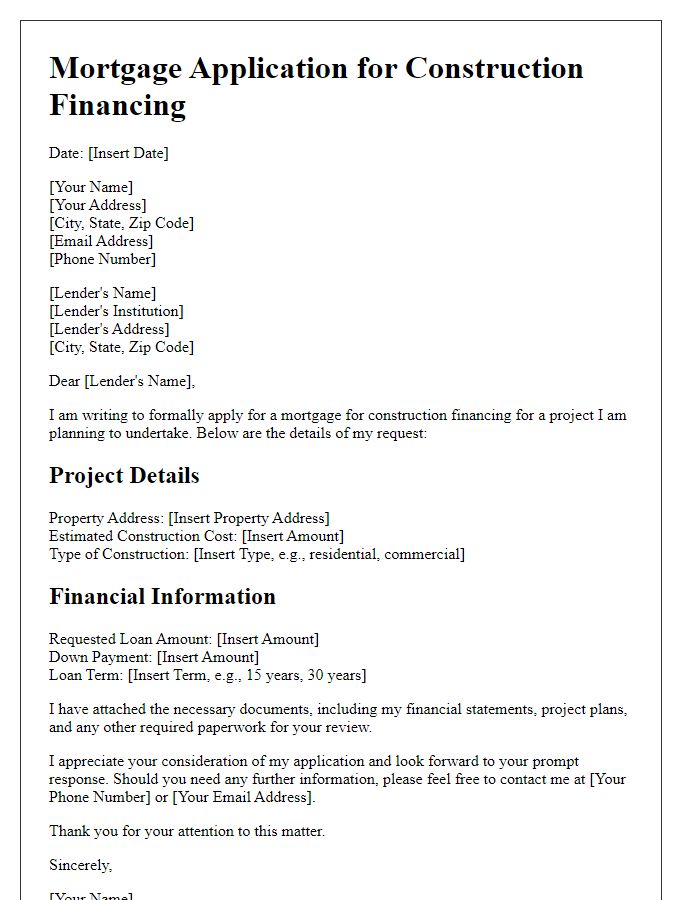

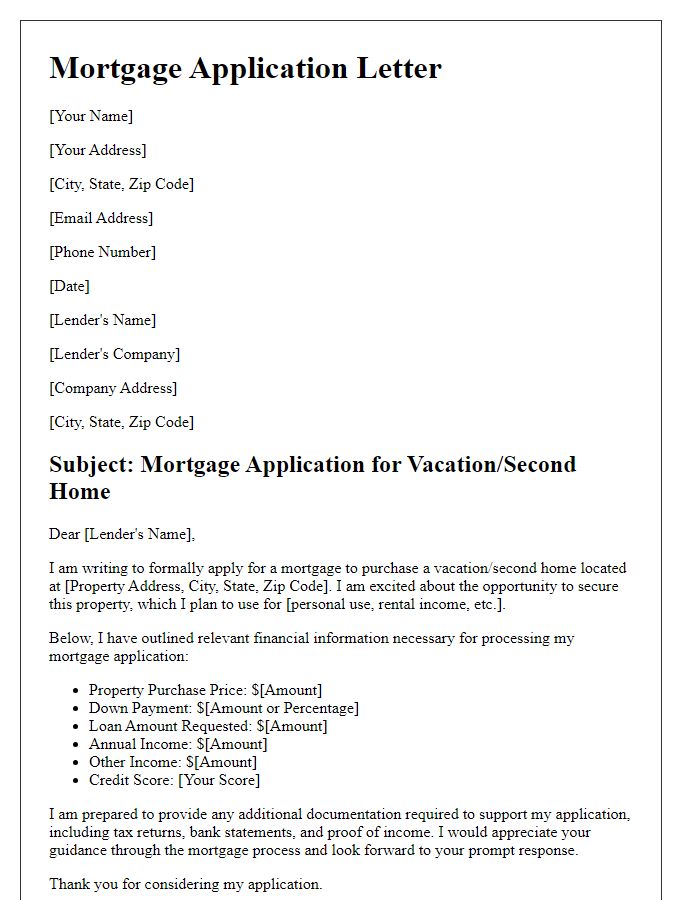

Loan amount and purpose

A property mortgage application often requires specific details regarding the loan amount and its intended purpose. For instance, a homeowner may seek a mortgage of $300,000 to purchase a family residence in suburban Atlanta, Georgia. This funding typically covers costs such as the acquisition price, closing expenses, and possible renovations for improved living conditions. Accurate documentation that illustrates the intended use of the funds can increase the likelihood of approval by lending institutions. In many cases, lenders may request additional financial statements to assess the applicant's repayment capability and verify the property's appraisal value.

