Are you ready to simplify your expense reimbursement process? Understanding the steps involved can save you time and ensure you get reimbursed quickly. Whether you're submitting travel expenses or seeking reimbursement for office supplies, knowing the right procedures makes all the difference. So, let's dive into the details and make this process as seamless as possible â read on to discover our comprehensive guide!

Purpose and Scope

The client expense reimbursement procedure establishes a systematic method for reviewing and approving expenditures incurred by employees during project-related activities. This process includes guidelines for eligible expenses, such as travel costs (airfare, hotel accommodations), meal allowances, and necessary materials (office supplies, software licenses) required for optimal project delivery. All claims must be submitted within a specified timeframe (typically 30 days post-expense), accompanied by relevant documentation like receipts and invoices, to ensure timely reimbursement. This procedure aims to foster transparency, maintain financial integrity, and provide clarity for employees navigating reimbursement requests to support efficient project execution and reporting.

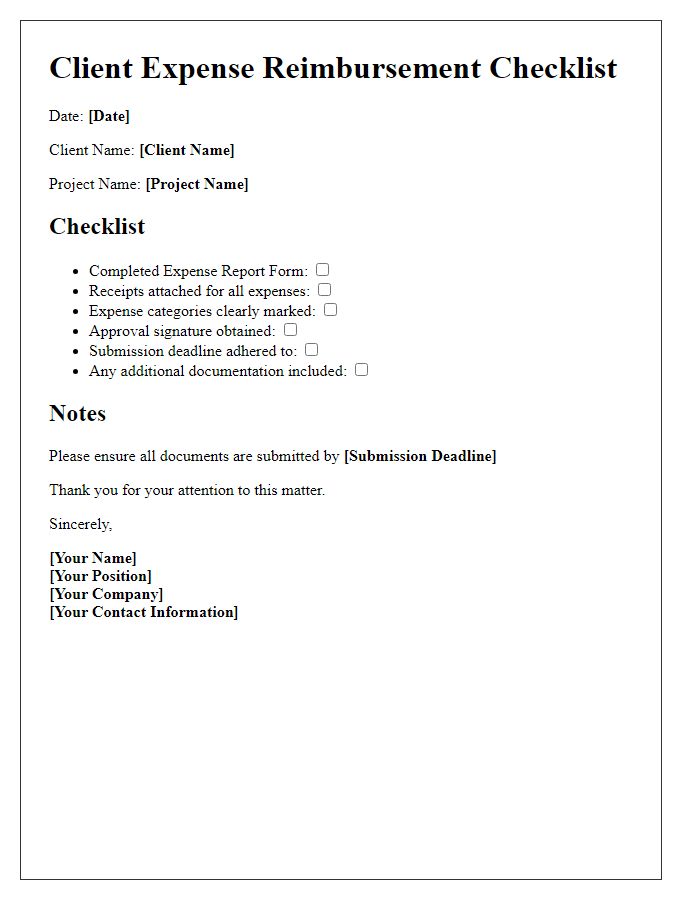

Eligibility Criteria

Eligibility criteria for client expense reimbursement procedures often include several key factors. First, expenses must be directly related to business activities or projects approved by the organization, ensuring alignment with operational goals. Second, documentation requirements necessitate detailed invoices, receipts, or other proof of expenditure for transparency and accuracy, with a minimum threshold often defined (e.g., expenses exceeding $25). Third, eligible expenses typically encompass travel costs, accommodation fees, meals during business meetings, and necessary supplies. Fourth, expenses incurred outside of policy guidelines, such as personal expenses or non-business-related activities, are non-reimbursable, promoting responsible spending practices. Lastly, there may be a submission deadline, often within 30 days of incurring expenses, to facilitate timely processing and maintain financial accountability.

