Are you navigating the process of applying for a sales tax exemption? It can feel a bit overwhelming, but don't worry; we're here to help you simplify it. From understanding the necessary documentation to ensuring you meet all required criteria, we'll guide you step by step. So, let's dive in and explore how you can successfully submit your sales tax exemption application!

Business Information and Registration Details

Business owners seeking sales tax exemption must provide comprehensive business information and accurate registration details. Essential elements include the business name, which could be any registered title under state regulations, and the legal structure, such as Limited Liability Company (LLC) or Corporation. The federal Employer Identification Number (EIN) issued by the Internal Revenue Service (IRS) is crucial for tax identification. Address details, including street address, city, state, and zip code, should match official records to avoid discrepancies. The nature of the business, specifying the primary trade or services offered, should be woven into the application. Additional registration documents, like state business licenses or sales tax permits, may be necessary to substantiate the application.

Reason for Exemption Request

Sales tax exemption requests often pertain to specific circumstances in which goods or services purchased may not be subject to taxation. Common reasons for exemption include purchases made for resale, items used in manufacturing processes, or purchases by nonprofit organizations engaging in educational or charitable activities. For instance, a nonprofit organization such as Habitat for Humanity may request a sales tax exemption to acquire construction materials that directly contribute to building homes for low-income families. This exemption is crucial for reducing overall project costs and allocating more funds towards charitable efforts within communities. To solidify the exemption request, documentation such as tax exemption certificates, an identification number from the state's Department of Revenue, and detailed descriptions of the intended use for the items may be necessary.

Supporting Documentation and References

When applying for sales tax exemption status, providing comprehensive supporting documentation is crucial for a successful application process. Required documents typically include a completed exemption certificate (such as Form ST-2 in New York), proof of the entity's tax-exempt status (e.g., 501(c)(3) designation for non-profit organizations), financial statements for the previous fiscal year, and a detailed description of the nature of the organization's operations. Additional references may include state-specific guidelines outlined by the Department of Revenue or tax authority, along with internal policies that validate the need for tax-exempt purchases. Submitting clear and organized documentation can significantly expedite the processing time for exemption requests, thereby benefiting the organization financially.

Contact Information for Follow-Up

In a sales tax exemption application, providing accurate contact information is crucial for efficient communication. Include full name, such as John Doe, followed by a title like Sales Manager. Specify the organization name, for example, XYZ Manufacturing Corp. Include complete address details, including street number (123), street name (Main St), city (Springfield), state (IL), and ZIP code (62701). Provide a reliable phone number (e.g., 555-123-4567) for direct inquiries. Lastly, include an email address, like johndoe@xyzmanufacturing.com, to facilitate prompt electronic communication regarding the application status.

Clear and Concise Language

Sales tax exemption applications require clear, concise language to effectively communicate the request. The application should include key elements such as the name of the organization (for instance, "Nonprofit Organization ABC"), the specific type of exemption (like "501(c)(3) status"), and the state tax authority being addressed (for example, "California Department of Tax and Fee Administration"). It must detail the purpose of the exemption, highlighting the organization's mission (e.g., "providing educational resources to low-income families") and any relevant supporting documents (like "IRS determination letter"). Clear identification of the tax-exempt status and the applicable sales tax laws specific to the state will strengthen the application, ensuring a smoother review process. Always ensure that contact information is included for follow-up questions or clarifications.

