Have you ever found yourself in the awkward position of needing to follow up on an unpaid service fee? It can feel uncomfortable, but it's a necessary part of maintaining a healthy business relationship. In this article, we'll explore some effective letter templates to help you navigate these conversations with ease and professionalism. Let's dive in and empower yourself with the tools you need to encourage timely payments!

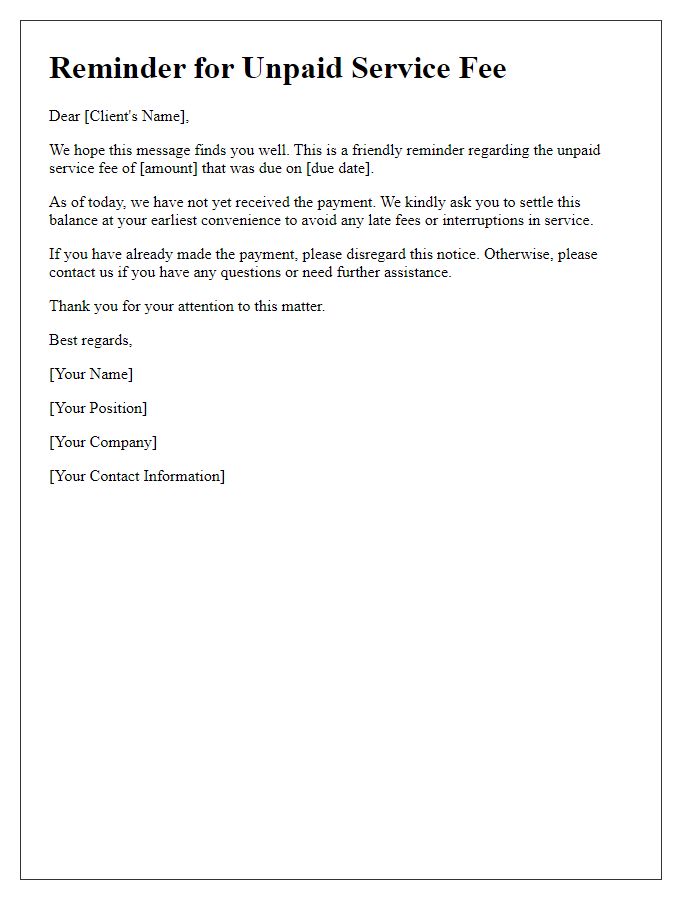

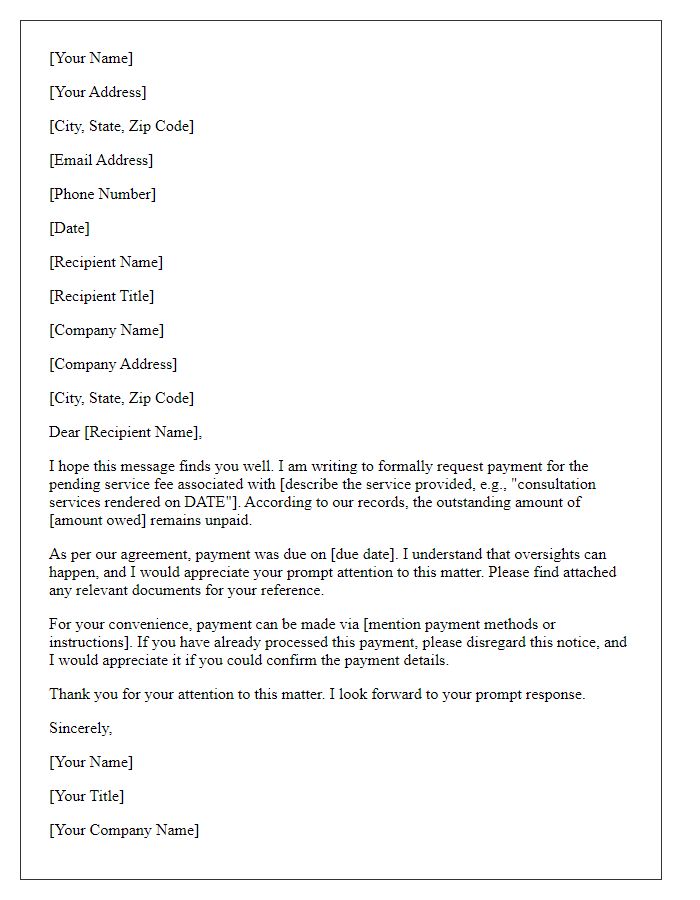

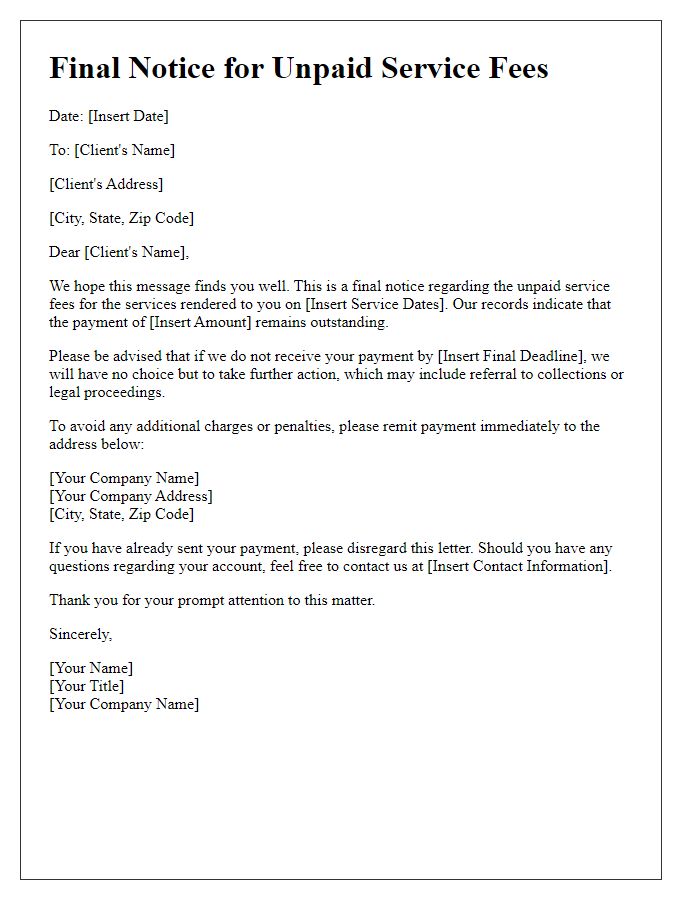

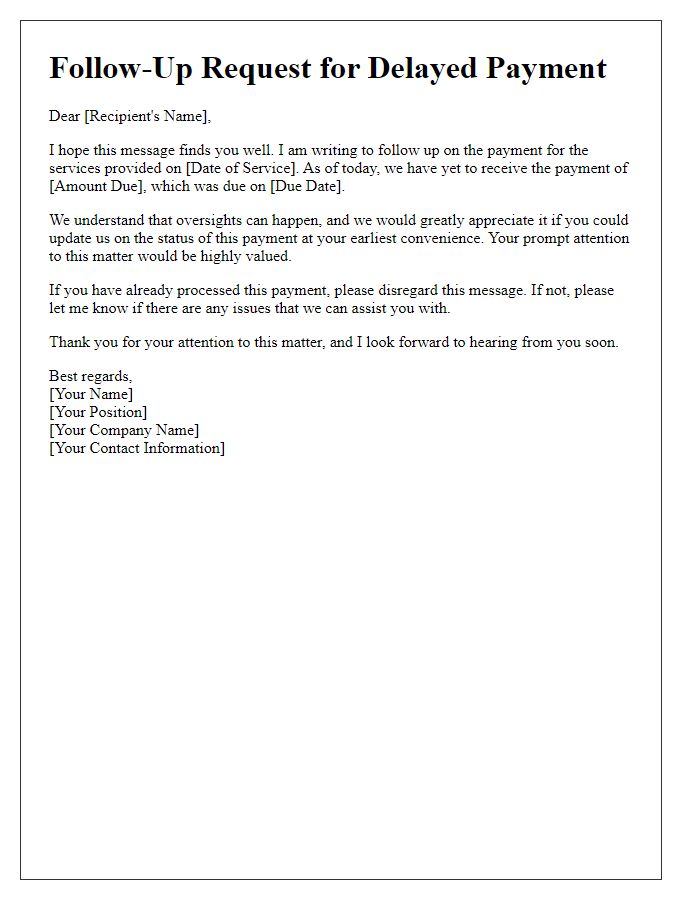

Polite and Professional Tone

A follow-up for unpaid service fees is crucial for maintaining healthy business relationships while ensuring prompt payment. In the case of outstanding fees, reaching out professionally is essential for clear communication and resolution. A gentle reminder can emphasize the due amount, such as "$500 for services rendered between July 1 and July 15, 2023," along with the original invoice date. Check the payment terms, typically outlined with a net 30-day expectation. Highlighting the importance of prompt payment for continued services can foster good rapport. Sending this communication by email can streamline the process while maintaining professionalism. Remember to include your contact details for any immediate queries.

