Are you curious about how your company is performing financially this quarter? Understanding financial performance is crucial for making informed business decisions, and it can reveal trends that can guide your strategy moving forward. In this article, we'll delve into key metrics and insights that showcase not only your company's stability but also its growth potential. So, if you want to unlock the secrets behind your financial data, keep reading!

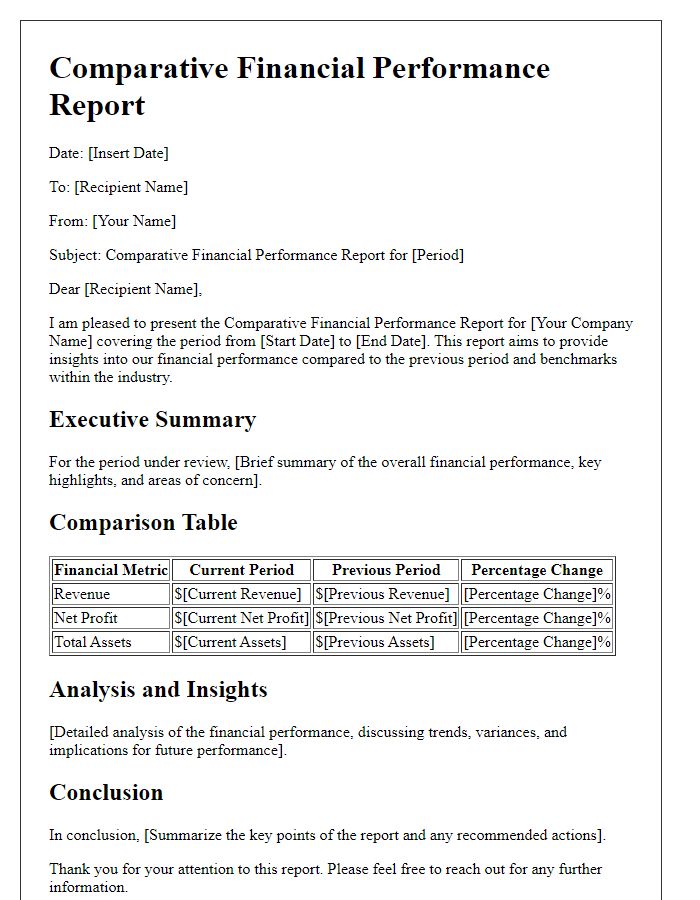

Introduction and Greeting

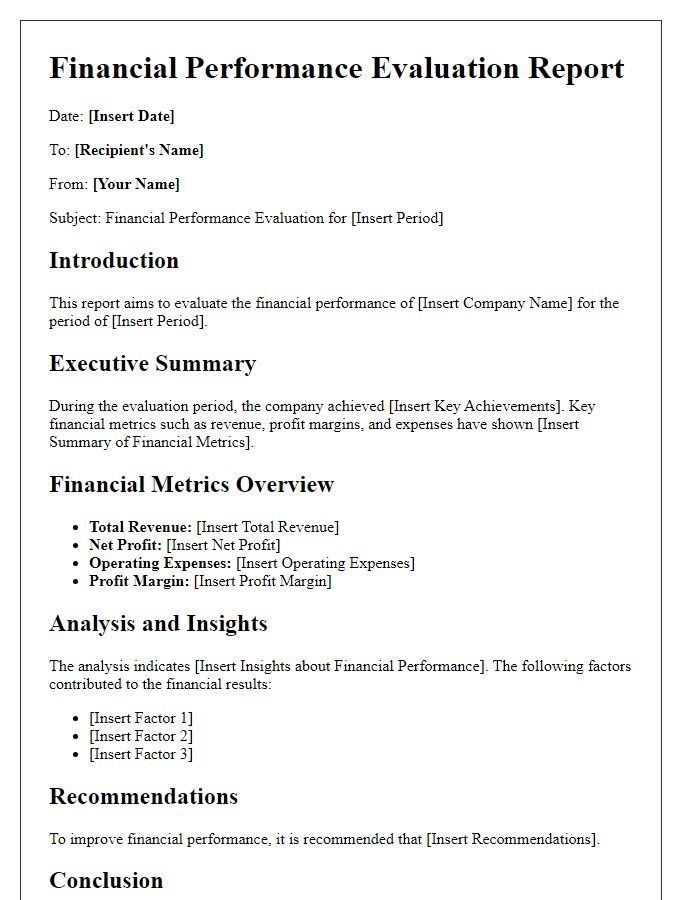

The financial performance overview reflects the fiscal health of the organization for the third quarter of 2023, highlighting key metrics such as revenue growth, expense management, and profitability trends. This document serves to inform stakeholders about the financial position and strategic direction. Financial analysts assess quarterly results against historical performance and industry benchmarks, identifying areas of strength and opportunities for improvement. Engaging with stakeholders fosters transparency and encourages collaborative efforts in achieving organizational goals.

