Are you navigating the complexities of a partnership agreement breakdown? It can be a challenging situation, filled with conflicting interests and emotions. Understanding the key elements involved can help you approach this issue more effectively, ensuring that all parties feel heard and respected. Dive into our article to explore essential strategies for managing partnership dissolutions and discover how to turn conflicts into opportunities for growth.

Introduction and Parties Involved

In a partnership agreement breakdown, the introduction outlines the context and intent of the partnership, as well as the parties involved. Each entity, such as Company A, a tech startup based in San Francisco, and Company B, a marketing firm operating in New York City, is defined by their roles and contributions within the partnership framework. Key details include the date of the partnership initiation, specific areas of collaboration, expected outcomes, and the legal obligations that govern the partnership. Clarity about the responsibilities and stakes of each party ensures a transparent and mutually beneficial relationship, enabling effective communication and collaboration moving forward.

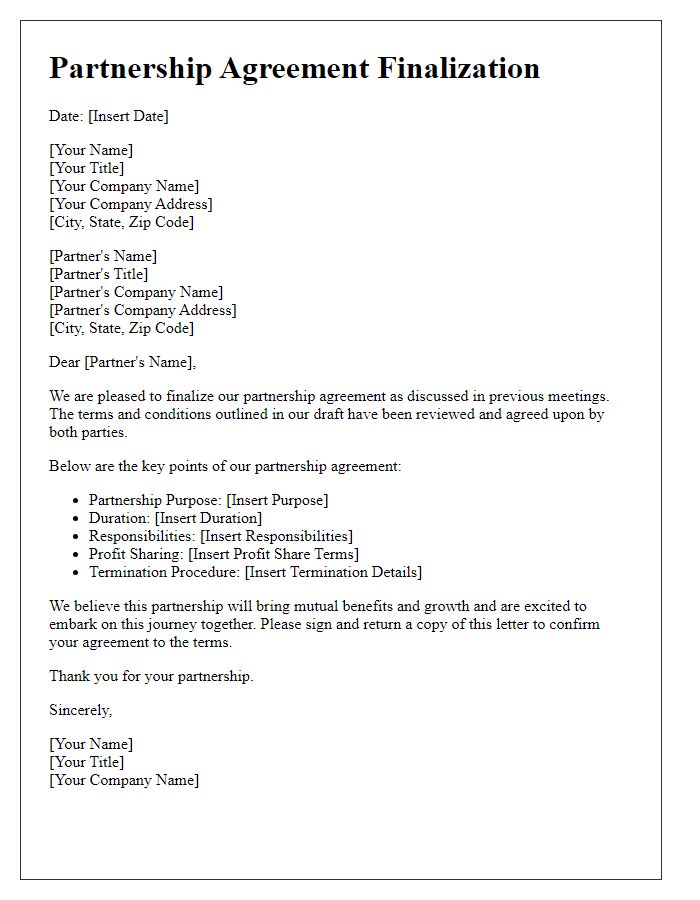

Overview of Partnership Terms

A partnership agreement breakdown outlines the fundamental terms governing a collaborative business relationship. Key components include the ownership structure, such as equity percentages (e.g., 50/50 or 70/30) of each partner and their respective roles within the partnership, which may involve management responsibilities or specific duties (e.g., sales, marketing). Financial contributions, including initial investments and ongoing capital requirements, are also crucial elements; specific dollar amounts or percentage shares should be detailed. Decision-making protocols address how major business decisions will be made, whether unanimously or by majority vote. Lastly, terms for profit distribution outline how revenues, potentially amounting to thousands or millions annually, will be divided among partners, typically expressed as percentages of net income. These agreements often specify conditions for partnership dissolution or exit strategies to protect all parties involved.

