Are you looking to understand the intricate details of an escrow agreement requisition? It's a vital part of many transactions, ensuring that funds and assets are handled securely and fairly. In this article, we'll break down the key components of an escrow agreement, highlighting its importance and the steps needed to initiate a requisition. So, stick around to delve deeper into this topic and learn how to navigate the process effectively!

Key Parties Involved

An escrow agreement is a crucial legal document facilitating a transaction where a neutral third party (escrow agent) holds assets (funds, property) until specified conditions are met. Key parties involved in this agreement typically include the buyer, who seeks ownership of the asset; the seller, who transfers ownership upon fulfilling conditions; and the escrow agent, often a financial institution or attorney managing the escrow process. Additionally, relevant details such as transaction amounts, timelines, and conditions for release of funds are integral to the agreement, ensuring the protection of all parties' interests in the transaction. Clear identification of parties ensures accountability and transparency throughout the escrow process.

Specific Terms and Conditions

An escrow agreement outlines specific terms and conditions for transactions involving a neutral third party, often utilized in real estate purchases, online sales, or large investments. The agreement specifies the obligations of the buyer and seller, including payment amounts (e.g., $250,000 for residential properties), timelines for deposit services (typically 30 days from signing), and conditions for fund release (completion of inspections, satisfactory appraisal). Additionally, it identifies the escrow agent, usually a licensed attorney or financial institution, responsible for holding and managing the funds. This document also details dispute resolution processes, including potential mediation in the event of conflicts, and outlines the associated fees, often ranging from $500 to $2,000 depending on transaction complexity. Lastly, it stipulates jurisdictional compliance, ensuring adherence to local real estate laws, such as those in California or New York.

Payment and Release Conditions

An escrow agreement serves as a secure financial arrangement between parties, ensuring that payments are held by a neutral third party until specific conditions are met. Payment conditions often include financial milestones, such as the completion of services or delivery of goods, with clear indicators like official invoices or completion certificates required for fund release. Release conditions stipulate when the funds can be disbursed, often contingent upon satisfactory inspections or compliance with contractual obligations. The designated escrow agent, typically a legal firm or specialized escrow company, plays a crucial role in managing these terms, safeguarding the interests of both the payer and the payee throughout the transaction process.

Escrow Agent Responsibilities

The escrow agent's responsibilities play a crucial role in ensuring the smooth execution of an escrow agreement. These responsibilities include safeguarding financial assets, such as significant deposits or earnest money, typically amounting to thousands of dollars during real estate transactions. The escrow agent must verify the authenticity of all documents related to the transaction, including purchase agreements and title reports, to ensure compliance with state regulations. Additionally, they are responsible for disseminating funds at the appropriate milestones, such as upon completion of inspections or after title transfer, ensuring funds are securely managed until all conditions are met. The escrow agent also serves as a neutral intermediary, facilitating communication between involved parties, including buyers, sellers, brokers, and lenders, while ensuring confidentiality and adherence to the terms outlined within the escrow agreement.

Dispute Resolution Procedures

The escrow agreement encompasses various dispute resolution procedures designed to address conflicts arising from transactions involving an impartial third party, known as an escrow agent. This agent assumes responsibility for holding funds or documents until all parties fulfill their obligations in a transaction, typically involving real estate, mergers, or high-value sales. Mediation (a voluntary process led by a neutral third party) and arbitration (a more formal process resulting in a binding decision by an arbitrator) serve as primary methods for resolving disputes under this agreement. An essential feature is the stipulated timeframe for initiating these procedures, often outlined to be within 30 days from the occurrence of the disputed event. Specific jurisdictions (local, state, or federal) dictate the applicable laws governing these procedures, ensuring that all parties remain compliant with standard practices in the oversight of escrow arrangements. Additionally, parties may also establish an escalation clause that details how unresolved disputes will proceed to higher levels of negotiation or legal adjudication if initial methods fail. Proper documentation and adherence to these procedures are critical for upholding the integrity and effectiveness of the escrow transaction.

