Are you ready to navigate the essential process of an audit engagement for your nonprofit organization? Understanding the significance of this procedure can empower you to enhance accountability and transparency in your financial practices. With the right approach, you can ensure that your organization's mission thrives while maintaining the trust of donors and stakeholders alike. Dive deeper into our article to uncover tips and insights tailored for nonprofits like yours!

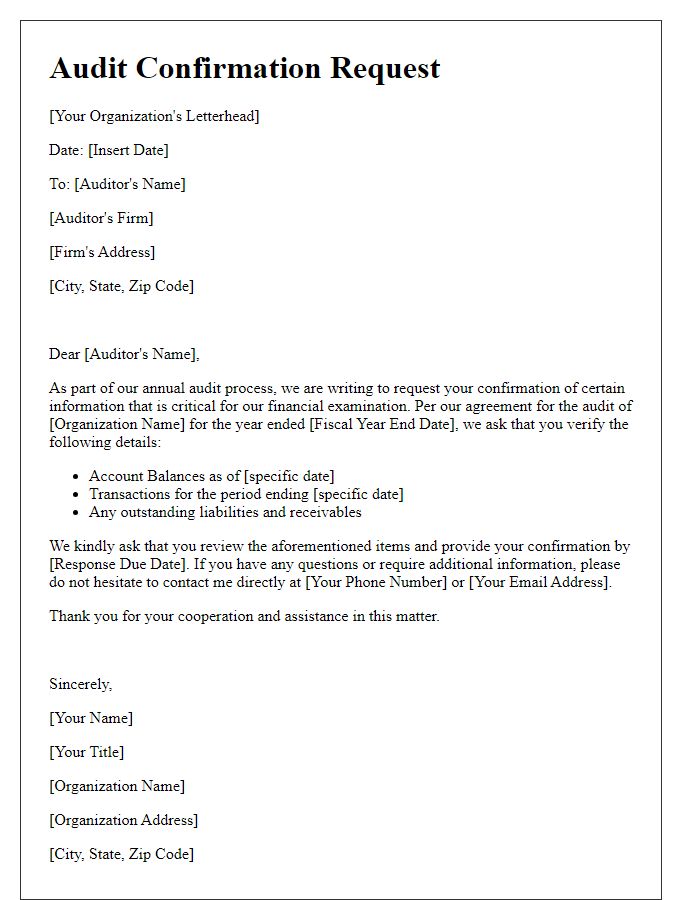

Engagement Scope and Objectives

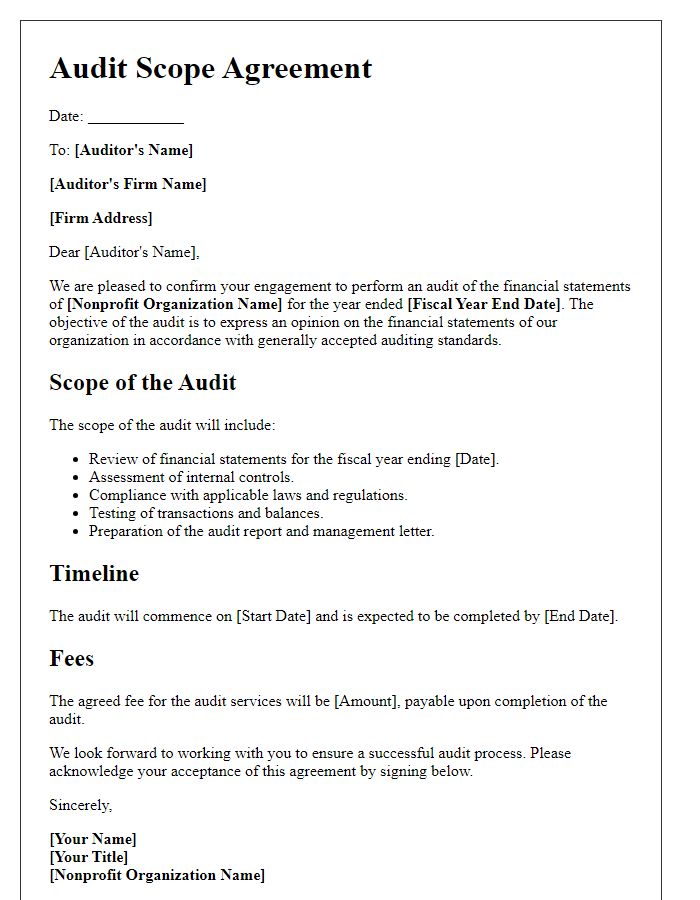

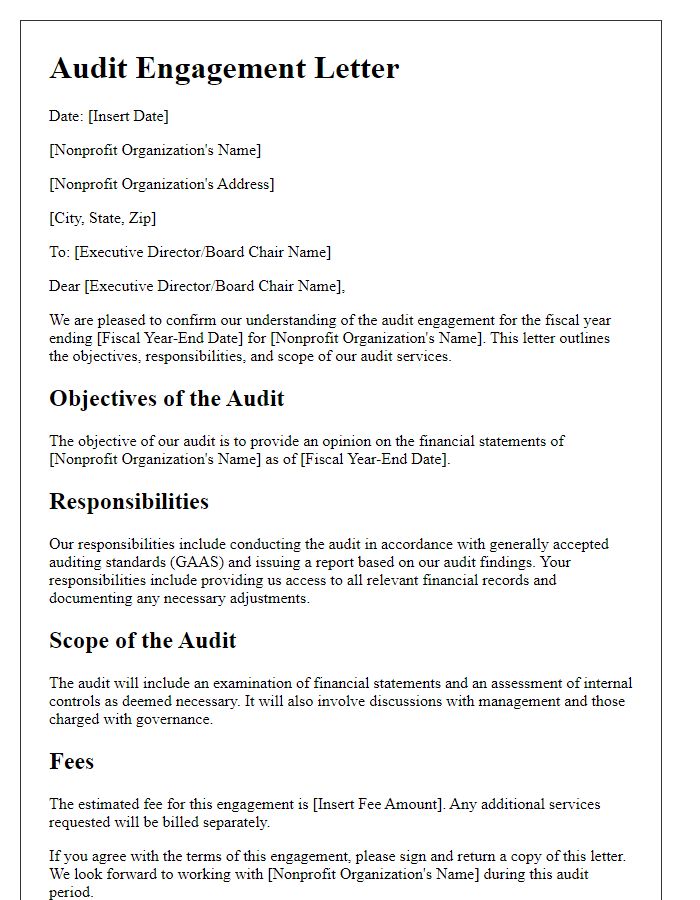

During the nonprofit organization audit engagement, the primary objectives include assessing financial statements for accuracy and compliance with accounting standards such as Generally Accepted Accounting Principles (GAAP). The scope encompasses reviewing key financial documents, including the statement of financial position, statement of activities, and supporting schedules, while also evaluating internal controls and risk management practices. This process aims to provide transparency and accountability to stakeholders, including donors and grantors, while ensuring alignment with the nonprofit's mission. Additionally, the audit will identify areas for improvement in financial reporting and operational efficiency, ultimately reinforcing trust among the community and enhancing organizational effectiveness.

