Are you ready to take your financial future to the next level? In today's fast-paced world, effective wealth management is crucial for securing and maximizing your assets. Whether you're looking to invest, save for retirement, or explore new opportunities, partnering with an experienced wealth management team can help you navigate the complexities of finance. Join us as we delve into strategies for success and the benefits of forming a solid partnership in wealth managementâread on to discover how you can make the most of your financial journey!

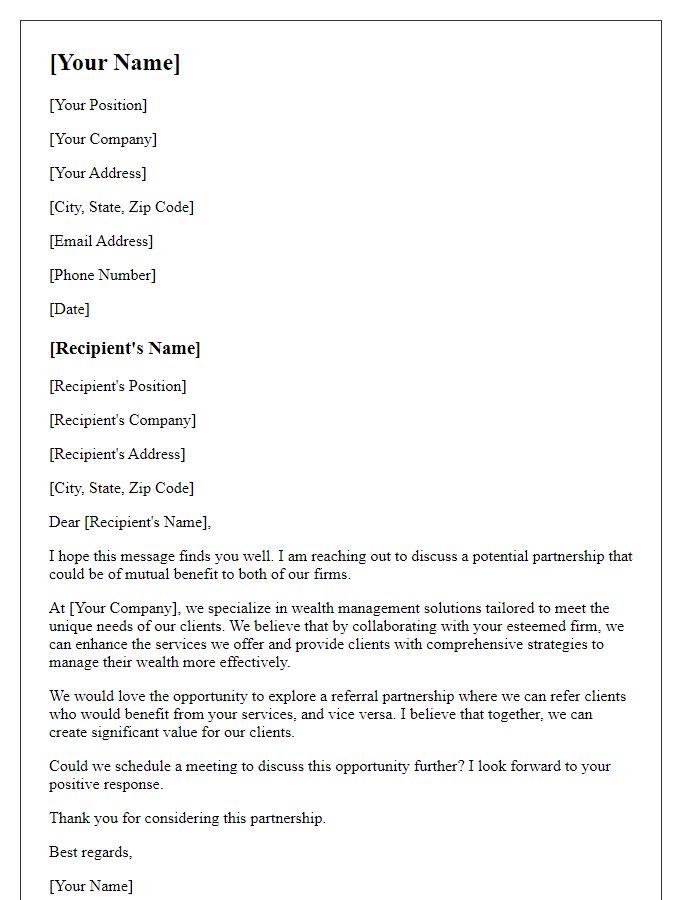

Introduction and Purpose

Wealth management partnerships aim to provide personalized financial strategies tailored to individual client needs. This collaboration seeks to optimize asset growth, mitigate risks, and enhance overall financial well-being. By combining expertise in investment management, tax planning, and estate conservation, wealth management firms create customized solutions for clients. These firms often include professionals such as Certified Financial Planners (CFP), Chartered Financial Analysts (CFA), and estate attorneys, who collectively ensure comprehensive coverage of all financial aspects. The ultimate goal is to build lasting relationships marked by trust, transparency, and mutual success in wealth accumulation and preservation.

Partnership Terms and Conditions

Wealth management partnerships often involve various terms and conditions to outline the relationship between the parties involved. These agreements typically define roles, responsibilities, and expectations for both partners. Key components may include investment strategies, fee structures, profit-sharing models, and duration of the partnership. Terms may specify compliance with regulatory requirements, risk tolerance levels, and reporting obligations. Clear stipulations regarding dispute resolution procedures and exit strategies are essential to mitigate conflicts. Comprehensive documentation aids in establishing trust and accountability between entities involved in wealth management, fostering long-term collaboration for achieving financial objectives.

Roles and Responsibilities

Wealth management partnerships typically involve various roles and responsibilities that are crucial for effective management of client assets. Financial advisors focus on personalized investment strategies, assessing risk tolerance, and tailoring portfolios to achieve clients' specific financial objectives. Portfolio managers oversee the allocation of assets in various investment vehicles, such as stocks, bonds, and mutual funds, ensuring alignment with market trends and client goals. Client relationship managers maintain communication, addressing inquiries and providing regular performance updates, thereby fostering trust and engagement. Compliance officers ensure adherence to financial regulations and ethical standards, safeguarding both the firm and clients against potential legal issues. Support staff handle administrative tasks, including documentation and scheduling, allowing advisors to concentrate on client interactions and investment strategies. Together, these roles create a comprehensive wealth management approach, promoting client satisfaction and financial success.

Confidentiality and Data Security

Wealth management firms face significant challenges regarding confidentiality and data security, especially when handling sensitive client information such as financial portfolios and personal identification details. Robust data protection measures, including encryption protocols and secure cloud storage systems, must be implemented to safeguard this information from unauthorized access and cyber threats. Compliance with regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) is crucial to avoid legal penalties, ensuring the privacy of client data. Regular security audits and employee training on best practices in data handling are essential to mitigating risks. Furthermore, establishing clear confidentiality agreements between partners and clients builds trust, emphasizing the firm's commitment to secure and responsible management of wealth-related data.

Contact Information and Next Steps

Developing a wealth management partnership requires clear communication and organized contact information to streamline future interactions. Essential contact information includes a primary contact's name, including their title such as Financial Advisor or Portfolio Manager, along with phone numbers, email addresses, and office locations, ideally in financial hubs like New York City or London. Outlining next steps is vital; this could entail scheduling a follow-up meeting, providing additional financial documents, or setting specific investment goals to better align strategies. Establishing a timeline for these actions fosters accountability and clarity, ensuring both parties remain engaged in optimizing wealth growth and management effectively.

Comments