Are you navigating the often confusing world of miscellaneous income reporting? Understanding how to accurately report these earnings can save you from potential headaches down the line. In this article, we'll break down the essential components you need to know, making the process straightforward and manageable. So, if you're ready to simplify your reporting duties, keep reading to discover expert tips and insights!

Accurate Description of Income Source

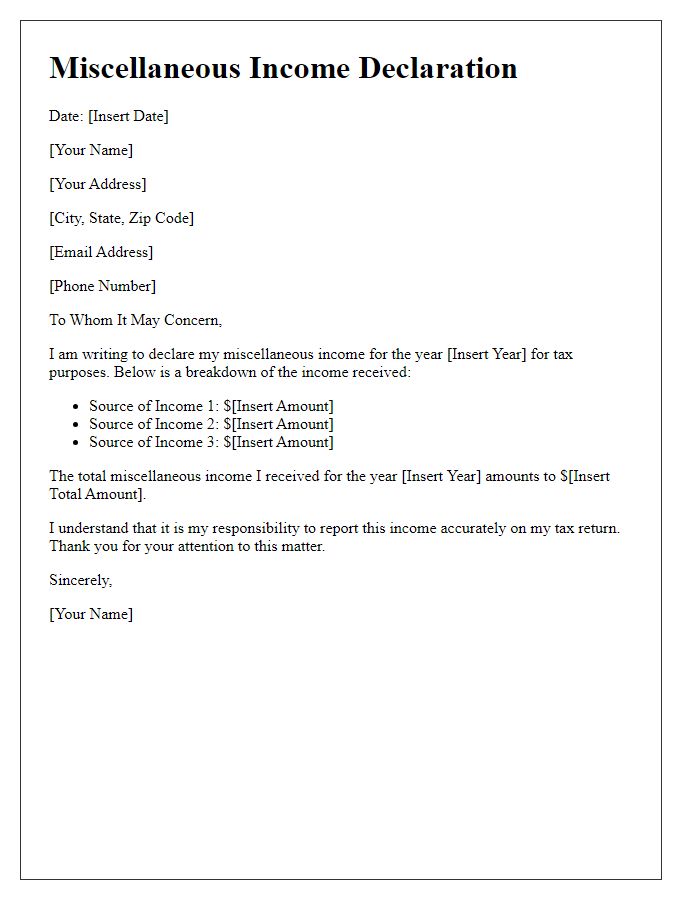

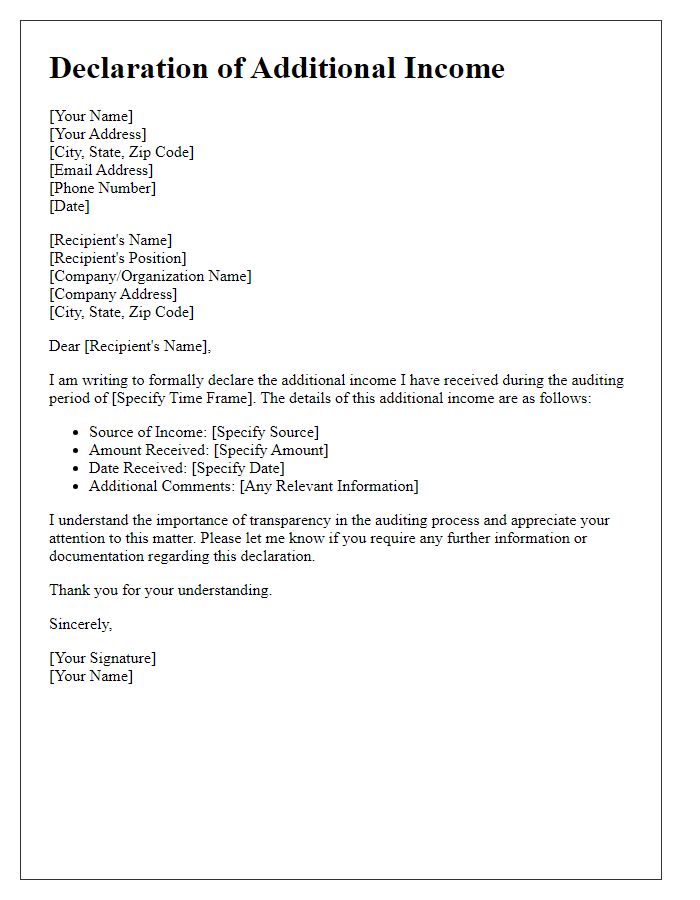

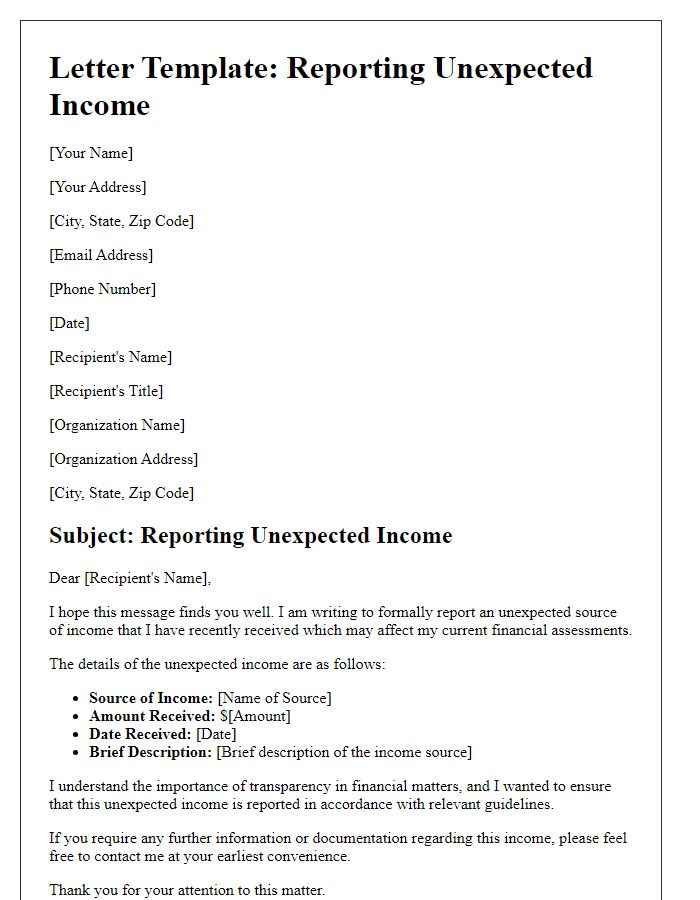

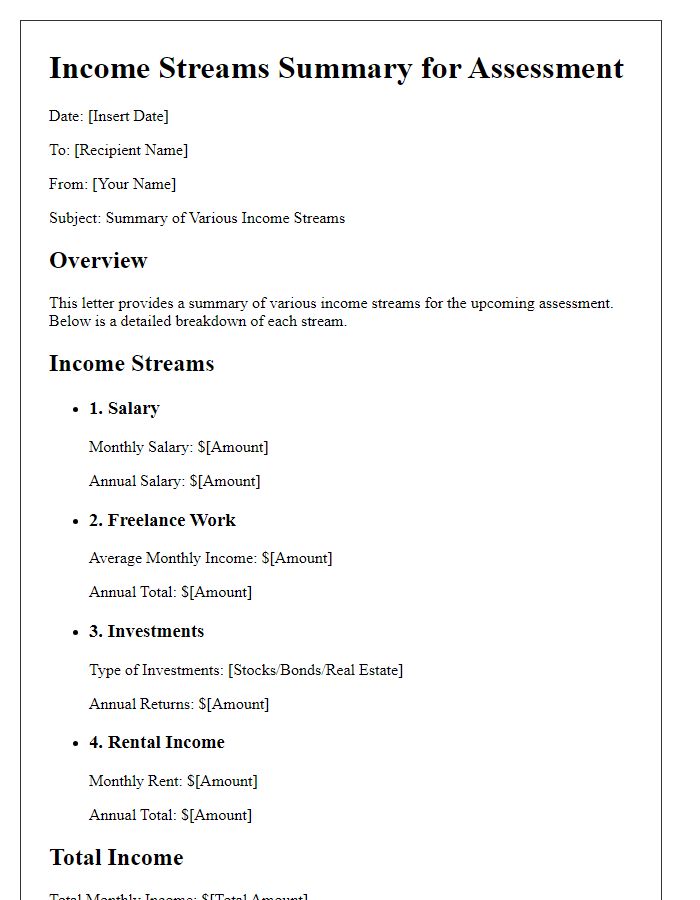