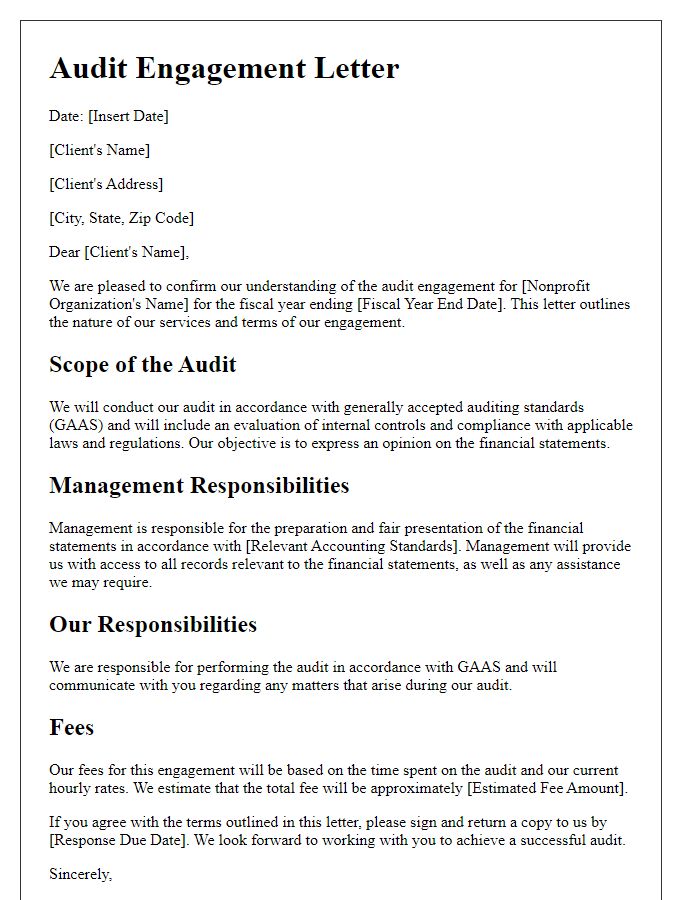

Responsibilities of Management and Auditors

Management of a nonprofit organization, such as [Nonprofit Name], holds primary responsibility for the preparation and fair presentation of financial statements in accordance with applicable accounting standards (like GAAP or IFRS). They must ensure the accuracy of financial records, compliance with applicable laws, and the effectiveness of internal controls. Management must also provide auditors with all relevant documentation, access to personnel, and necessary explanations to facilitate the audit process. On the other hand, auditors, such as [Audit Firm Name], are tasked with providing an independent assessment of the financial statements. Their responsibilities include planning and conducting the audit in a manner that ensures compliance with auditing standards (like GAAS or IAASB), evaluating the appropriateness of accounting policies, and assessing the overall presentation of financial statements. Auditors must collect sufficient appropriate evidence to obtain reasonable assurance that financial statements are free from material misstatements, whether due to fraud or error. Both parties must maintain open communication to address any significant issues that arise during the audit engagement.