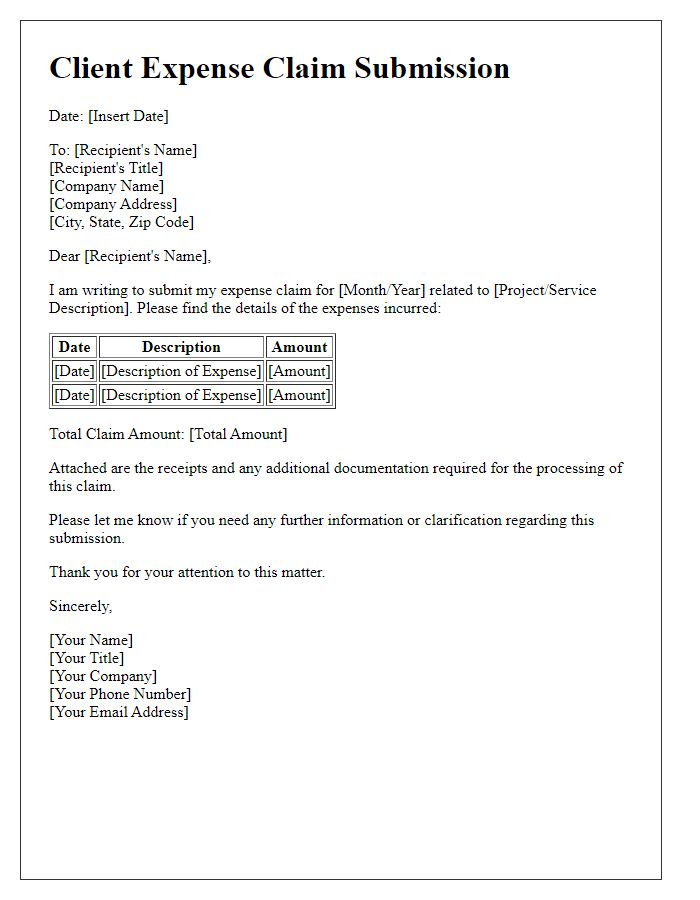

Required Documentation

The client expense reimbursement procedure necessitates supporting documentation for claims submission. Acceptable documents include original receipts detailing the transaction, dated invoices specifying services rendered, and travel itineraries for expenses related to journeys. Expense reports must itemize costs, indicating purpose, date, and amount, ensuring clarity for finance departments. In cases of meal expenses, documentation should also include the names of participants and their business relationship. Accurate and complete documentation expedites reimbursement, typically processed within 30 days of submission, adhering to company policy guidelines.

