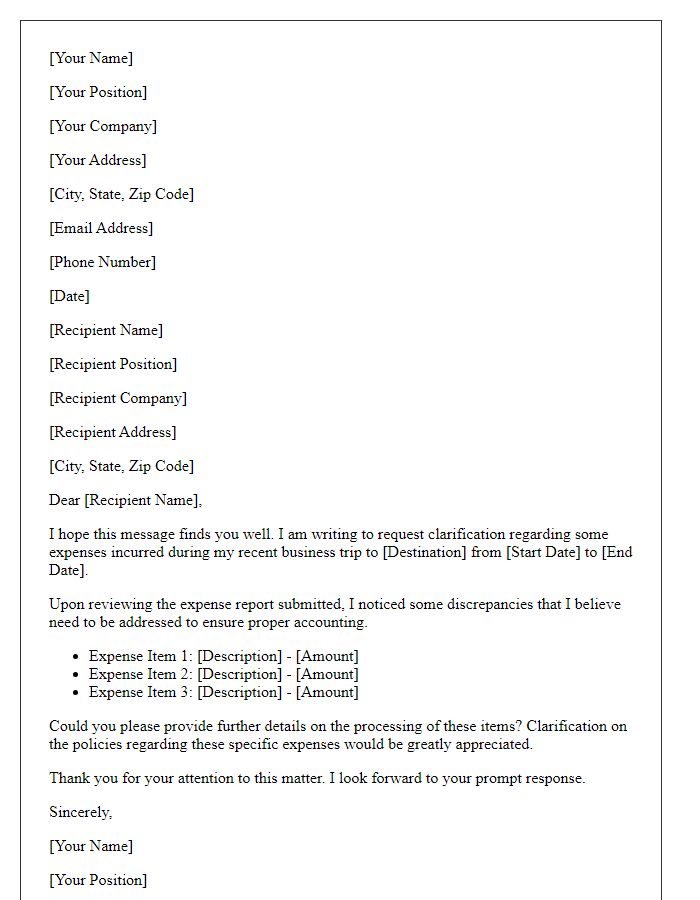

Are you feeling a bit overwhelmed by the intricacies of business travel expense reporting? Navigating through various policies, receipts, and reporting forms can sometimes feel like a daunting task. But don't fretâthis guide aims to simplify the process and ensure you're equipped with all the essential knowledge you need to streamline your expense reporting. So, grab a cup of coffee and let's dive into the details that will make your next business trip a breeze!

Purpose of the report

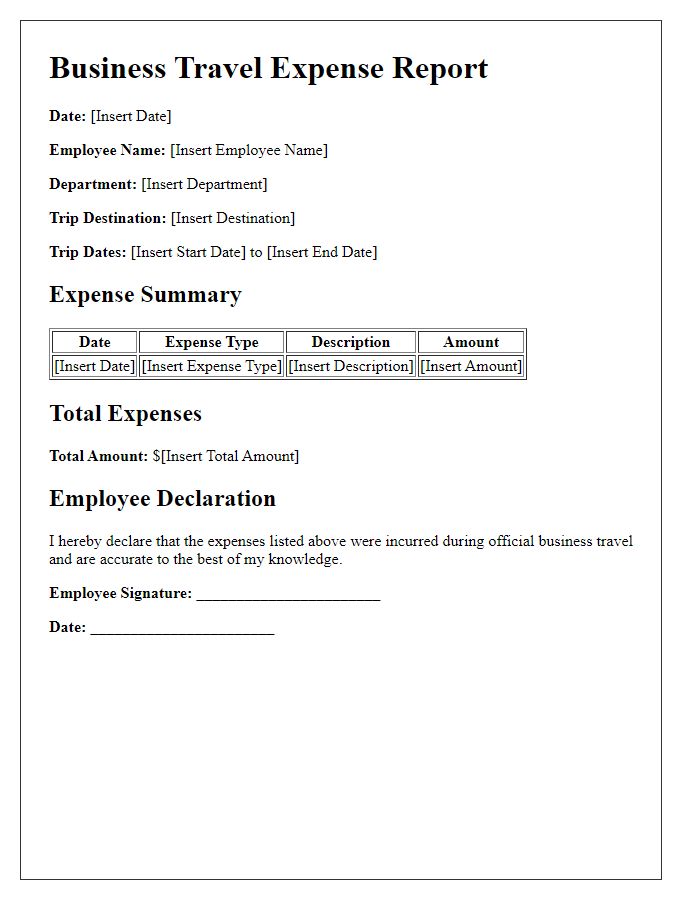

The purpose of the business travel expense report is to provide a comprehensive overview of expenditures incurred by employees during official trips, ensuring adherence to company policies for financial accountability. This document serves to categorize expenses associated with transportation (flights, taxis, car rentals), accommodation (hotels, lodgings), meals (per diem allowances), and incidentals (supplies, tips) while adhering to budget limits established by the organization. Accurate reporting facilitates timely reimbursements, enhances fiscal tracking, supports budget planning for future trips, and fosters transparency within financial operations. Proper documentation, including receipts and invoices, is essential to validate expenses claimed. This process is critical for maintaining organizational integrity and compliance with tax regulations.

