Are you looking to navigate the intricate world of acquisition agreements? Understanding the nuances involved in such documents is crucial for making informed decisions. In this article, we will break down the essential components and strategic considerations you should keep in mind. So, let's dive in and explore how to effectively approach your next acquisition inquiry!

Clear Subject Line

Acquisition Agreement Inquiry: Request for Information and Next Steps

Professional Greeting

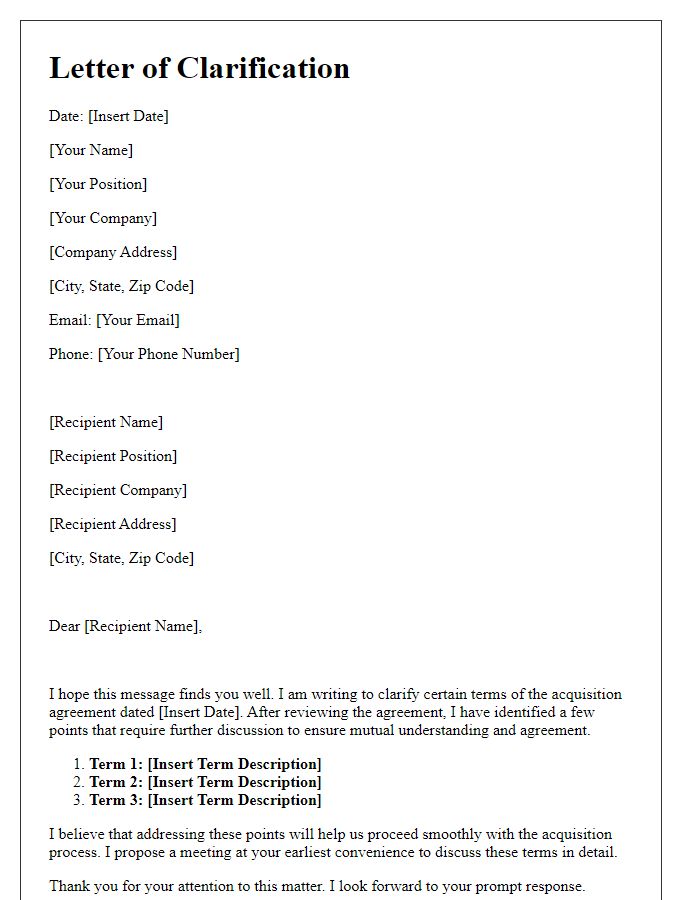

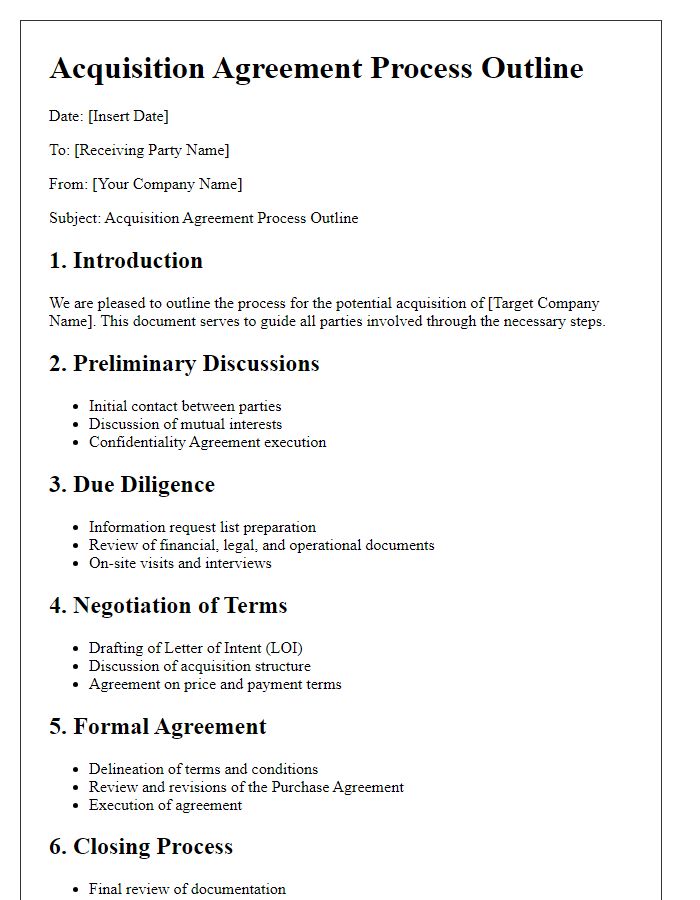

Acquisition agreements, particularly in the context of corporate mergers and acquisitions, are critical documents outlining the terms of a transaction. Such agreements often involve a detailed articulation of the assets (like intellectual property or real estate) being acquired, the liabilities (financial obligations or legal issues) transferred, and the purchase price (monetary compensation). These negotiations typically unfold in key business locations, like New York City, known for its financial markets, or Silicon Valley, a hub for technology acquisitions. Essential parties involved include corporate executives (CEOs or CFOs) and legal teams specializing in corporate law, ensuring compliance with regulatory standards. Each agreement is tailored to align with specific business goals, risk management, and strategic planning. The due diligence phase (an exhaustive appraisal of a potential investment) plays a crucial role in these inquiries, aiming to uncover pertinent financial and operational information before finalizing the acquisition.

