When it comes to intercompany transactions, clarity and compliance are crucial for the smooth functioning of business operations. These transactions, which occur between different branches or subsidiaries, require meticulous documentation to ensure transparency and adherence to regulations. In this article, we'll guide you through an effective letter template that will make intercompany transaction reporting easier and more efficient. So, grab a cup of coffee and dive in to learn how to streamline your reporting process!

Purpose of the transaction

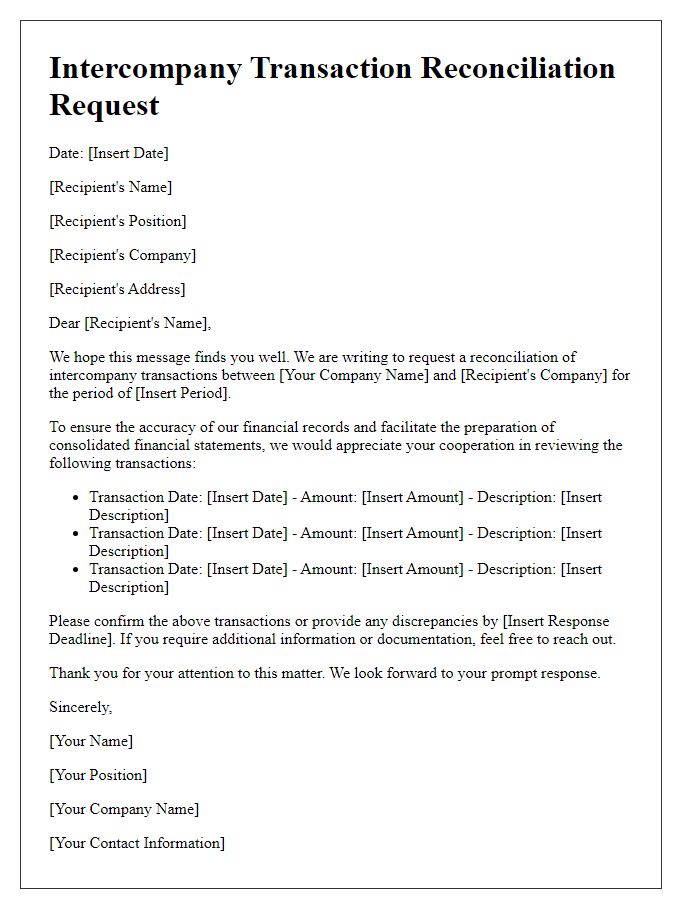

Intercompany transactions serve as vital components of corporate accounting practices, ensuring seamless financial communication between affiliated entities within a larger corporate structure. These transactions, which can include the exchange of goods, services, or intellectual property, must be carefully documented to align with international standards, such as the OECD Transfer Pricing Guidelines. Accurate reporting facilitates compliance with tax regulations, particularly in jurisdictions like the United States, which mandates specific disclosures for related-party transactions. Additionally, the assessment of transfer pricing methodologies becomes crucial to prevent disputes with tax authorities, especially in light of growing scrutiny on multinational corporations. Each intercompany transaction must be precisely categorized, including the nature of the goods or services provided, the purpose behind the transaction, and the agreed-upon financial terms such as pricing and payment schedules.

