Have you ever noticed a discrepancy in your paycheck and wondered what to do next? It can be frustrating to see numbers that don't add up, leaving you puzzled and seeking answers. Understanding the steps to address payroll discrepancies can help alleviate concerns and ensure you're compensated fairly. Join me as we dive deeper into how to effectively craft a letter for your payroll inquiry and get the clarity you deserve!

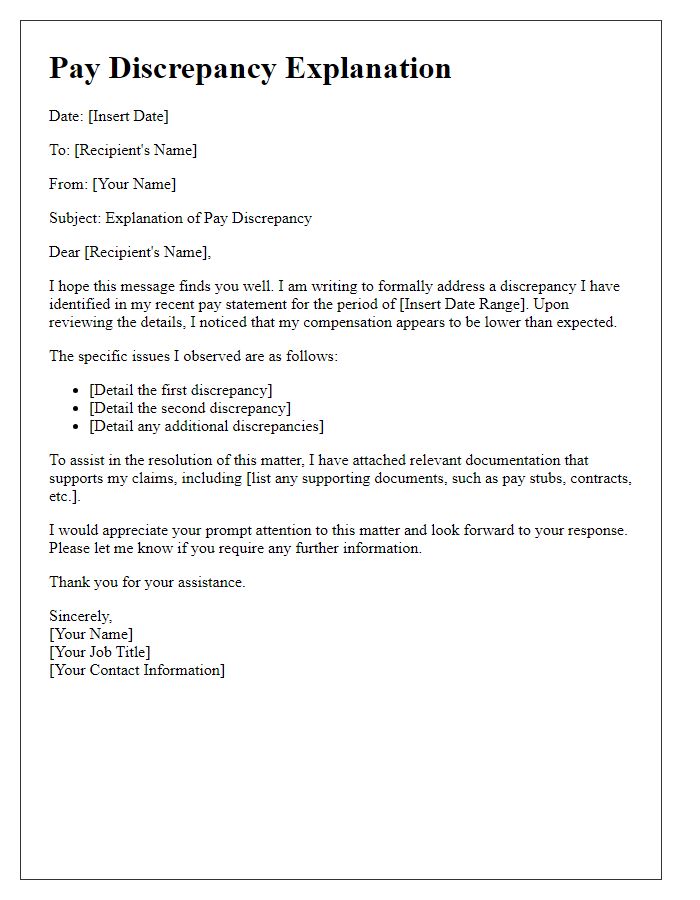

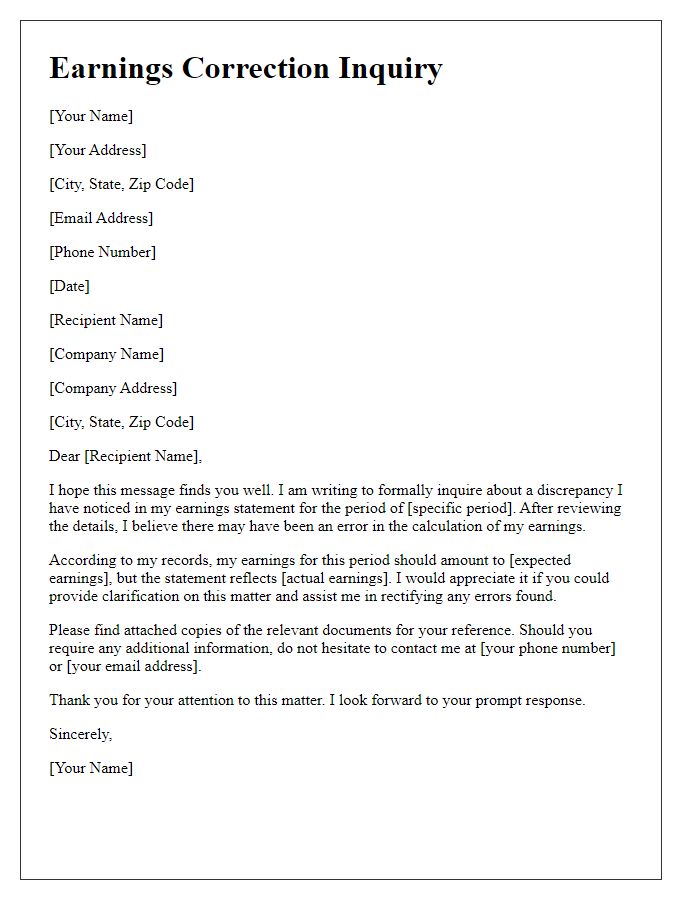

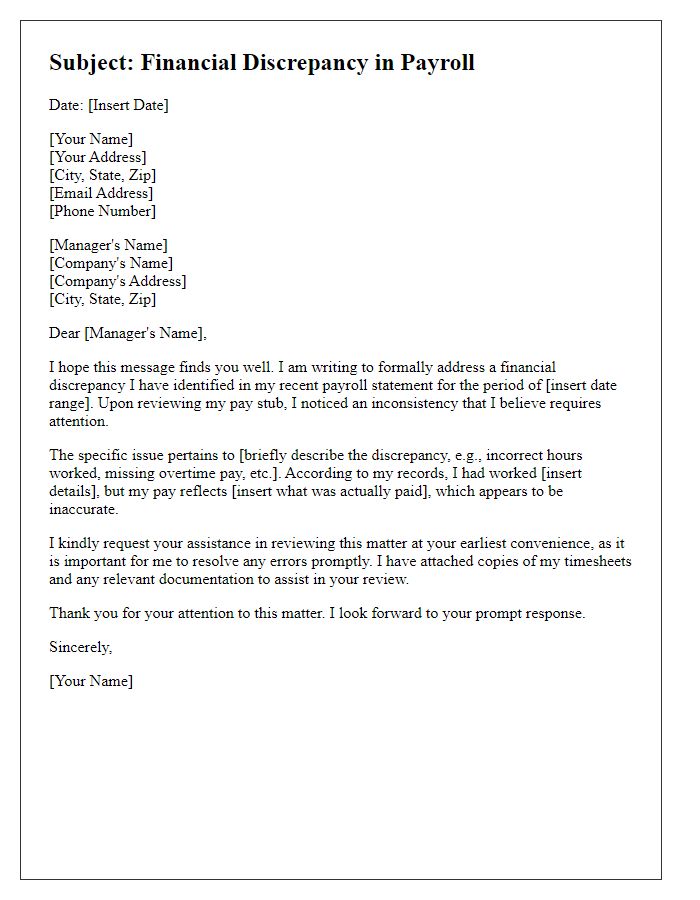

Subject Line: Clear and Specific

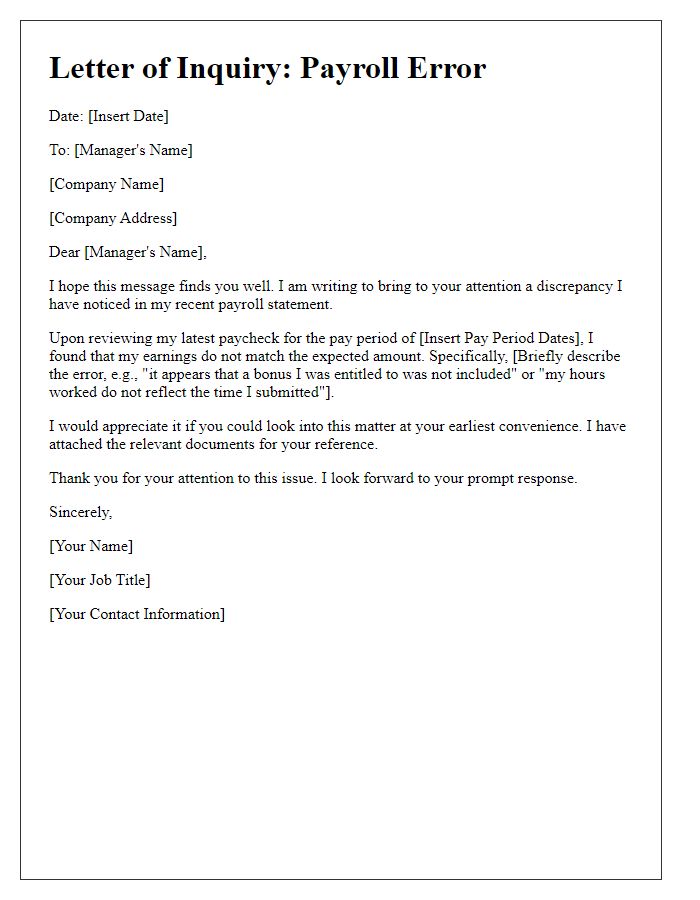

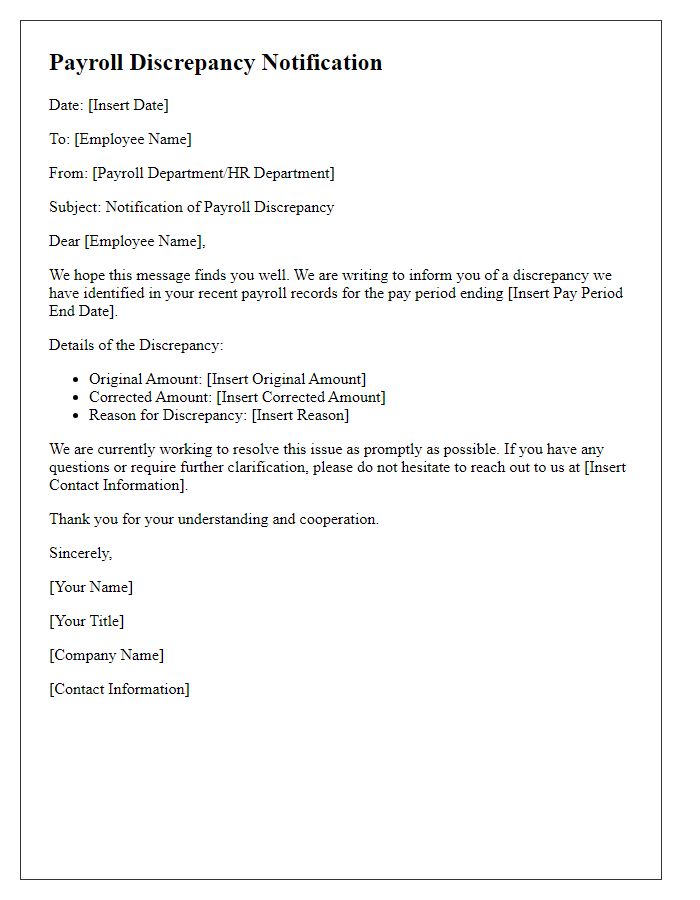

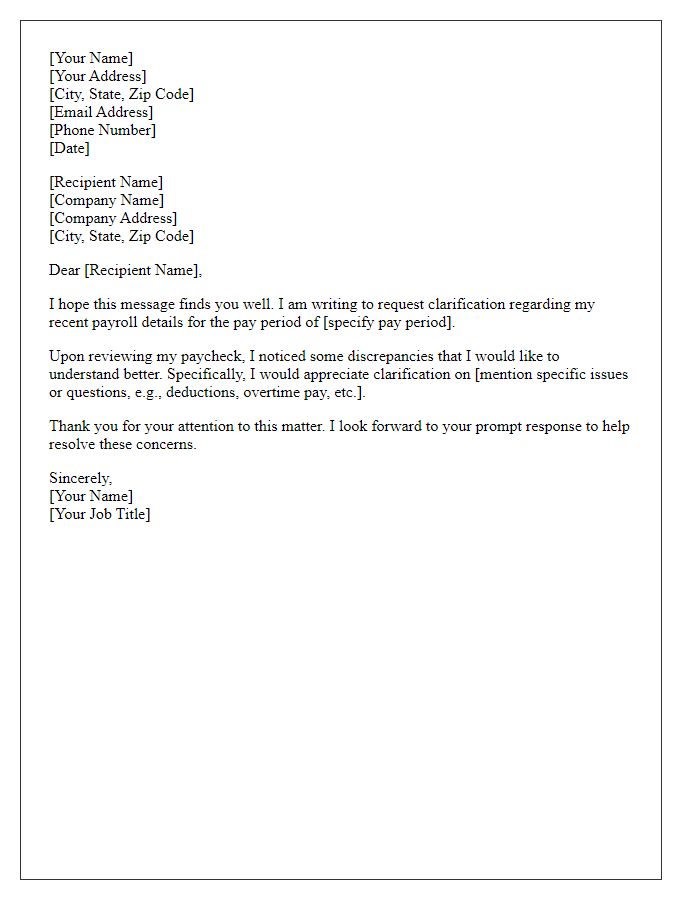

Inquiries regarding payroll discrepancies often arise in various workplaces, emphasizing the importance of addressing issues promptly for employee satisfaction. Payroll records, including hours worked, overtime calculations, and deductions, can sometimes contain errors, leading to incorrect payments. Organizations typically have a structured process for employees to report discrepancies, allowing human resources departments