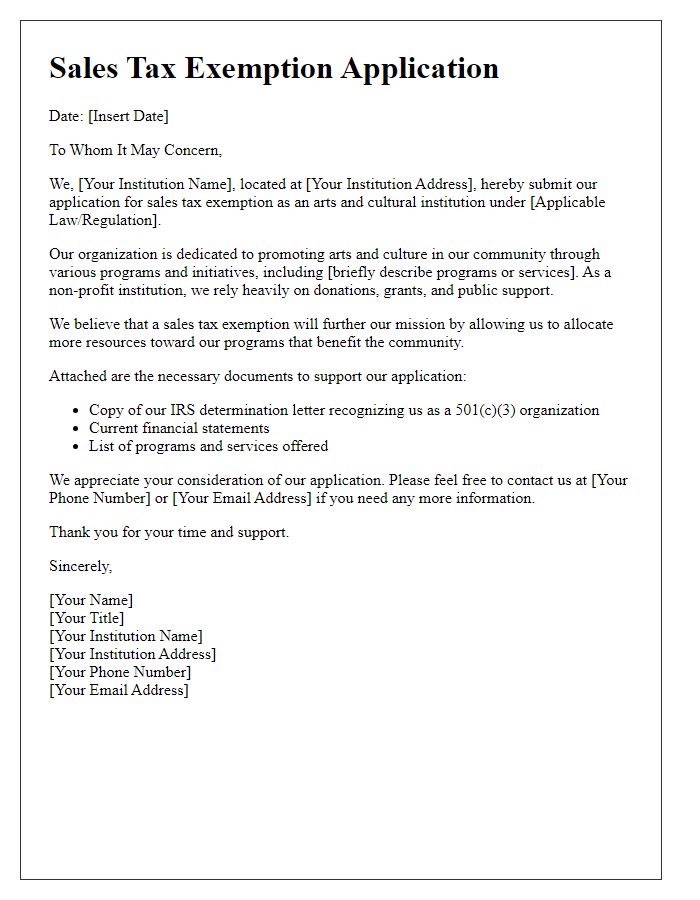

Letter Template For Sales Tax Exemption Application Samples

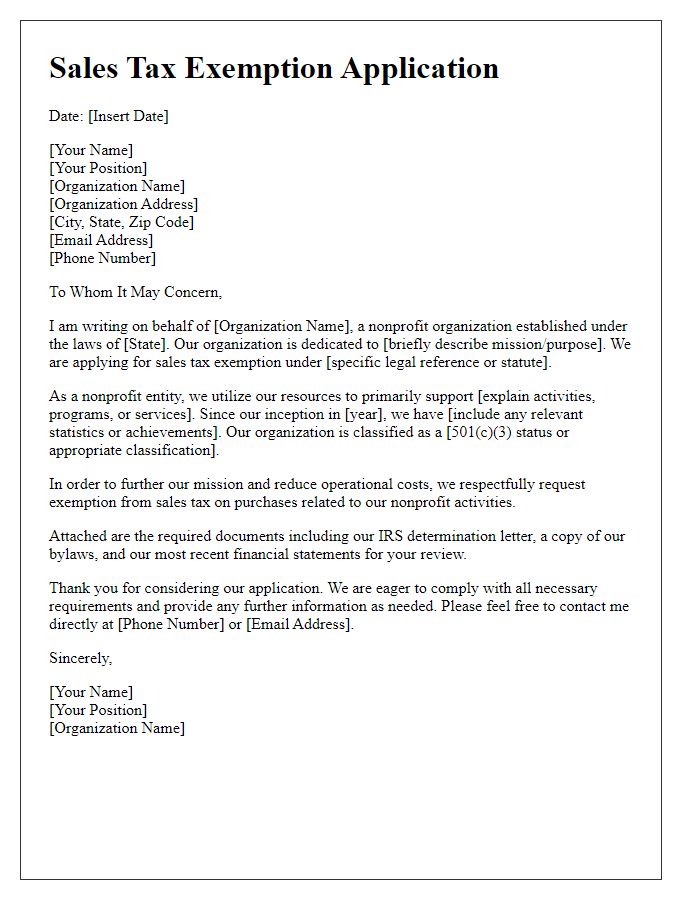

Letter template of Sales Tax Exemption Application for Nonprofit Organizations

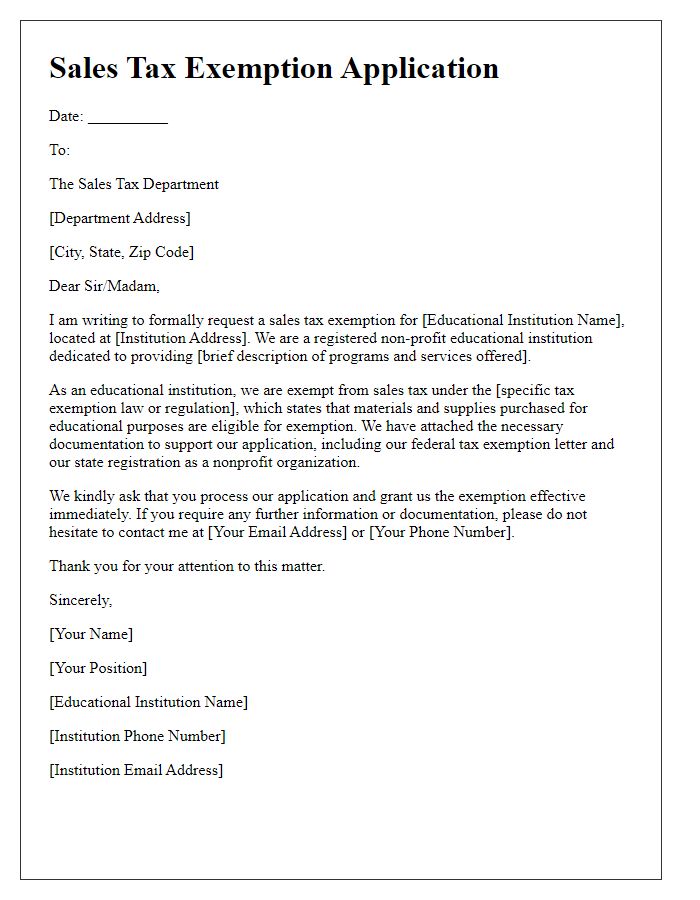

Letter template of Sales Tax Exemption Application for Educational Institutions