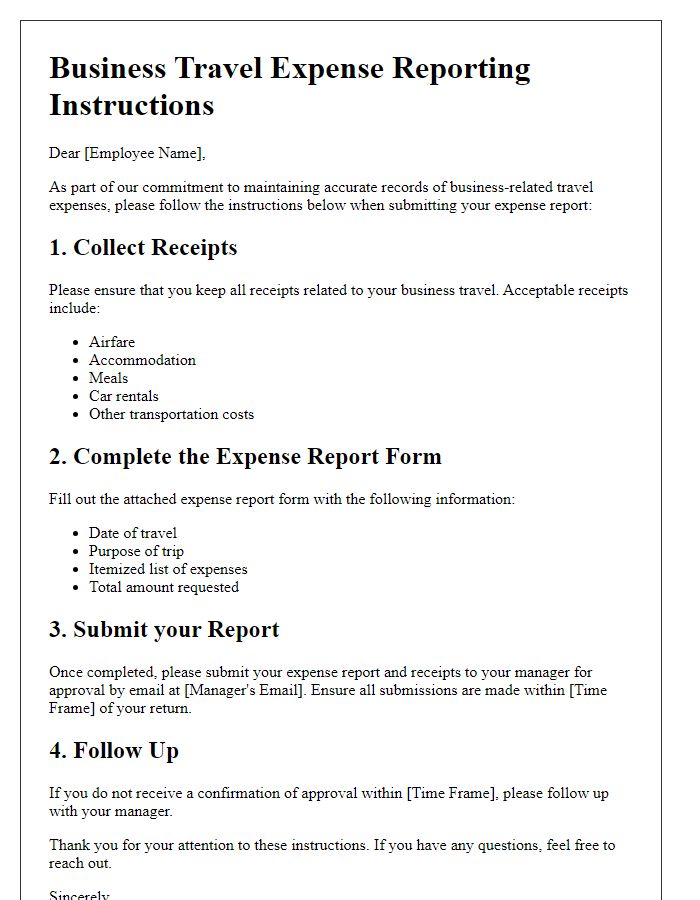

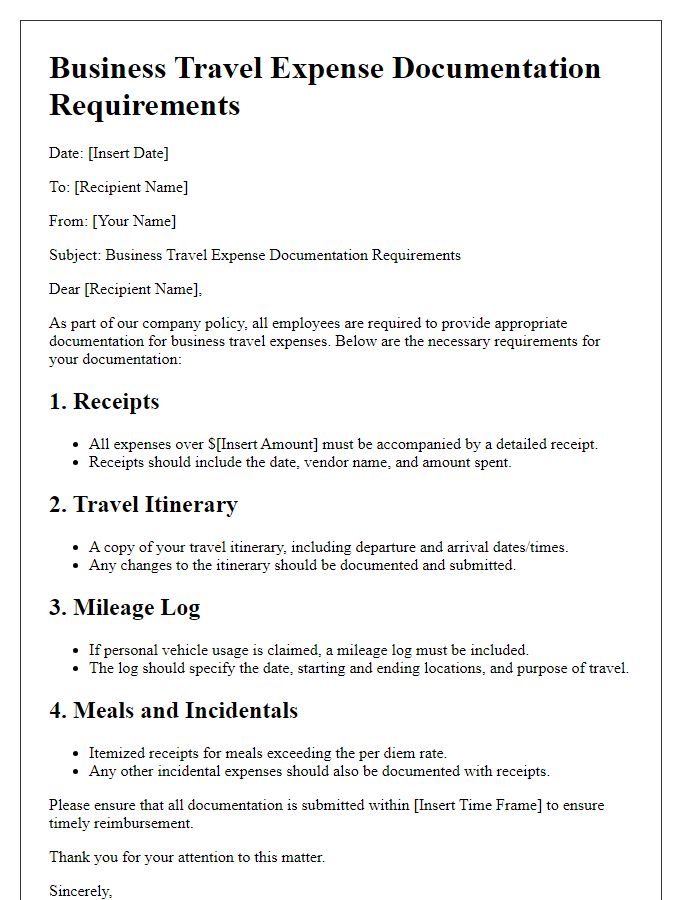

Required documentation and receipts

Accurate documentation is essential for business travel expense reporting processes. Receipts must include clear details such as date, vendor name, and itemized costs for transactions, typically under company policies for reimbursement in organizations like the IRS standards. Travel itineraries, including flight details from airlines such as Delta or American Airlines, should accompany claims. Meal receipts should reflect expenses in compliance with per diem rates outlined by the GSA (General Services Administration) in the United States, ensuring adherence to budget guidelines. For lodging, invoices from hotel chains like Marriott or Hilton must show the duration of stay, breakdown of charges, and any applicable taxes. Submission of all documentation within stipulated deadlines--often 30 days post-travel--ensures timely reimbursement and compliance with company regulations.