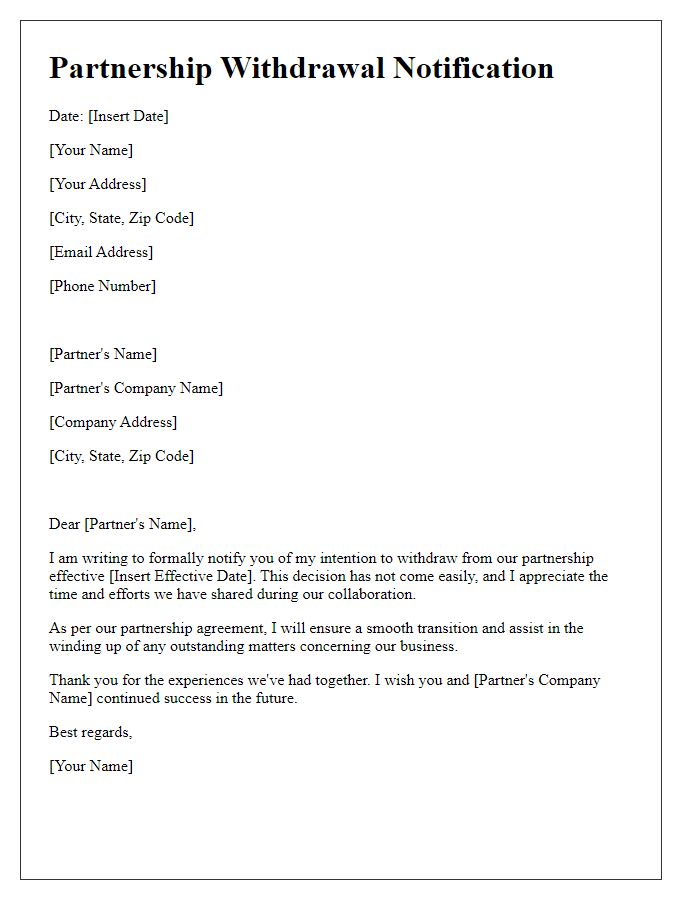

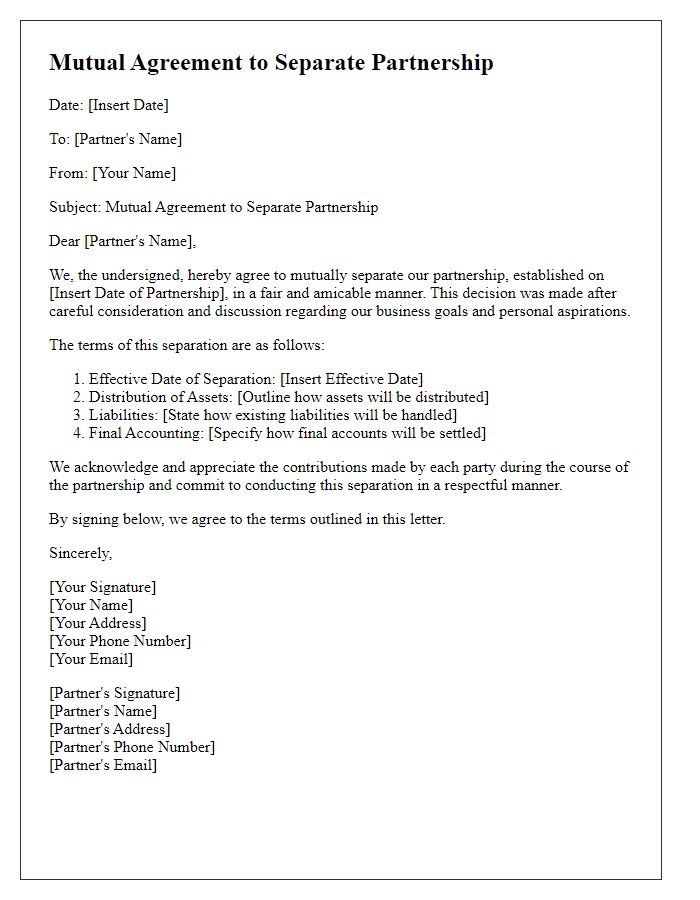

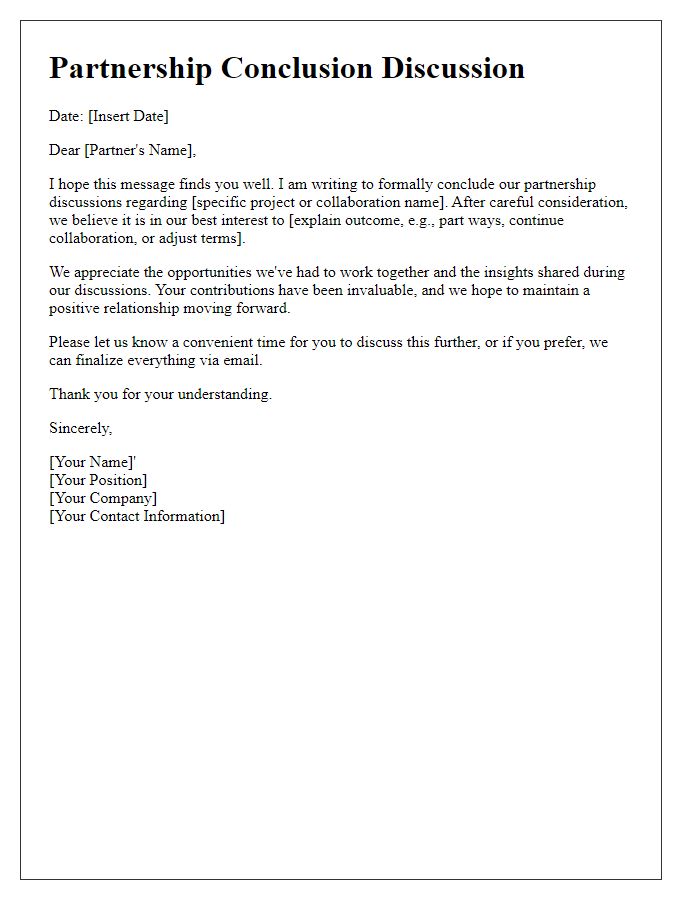

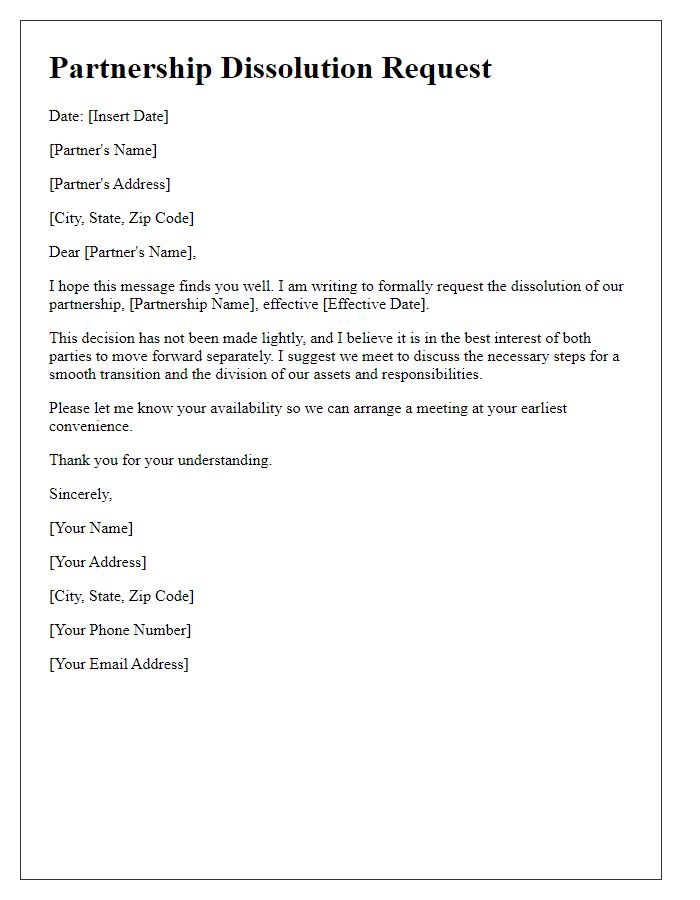

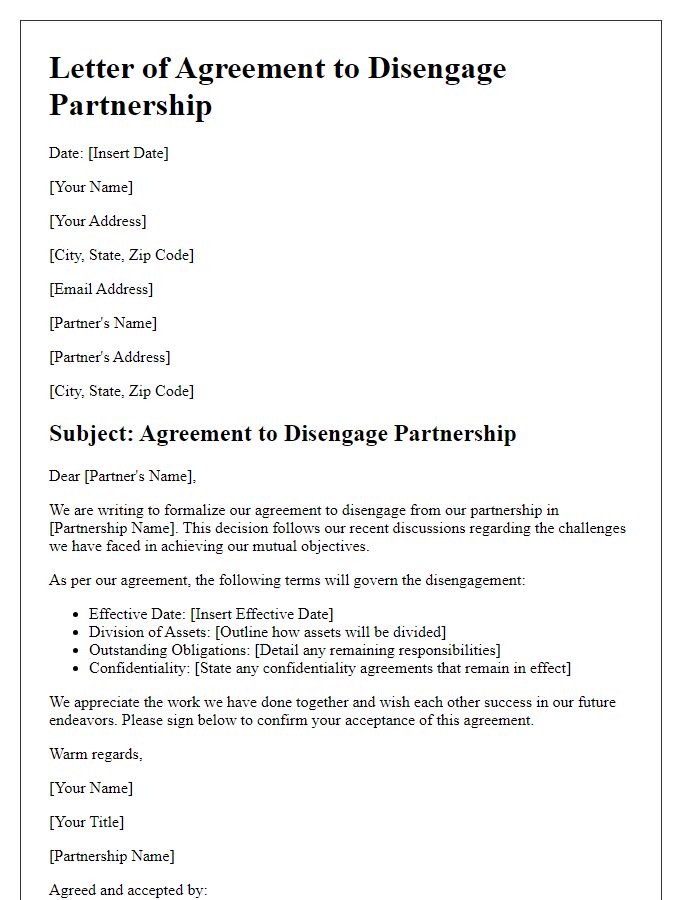

Amicable Termination Agreement

An amicable termination agreement outlines the mutually accepted terms for dissolving a partnership. This document should include key elements such as identification of the partnership (e.g., ABC Consulting, established in 2019), the names of partners involved (e.g., John Smith and Jane Doe), and the reason for dissolution (e.g., changing business strategies or personal circumstances). Important details should also cover the effective termination date (for instance, January 31, 2024), the division of assets and liabilities (specifying percentages or values), and any ongoing responsibilities post-termination (like settling accounts or client handovers). Additionally, clauses about confidentiality and non-compete agreements may be included to protect both parties' interests in the future. Timelines for completing necessary actions and signatures of both partners should ensure lawful closure.

