Are you feeling overwhelmed by the VAT refund process? You're not aloneâmany individuals and businesses face challenges when trying to navigate this complicated maze of paperwork and regulations. Fortunately, with the right template for your VAT refund request, you can streamline the process and improve your chances of a successful outcome. Ready to simplify this task? Dive into our comprehensive guide to learn more!

Clear Subject Line

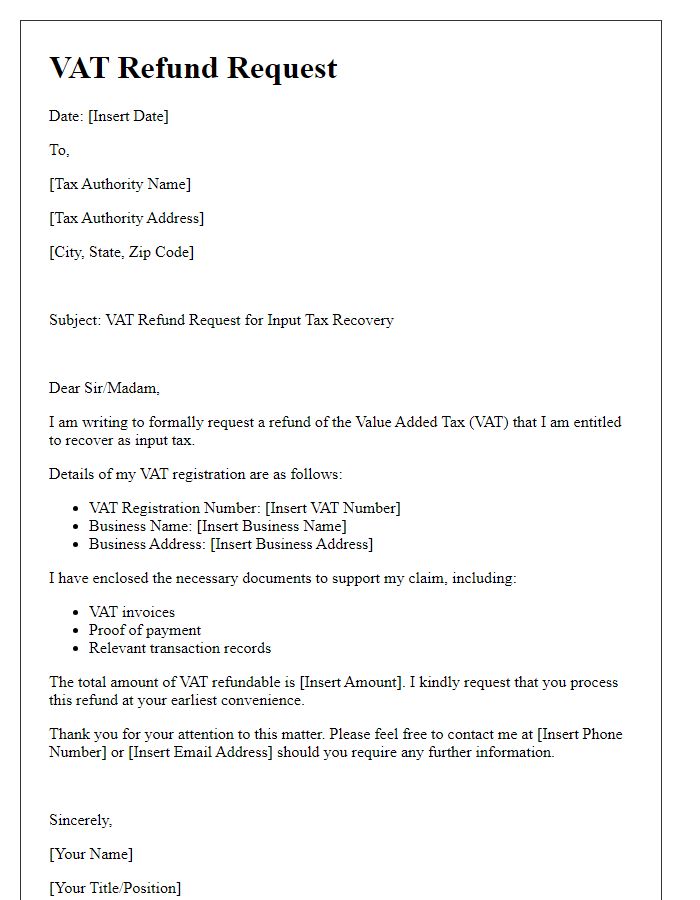

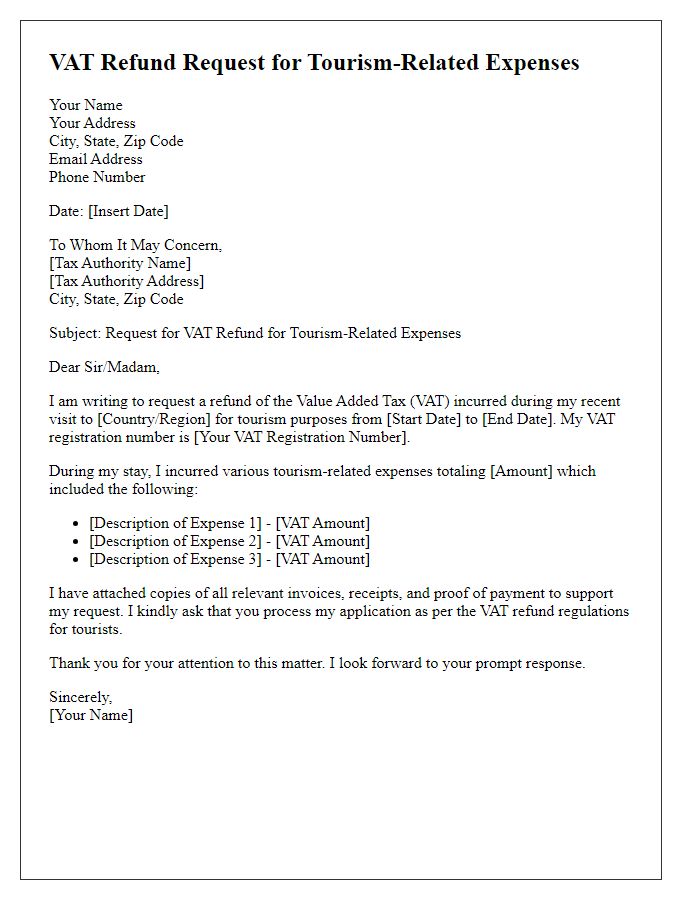

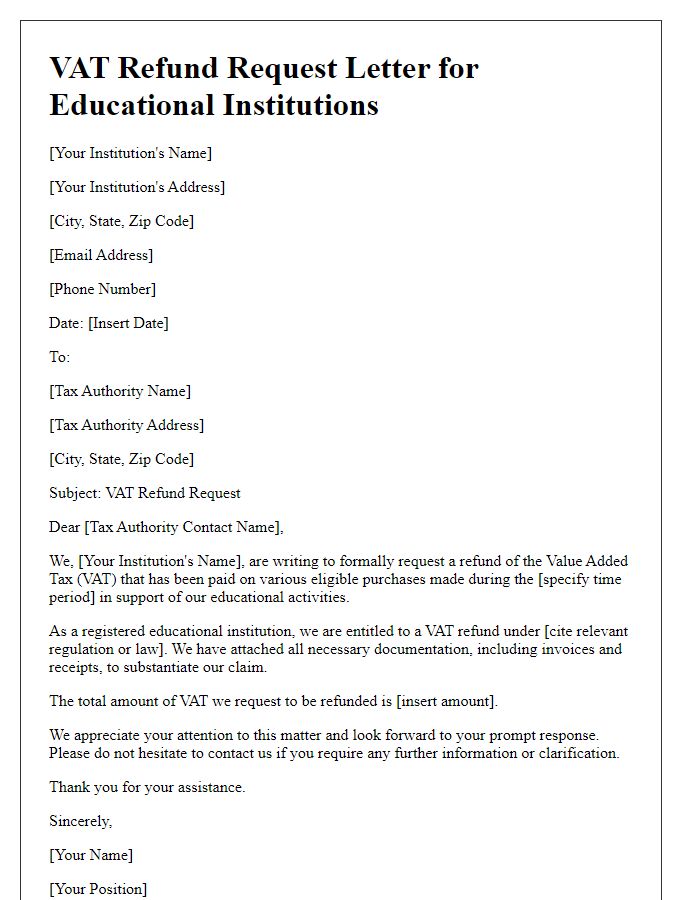

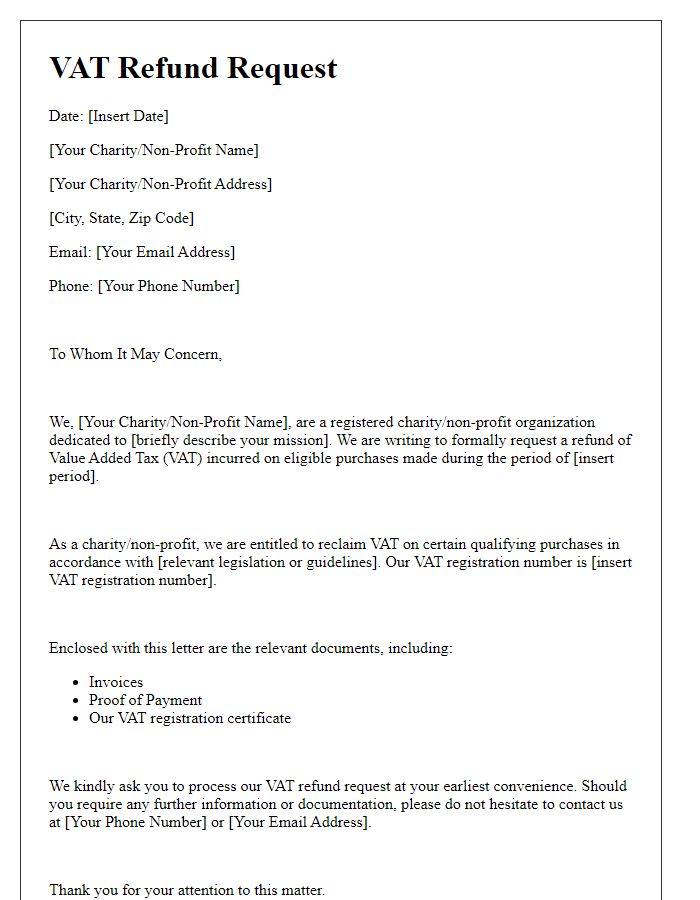

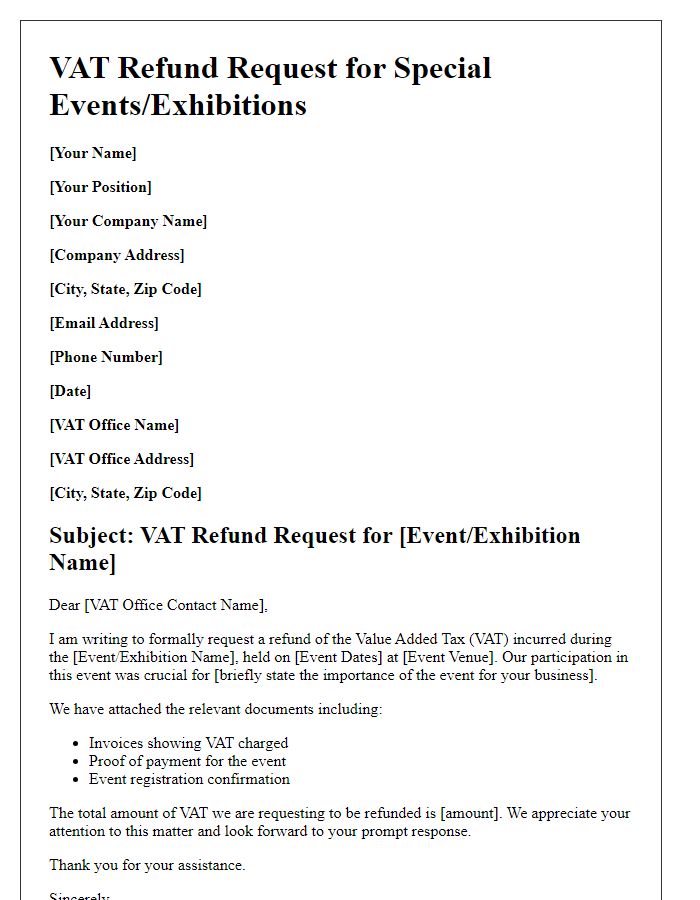

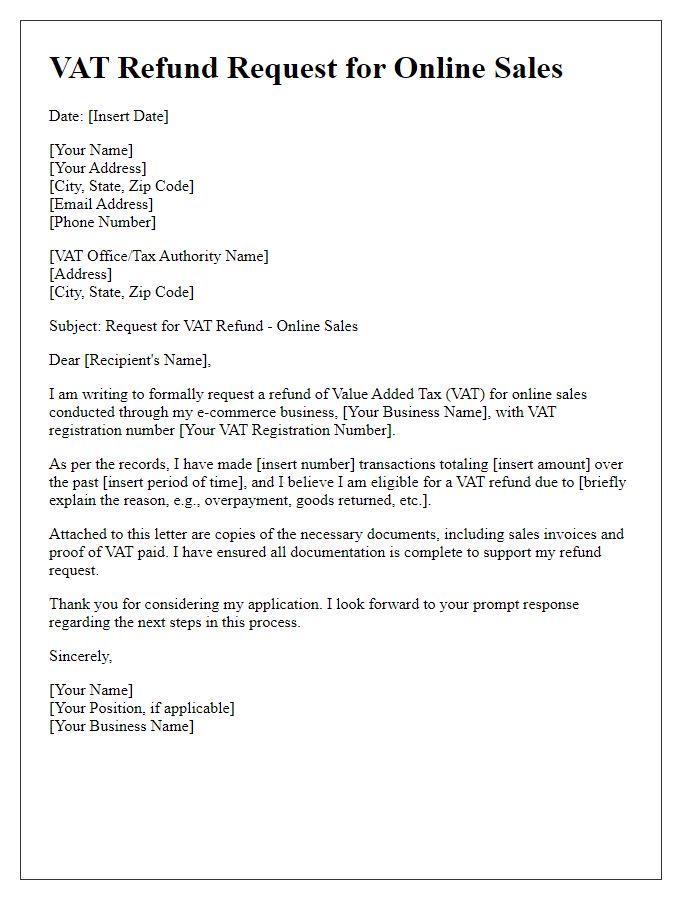

VAT refund requests can be submitted via a structured approach to ensure clarity. The subject line should succinctly state the purpose, such as "VAT Refund Request for Transaction ID #12345." This aids in proper categorization and urgency. Include essential details in the body, like the refund amount (e.g., PS500), related transaction date (e.g., March 15, 2023), and supporting documentation (such as purchase receipts and invoices). Ensure inclusion of