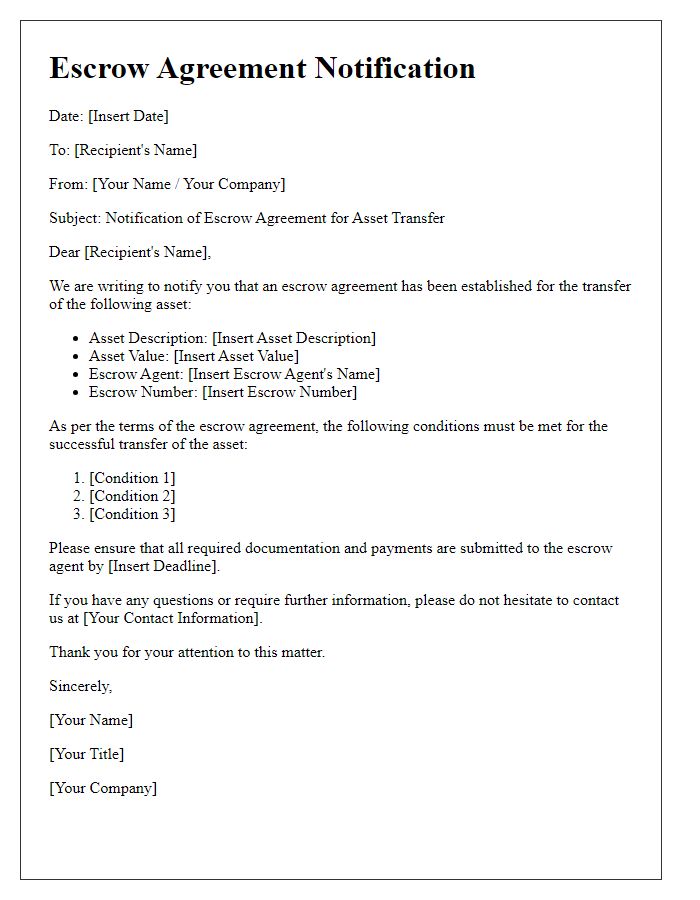

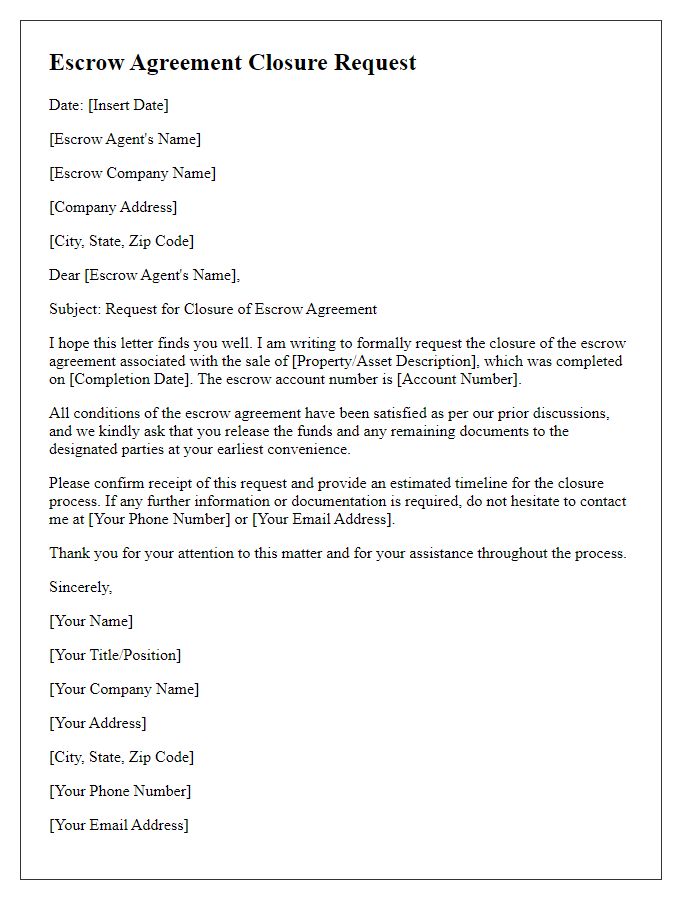

Letter Template For Escrow Agreement Requisition Samples

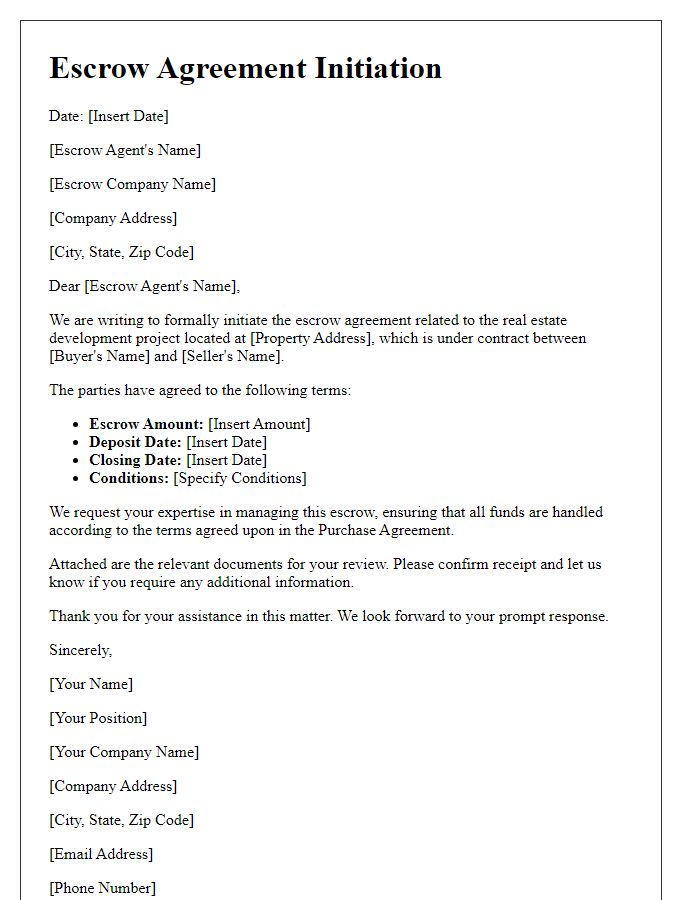

Letter template of escrow agreement initiation for real estate development.

