If you've ever found yourself juggling receipts and wondering how to ask for reimbursement, you're not alone! Many of us have gone through the hassle of tracking down expenses only to face the challenge of filling out the right forms and writing the perfect letter. In this article, we'll explore helpful tips and a simple letter template that can streamline the reimbursement process, making it easier for you to get back what you deserve. So, grab a cup of coffee and join us as we dive into the ins and outs of expense reimbursement!

Clear Subject Line

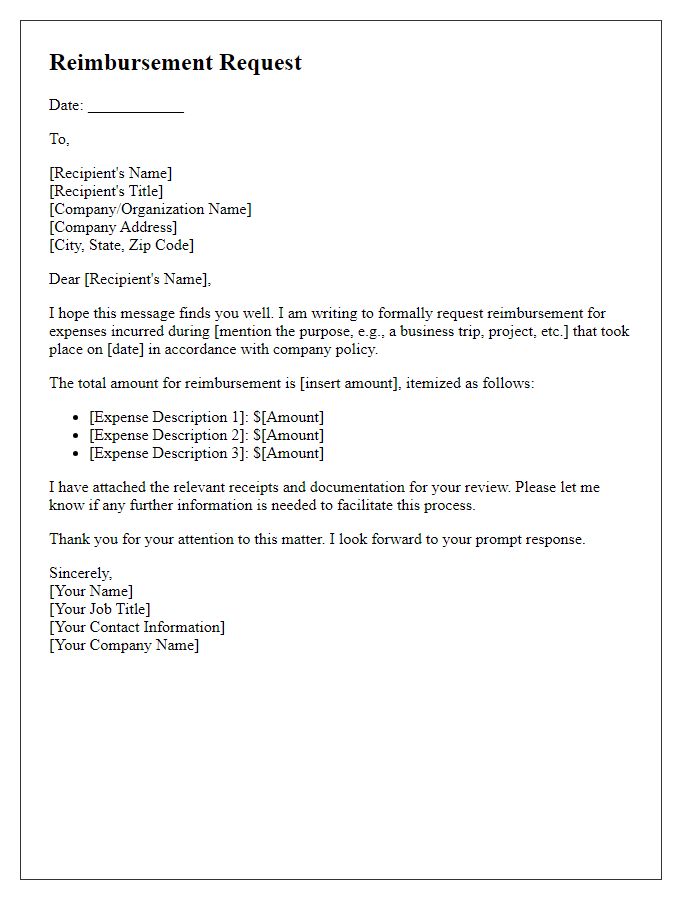

A reimbursement request involves detailed documentation and specific information about incurred expenses. Submitting receipts (official documents showing purchase details), a cover sheet (summary of expenses), and a justification statement (explanation of the necessity for these expenses) is crucial. Organizations, such as companies and educational institutions, often have guidelines and specific forms for processing reimbursements. For example, employees in the United States might adhere to IRS rules governing travel and lodging expenses to ensure compliance. Furthermore, timelines for submission can vary, with some organizations requiring requests within 30 days following the expense date. Properly formatted requests expedite the approval process and ensure timely reimbursement.

