Are you looking for a straightforward way to gain approval for your capital expenditures? Writing a clear and concise letter can make all the difference in conveying your needs effectively. In this article, we'll explore a helpful template that will streamline the approval process and ensure you cover all essential points. So, let's dive in and discover how to craft the perfect letter for your capital expenditure request!

Purpose and Justification

The proposed capital expenditure, amounting to $1.5 million, aims to enhance operational efficiency at the manufacturing facility located in Springfield, Massachusetts. This investment involves upgrading machinery, specifically the XYZ-200 CNC milling machines, which are crucial for precision manufacturing in the automotive sector. Current equipment, built in 2010, has a production efficiency rate of 75%, significantly lower than the industry standard of 90%. The new machines are expected to reduce production time by 20%, leading to an estimated annual savings of $300,000. In addition, acquiring state-of-the-art technology aligns with our sustainability goals by decreasing energy consumption by 15%, addressing rising energy costs and minimizing our carbon footprint. This expenditure is justified by the long-term financial gains and adherence to industry regulations, ensuring our competitive advantage in the market.

Detailed Cost Analysis

Capital expenditure approval requires a thorough examination of projected costs and benefits related to significant investments such as equipment, facilities, or technology upgrades. A detailed cost analysis involves breaking down expenses into categories, including initial acquisition costs, installation fees, maintenance expenses, potential tax implications, and financing costs. For instance, an investment of $500,000 in advanced manufacturing machinery may include a $30,000 installation fee, annual maintenance costs of $15,000, and a projected operational efficiency gain of 20%, translating to significant long-term savings. Additionally, mapping out timelines for return on investment (ROI) over five years can provide stakeholders with a clearer understanding of the financial impact. A well-structured document will also illustrate how the expenditure aligns with organizational goals, enhances productivity, and contributes to competitive advantage in specific markets like healthcare or technology.

Expected Benefits and ROI

Capital expenditure approval processes are crucial for businesses looking to invest in significant assets, equipment, or infrastructure. Expected benefits from capital expenditures often encompass increased operational efficiency, enhanced production capacity, or improved technology adoption. For example, investing in energy-efficient machinery may lead to a reduction in utility costs by approximately 20%, translating to substantial savings over time. Additionally, anticipated return on investment (ROI) can be calculated based on performance metrics, such as payback periods typically ranging from three to five years and internal rates of return exceeding 15%. These financial indicators help illustrate the project's validity, ensuring alignment with strategic goals while maximizing shareholder value. Implementing strong capital management frameworks enhances organizational growth and innovation potential.

Risk Assessment and Mitigation

Capital expenditure approval relies heavily on thorough risk assessment and mitigation strategies. Identifying potential financial risks, such as budget overruns (exceeding the allocated budget by more than 10% in many cases) and project delays (typically exceeding the planned timeline of six months), is crucial to ensure fiscal responsibility. Additionally, market risks, including fluctuations in supply costs (a rise of 5% to 15% in raw material prices), can impact overall project viability. Implementing effective mitigation strategies, such as contingency budgets (generally 15% to 25% of total costs reserved for unexpected expenses) and regular progress reviews (scheduled bi-weekly) can significantly reduce potential negative impacts. Engaging stakeholders and subject matter experts throughout the process will enhance overall decision-making and ensure that all necessary precautions are taken to safeguard the investment's success.

Implementation Timeline and Milestones

The implementation timeline for the capital expenditure project outlines crucial milestones that ensure efficient progress and accountability. Initial phase includes project approval by stakeholders, expected within two weeks of proposal submission, outlining budget allocations and resource planning. Following approval, a comprehensive site assessment in New York City, scheduled for December 2023, will enable precise measurements and compliance checks with local regulations. The procurement phase will commence in January 2024, where construction materials and contracted labor will be sourced, targeting completion within eight weeks. Significant milestones, such as completion of structural work by March 2024, will be followed by essential quality assurance inspections. Final project completion and handover to the facility management team in April 2024 will mark the conclusion of the implementation process, ensuring all project requirements are met efficiently.

Letter Template For Capital Expenditure Approval Samples

Letter template of capital expenditure proposal for new equipment purchase

Letter template of capital expenditure justification for technology upgrade

Letter template of capital expenditure plan for infrastructure development

Letter template of capital expenditure authorization for software investment

Letter template of capital expenditure outline for operational efficiency improvements

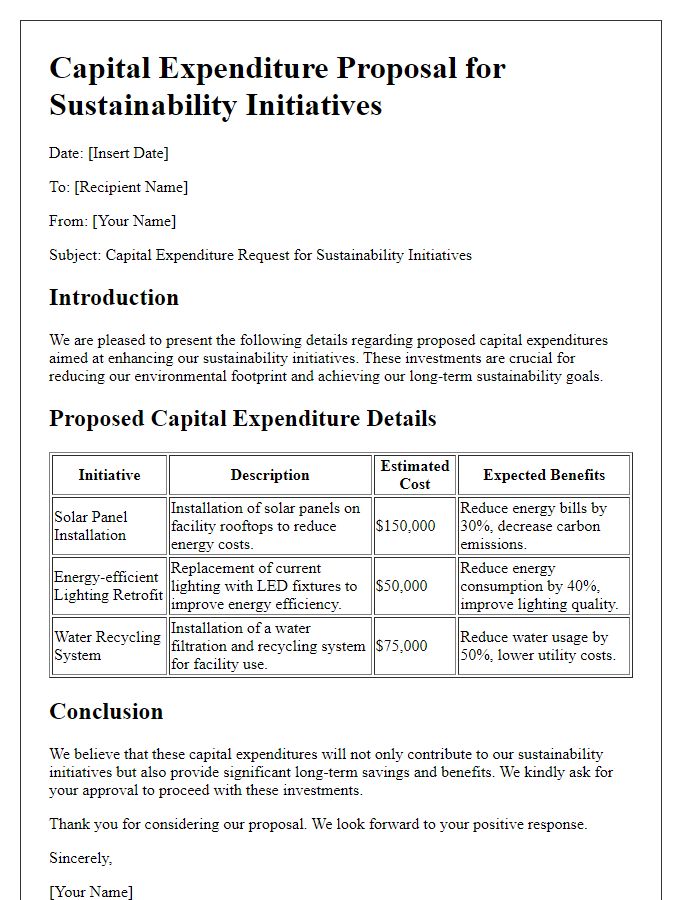

Letter template of capital expenditure details for sustainability initiatives

Letter template of capital expenditure submission for research and development funding

Comments