Are you curious about the intricacies of interest income forecasting? In today's fast-paced financial landscape, understanding how to accurately predict interest income can make a significant difference in your investment strategy. This article will guide you through the essential components of creating an effective forecasting model, helping you to navigate the complexities of interest rates and market trends. So, grab a cup of coffee and dive in as we explore this critical topic further!

Recipient's Information

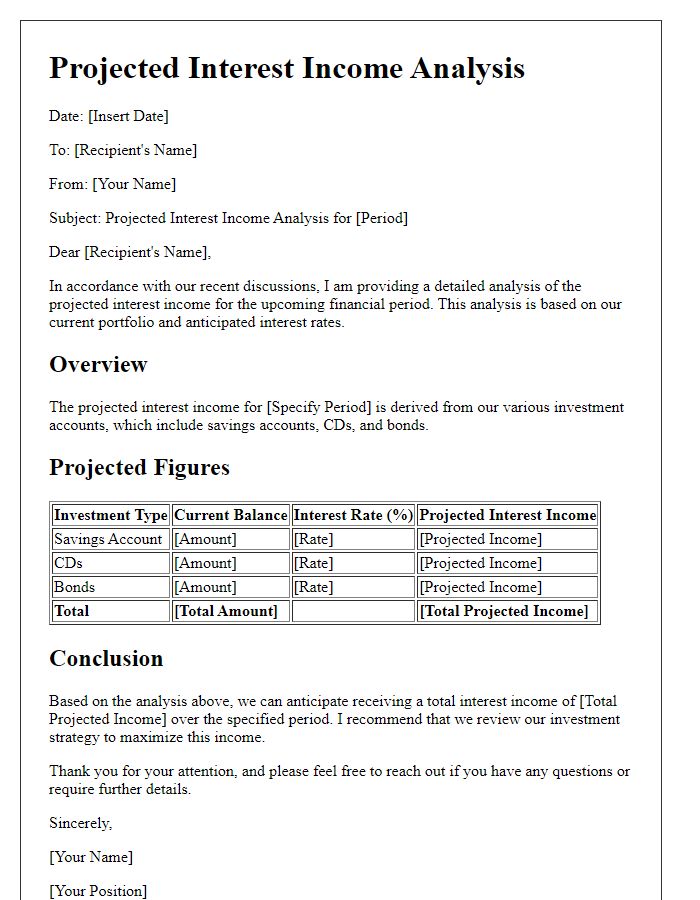

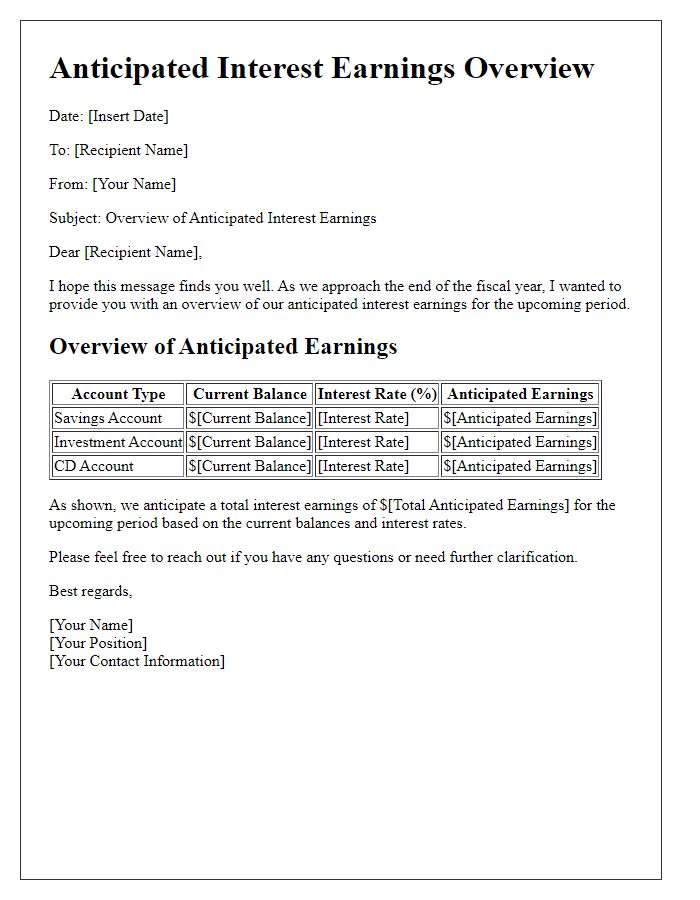

Interest income forecasting plays a crucial role in financial planning for institutions and individuals. Accurate projections can greatly influence investment strategies and cash flow management. Various factors, including interest rates, economic indicators, and market trends, need to be considered. For instance, a rise in the Federal Reserve's benchmark interest rate might lead to an increase in income from savings accounts or bonds. Forecasting tools often utilize historical data, such as annual returns from previous years, to predict future income effectively. Detailed analysis of specific financial products, such as high-yield savings accounts or certificates of deposit (CDs), can provide further insights into expected earnings. Additionally, incorporating macroeconomic factors, such as inflation rates around 3% and GDP growth estimates of 2.5%, enhances the accuracy of these forecasts, guiding investors in making informed decisions.