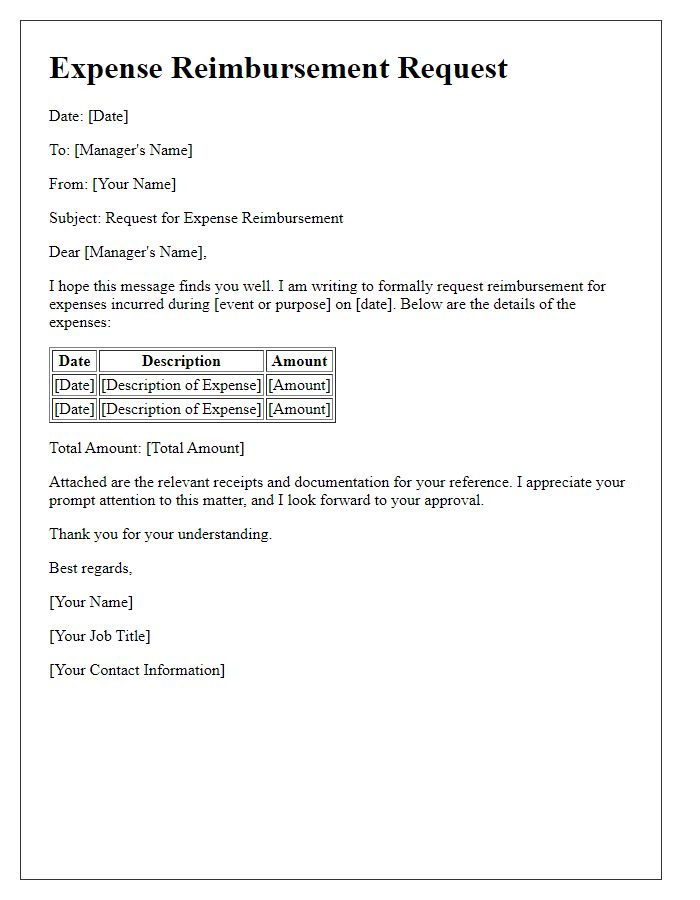

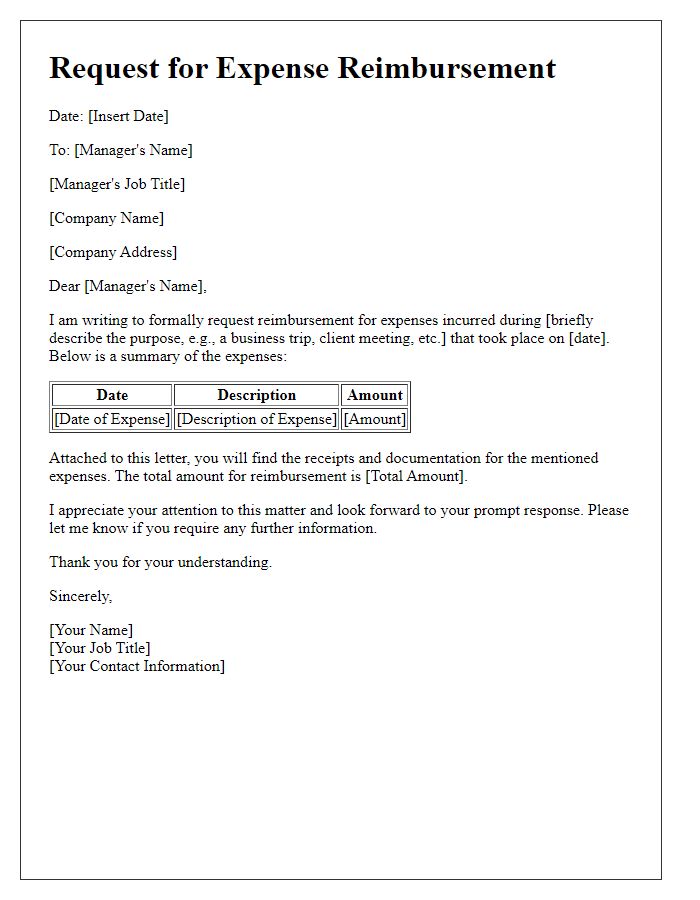

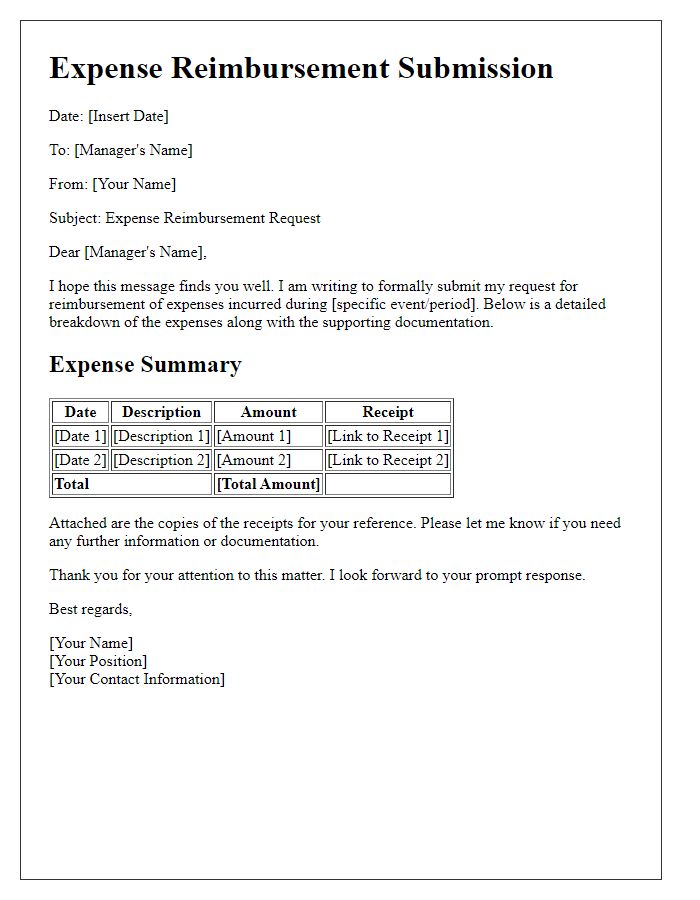

Detailed Expense Report

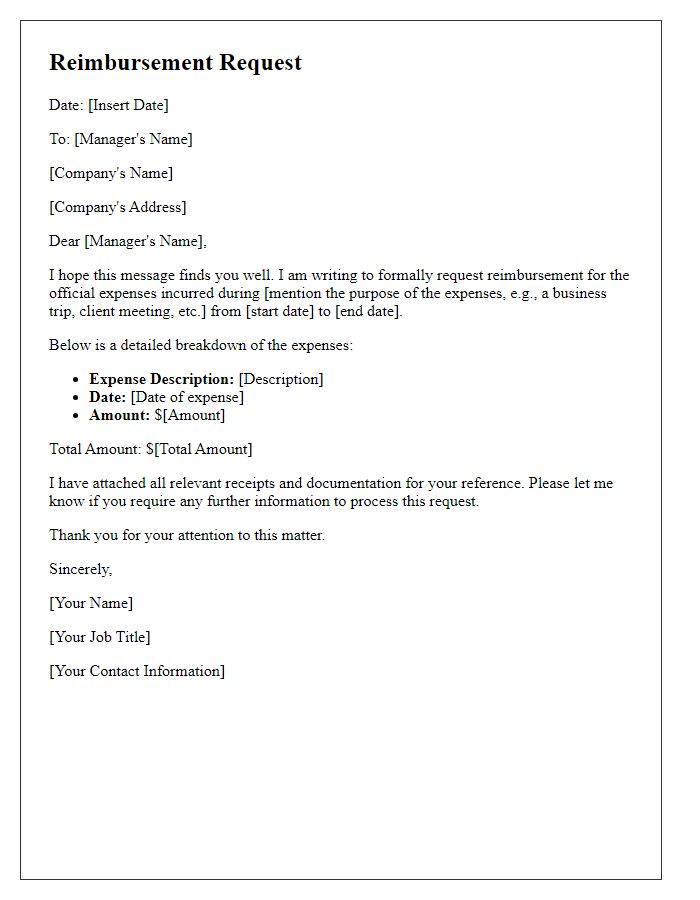

A detailed expense report is critical for seeking reimbursement of incurred costs while maintaining proper documentation. This report typically includes various categories such as travel expenses, accommodation costs, meal allowances, and other work-related expenditures. Each entry must indicate the date, purpose, and amount spent. For instance, travel fares can include plane tickets from Delta Airlines, hotels like Marriott costing $250 per night in New York City, and meals averaging $50 per day during a business conference. Gathering receipts is essential for verification, with specific purchase details like transaction dates and vendor names clearly captured. Clear organization and accuracy in this report facilitate smoother processing for reimbursement claims.