Audit Timeline and Deliverables

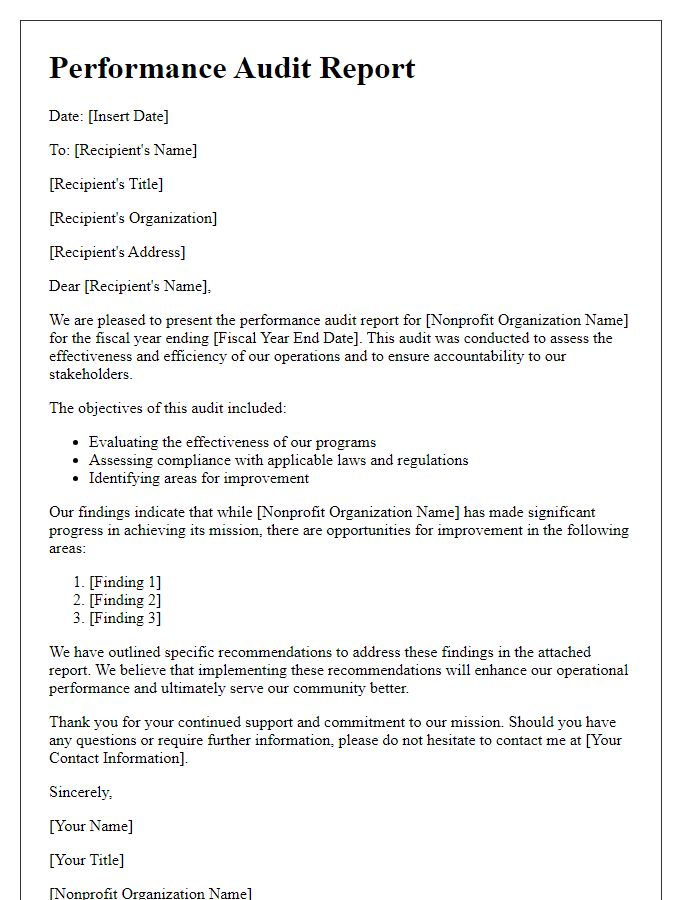

The audit timeline for nonprofit organizations typically spans several key phases, each with specific deliverables essential for a thorough review. The planning phase may begin six months prior to the fiscal year-end, allowing auditors to develop a detailed audit plan outlining objectives and methodologies. Initial meetings can establish expectations, clarifying compliance with accounting standards, such as Generally Accepted Accounting Principles (GAAP). Fieldwork, scheduled for two to four weeks post-year-end (e.g., December 31), involves in-depth examination of financial records, including grant management, donor contributions, and expense documentation. Deliverables during this phase include interim reports highlighting preliminary findings. Upon completion, the auditors will present a comprehensive audit report detailing financial statements, any identified concerns, and recommendations-- this final report often shared with the board of directors and stakeholders. Subsequently, a management letter summarizing observations and suggestions for operational improvements typically follows within two weeks. Adhering to this structured timeline ensures nonprofit organizations maintain transparency and accountability in their financial reporting.

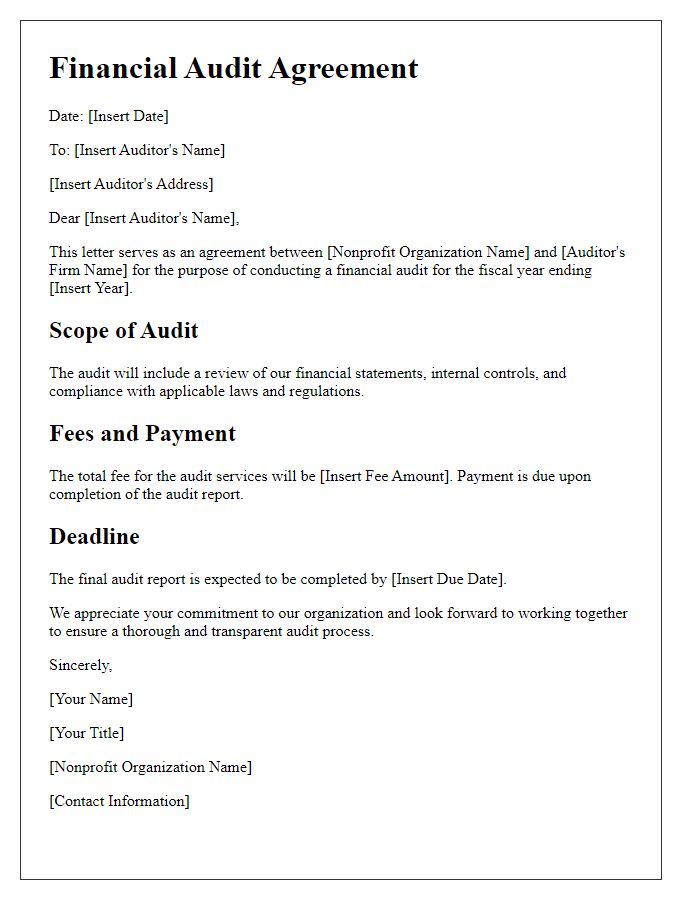

Fee Structure and Payment Terms

The fee structure for nonprofit organization audit engagements typically consists of three main components: base fees, additional services, and payment terms. Base fees are determined based on the organization's size and complexity, often starting at $5,000 for smaller nonprofits with straightforward financial operations. Additional services, which may include specialized compliance testing or grant preparation assistance, are generally charged at an hourly rate, commonly ranging from $150 to $300, depending on the expertise required. Payment terms usually involve an initial retainer, often 30% of the total fee, due upon engagement acceptance, with the remaining balance payable upon completion of the audit. Prompt payments ensure continued service and support, fostering a strong professional relationship that benefits both parties in fulfilling the organization's mission effectively.

Confidentiality and Data Protection

A comprehensive audit engagement for nonprofit organizations necessitates a robust framework for confidentiality and data protection. Nonprofits like Charity: Water, which operates globally, often handle sensitive donor information and financial data. Auditors must ensure the secure management of data in accordance with regulations like the General Data Protection Regulation (GDPR) enacted in Europe. Implementing secure data storage solutions, encryption technologies, and access controls can mitigate risks associated with unauthorized access to confidential information. Additionally, staff training on data protection policies is essential to foster a culture of confidentiality within the organization. Regular audits and assessments can further enhance data protection practices, ensuring compliance and safeguarding stakeholder trust.

Comments