Are you feeling overwhelmed by your financial obligations and considering a deferred payment agreement plan? You're not alone; many individuals find themselves in similar situations, seeking a workable solution to manage their debts. In this article, we'll explore the ins and outs of setting up a deferred payment agreement, helping you understand your options and guiding you through the process. So, let's dive in and uncover the steps you need to take for a more manageable financial future!

Clear identification of parties involved

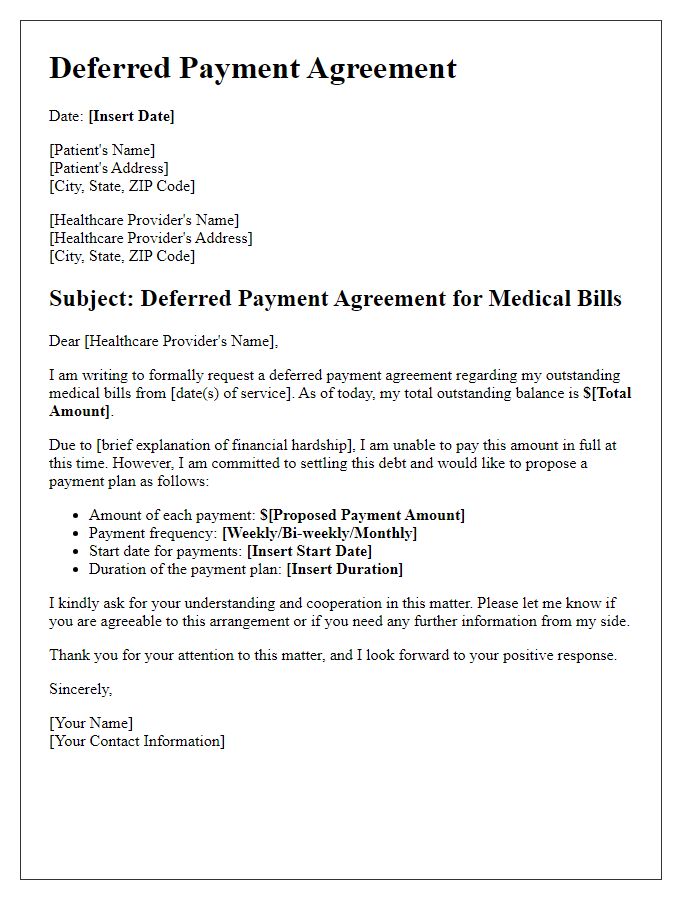

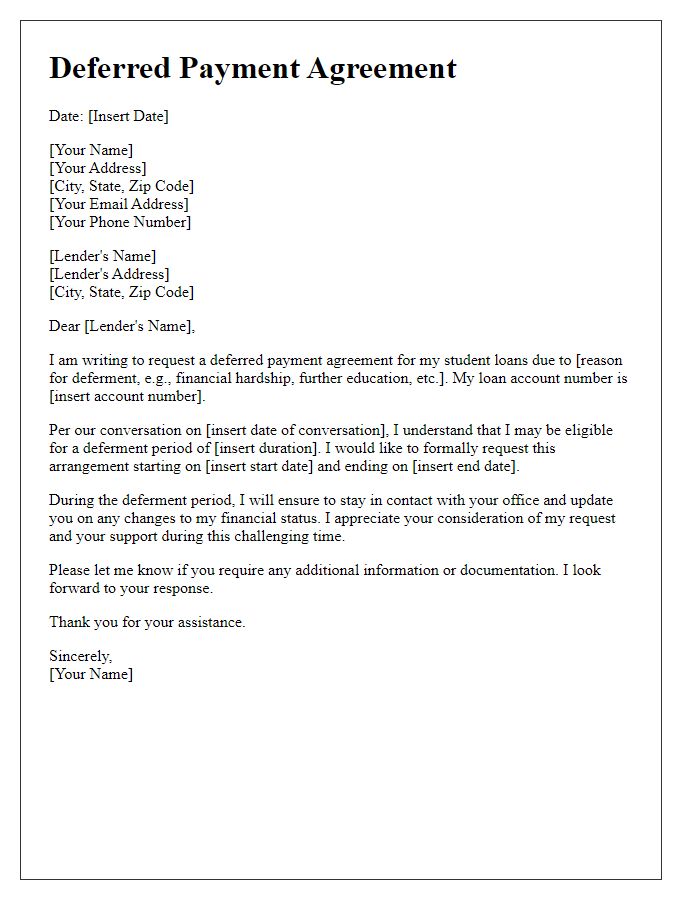

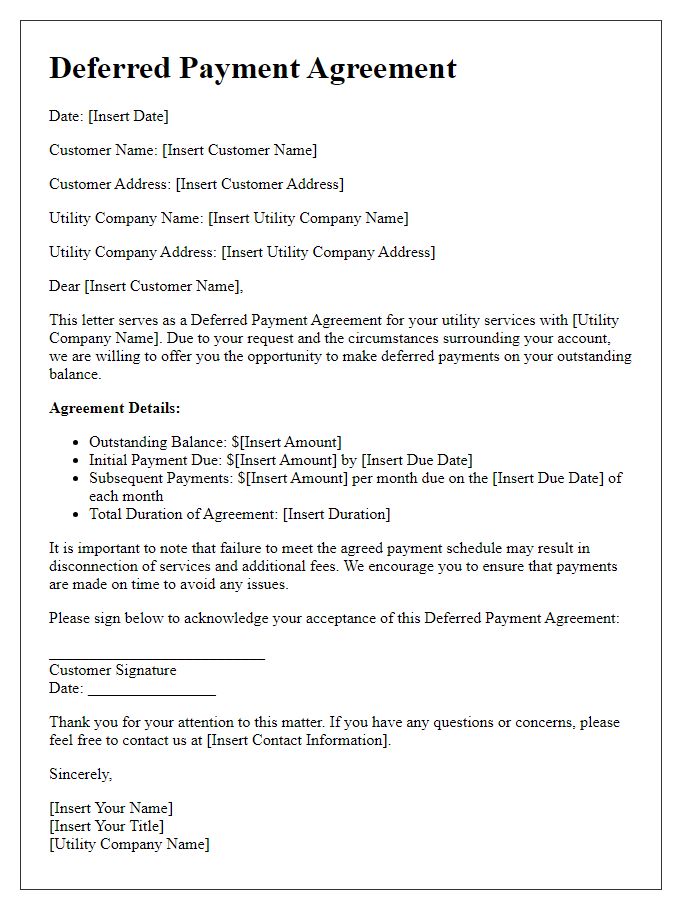