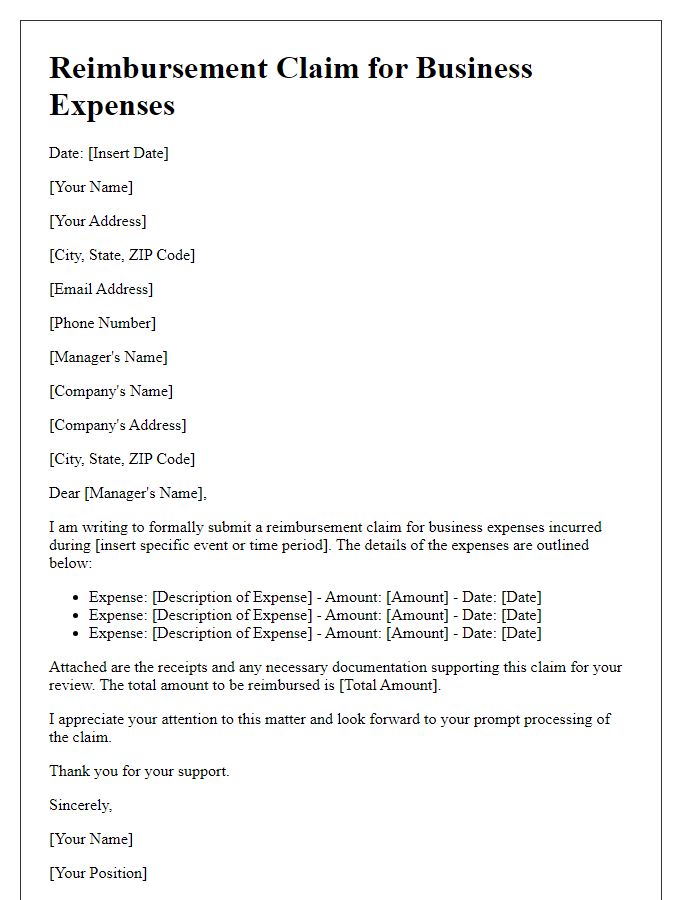

Receipt Attachments

Submitting reimbursement requests requires comprehensive documentation to validate expenses. Receipts represent proof of expenditure, detailing the vendor's name, date of transaction, purchased items, and total amount spent. Expenses may include business-related travel costs such as airfare (including airlines like Delta or American Airlines), lodging expenses at hotels (like Marriott or Hilton), and meal costs at restaurants (for example, Olive Garden or Chipotle). Each receipt must be legible and categorized according to company policy, ensuring compliance with financial regulations. Completing the reimbursement form accurately, including the total amount and purpose linked to each attachment, is essential for timely processing of reimbursement requests.