relevant personal or business information, including VAT registration number, to establish validity. Always specify the preferred method for refund processing, such as bank transfer or cheque. This transparent communication facilitates smoother handling of requests.

Complete Contact Information

To initiate a VAT refund request, individuals and businesses must submit detailed contact information to facilitate the process. Essential elements include full name (including titles), which identifies the requester. The postal address must be precise, including the street address, city (such as London), postal code (for instance, EC1A 1BB), and country (like the United Kingdom). An email address is crucial for electronic communication, ensuring timely updates. Additionally, a valid phone number, typically including the country code, allows authorities to reach out for clarification or additional information. Business entities may also need to include the company registration number, VAT registration number (e.g., GB123456789), and registered office address to associate the refund with the correct tax account. Providing accurate details expedites the review process and minimizes delays.

Detailed Transaction Information

VAT refunds can significantly impact cash flow for businesses, particularly in the European Union, where Value-Added Tax is prevalent. Proper documentation of detailed transaction information is crucial for a successful submission. This includes the transaction date (format: DD/MM/YYYY), invoice number, supplier details (name, address, VAT registration number), goods/services description, transaction amount (including VAT), and the total VAT amount claimed. Compliance with regulations set by the local tax authority, such as HM Revenue and Customs (HMRC) in the UK or the Federal Central Tax Office (BZSt) in Germany, requires meticulous record-keeping. Accurate submission can streamline the refund process, minimizing delays and ensuring that businesses retain the necessary financial liquidity for operations.

Specific VAT Amount Claimed

Specific VAT amounts claimed for refund submissions can significantly vary based on business activities and purchases. For instance, businesses involved in exporting goods may seek refunds on Value Added Tax (VAT) paid, often amounting to thousands of dollars depending on the volume of transactions. In the United Kingdom, a VAT registered company can submit a claim through the HM Revenue and Customs (HMRC) system, detailing specific figures from financial documents like invoices. Accurate record-keeping is essential, as discrepancies may lead to delayed processing or rejection of the claim. Completing the VAT refund application requires a comprehensive breakdown of claimed amounts alongside supporting documentation, such as purchase receipts, which must be retained for a minimum of six years to comply with UK regulations.

Formal Closure and Signature

A VAT refund request submission concludes with a formal closure, which typically includes a polite statement of gratitude for the attention given to the request and anticipation for a timely resolution. The signature section comprises the name, title, and contact information of the requester. The date of the submission should be clearly indicated. Adhering to these formalities ensures clarity and professionalism in the communication, vital in contexts involving financial transactions and regulatory compliance.