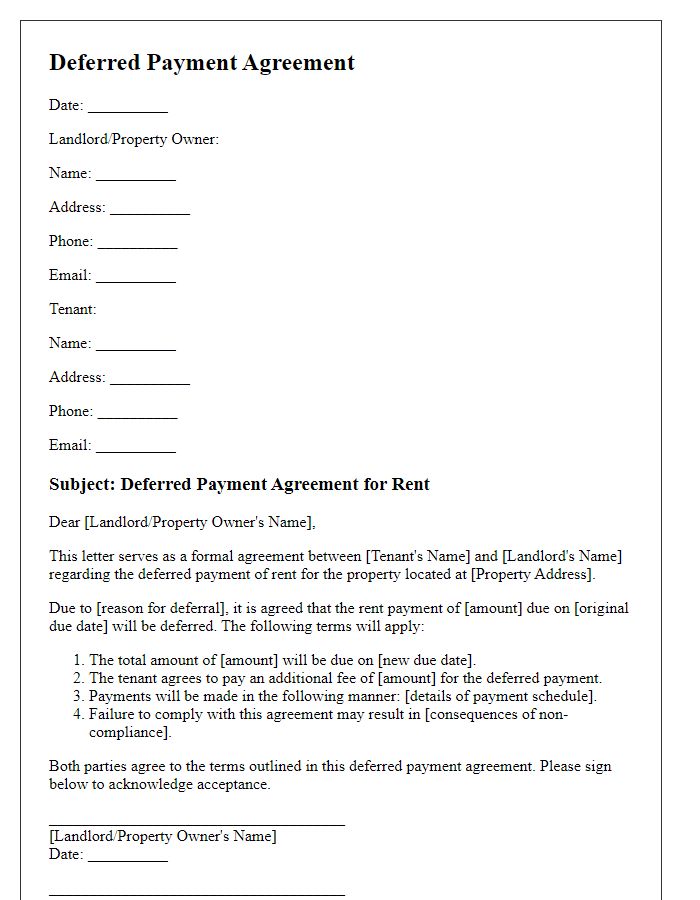

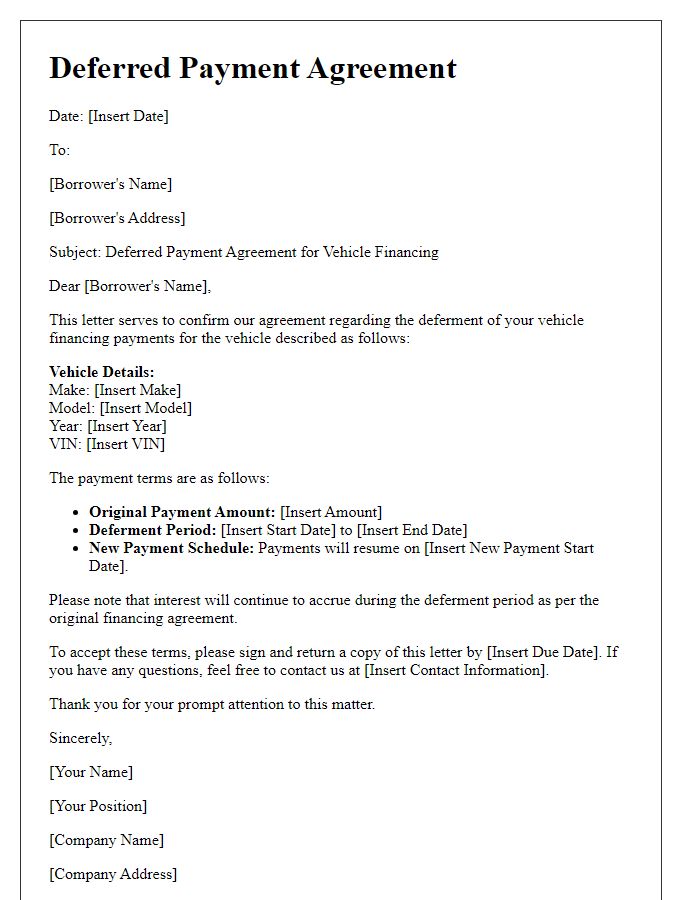

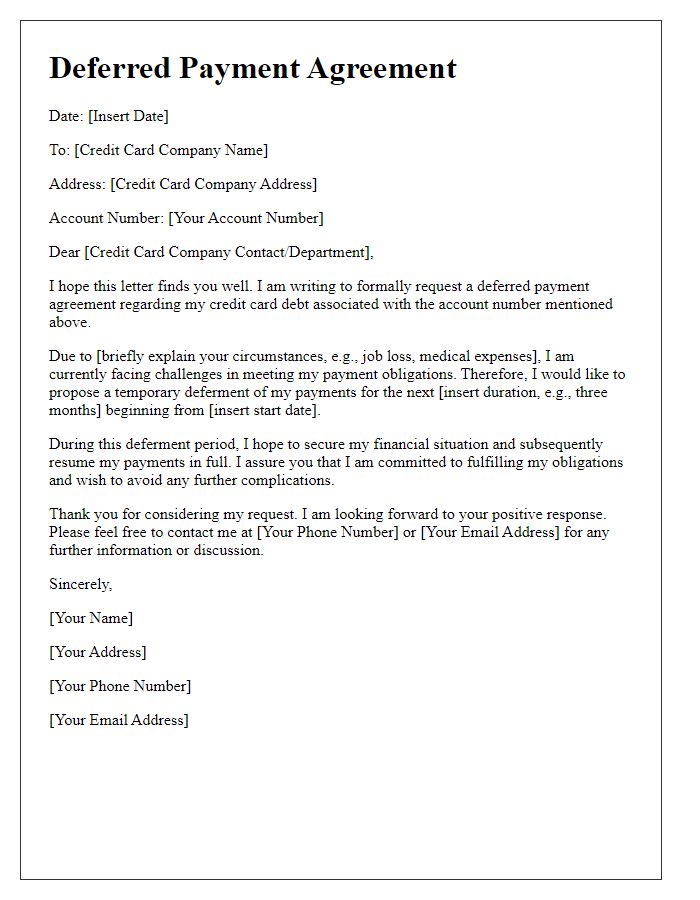

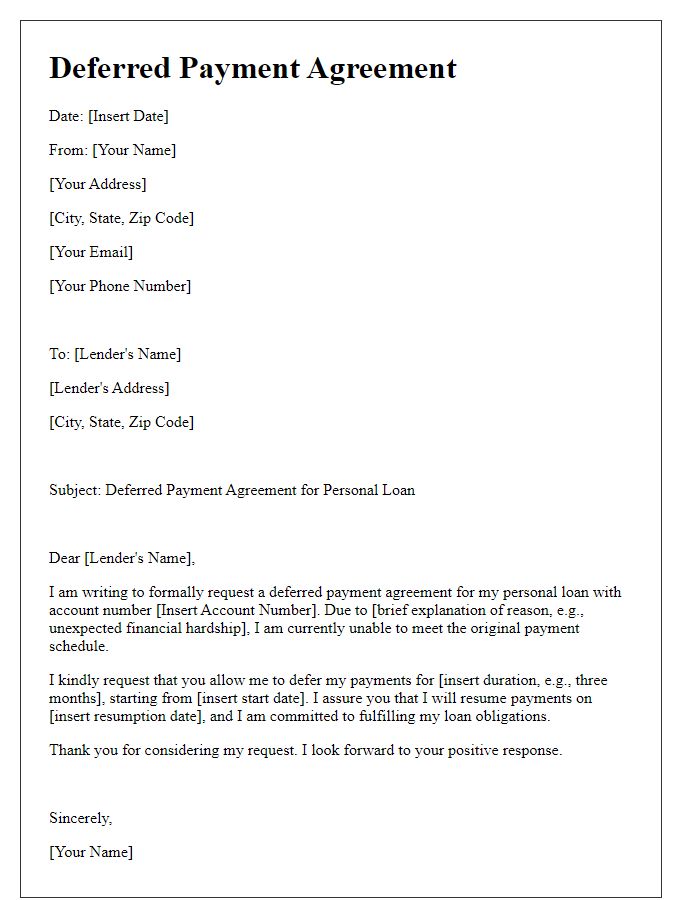

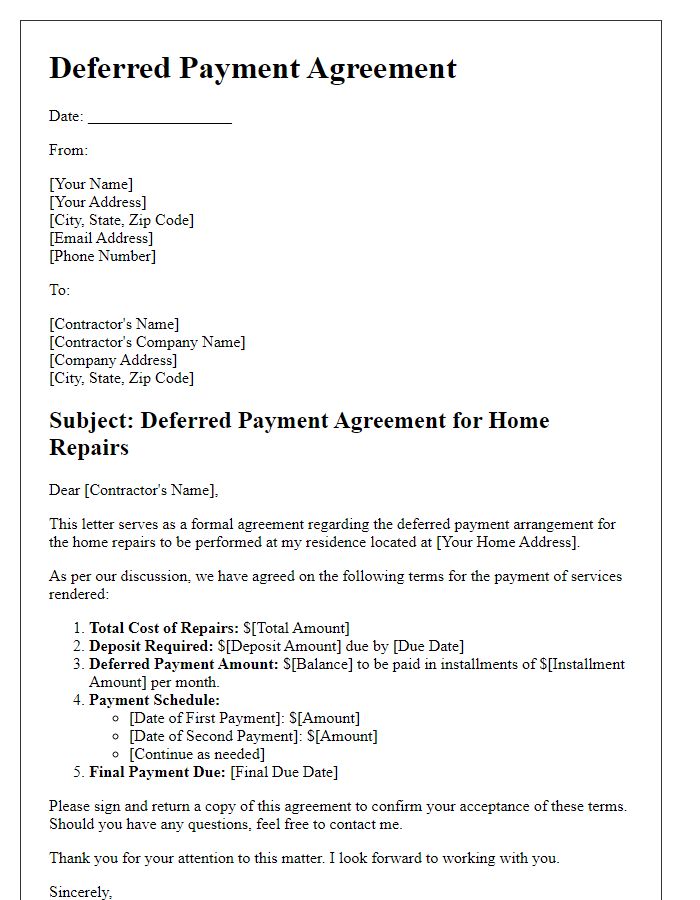

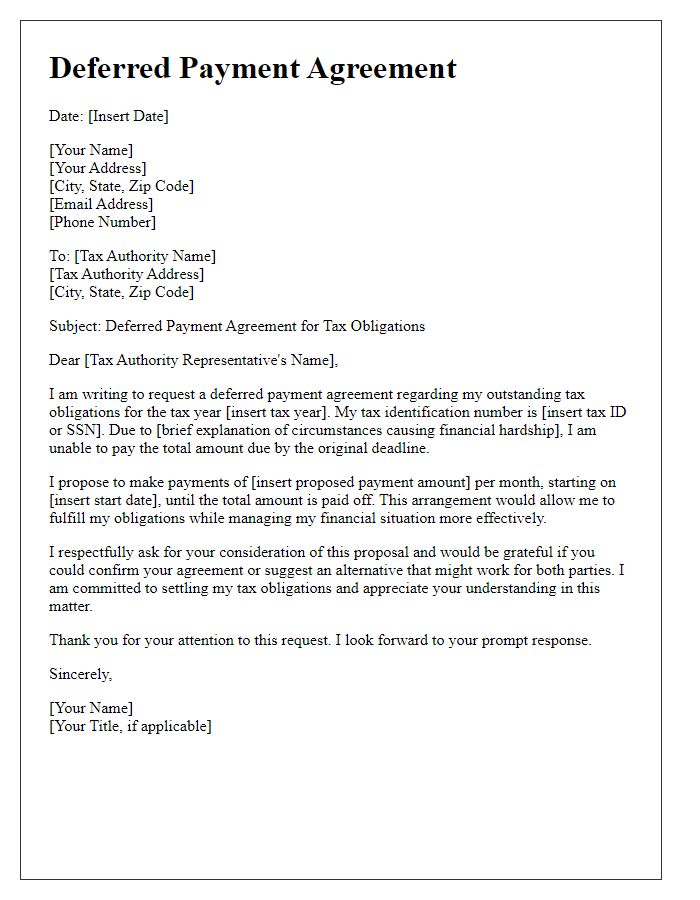

In a deferred payment agreement plan, the parties involved typically include the creditor (the party providing the service or loan, such as a bank, financial institution, or business) and the debtor (the party receiving the loan or service, such as an individual consumer, business entity, or organization). Clear identification of the creditor often includes the full legal name, business address, and contact information to ensure proper communication. Similarly, the debtor's identification should include the full legal name, physical address, and relevant details like Social Security number or business registration number. Establishing clear identification helps avoid confusion and ensures that both parties understand their rights, obligations, and responsibilities under the agreement.