Polite Opening and Closing

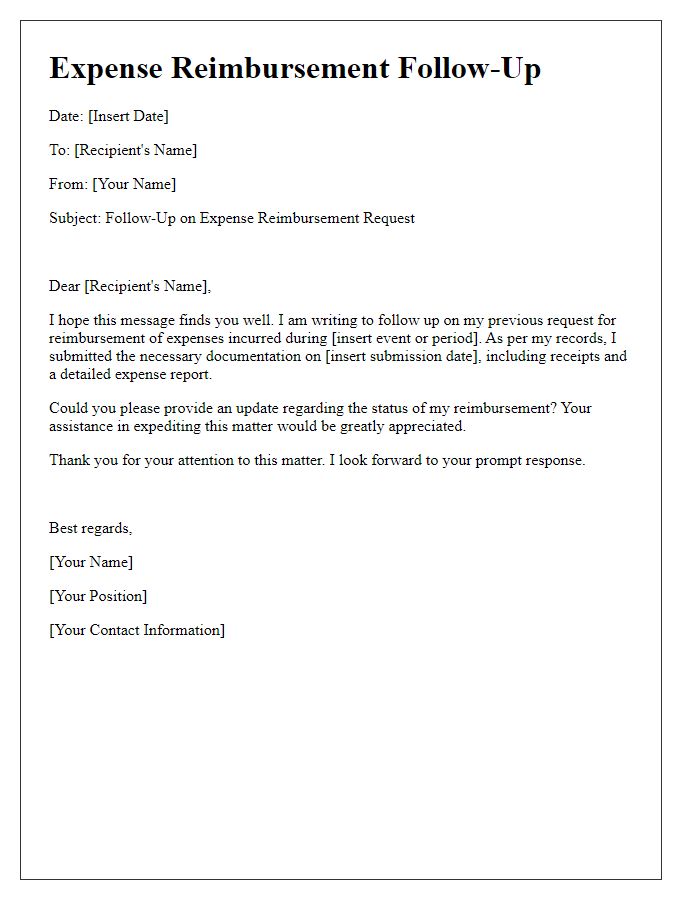

In the bustling business world, navigating the reimbursement process for expenses incurred during work-related activities can often become a tedious task. Employees frequently find themselves submitting detailed expense reports that clearly outline costs associated with travel, lodging, meals, and other necessary expenditures while attending conferences or meetings. Companies establish specific guidelines regarding acceptable expense claims, along with necessary documentation, such as receipts or invoices (often required within 30 days of the incurred expense). A prompt and streamlined reimbursement system is vital for maintaining employee satisfaction and productivity, as delays may lead to frustration and financial burdens. Ultimately, a well-defined process encourages transparency and trust between employees and management, fostering a harmonious working environment.

Specific Reimbursement Request

Submitting a reimbursement request for specific expenses can streamline the financial process in an organization. For example, employees traveling for work-related conferences, such as the annual Tech Innovations Summit in San Francisco, may incur costs for airfare, lodging, and meals. Detailed receipts can serve as evidence for expenses, itemizing amounts like $300 for a round-trip flight and $150 per night for hotel accommodation over three nights. Furthermore, per diem rates can be applied, which may approximate $60 per day for meals and incidentals. This structured approach ensures clarity and transparency in accounting and allows for timely reimbursement alignment with organizational policies.

