Are bookkeeping errors keeping you awake at night? You're not alone! Many businesses face challenges with their financial records, and it's crucial to address these discrepancies promptly to keep your operations running smoothly. If you're looking for a simple yet effective way to rectify those errors, we've created a comprehensive letter template just for youâread on to find out how you can streamline this process!

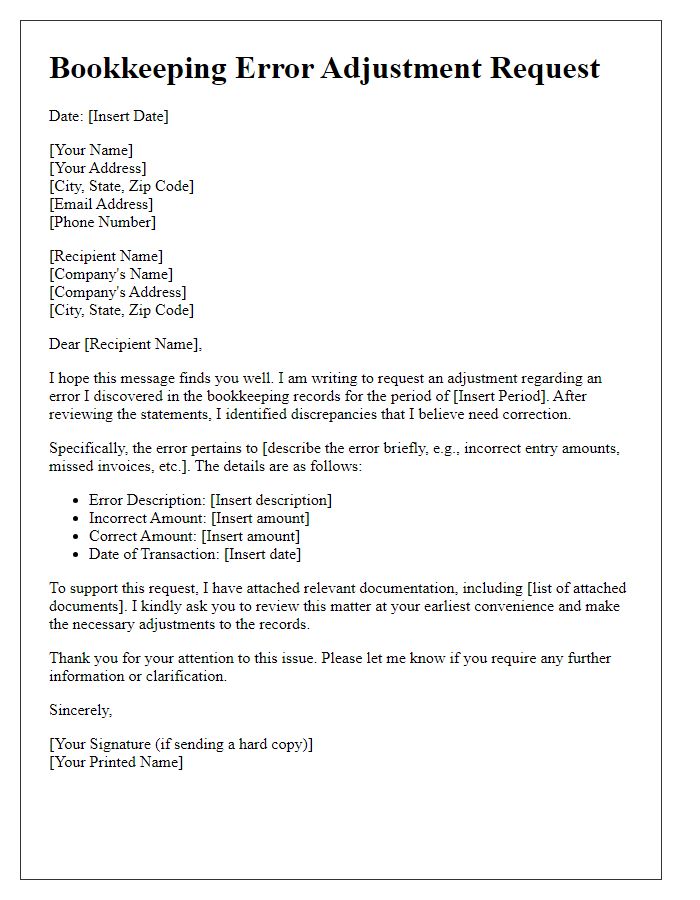

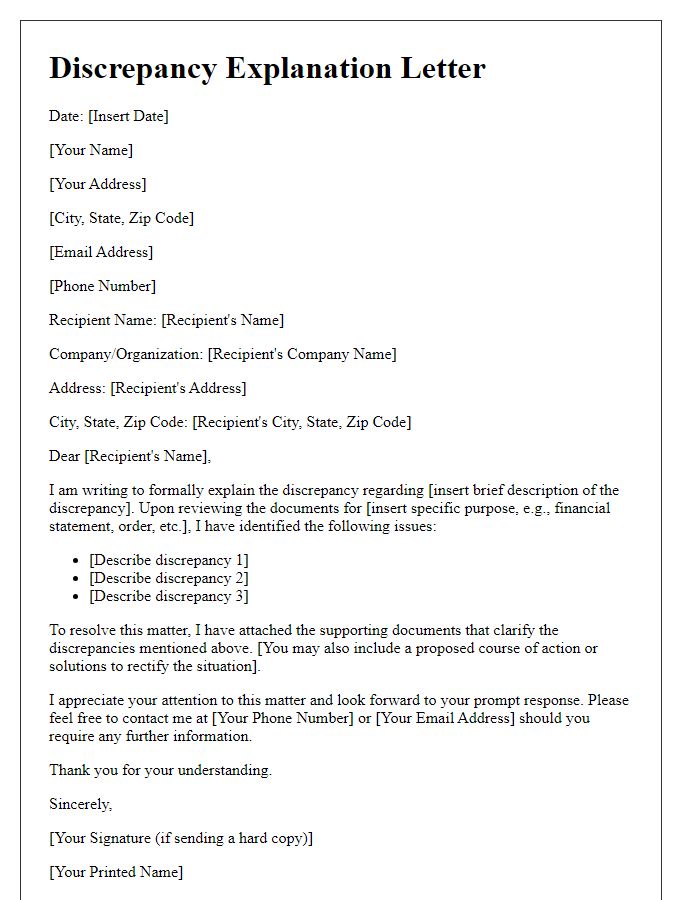

