Are you curious about how companies distribute dividends and the forecasts that guide these decisions? Understanding dividend distribution can seem complex, but it's crucial for both investors and stakeholders. In this article, we'll break down the key factors that influence a company's dividend policies and how these forecasts can impact your investments. Join us as we explore the fascinating world of dividends and discover insights that could enhance your financial strategies!

Clear subject line

Dividend distribution forecasts provide investors with essential insights into a company's financial health and future plans. Typically announced quarterly or annually, these forecasts outline expected payment dates, amounts, and the total anticipated distribution based on profits from operations. Key financial metrics, such as Earnings Per Share (EPS) and Return on Equity (ROE), significantly influence these projections. Institutions such as SEC (Securities and Exchange Commission) play a crucial role in ensuring transparency in these forecasts, affecting investor confidence. Additionally, historical patterns of dividend payout ratios provide context, allowing for comparisons against market trends affecting similar industry sectors.

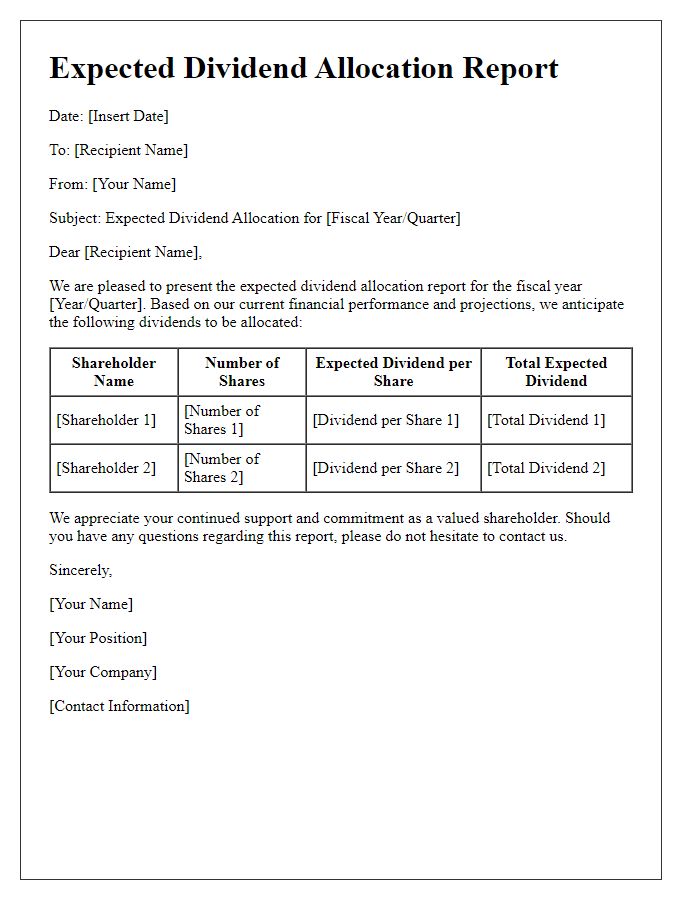

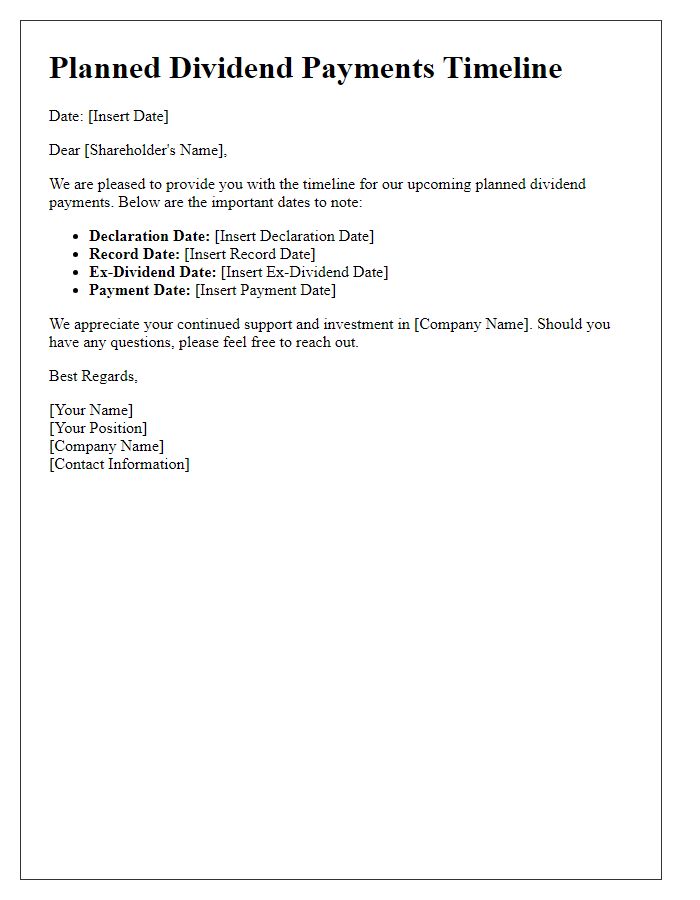

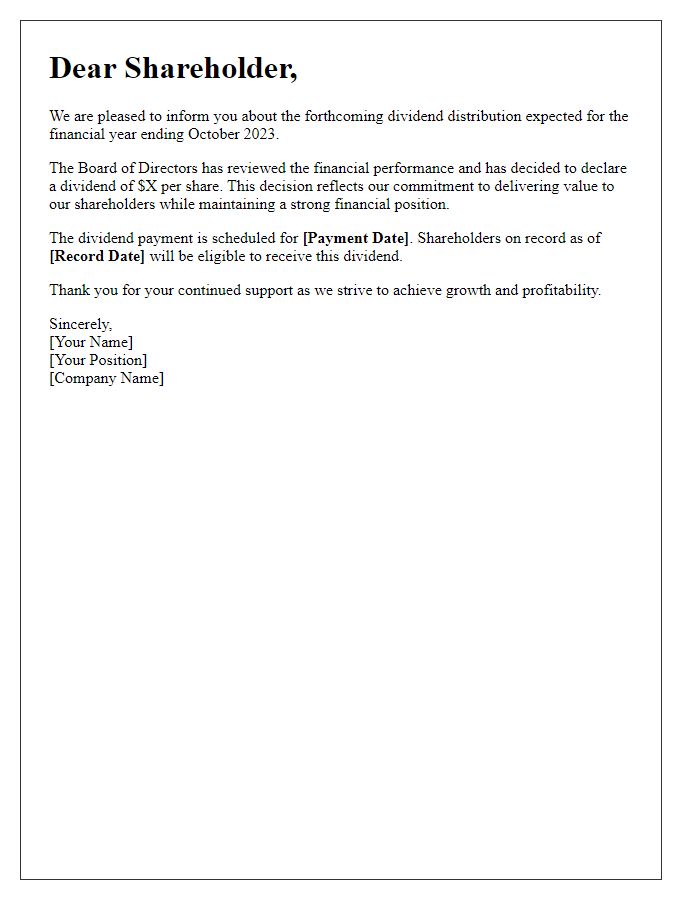

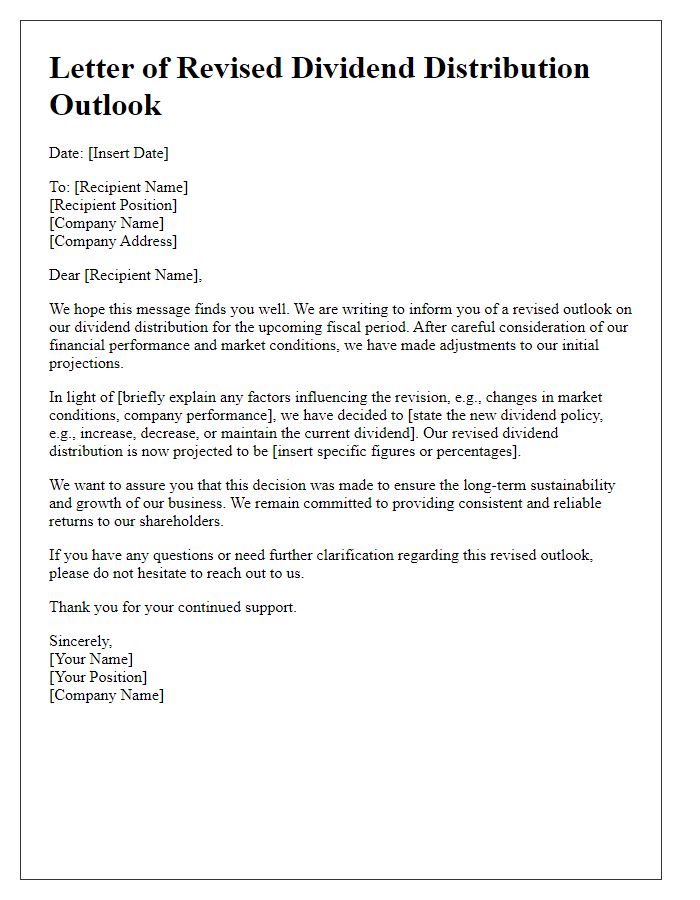

Company letterhead and date

Company letterhead displays the logo and contact information prominently at the top of the page. The date, formatted as Day Month Year, is positioned below the letterhead on the left side. Following the date, the letter should address shareholders, detailing the anticipated dividend distribution based on financial analysis and forecasts. Key metrics such as earnings per share (EPS), historical dividend payout ratios, and projected growth figures should be included for clarity. The letter should emphasize the company's commitment to returning value to shareholders while outlining potential risks and considerations. A conclusion may reinforce confidence in the company's long-term strategy, along with a warm invitation for shareholder feedback or inquiries.

Introduction paragraph

Dividend distribution forecasts play a crucial role in informing shareholders and potential investors about the expected allocation of profits from a company. This financial strategy, executed by corporations such as publicly traded companies listed on stock exchanges, outlines anticipated cash payments to shareholders (often on a quarterly basis) derived from the company's earnings (net income). Analysts typically utilize factors like historical payout ratios and current earnings estimates to project future dividends, fostering confidence in investment opportunities. Essentially, transparent forecasting regarding dividend policies can enhance investor relations and lead to increased stock valuation.