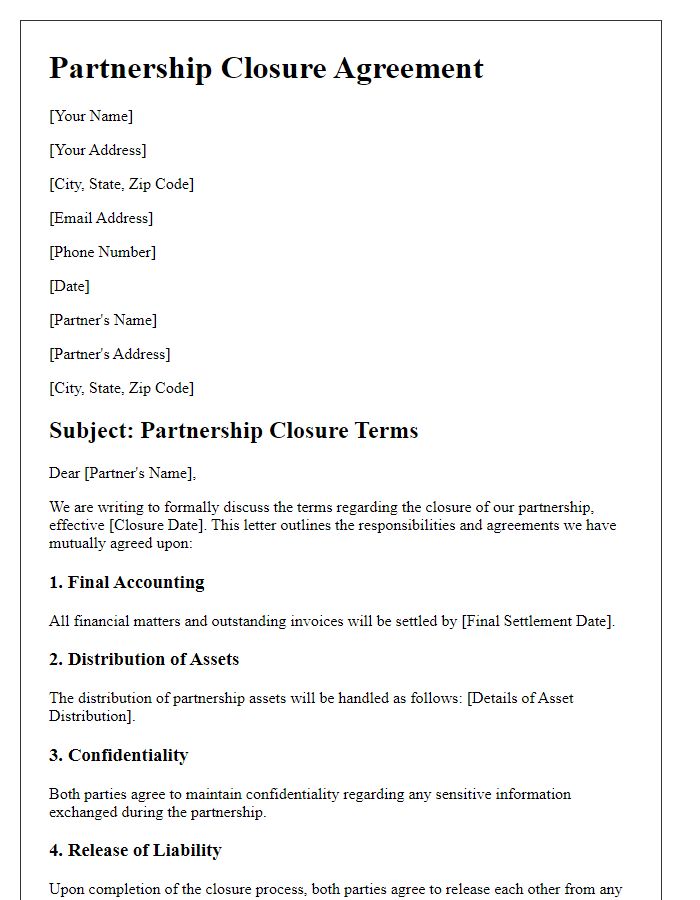

Distribution of Assets and Liabilities

In a partnership agreement breakdown, the Distribution of Assets and Liabilities section outlines the division of financial resources and obligations among partners. This process begins with a detailed inventory of all assets, including cash reserves (totaling $50,000), physical property (such as office space valued at $1 million), and inventory (amounting to $200,000). Liabilities encompass outstanding debts, such as a business loan of $150,000 and accounts payable of $50,000. Each partner's ownership percentage influences the distribution ratios; for instance, Partner A holding a 60% stake, and Partner B holding 40%. This agreement also specifies timelines for asset distribution, with a proposed date of March 31, 2024, and conditions outlining the settlement of liabilities, ensuring that all creditors are paid before asset distribution occurs. Legal considerations ensure compliance with state laws governing partnerships, providing a clear framework for resolution should disputes arise.

Confidentiality and Non-Disclosure

A breakdown of the confidentiality and non-disclosure agreement in a partnership elucidates the essential framework protecting sensitive information exchanged between partners. Confidential information encompasses trade secrets, financial records, proprietary technologies, and strategic plans that both parties agree to keep secure. The agreement typically stipulates the conditions under which the information may be disclosed, emphasizing that unauthorized sharing with third parties can result in legal penalties. The duration of the confidentiality obligation usually persists beyond the termination of the partnership agreement, often defined for a period of three to five years, ensuring prolonged protection. Furthermore, specific clauses may outline exceptions, including disclosures required by law or prior knowledge, reflecting transparency and mutual trust in the partnership's operations.

Comments