Purpose of Communication

Interest income forecasting provides essential insights for financial planning, investment strategies, and overall business health assessments. Accurate projections of interest income from various sources, such as savings accounts, bonds, or loans, can influence capital allocation and cash flow management. Forecasting tools often consider historical interest rates, current market trends, and economic indicators. For instance, the Federal Reserve's interest rate adjustments significantly impact income from interest-bearing assets. By analyzing these factors, organizations can make informed decisions, ensuring sustainable growth and liquidity. Understanding projected interest income helps stakeholders anticipate revenue fluctuations and align their financial goals accordingly.

Forecast Summary and Insights

Interest income forecasting relies on various factors like interest rates, loan volumes, and economic conditions. In 2024, projected interest rates may hover around 4.5% based on Federal Reserve guidelines. Increased demand for personal and business loans can potentially elevate loan volumes, with estimates suggesting a growth of 10% compared to 2023. Economic indicators, such as GDP growth at 2.3%, also influence borrower behavior and repayment rates. Seasonal trends may further impact income fluctuations, particularly in Q2 and Q3 when borrowing typically peaks. Detailed analysis of these elements can enhance the accuracy of forecasting models, enabling more strategic financial planning and investment decisions.

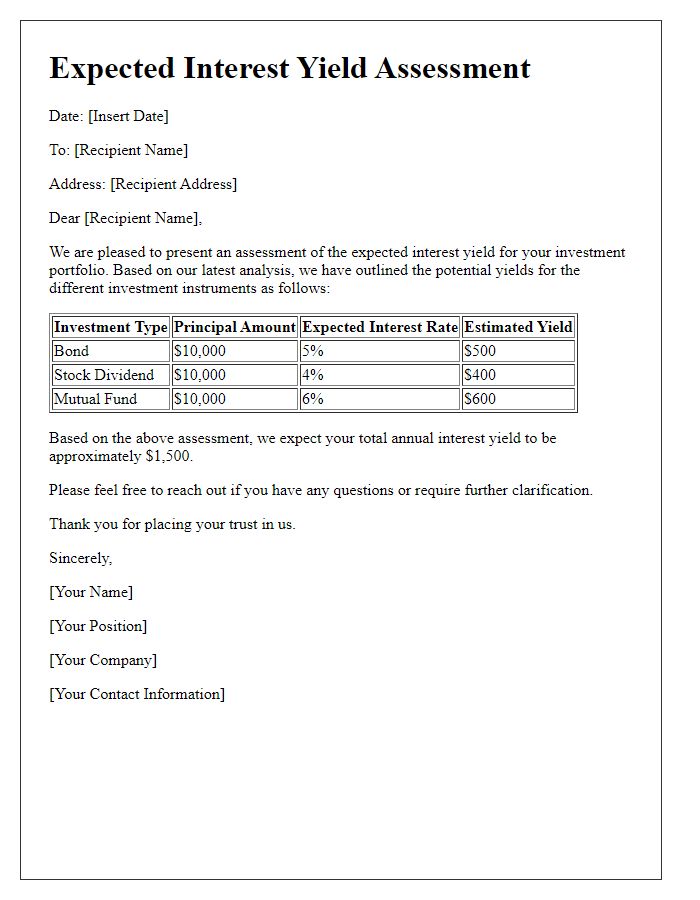

Key Assumptions and Variables

Interest income forecasting relies on several key assumptions and variables that significantly influence the expected earnings from financial instruments such as loans and investment securities. The interest rate environment, specifically the prevailing federal funds rate set by the Federal Reserve, plays a critical role in determining the rates applied to various loan products. Forecasts should consider economic indicators like inflation rates, which currently hover around 3% annually, as they directly affect purchasing power and the pricing of loans. Additionally, the projected growth rate of the loan portfolio, estimated at 5% annually, and expected changes in borrower credit quality are essential variables impacting default risk and net interest margins. The composition of the loan portfolio, including the ratios of fixed vs. adjustable-rate products, influences sensitivity to interest rate fluctuations. Lastly, regulatory changes in banking, such as capital requirement adjustments, can also impact overall lending capacity and subsequent interest income.

Contact Information for Queries

Interest income forecasting is crucial for financial institutions, particularly for banks leveraging interest rate data (like LIBOR) to project future earnings from loans and deposits. Accurate forecasts can significantly impact profitability and risk management, guiding decisions on lending strategies and investment portfolios. Regulatory environments change; thus, compliance with regulations from entities such as the Financial Accounting Standards Board (FASB) and the International Financial Reporting Standards (IFRS) is essential. Various modeling techniques, including Monte Carlo simulations and regression analysis, help in assessing potential interest income under different economic scenarios, providing valuable insights for stakeholders. Regular updates from economic indicators such as inflation rates and employment figures can further fine-tune these forecasts, ensuring they remain relevant and actionable.

Comments