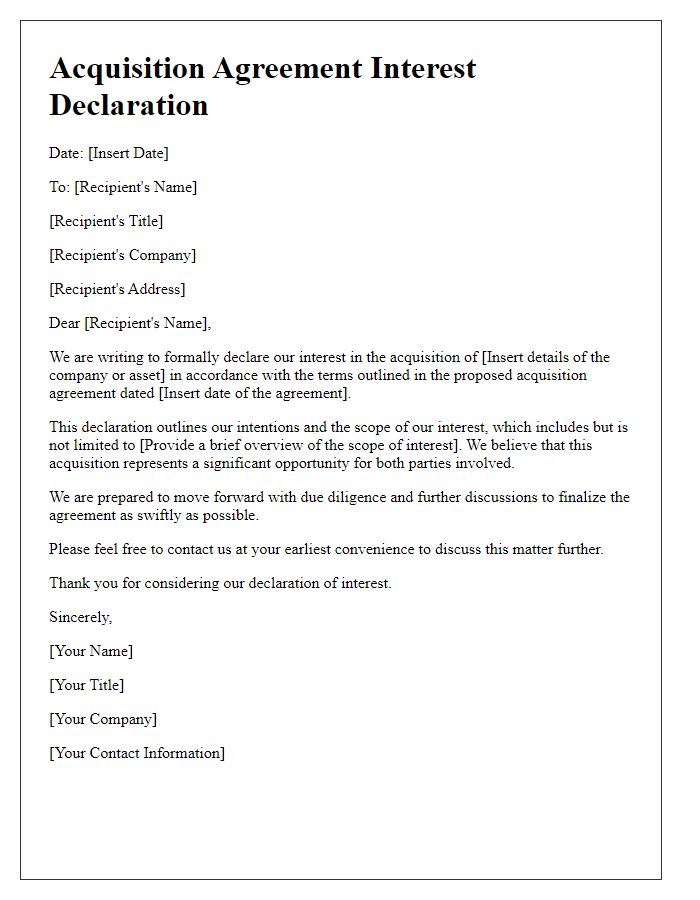

Purpose of Inquiry

Inquiring about the acquisition agreement relates to understanding the potential partnership details and terms of the transaction. Key factors include asset valuation methods, targeted timelines for negotiations, and conditions precedent for the acquisition process. Clarity on intellectual property assets involved, potential liabilities associated with the target entity, and any regulatory approvals required from organizations, such as the Federal Trade Commission (FTC), are critical. Ensuring that due diligence is appropriately conducted can prevent future legal complications and enable a smoother integration post-acquisition, potentially leveraging synergies in operations and market presence.

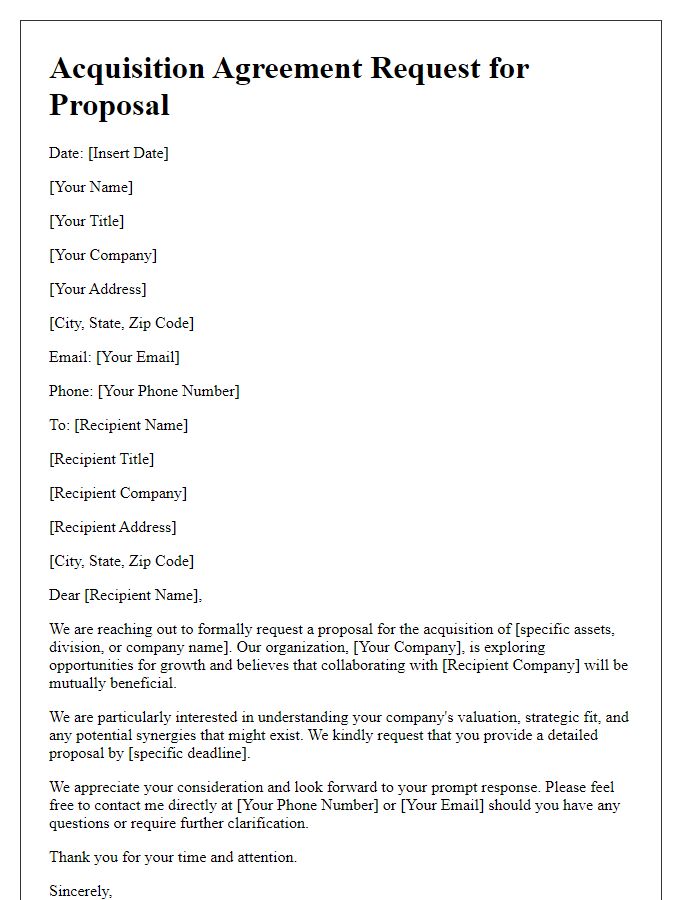

Key Details & Requirements

An acquisition agreement inquiry is essential for potential business transactions, typically involving the transfer of ownership of one company (the target) to another (the acquirer). Key details include financial terms, valuation metrics, and payment structures. Essential requirements often encompass due diligence items such as financial statements, tax records, and legal compliance documentation from the target, as well as clear timelines for the transaction process. Specific regulations may apply depending on the industry and jurisdiction, such as antitrust laws in the United States. Additionally, confidentiality clauses are critical to protect sensitive information during negotiations, ensuring that proprietary data remains secure throughout the inquiry phase.

Contact Information and Closing

The acquisition agreement inquiry process involves specific contact information (such as email addresses, phone numbers) crucial for communication between parties. This information facilitates clear dialogue throughout negotiations. The closing phase includes finalizing terms and confirming documentation, ensuring compliance with legal standards in various jurisdictions. Essential documents often include due diligence reports and financial statements, which are critical for assessing the viability of the acquisition. Timely responses from both parties is vital for a smooth transition and completion of the agreement, preventing potential delays in the acquisition timeline.

Comments