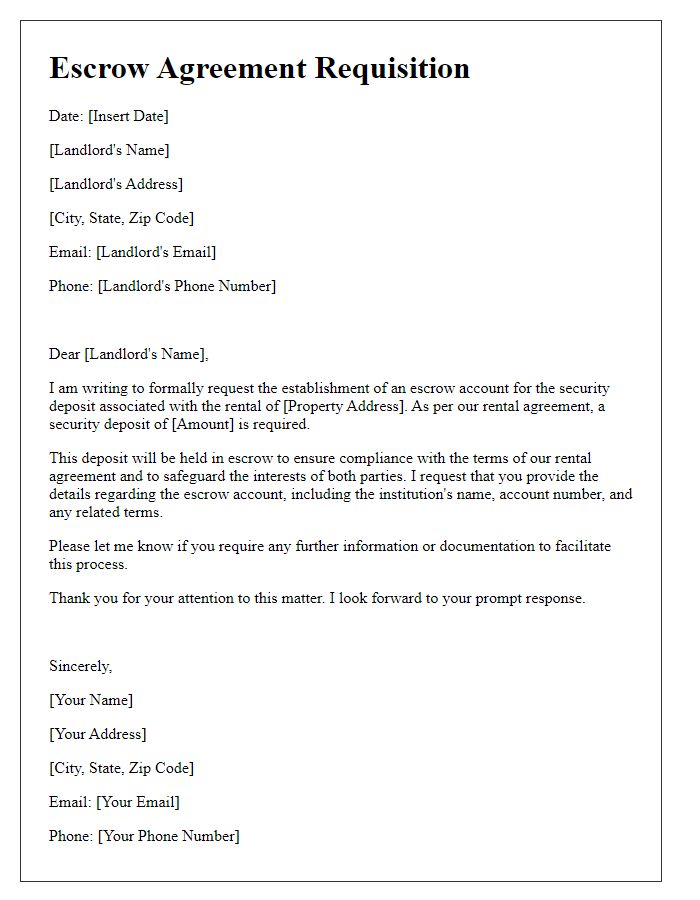

Letter template of escrow agreement requisition for rental security deposit.

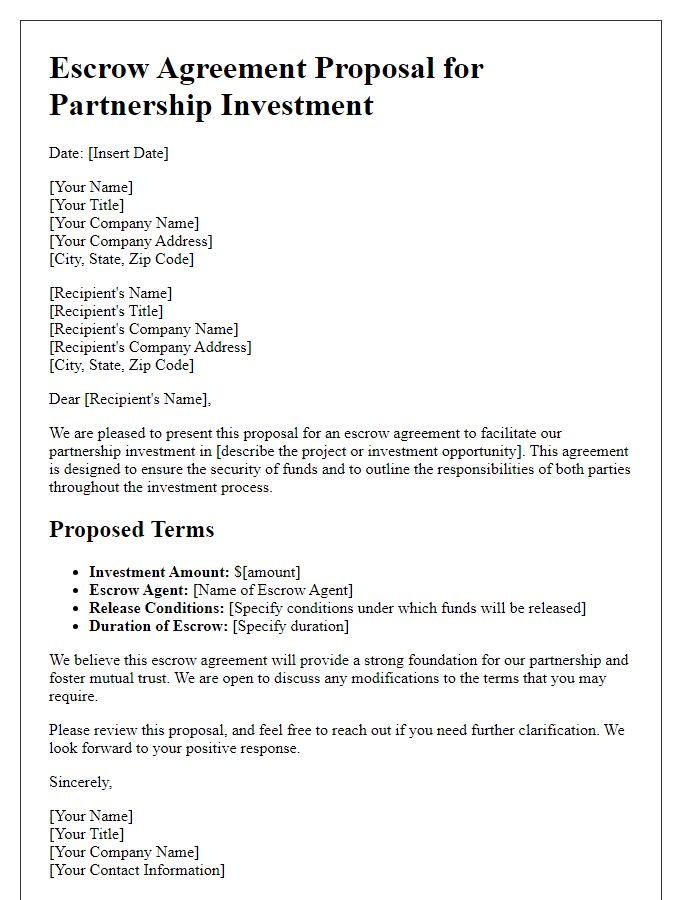

Letter template of escrow agreement proposal for partnership investment.

Letter template of escrow agreement adjustment request for fund disbursement.

Letter template of escrow agreement confirmation for construction financing.

Comments