Have you ever wondered how your estate plan stands up in today's ever-changing landscape? It's crucial to regularly review your assets and ensure everything aligns with your intentions. As our lives evolve, so do our needs and priorities, making it essential to stay proactive. Join us as we delve deeper into the importance of an estate plan asset review and how it can safeguard your legacy.

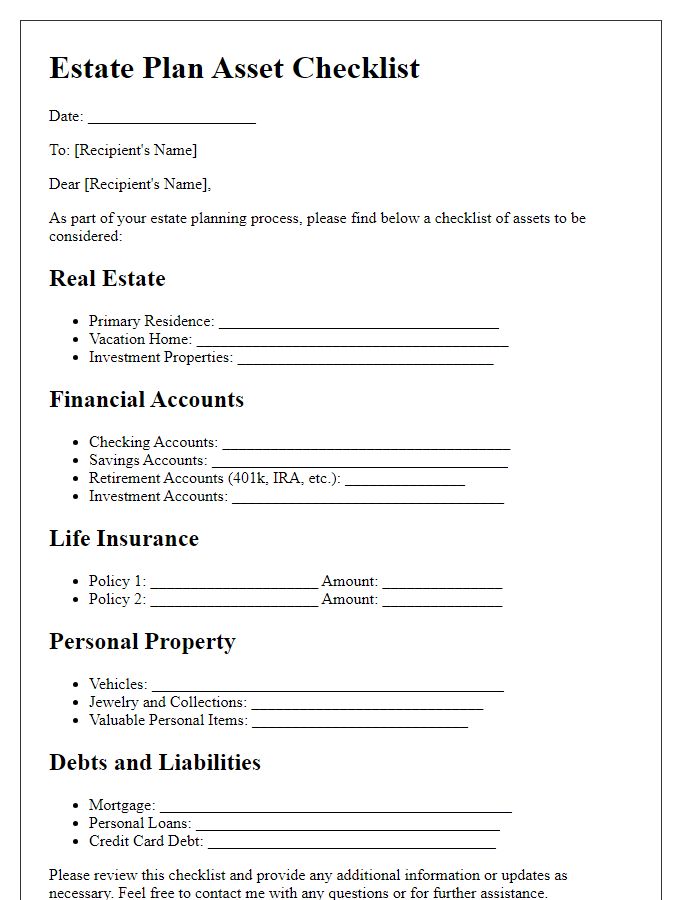

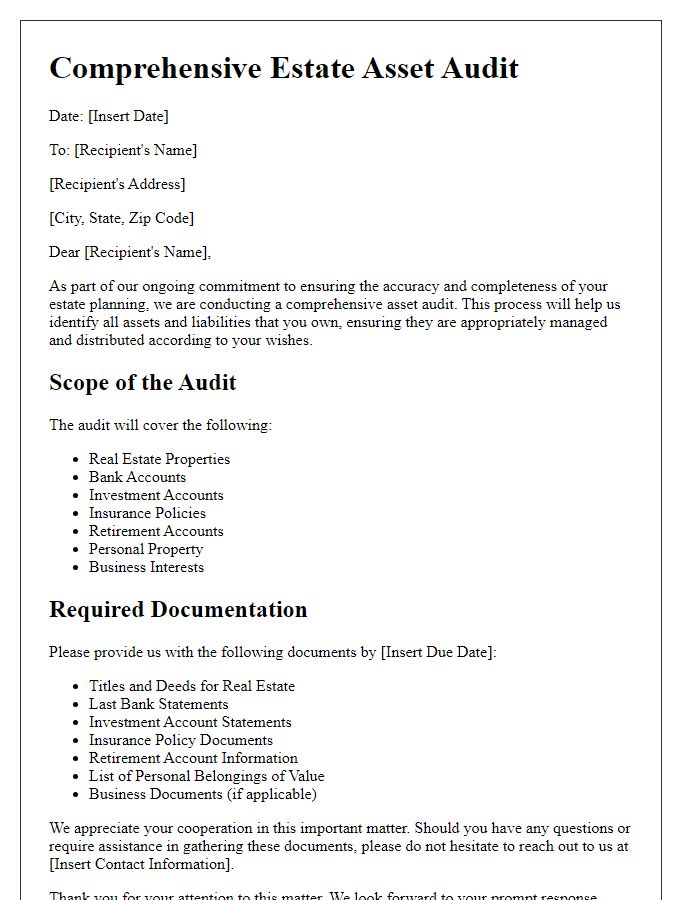

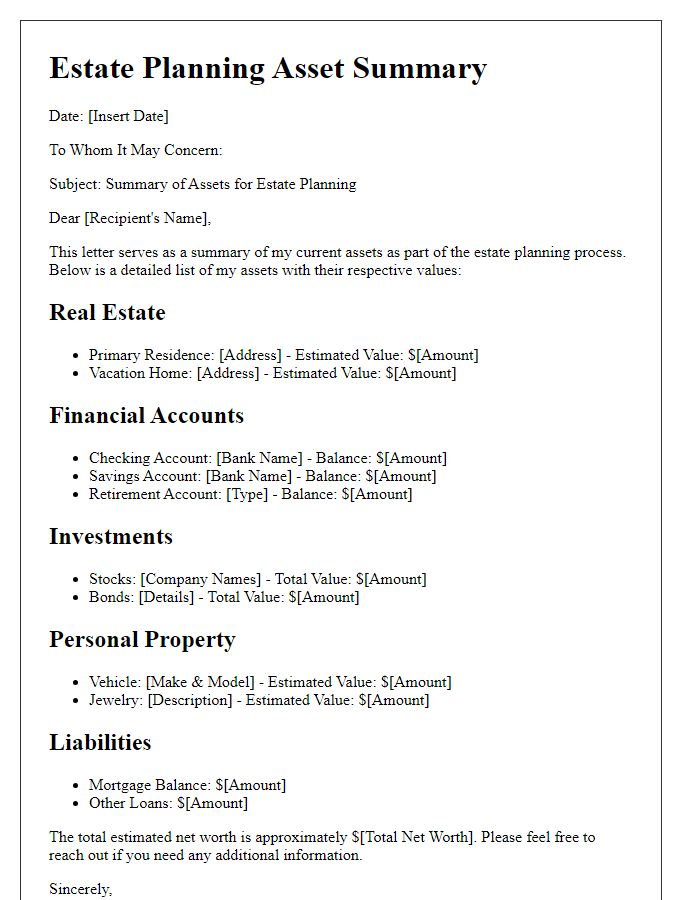

Asset Identification and Categorization

Conducting a thorough asset identification and categorization process is crucial for effective estate planning. Assets may include real estate properties such as residential homes in upscale neighborhoods or vacation rentals in tourist destinations, financial accounts like checking accounts at National Banks or investment portfolios containing stocks from Fortune 500 companies, personal property including valuable items like antiques or artwork, and life insurance policies with significant cash value. Documenting the current market value of each asset is essential for understanding the overall estate value. Additionally, categorizing assets into tangible and intangible assets, as well as identifying ownership structures such as joint tenancy or living trusts, provides clarity for distribution plans and tax implications. This meticulous review enhances the estate plan's execution after passing, ensuring beneficiaries receive their intended inheritances.