to investigate and reconcile any issues effectively. This process often involves submitting a formal inquiry, detailing the specific discrepancy, including dates, amounts, and relevant payroll periods, ensuring clarity for the responsible parties. Proper resolution not only enhances employee trust but also maintains financial accuracy and compliance with labor regulations.

Employee Information: Name and ID

Payroll discrepancies can lead to significant financial stress for employees. Accurate employee information is critical for a seamless payroll process. An employee's unique identification number (ID) ensures efficient tracking of salary records (such as hourly rates, bonuses, deductions). An inquiry regarding a payroll discrepancy must include the employee's full name and ID, providing essential context for human resources or payroll departments to investigate issues related to incorrect pay amounts or missed bonuses. Proper documentation helps clarify concerns and expedite the resolution process, reducing the potential financial impact on the employee.

Description of Discrepancy: Explicit Details

Payroll discrepancies could arise from various factors, such as incorrect hours logged or miscalculated wages. For instance, if an employee worked 40 hours in a week but received payment for only 35 hours, a difference of 5 hours exists that should be addressed. Explicit details can include the specific pay period affected (e.g., September 1 to September 7, 2023), the expected hourly wage (e.g., $20 per hour), and the total amount owed for the missing hours (e.g., 5 hours x $20 = $100). It's crucial to provide supporting documentation such as time sheets or pay stubs to clarify the matter efficiently. Accurate record-keeping and clear communication with HR or the payroll department will facilitate the resolution of this discrepancy.

Supporting Documents: Attach Relevant Evidence

Payroll discrepancies can significantly impact employee satisfaction and financial planning. It is crucial to address issues such as incorrect wage calculations, missing overtime pay, or unrecorded bonuses promptly. Providing supporting documents, such as pay stubs (evidence of earnings and deductions), timesheets (records of hours worked), and employment contracts (stating agreed-upon terms and conditions), can substantiate the inquiry. Relevant evidence helps create a clear narrative for the human resources department, ensuring a timely resolution. Ensuring accurate payroll processing fosters trust between employees and the organization, enhancing workplace morale and productivity.

Request for Resolution: Desired Action and Timeline

Payroll discrepancies can create significant issues for employees budgeting and financial planning. Common errors include incorrect salary amounts (up to 20% variations reported), missed overtime payments (federal regulations require 1.5 times the hourly rate), or unpaid bonuses (annual bonuses can amount to thousands of dollars). Employees often report issues to human resources departments in companies, typically located in business districts like Silicon Valley, New York City, or London. Resolution processes usually occur within a two-week timeframe, relying on payroll software systems (such as ADP or Paychex) to verify data accuracy. Rapid clarification of discrepancies is crucial for maintaining morale and ensuring timely payments.

Comments