Submission deadlines

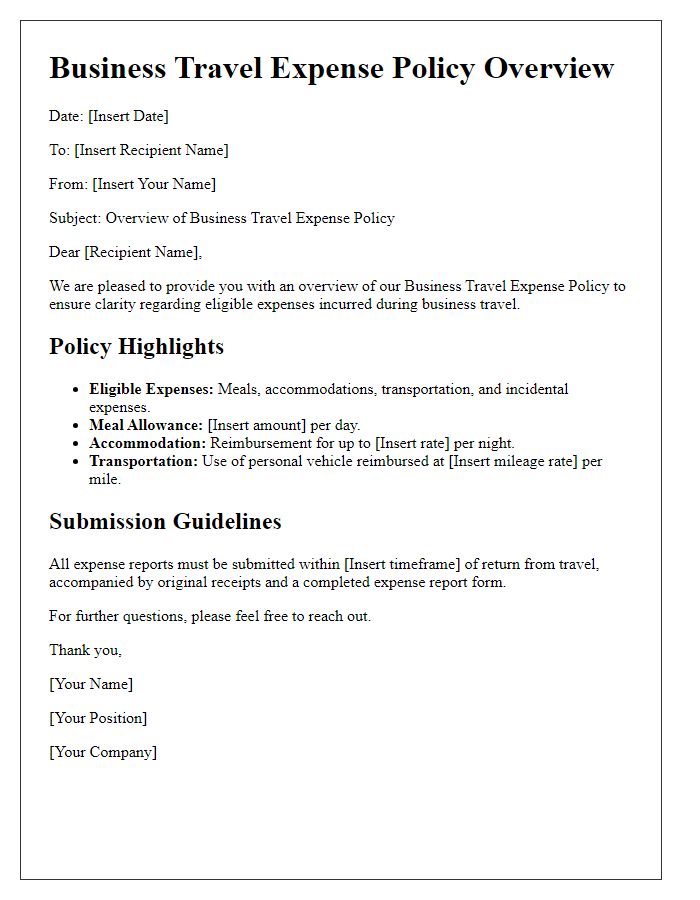

Timely submission of business travel expense reports is crucial for efficient financial management within organizations. Companies often establish specific deadlines, typically within 30 days post-travel completion, to ensure prompt reimbursement and accurate budget tracking. Late submissions can result in complications, such as delayed payments or disallowance of certain expenses. Employees must adhere to their respective company's policies, as outlined in the employee handbook, regarding required documentation and format of receipts. Utilizing expense reporting software, like Concur or Expensify, often facilitates quicker processing. Additionally, employees are encouraged to keep a detailed travel log that includes dates, locations (such as cities visited), and purposes of business activities. Following these guidelines ensures a smoother expense reporting process and maintains the company's financial integrity.