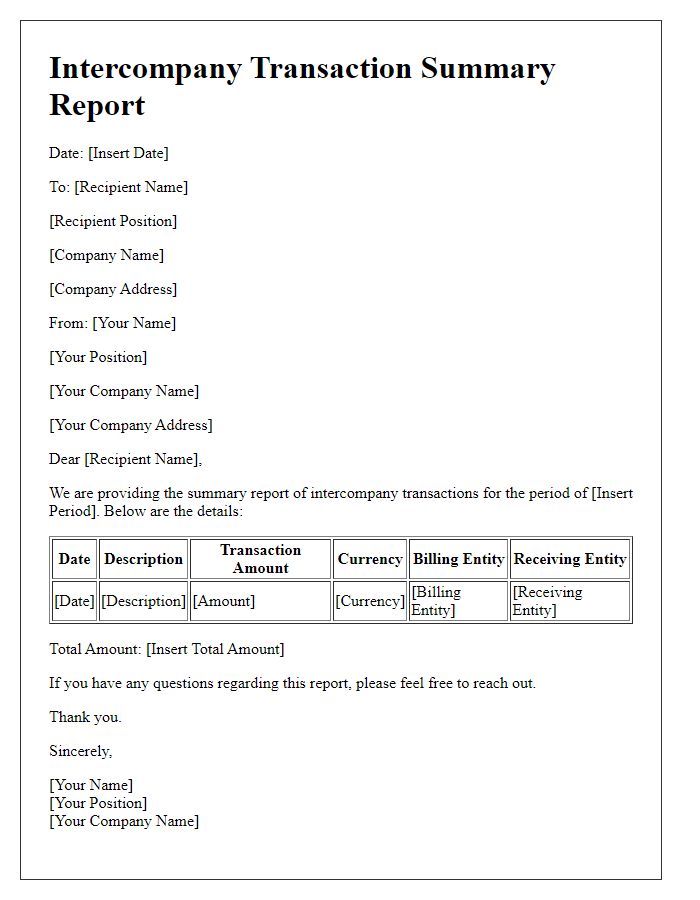

Detailed description of the transaction

Intercompany transactions involving the sale of goods between subsidiaries can entail complex reporting requirements. For instance, a company in New York may sell manufactured electronics to a subsidiary in Toronto, amounting to $500,000. The goods are subject to a transfer pricing strategy compliant with IRS regulations to ensure that profits are accurately reported and taxes paid in the respective jurisdictions. Documentation such as invoices, shipping manifests, and customs declarations must be meticulously maintained to provide transparency for audits. The exchange of currency can impact the transaction value due to fluctuating rates, requiring careful financial analysis and adjustments in accounting records to reflect the true economic impact of the sale. Accurate reporting helps in consolidated financial statements, affecting key metrics such as revenue, profit margins, and tax liabilities.

Financial implications and impact

Intercompany transactions play a crucial role in establishing financial accountability among subsidiaries within a corporate group. Accurate reporting of these transactions, such as sales, services, and asset transfers, is essential for compliance with regulatory standards like the International Financial Reporting Standards (IFRS). Financial implications include transfer pricing adjustments, which can influence taxable income and overall profitability in various jurisdictions like the United States and the European Union. Additionally, discrepancies in reporting can lead to significant penalties, impacting cash flow and financial statements. Timely and transparent documentation ensures that all stakeholders, including auditors and tax authorities, have a clear understanding of the intercompany activities, ultimately safeguarding the organization's financial integrity.