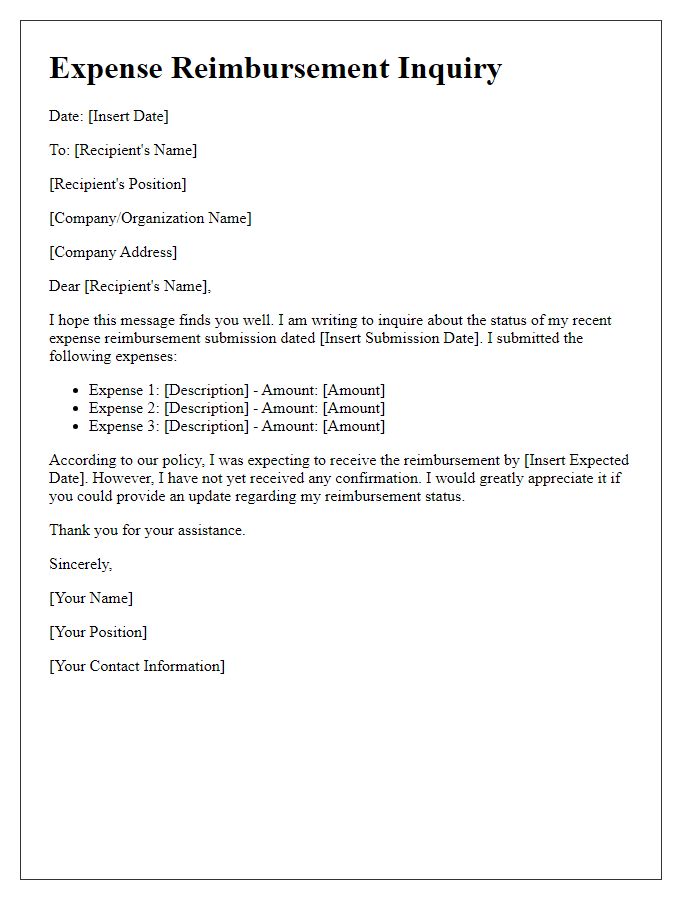

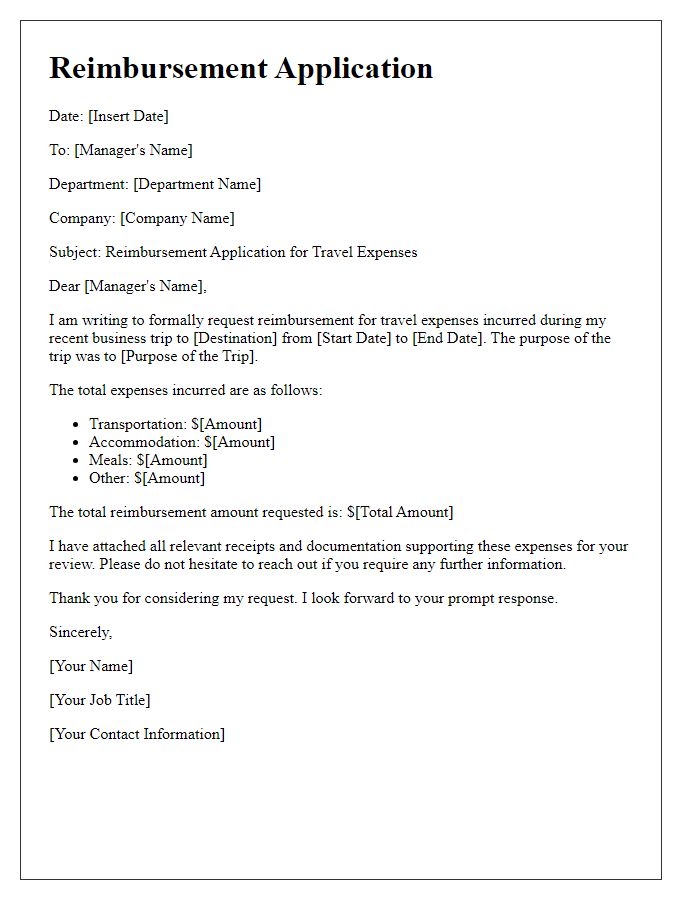

Letter Template For Reimbursement Of Expenses Samples

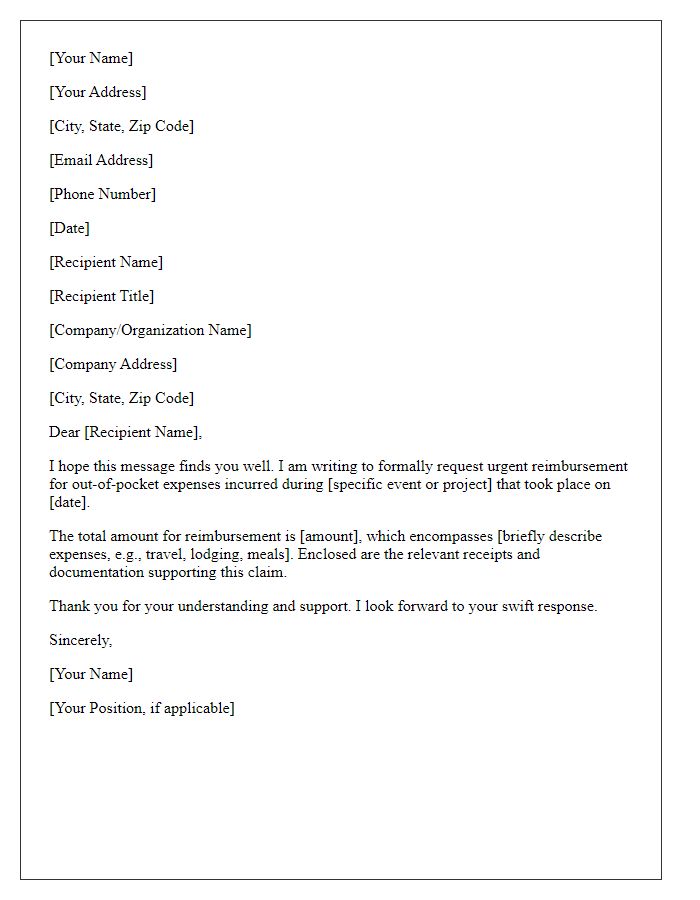

Letter template of urgent reimbursement claim for out-of-pocket expenses

Comments