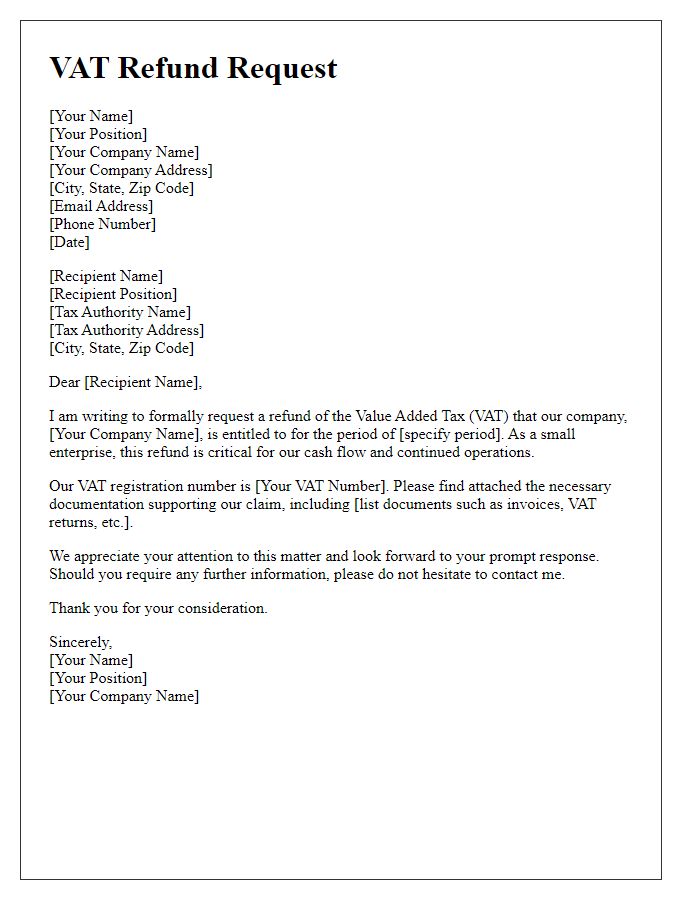

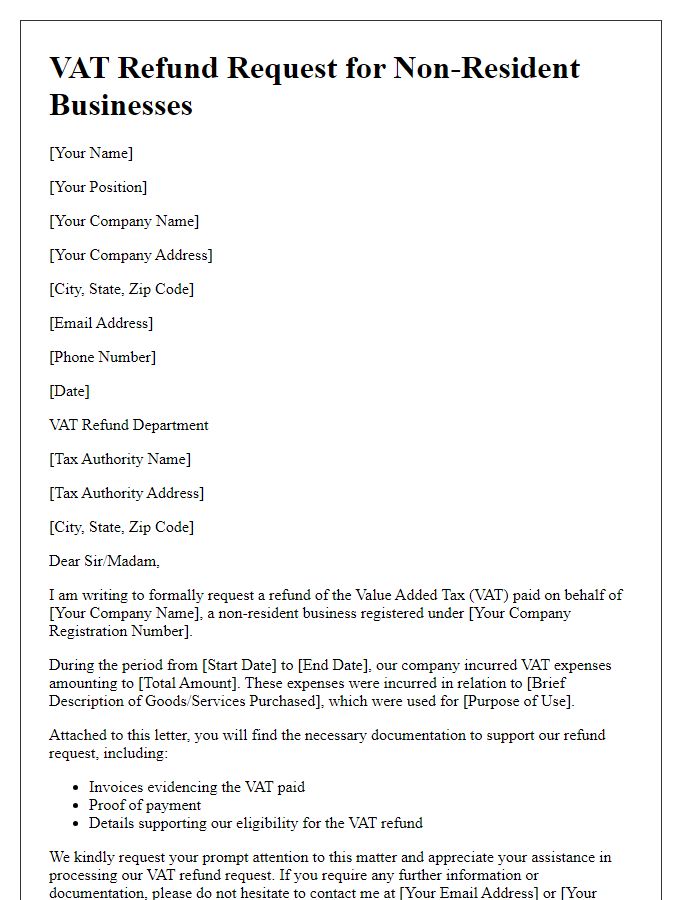

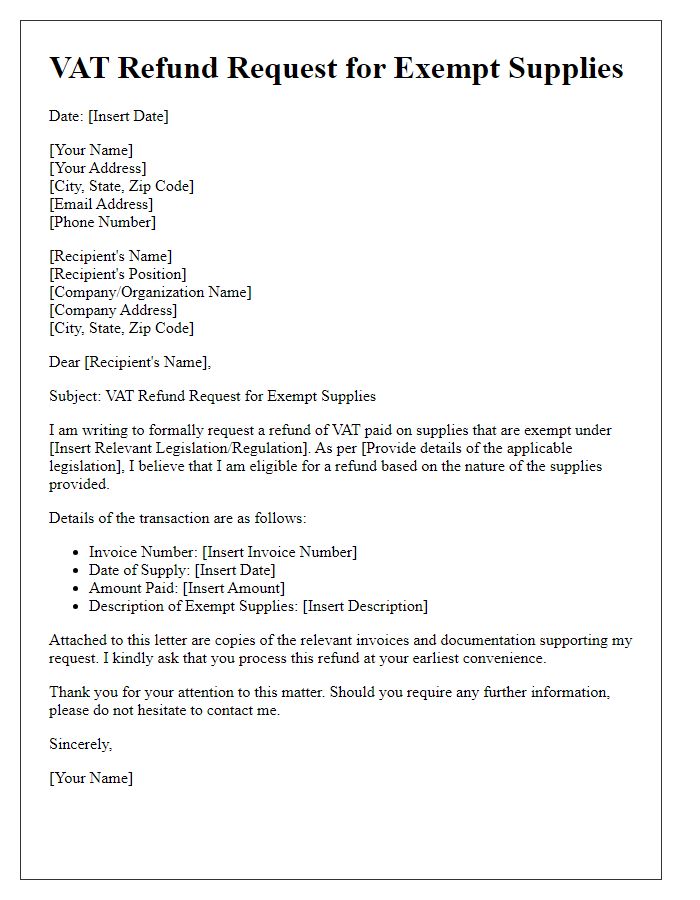

Letter Template For Vat Refund