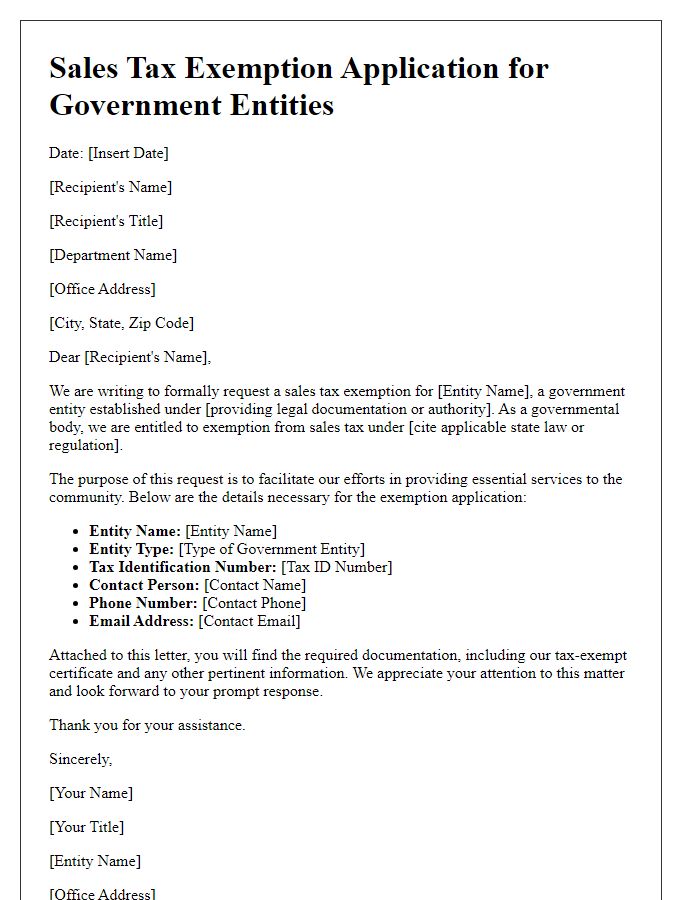

Letter template of Sales Tax Exemption Application for Government Entities

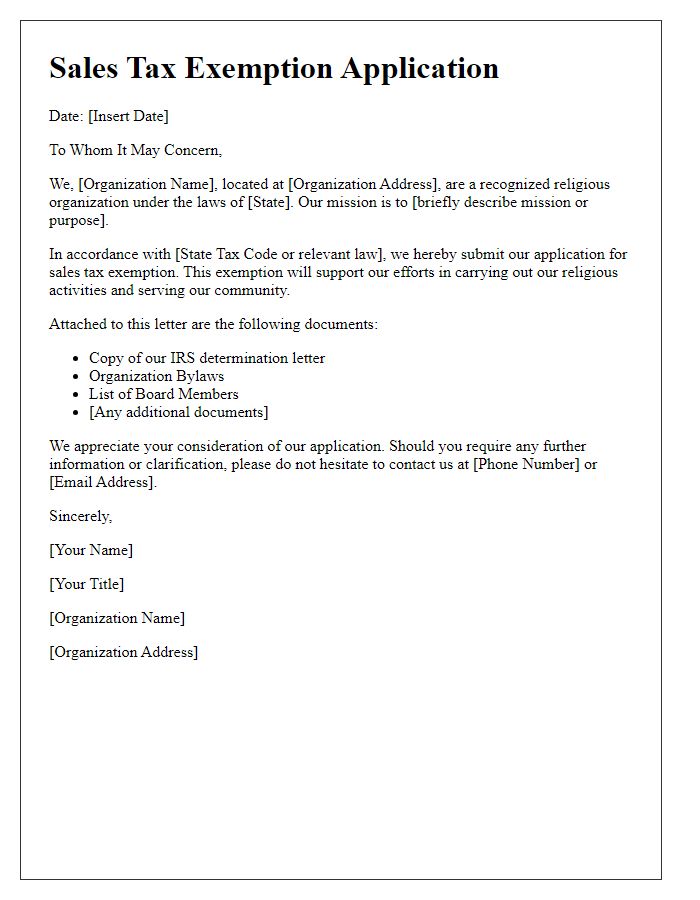

Letter template of Sales Tax Exemption Application for Religious Organizations

Letter template of Sales Tax Exemption Application for Charitable Foundations