Accurate reporting of miscellaneous income is crucial for tax compliance. Types of income sources can include rental income, freelance earnings, and one-time payments from services rendered. For example, a graphic designer might receive $2,500 for a project completed in April 2023. Clear documentation such as invoices or contracts provides evidence of income, ensuring accurate tax return filing. Additionally, businesses should consider recording income from cash transactions, like selling handmade crafts at local fairs, which might total $800 over summer months. Maintaining organized records aids in minimizing errors during tax preparation and supports transparency in income reporting.

Total Amount Received

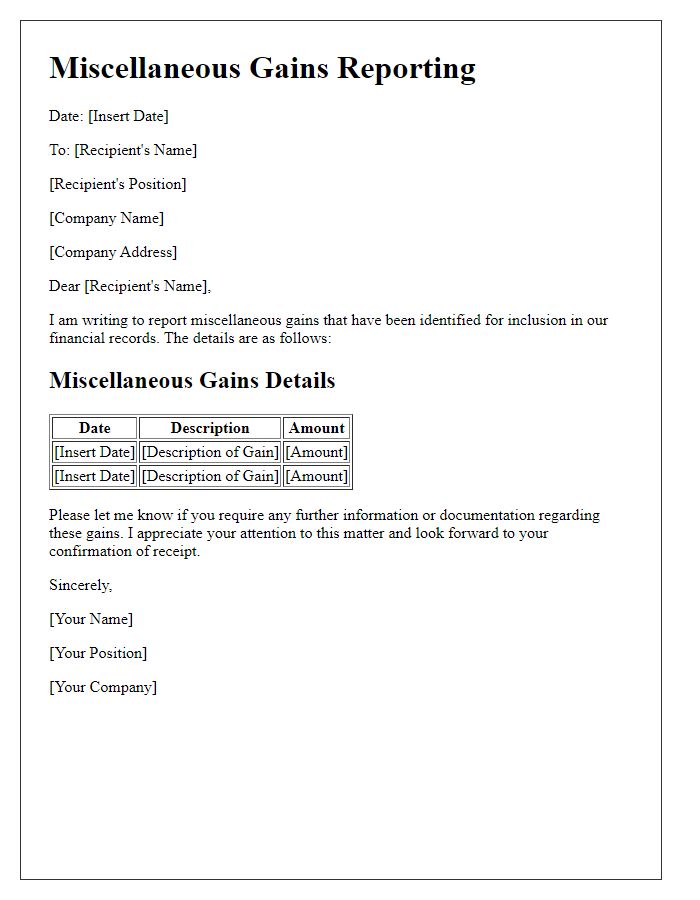

The total amount received as miscellaneous income can significantly impact personal finances, particularly for taxpayers in the United States who report such earnings using IRS Form 1040. This type of income may include payments from freelance work, rental income, or awards exceeding $600, requiring individuals to account for the total received during the tax year. Accurate reporting is essential to avoid penalties from the Internal Revenue Service, particularly for income exceeding $400, which necessitates self-employment tax calculations. Additionally, keeping detailed records of each transaction, including dates, payers, and purposes, can aid in substantiating income levels during tax audits while ensuring compliance with federal regulations.