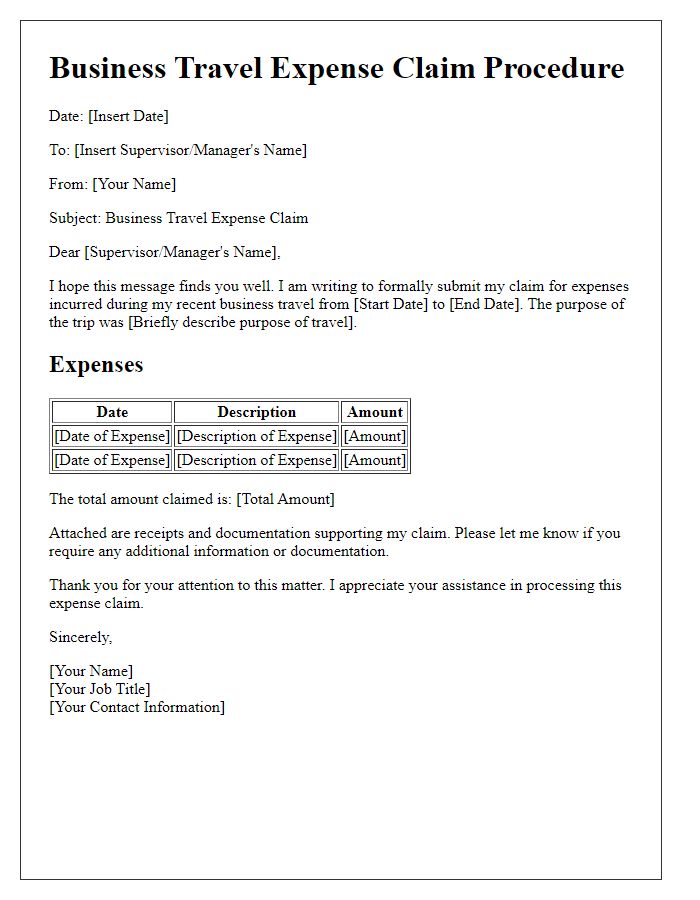

Approval process

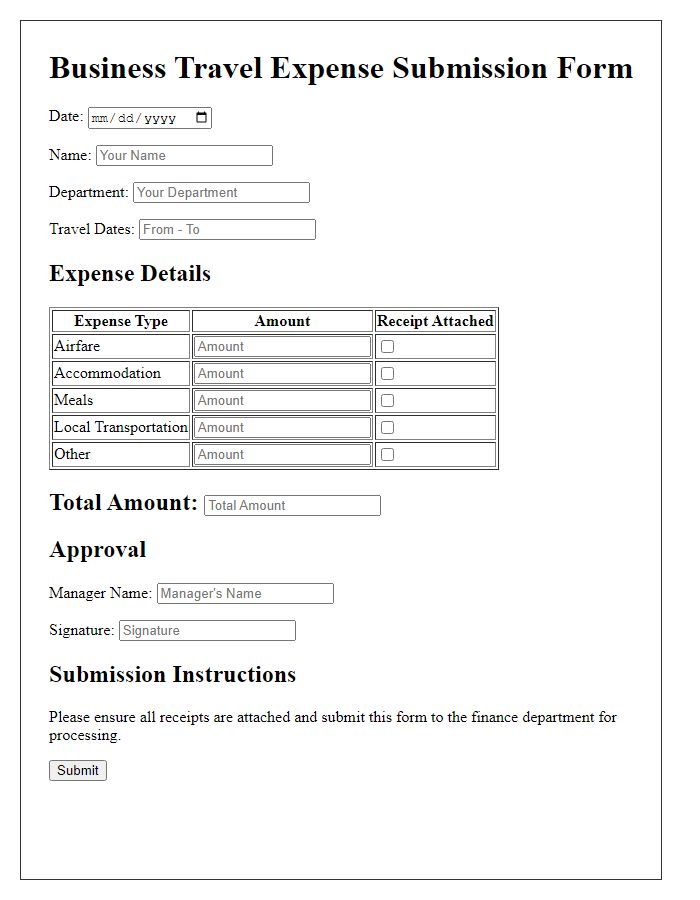

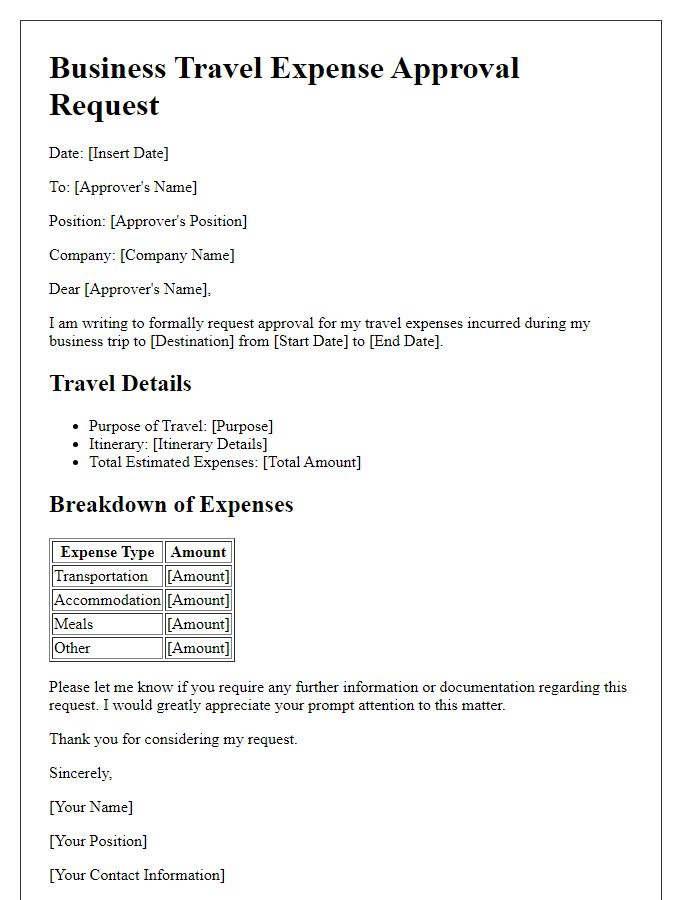

Business travel expense reporting requires adherence to specific approval processes to ensure financial accountability. Employees must submit their expense reports, including receipts, within 30 days of completing their travel. Approval flows through several levels, beginning with immediate supervisors who review the submitted expenses against the company's travel policy, which outlines allowable expenses and limits. Following supervisor approval, reports are forwarded to the finance department, where staff confirm compliance with budgetary constraints and initiate reimbursement processes. Timely submissions (within the outlined 30 days) facilitate quicker reimbursements, ensuring that employees are reimbursed for allowable costs such as airfare, lodging, meals, and necessary transportation. Companies typically use designated software (like Concur or Expensify) for tracking and streamlining expense reporting, enhancing efficiency and reducing discrepancies.