Financial information and income verification

In a property mortgage application, financial information and income verification play crucial roles in assessing the applicant's ability to repay the loan. Applicants must provide essential documents, including recent pay stubs (typically covering the last 30 days), W-2 forms from the previous two years, and personal tax returns (also for the past two years). Bank statements from personal checking and savings accounts (usually the last two to three months) are needed to verify liquid assets and demonstrate financial stability. Additional income sources such as rental properties, dividends, or bonuses must also be documented, often requiring additional paperwork like 1099 forms or lease agreements. Lenders analyze this data to calculate the debt-to-income (DTI) ratio, generally aiming for a DTI of 43% or lower, to ensure the applicant can manage monthly payments alongside existing debts.

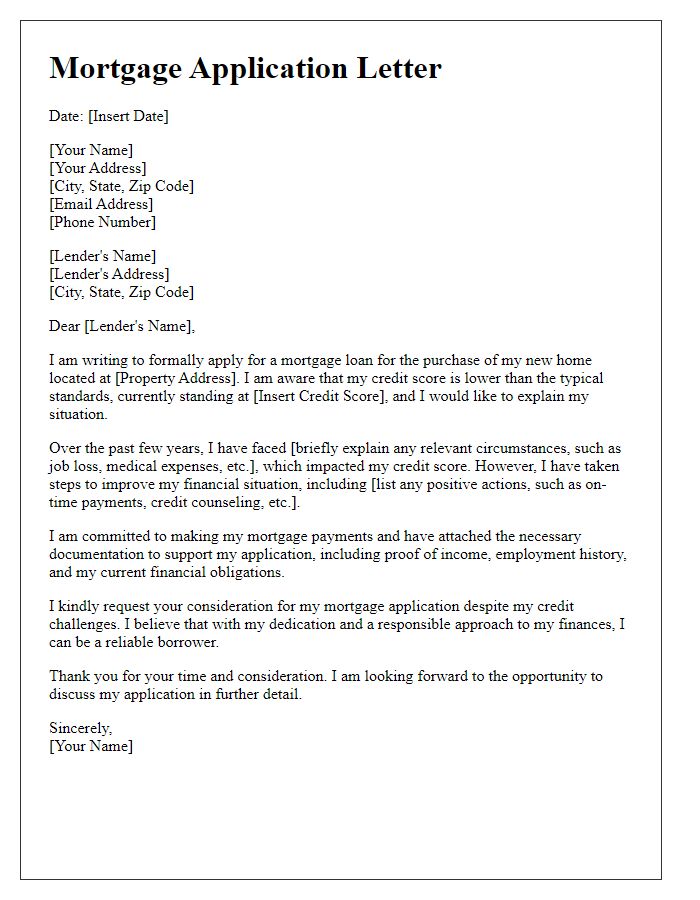

Supporting documents and credit history

A property mortgage application requires several essential supporting documents and a thorough credit history review to assess the borrower's financial reliability. Standard documents include recent pay stubs (covering two months, typically) verifying income, W-2 forms (from the last two years) for employment verification, and bank statements (showing the last two months of financial activity) to assess liquid assets. A tax return (from the previous year) may also be necessary for a complete income picture. Additionally, a credit report (reflecting history over the past seven years) provides insights into borrowing behavior, outstanding debts, and payment history. Lenders typically favor a credit score above 620, as this indicates reliability to meet mortgage obligations. Overall, precise documentation and a solid credit history play critical roles in securing mortgage approval, especially in competitive markets like San Francisco or New York City.

Comments