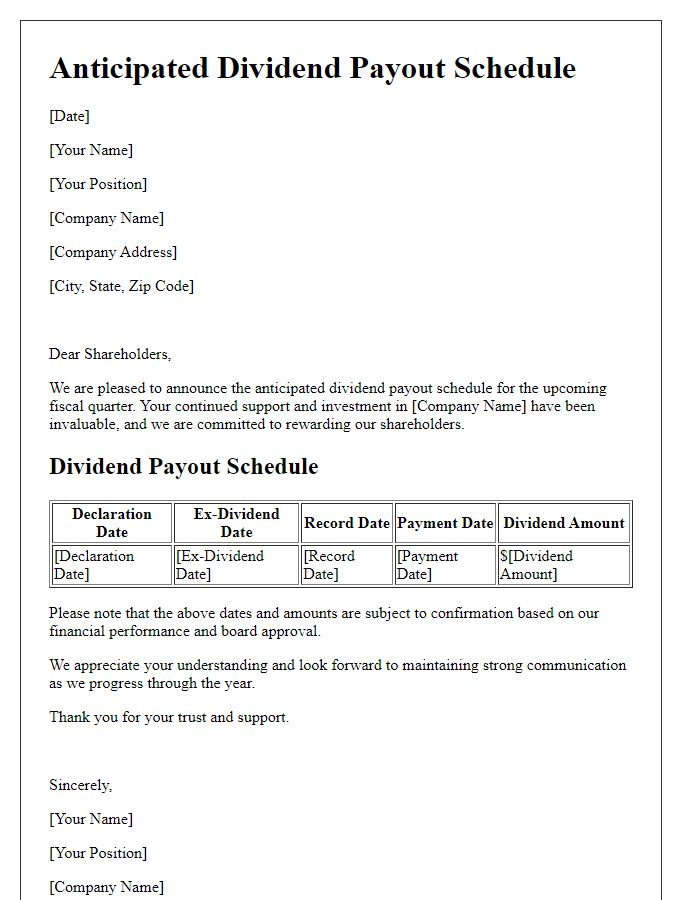

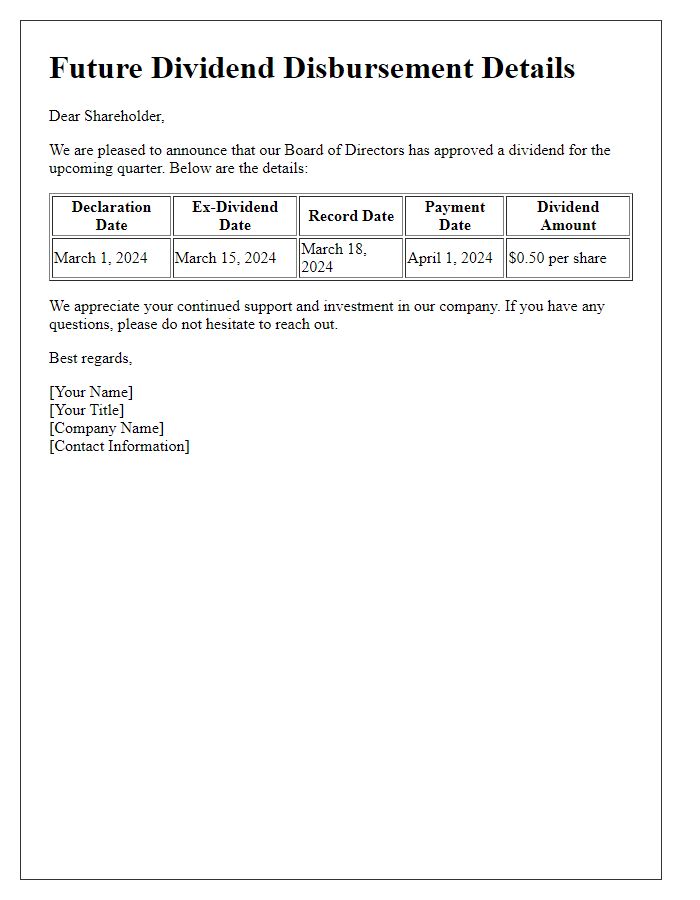

Dividend forecast details

The dividend distribution forecast provides shareholders with an estimated projection of upcoming dividend payouts from a company, such as XYZ Corporation, which specializes in renewable energy solutions. This forecast outlines the anticipated dividend per share (DPS), projected at $1.50, based on estimated earnings growth of 10% year-over-year. Furthermore, the payout ratio is expected to remain stable at 40%, reflecting the company's commitment to returning value to investors while maintaining sufficient reinvestment for future growth. Historical trends indicate that XYZ Corporation consistently increases dividends, with distributions in the previous fiscal year totaling $1.35 per share, underscoring a reliable commitment to shareholder returns. The forecast period spans the next fiscal year, ending December 31, 2024, ensuring a clear timeline for investors to anticipate potential cash flows from dividends.

Contact information and closing remarks

Dividend distribution forecasts predict shareholder returns in publicly traded corporations. Accurate estimates rely on factors like corporate earnings (net profit of a company), dividend payout ratios (percentage of earnings distributed as dividends), and market conditions. For instance, a company like Apple Inc. may project a dividend increase based on strong quarterly earnings results, reporting over $20 billion in net income. Furthermore, effective communication with shareholders through official reports, such as earnings calls and investor newsletters, ensures transparency about future dividend policies. Investors often utilize this information to adjust their portfolios, assess potential dividends, and optimize their investment strategies accordingly.

Comments