Letter template of Sales Tax Exemption Application for Veterans' Organizations

Letter template of Sales Tax Exemption Application for Healthcare Providers

Letter template of Sales Tax Exemption Application for Environmental Protection Groups

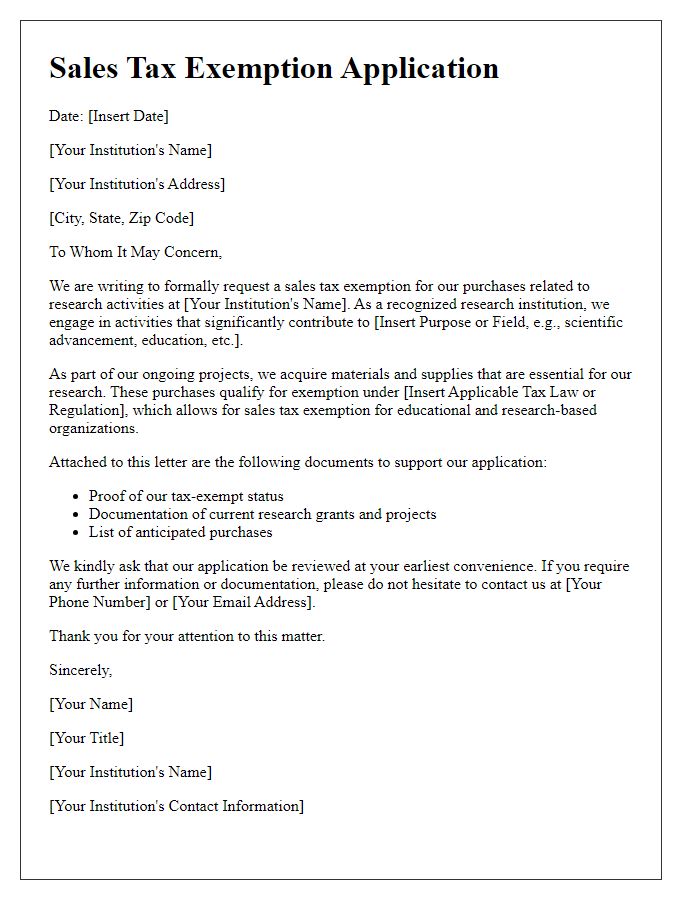

Letter template of Sales Tax Exemption Application for Research Institutions

Comments