Request Submission Samples

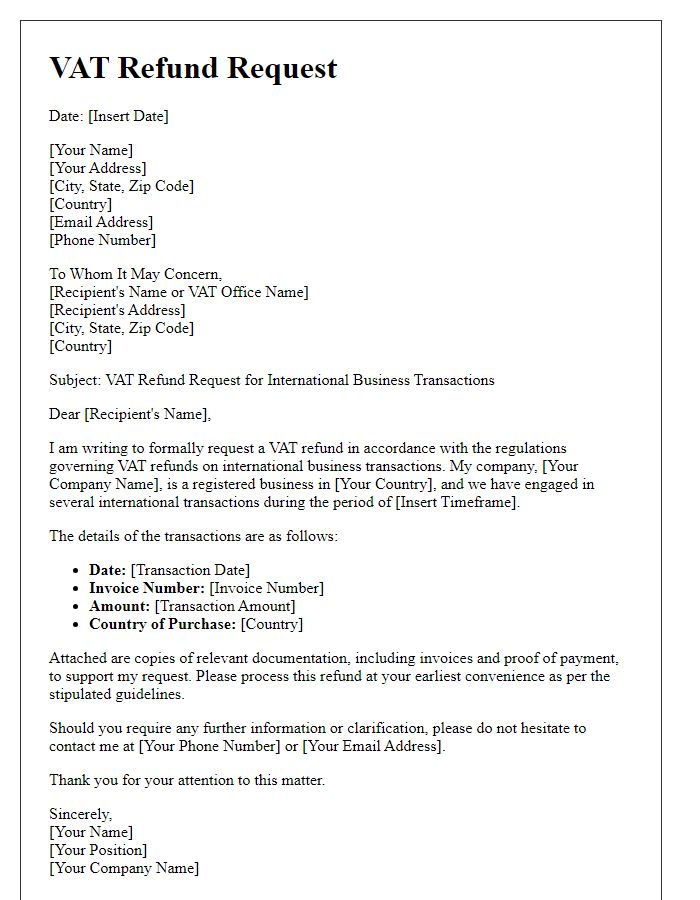

Letter template of VAT refund request for international business transactions

Comments