Navigating the complexities of transfer pricing can feel overwhelming, especially when it comes to documentation preparation. Companies face a myriad of regulations and requirements, and understanding the nuances is crucial for compliance and optimizing financial performance. In this article, we'll break down essential elements and best practices for preparing effective transfer pricing documentation that meets legal standards while supporting your business's strategic objectives. So, let's dive in and explore how you can streamline your transfer pricing processes!

Executive Summary.

Transfer pricing documentation preparation involves creating a comprehensive executive summary that outlines the methods and rationale for pricing transactions between related entities. This documentation is essential for ensuring compliance with regulations set forth by tax authorities like the OECD and the IRS. A well-structured summary should include key elements such as the organizational structure of the multinational enterprise (MNE) with emphasis on operational entities, the nature of intercompany transactions, and the financial performance of each entity involved. Detailed benchmarking studies should be referenced to demonstrate the arm's length principle, supported by relevant economic and market analyses. Additionally, the summary should highlight any industry-specific regulations or trends affecting pricing strategies, showcasing adherence to local regulations in countries of operation like the United States, Germany, or Japan, ensuring a robust defense against transfer pricing audits.

Methodology and Approach.

Transfer pricing documentation preparation involves a systematic methodology and approach to ensure compliance with international guidelines and local regulations. The process typically begins with identifying related party transactions, which may include sales of goods, provision of services, or financial arrangements, valued at significant amounts such as exceeding $1 million annually. The functional analysis helps to dissect the roles and responsibilities of each associated enterprise involved, often grouped under multinational corporations (MNCs) operating in various jurisdictions like the United States and Germany. Market analysis follows, evaluating comparable transaction data within the same industry, utilizing databases like Orbis or Amadeus, ensuring data reliability and relevance. The selection of appropriate transfer pricing methods, such as Comparable Uncontrolled Price (CUP) or Cost Plus Method (CPM), is critical in determining arm's length pricing. Finally, comprehensive documentation, comprising financial statements, benchmark studies, and local file requirements, is prepared to substantiate the pricing strategies adopted, thereby mitigating risks of adjustments or penalties from tax authorities globally.

Economic Analysis.

Economic analysis in transfer pricing documentation involves the detailed assessment of intercompany transactions to ensure compliance with local regulations and international standards. This analysis evaluates comparable transactions, focusing on factors like financial performance indicators, industry benchmarks, and relevant market conditions. Geographic regions such as the European Union, United States, or Asia-Pacific may have specific guidelines impacting pricing strategies. Utilizing methodologies like the Comparable Uncontrolled Price (CUP) method or the Profit Split method, firms can ascertain fair market values of transferred goods, services, or intellectual property. This ensures that the profit allocation among subsidiaries aligns with the arm's length principle while mitigating risks of tax audits from authorities like the Internal Revenue Service (IRS) and the Organisation for Economic Co-operation and Development (OECD).

Functional Analysis.

Functional analysis in transfer pricing documentation involves a comprehensive assessment of the functions performed, assets utilized, and risks assumed by entities within a multinational enterprise (MNE). This analysis typically includes key functions such as research and development (R&D), manufacturing, distribution, and marketing, which are critical for determining arm's length pricing. Geographic locations (such as New York, Tokyo, or London) can influence functions performed and their respective market conditions, affecting profitability. Various assets like intellectual property (patents, trademarks) and tangible assets (machinery, facilities) are evaluated for their contribution to value creation, while risks like currency fluctuations, market demand, and regulatory compliance are also scrutinized. The synthesis of this information leads to a clearer understanding of how intercompany transactions should be structured and priced, ensuring compliance with regulations such as OECD guidelines and local tax laws.

Compliance and Regulatory References.

Transfer pricing documentation preparation requires adherence to compliance and regulatory references established by governing bodies. The OECD (Organisation for Economic Co-operation and Development) guidelines serve as a primary framework for multinational enterprises operating in various countries. Additionally, local regulations, such as the IRS (Internal Revenue Service) requirements in the United States or HMRC (Her Majesty's Revenue and Customs) guidelines in the United Kingdom, provide specific rules for reporting intercompany transactions. Compliance with these regulations ensures transparency and accountability in the documentation process, mitigating risks of audits and penalties. Furthermore, the arm's length principle remains a cornerstone, promoting fair pricing practices between related entities, thus reinforcing tax compliance globally.