Compliance and regulatory considerations

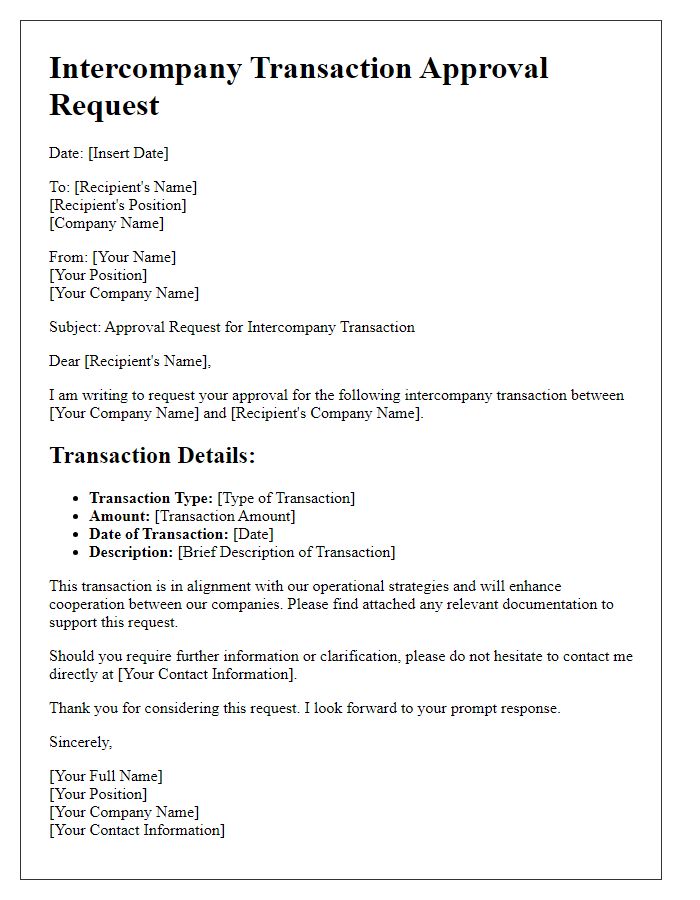

Intercompany transactions require strict compliance with regulations such as the OECD guidelines and local tax laws. Documentation must include accurate transfer pricing models to justify pricing of goods or services exchanged between subsidiaries located in different jurisdictions. Regulatory authorities, such as the IRS in the United States or HMRC in the United Kingdom, often scrutinize these transactions to prevent tax evasion. Significant transactions exceeding the threshold of $100,000 may necessitate additional disclosures. Furthermore, compliance audits are essential to ensure adherence to legal frameworks, reducing the risk of penalties or adjustments during tax assessments. Accurate record-keeping and timely reporting are critical to maintaining transparency and accountability in intercompany transactions.

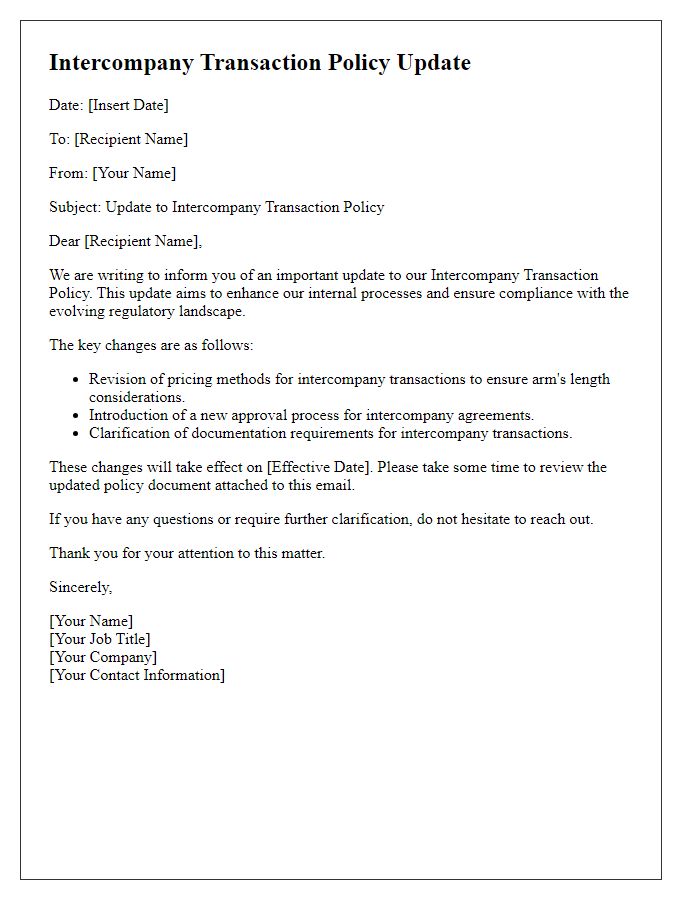

Internal controls and approval process

Intercompany transactions involve financial exchanges between two or more divisions or subsidiaries within the same parent company. Effective internal controls are essential for accurate reporting and ensuring compliance with regulatory standards. A robust approval process typically includes an initial review by departmental managers, followed by verification from the finance team to confirm the transaction's validity. Documentation such as invoices and intercompany agreements must be collected to substantiate the transactions. Regular audits, performed quarterly or annually, play a critical role in identifying discrepancies and ensuring that all intercompany transactions adhere to the established accounting standards, such as IFRS and GAAP. This process ultimately safeguards against potential financial risks and enhances accountability within the organization.

Comments