Specific payment terms and schedule

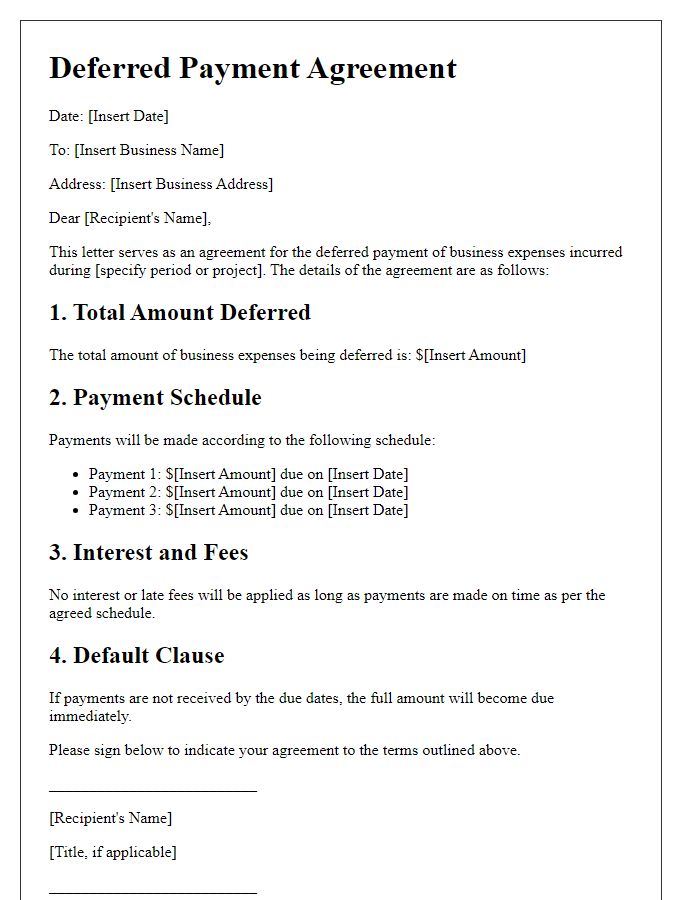

A deferred payment agreement plan outlines specific payment terms and schedules for financial obligations, such as outstanding debts or purchases. This agreement details the total amount due, which might be a sum like $5,000, divided into manageable monthly installments (e.g., $500 per month) over a defined period, often spanning several months or years (12 months, 24 months). Clear dates for each payment (e.g., the first payment due on the 1st of each month) are crucial for both parties to ensure timely transactions. The agreement may also specify interest rates, service fees, and penalties for late payments, contributing to a comprehensive financial plan. Furthermore, both parties' obligations to maintain communication regarding any financial difficulties are key elements for ensuring adherence to the payment schedule.

Interest rate and penalties for late payments

A deferred payment agreement plan allows individuals or organizations to manage financial obligations by postponing payments to a later date. This agreement typically outlines specific terms, including the interest rate applied on the outstanding balance, which can vary based on the lender's policies or prevailing market rates. For instance, a common interest rate for such plans may range from 5% to 10%, depending on the borrower's creditworthiness. Additionally, penalties for late payments are explicitly stated to encourage timely payments. These penalties might include a fixed fee or a percentage of the overdue amount, often ranging from $25 to 50 or 1% to 5% of the total due, depending on the amount and duration of the delay. Ensuring clarity on these crucial points protects both parties involved in the agreement.

Legal obligations and conditions

A deferred payment agreement plan outlines the legal obligations and conditions governing the arrangement between parties involved, such as a creditor and a debtor. The agreement specifies payment terms, including the total amount owed, installment amounts, due dates, and the duration of the payment plan, which might extend over several months or years. Interest rates may apply, calculated according to local laws applicable in jurisdictions like California or New York. Failure to adhere to agreed-upon conditions can lead to consequences, such as late fees, penalties, or legal actions, including possible court proceedings. Parties involved should include full names, addresses, and contact details in the documentation to ensure clarity and accountability. Notarization may be required in certain jurisdictions to validate the agreement, reinforcing its enforceability.

Signatures and date of agreement

A deferred payment agreement plan often includes specifics regarding the signatures of the involved parties and the date the agreement takes effect. The signatures function as a legal acknowledgment of the agreement's terms, indicating consent from each party, which may include individuals or business entities. The date of agreement marks the commencement of the deferred payment arrangement, ensuring clarity concerning when the terms become effective. Proper documentation is critical for legal enforceability in jurisdictions such as California or New York, where consumer protection laws may apply. The agreement should also specify provisions related to the payment schedule, interest rates, and consequences for non-compliance.

Comments