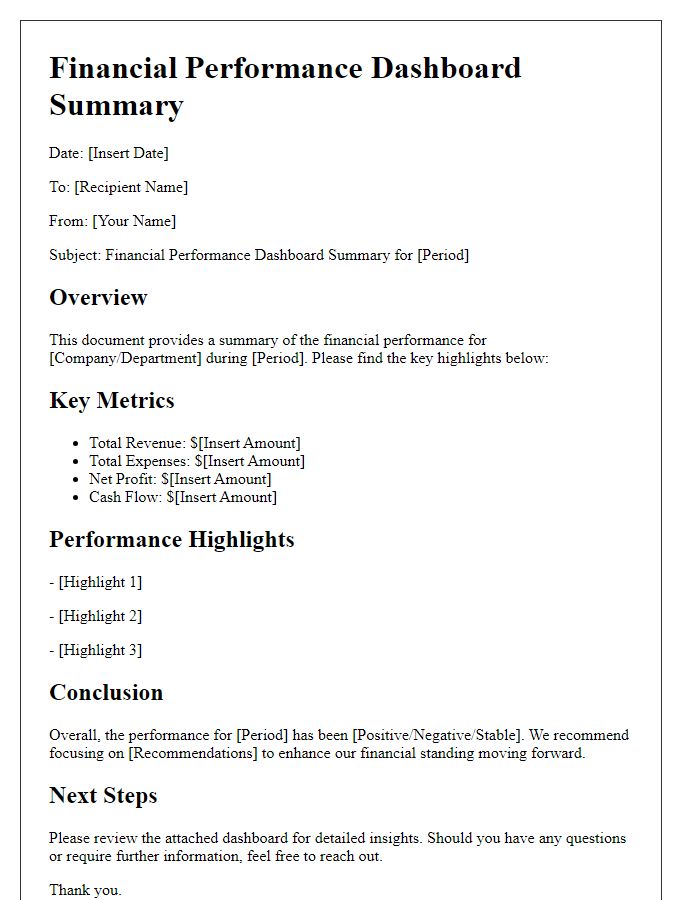

Overview of Financial Metrics and KPIs

The financial performance overview highlights key metrics and KPIs that reflect the economic health of the organization. Revenue growth percentage, which is a crucial indicator, was recorded at 12% for Q3 2023, signaling strong market demand. Operating margin, essential for understanding operational efficiency, stands at 25%, showing effective cost management practices in place. Net profit margin, measuring overall profitability, reached 15%, while total assets grew to $1.5 million, indicating robust investment strategies. Additionally, the return on equity (ROE) is at 18%, reflecting shareholder satisfaction and effective capital allocation. Debt-to-equity ratio sits at 0.5, confirming a balanced capital structure and minimized financial risk. These metrics provide a comprehensive view of how the organization is performing financially and inform strategic decision-making for future growth.

Detailed Analysis of Revenue and Expenses

The financial performance overview highlights the company's revenue streams and expenses for the fiscal year 2023. Total revenue reached $5 million, marking a 15% increase compared to the previous year due to enhanced sales in the e-commerce segment, which accounted for 60% of total income. The retail operations contributed $2 million, while international sales reached $1 million, reflecting a strong global market presence. Operating expenses totaled $3 million, consisting of administrative costs, totaling $1 million, and marketing expenditures of $800,000, which facilitated the revenue growth. Additionally, production costs of $1.2 million were recorded, underlining the importance of inventory management and supplier negotiations. A comprehensive analysis reveals a healthy profit margin of 40%, indicating efficient cost control measures and optimized resource allocation.

Strategic Recommendations and Future Outlook

The financial performance overview showcases a comprehensive analysis of revenue streams, highlighting key metrics such as a 15% increase in year-over-year sales, driven primarily by robust e-commerce growth, particularly in the North America region. Operating costs, however, rose by 10%, largely attributed to rising supply chain expenses connected to the global semiconductor shortage. Recommendations focus on diversifying suppliers and enhancing inventory management strategies to mitigate risks associated with potential disruptions. Furthermore, future outlook anticipates steady growth in emerging markets, with projected revenues expected to exceed $200 million by 2025, supported by an increased marketing budget aimed at brand awareness and customer engagement initiatives.

Closing Remarks and Contact Information

Financial performance over the last quarter revealed significant trends in revenue streams and expenditure patterns, particularly within sectors such as technology and healthcare. Notable increases occurred in Q2 2023, with a reported growth of 12% compared to Q1, largely attributed to successful product launches in emerging markets like Southeast Asia. Key performance indicators (KPIs) including net profit margin and return on investment displayed marked improvements, signaling effective cost-management strategies and operational efficiencies. Stakeholders may direct inquiries or seek further information through the finance department's contact, which is accessible via the company's official website.

Comments