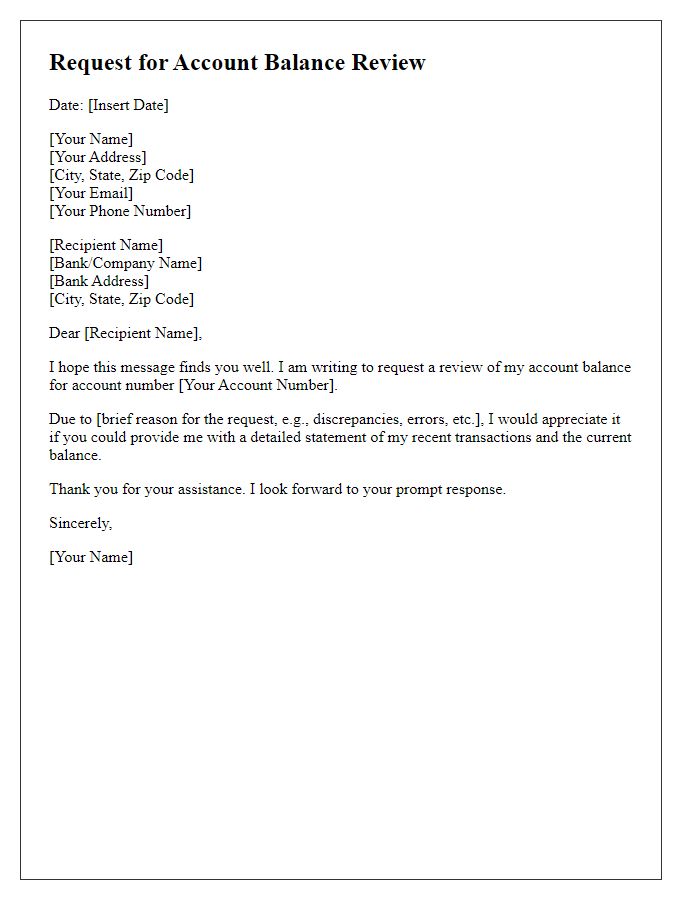

Recipient's name and contact information

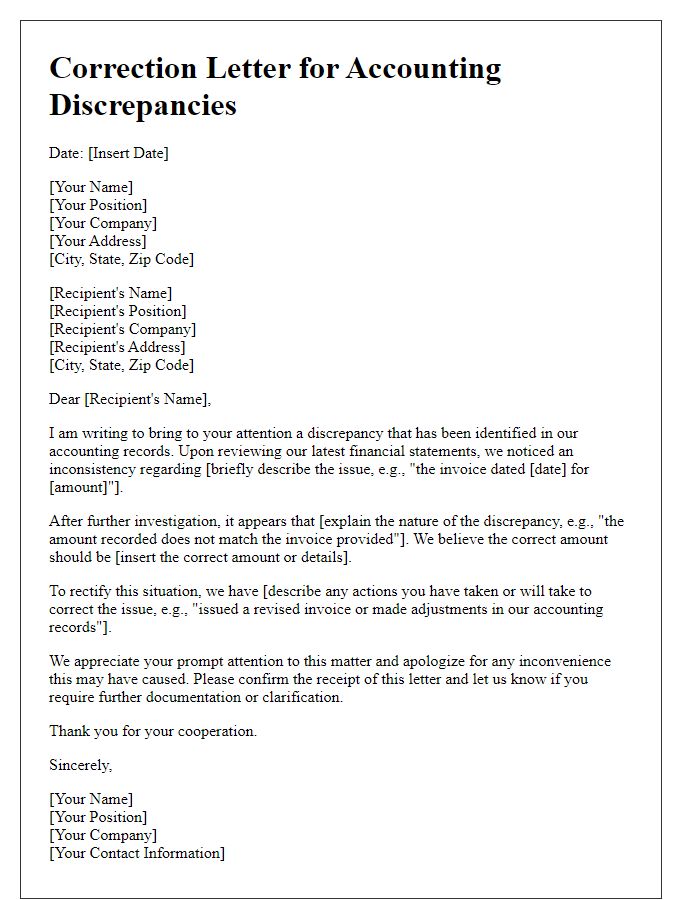

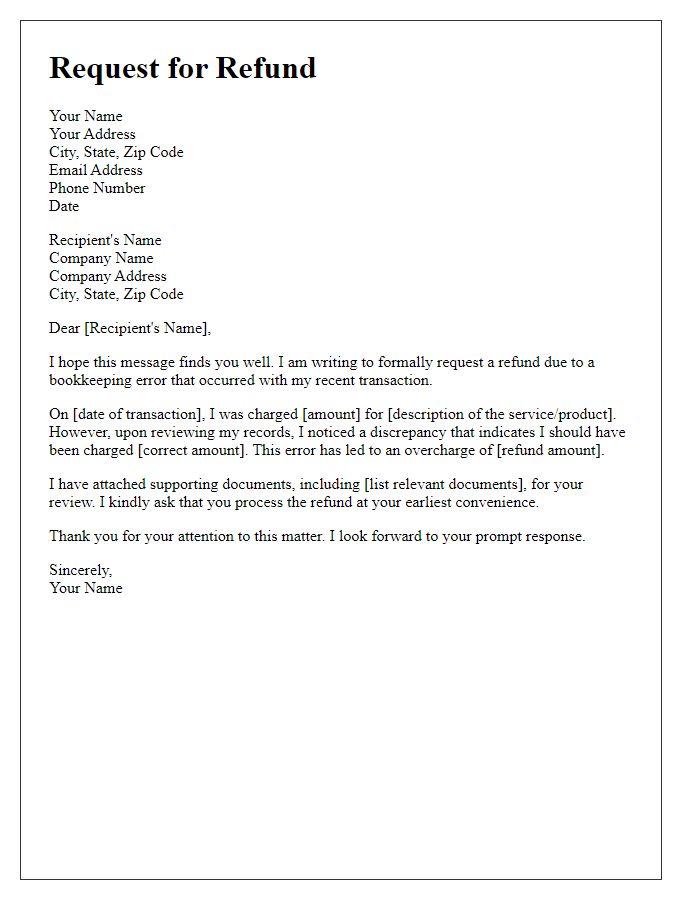

Inaccurate bookkeeping records can lead to significant financial discrepancies for organizations. A bookkeeping error often involves misclassified accounts, such as incorrectly categorizing expenses under assets, which can skew financial statements. Rectifying such errors requires meticulous attention to detail, particularly in documenting the original transaction date, amount, and affected accounts. For instance, a transaction from July 15, 2023, for office supplies purchased at a cost of $250 should properly reflect in the expense ledger to ensure accurate financial reporting. Identifying the source of the error, such as an overlooked invoice from a vendor like Staples, is crucial for correcting entries and maintaining integrity in financial documents. Regular audits can help prevent these errors from occurring, improving overall bookkeeping accuracy.