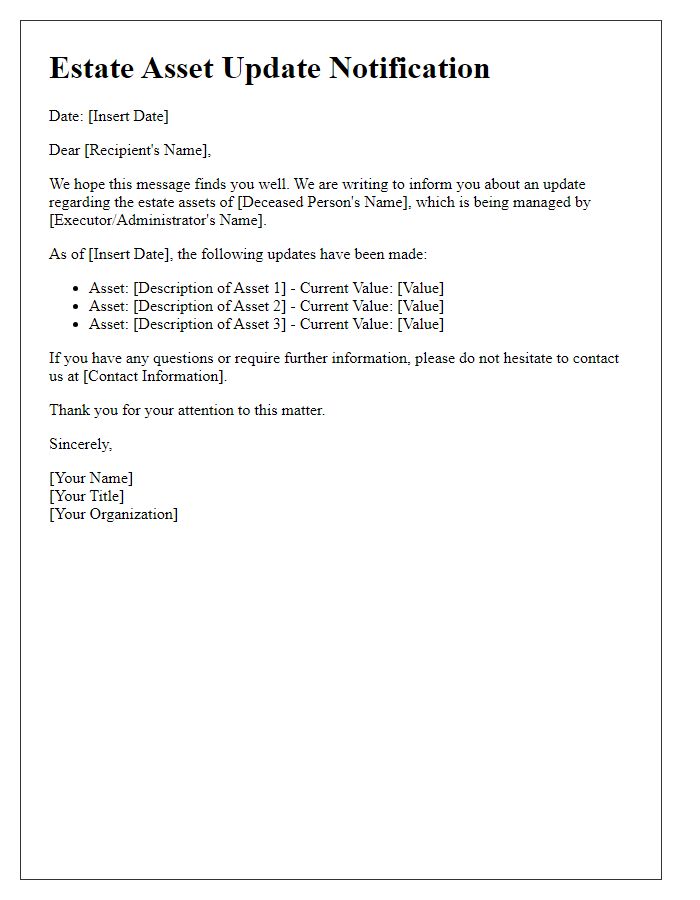

Beneficiary Designations

Beneficiary designations play a crucial role in estate planning, influencing the distribution of assets such as retirement accounts (e.g., 401(k) plans) and life insurance policies. Regular review of these designations is essential; life events like marriage, divorce, or birth (which can introduce new heirs) should prompt updates. Additionally, state laws can affect how beneficiary designations are honored, particularly in places like California or New York, with their specific probate requirements. Ensuring that beneficiary designations align with the overall estate plan helps avoid disputes among heirs and ensures that the intended recipients receive assets without unnecessary delay, reflecting one's wishes accurately in the event of death.

Tax Implications and Strategies

An estate plan asset review is essential to assess the potential tax implications associated with an individual's estate, ensuring that assets are transferred efficiently upon death. Federal estate taxes can impact estates exceeding $12.92 million due to the Tax Cuts and Jobs Act of 2017, necessitating strategic planning to minimize liabilities. State estate taxes vary significantly; for instance, Massachusetts imposes taxes on estates over $1 million, while Florida has no estate tax. Implementing strategies such as creating irrevocable trusts or gifting assets during one's lifetime can mitigate tax burdens and enhance wealth preservation for heirs. Regular reviews of asset valuations, current tax laws, and estate plan effectiveness are crucial for optimizing tax strategies while aligning with personal financial goals.

Legal Compliance and Updates

Regular asset reviews are essential for ensuring that estate plans remain compliant with state laws and accurately reflect the current wishes of the individual. Legal documents, such as wills, trusts, and powers of attorney, often require updates due to changes in legislation, like the Tax Cuts and Jobs Act of 2017 or individual circumstances such as marriage, divorce, or the birth of children. Scheduled reviews at least every three to five years are advisable to address any potential discrepancies and ensure alignment with current state regulations (varied by jurisdiction). Additionally, reviewing asset allocations within trusts can prevent future disputes among heirs and ensure that assets (properties, investments, or business interests) are distributed according to the most recent intentions. Annual evaluations of designated beneficiaries for accounts, such as retirement plans and life insurance policies, also aid in maintaining a clear and effective estate plan.

Trust and Probate Considerations

Estate planning involves numerous trust and probate considerations that significantly impact asset management. A living trust allows for the seamless transfer of assets, ensuring privacy and efficient distribution upon death. States like California have unique probate laws, which can affect the process duration, often ranging from six months to two years. Key assets such as real estate, stocks, and retirement accounts should be evaluated for their inclusion within trust structures to avoid lengthy probate proceedings. The tax implications, including estate taxes that could reach up to 40% federally for estates exceeding $12.92 million (as of 2023), play a critical role in strategic planning decisions. Regular reviews of beneficiary designations and asset allocations are essential to align with changing laws, personal circumstances, and potential changes in family dynamics.

Comments