Payer Information

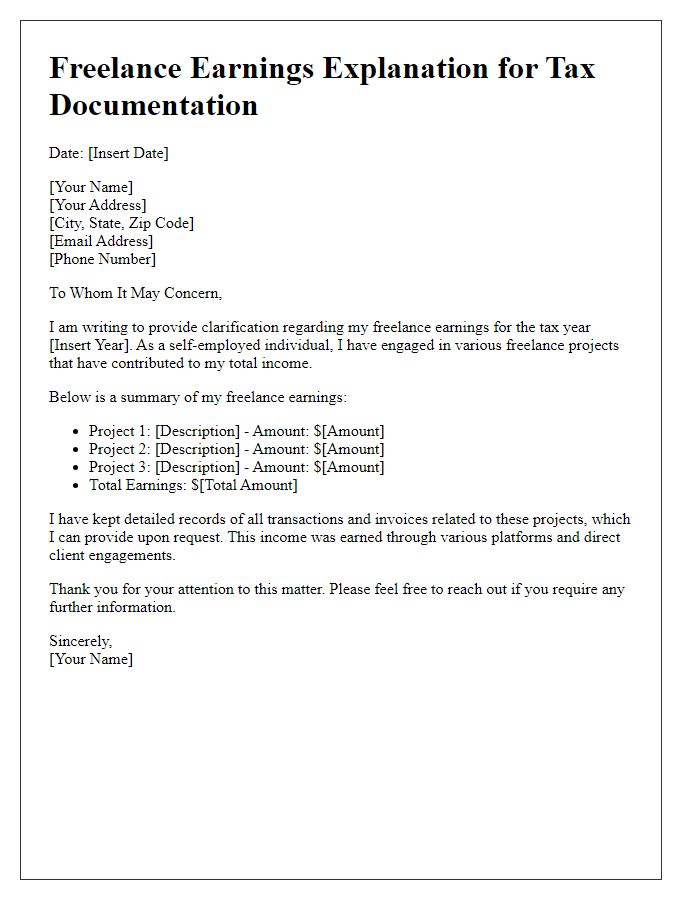

Reporting miscellaneous income requires accurate documentation of payer information to ensure compliance with tax regulations. Payer information includes the full name of the individual or business, such as ABC Corporation or John Doe LLC, an Employer Identification Number (EIN) or Social Security Number (SSN), and the complete mailing address, for instance, 123 Business Rd., Suite 456, New York, NY 10001. This information is crucial for forms such as 1099-MISC or 1099-NEC, which are required by the IRS to report various types of income earned by individuals or entities who are not considered employees. Additionally, it is important to capture the total amount of income for accurate reporting, such as $5,000 for freelance services or $2,500 for royalties. Keeping this data organized ensures timely submission to avoid penalties and facilitates the proper filing of tax returns.

Tax Identification Numbers

Miscellaneous income reporting requires careful documentation of Tax Identification Numbers (TINs) for individuals or entities receiving non-wage payments. TINs, such as Social Security Numbers (SSNs) for individuals, Employer Identification Numbers (EINs) for corporations, and Individual Taxpayer Identification Numbers (ITINs) for non-residents, are essential for accurately reporting income to the Internal Revenue Service (IRS) in the United States. Entities such as freelance workers (149,000 individuals estimating gross receipts) and freelance platforms (with millions of transactions annually) often fall under this category. Proper collection and verification of TINs ensure compliance with tax laws, avoiding potential penalties. Forms such as IRS Form 1099-MISC and Form 1099-NEC facilitate the reporting of miscellaneous income totaling over $600 during a calendar year. Accurate record-keeping and timely submission of these forms are crucial for both payers and recipients to maintain transparent income reporting practices.

Relevant Dates and Reporting Periods

Miscellaneous income reporting involves several crucial elements, particularly relevant dates and reporting periods. For instance, the IRS requires taxpayers to report miscellaneous income on Form 1099-MISC, which must be submitted by January 31 of the following tax year. Contextually, if an individual earned miscellaneous income, such as freelance payments totaling $600 or more in 2023, the reporting date would be January 31, 2024. Additionally, the reporting period for such income would encompass all earnings during the calendar year, from January 1 to December 31. Keeping accurate records of receipts and transactions during this timeframe is essential for accurate reporting and compliance with tax regulations.

Comments