Explanation of error identified

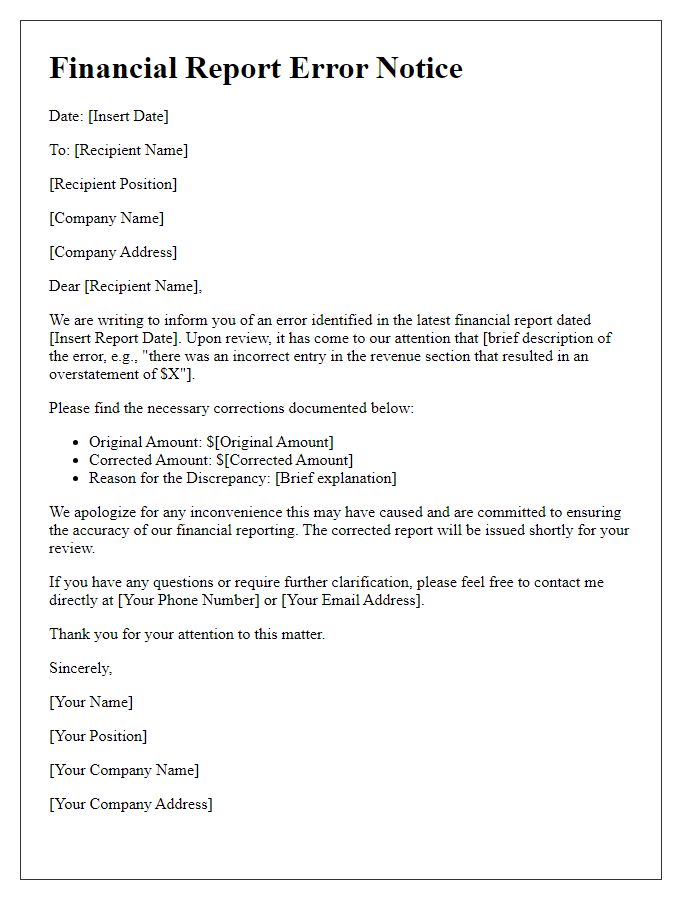

A bookkeeping error can significantly impact financial reports, such as those prepared under Generally Accepted Accounting Principles (GAAP). An example includes misclassifying expenses, where an office supply expense of $500 may be mistakenly recorded as a fixed asset. This misallocation can distort balance sheets, impacting decision-making processes in businesses, particularly in the service industry. Furthermore, if this error occurs in quarterly reports, it can lead to inaccurate projections for revenue and operational costs, affecting stakeholders' trust. Corrective actions generally involve identifying the specific ledger entries in accounting software like QuickBooks or Xero and accurately reclassifying them to restore financial integrity. Regular audits can help minimize such occurrences in the future.

Corrective measures taken to resolve the error

Bookkeeping errors can lead to significant discrepancies in financial records, impacting the overall integrity of an organization's accounting system. A systematic approach for rectification is essential. Identification of the specific error, such as miscalculated expenses or incorrect revenue entries, must occur first, enabling accurate adjustment. Corrective measures taken may involve updating the General Ledger (GL) entries, reconciling bank statements, and conducting a thorough audit of financial statements for the affected period, which might span monthly or quarterly reports. Utilizing accounting software, such as QuickBooks or Xero, assists in tracking any adjustments made along with documenting the process for future reference. Moreover, retraining bookkeeping personnel on error recognition and prevention techniques can enhance accuracy, ensuring that similar mistakes do not recur. Establishing a regular review system, possibly quarterly, can aid in maintaining an accurate and reliable set of financial records, contributing to the overall fiscal health of the organization.

Request for confirmation or acknowledgment

When addressing bookkeeping errors, businesses must acknowledge discrepancies in financial records, such as invoices (accounts payable), receipts (expenses), and bank statements. A legitimate inquiry seeks confirmation or acknowledgment from relevant parties, ensuring that all financial data aligns with compliance standards. For example, a review of the January 2023 financial statements may reveal a $500 discrepancy in the accounts receivable ledger, necessitating prompt communication with both clients and internal accounting teams. Clear documentation and timely follow-up are essential for maintaining accurate financial records and fostering trust among stakeholders.

Contact information for further communication

Inaccurate bookkeeping entries can lead to significant discrepancies in financial statements, impacting accuracy and compliance. For example, incorrect data entry, such as a misplaced decimal point in transaction amounts, can substantially alter revenue reports. It's essential to have clear communication channels for rectifying these errors. Typically, businesses should provide contact information, including a designated bookkeeping manager's email and phone number, allowing for prompt follow-up. Adhering to accounting principles, such as GAAP (Generally Accepted Accounting Principles), is crucial for maintaining transparency and addressing errors efficiently.

Comments