Letter Template For Transfer Pricing Documentation Preparation Samples

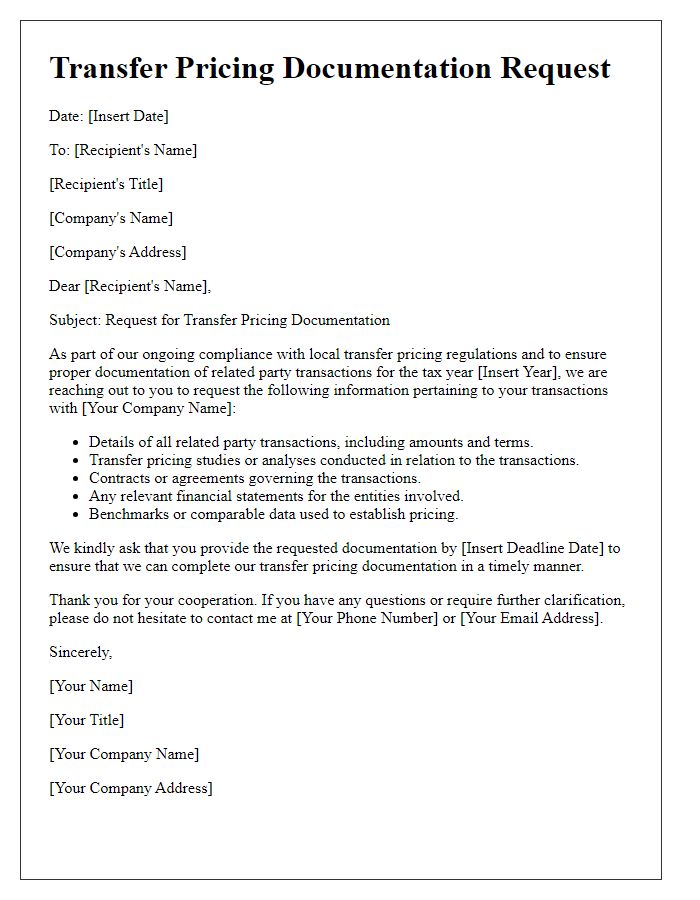

Letter template of transfer pricing documentation request for related party transactions.

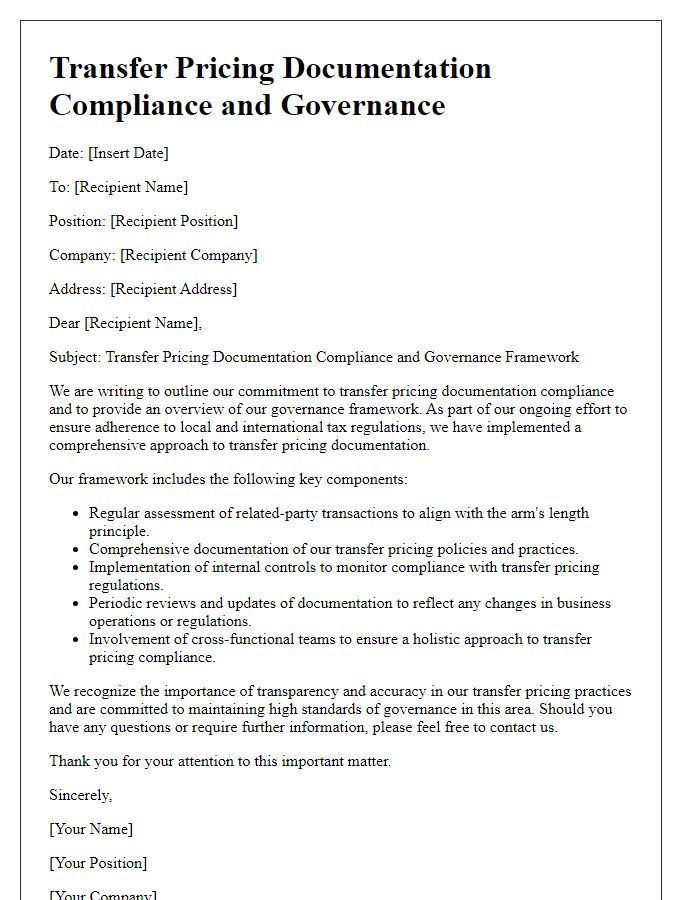

Letter template of transfer pricing documentation compliance and governance.

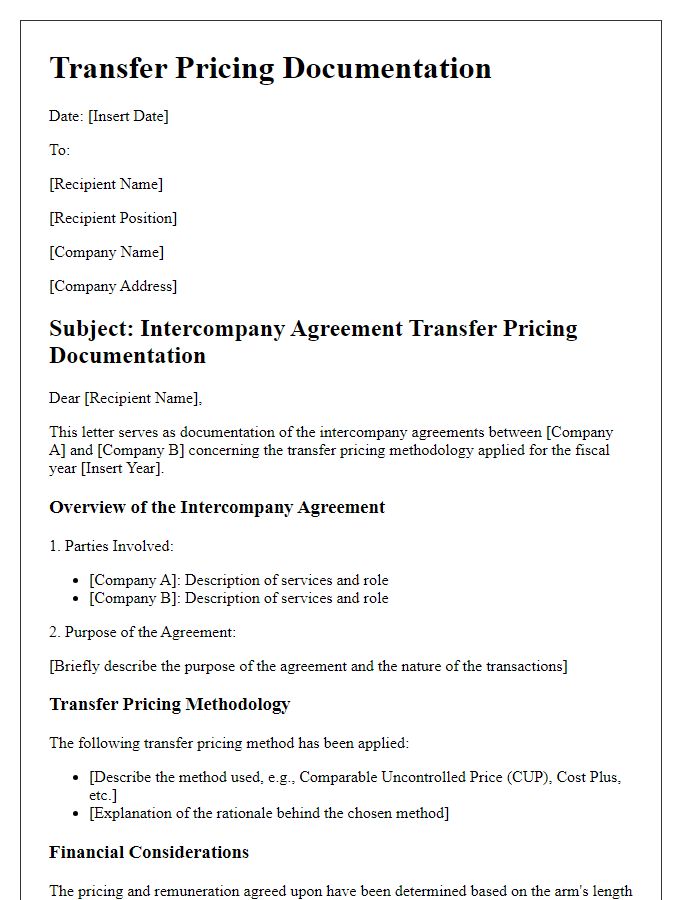

Letter template of transfer pricing documentation for intercompany agreements.

Letter template of transfer pricing documentation update for regulatory changes.

Letter template of transfer pricing documentation analysis for profit allocation.

Letter template of transfer pricing documentation justification for arm's length pricing.

Letter template of transfer pricing documentation review for financial reporting.

Letter template of transfer pricing documentation support for multinational operations.

Comments