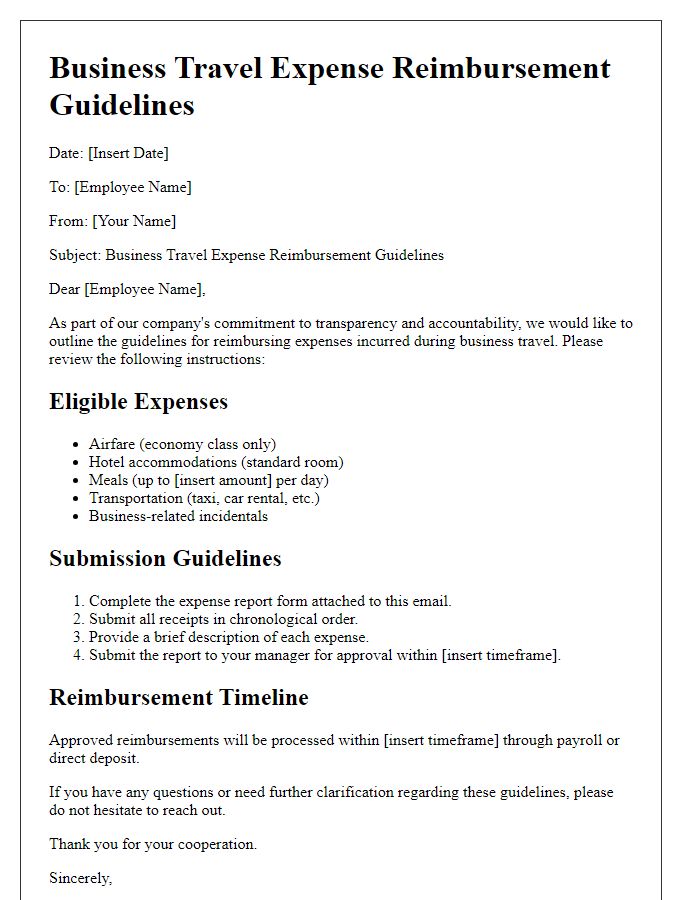

Reimbursement procedures

Business travel expense reporting requires meticulous adherence to established reimbursement procedures to ensure prompt and accurate refunds. Employees must meticulously document all expenses, including receipts for lodging, meals, transportation such as taxis or rideshares, and incidental costs. Each expense should clearly indicate the date, amount, and purpose, linked to the specific trip, such as client meetings in New York City or conferences held in San Francisco. Submission deadlines are critical; reports generally must be filed within 30 days of the travel date to streamline processing. All submissions should be directed to the finance department at corporate headquarters, ensuring they follow the company's expense policy guidelines, including allowable per diem rates and travel class restrictions. Following these guidelines facilitates efficient processing and minimizes delays in reimbursement.

Comments