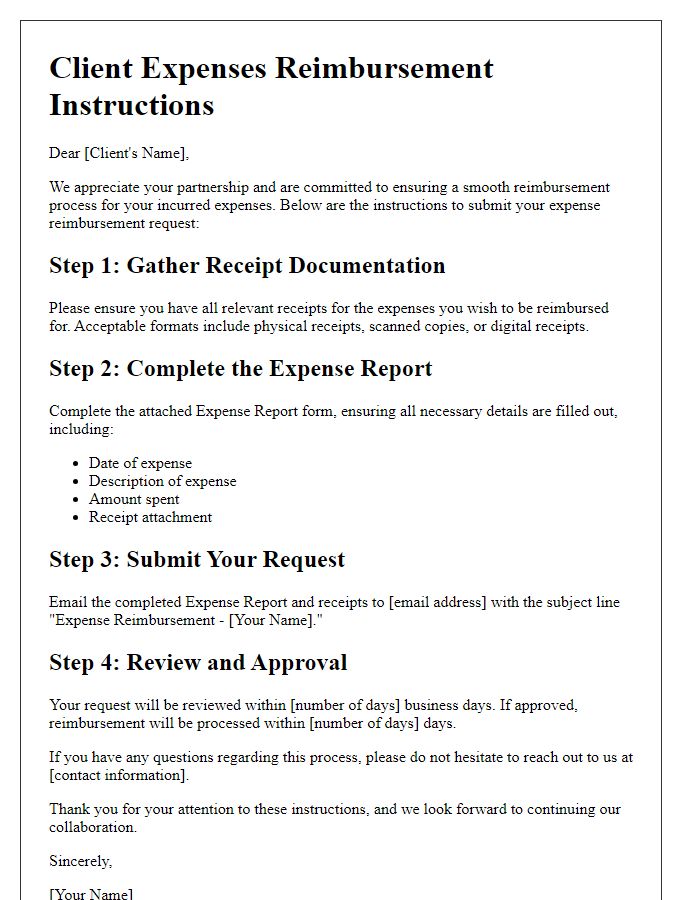

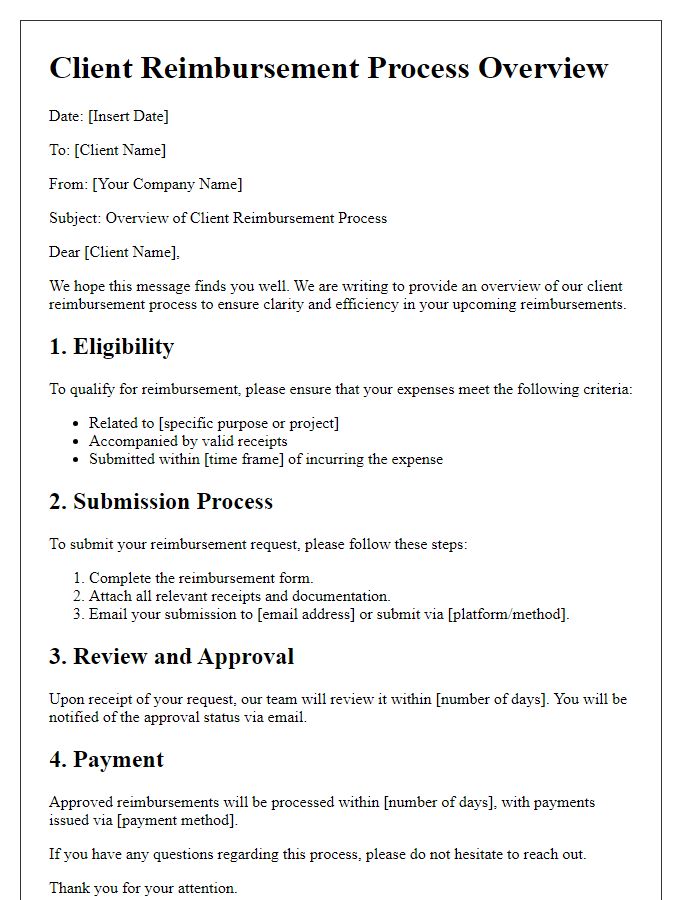

Submission Process

Submitting expense reimbursement requests entails following specific protocols to ensure prompt processing. Employees must complete a designated expense report form (usually digital) provided by the finance department. This form requires detailed entries for each expense, including date, purpose, amount, and accompanying receipts (original documents; digital copies may be acceptable based on the company's policy). Submissions should be sent to the finance department within a specified timeframe, typically within 30 days of incurring the expense. Proper documentation ensures compliance with corporate policies and facilitates accurate auditing processes. Employees should retain copies of submitted forms and receipts for personal records. Timely submissions specifically enhance cash flow management and promote operational efficiency within the organization.

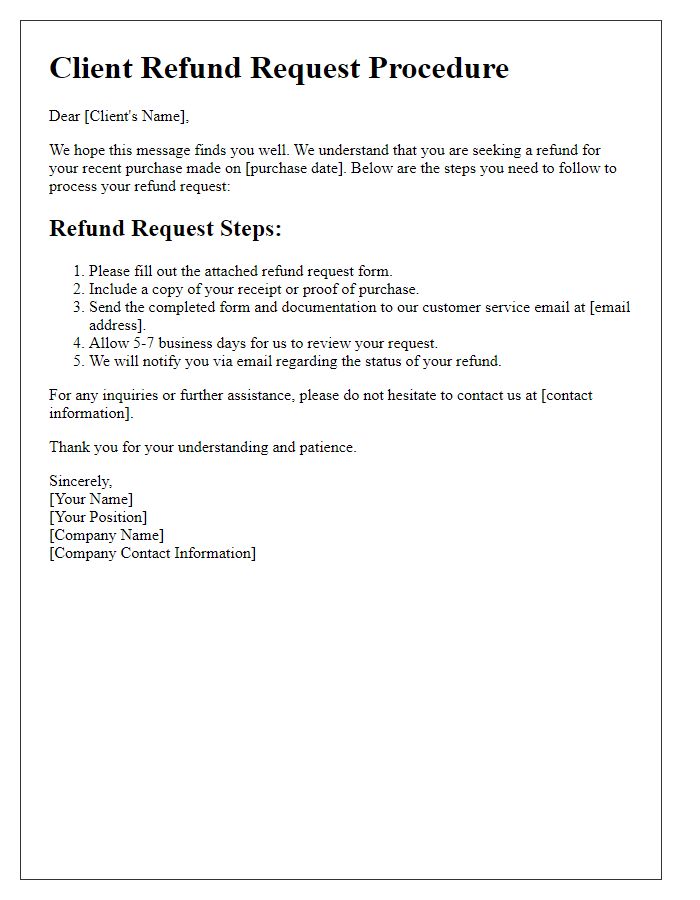

Approval and Reimbursement Timeline

The expense reimbursement procedure for clients involves a systematic approach to approval and reimbursement timelines. Step one revolves around submitting expense reports within 30 days following a project event, such as a conference or business meeting, conducted in cities like New York or San Francisco. Each submission must include itemized receipts for expenses, detailing costs associated with categories like travel, accommodation, and meals. The second step entails obtaining managerial approval, typically within five business days, where supervisors review the legitimacy of expenses against the company's policy guidelines and budget constraints. Once approved, the reimbursement request is submitted to the finance department, where processing will occur within a 14-day timeframe, ensuring that clients receive their funds promptly following the approval. This structured timeline ensures clarity and efficiency for both clients and the organization.

Comments