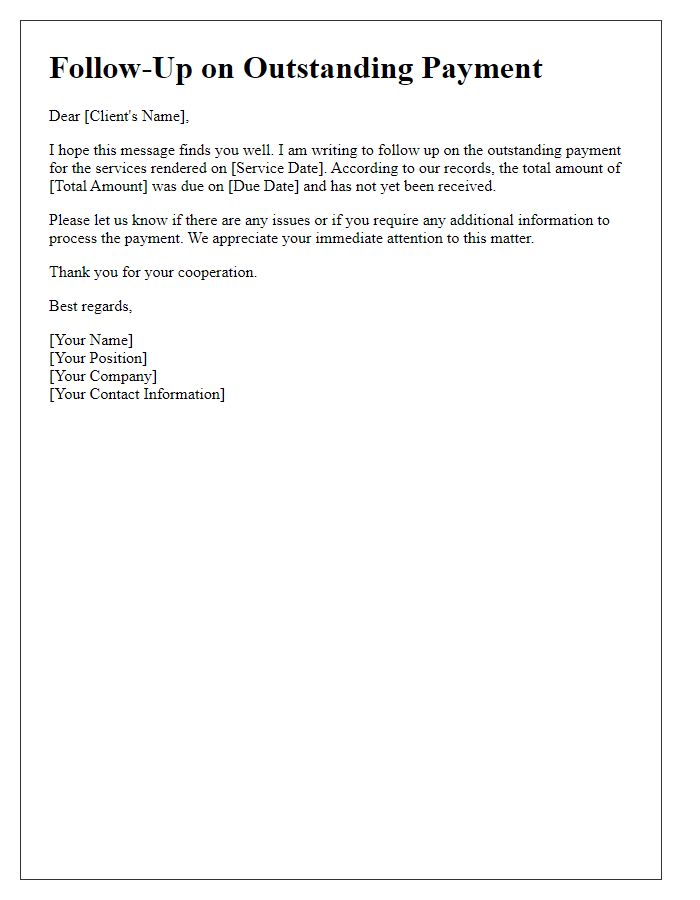

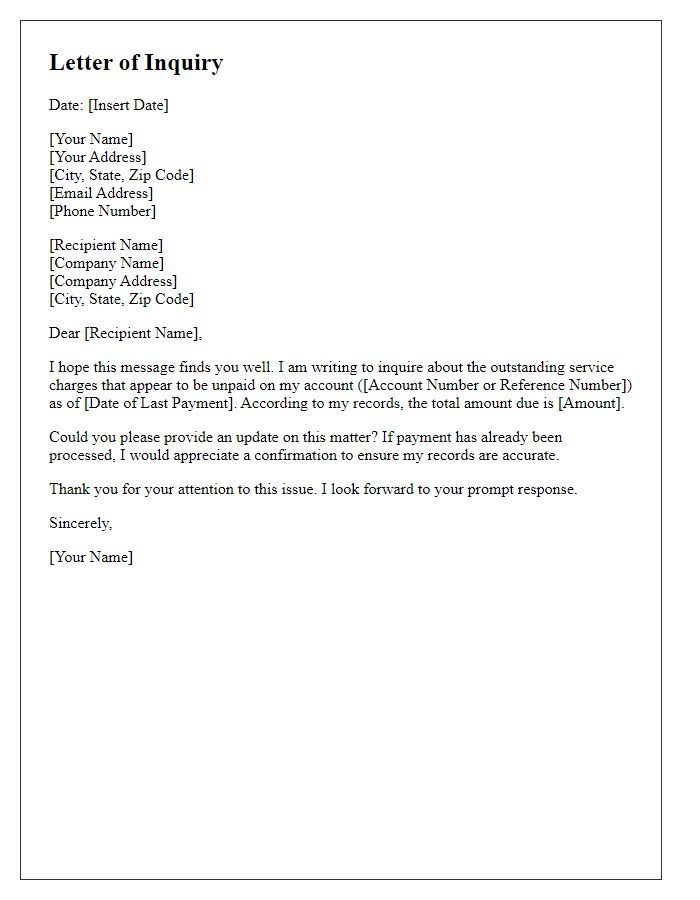

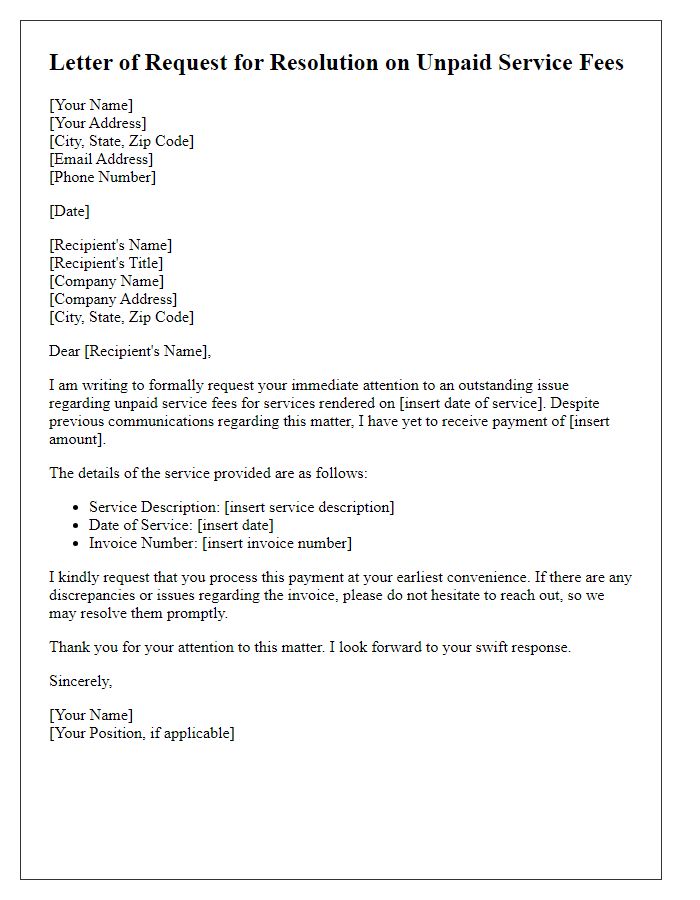

Clear Statement of Outstanding Amount

Businesses often encounter unpaid service fees that require diligent follow-up. The outstanding amount, typically displayed as a line item in accounts receivable, reinforces the need for timely payment reminders. For instance, a company providing web development services might issue a follow-up for an unpaid invoice dated September 1, showing a total of $2,500 due. Specific payment terms, such as 'net 30 days,' help clarify deadlines and emphasize urgency. Effective communication can lead to better cash flow management, essential for maintaining operational stability. Regularly monitoring accounts can prevent service disruptions while enhancing customer relationships through proactive engagement.

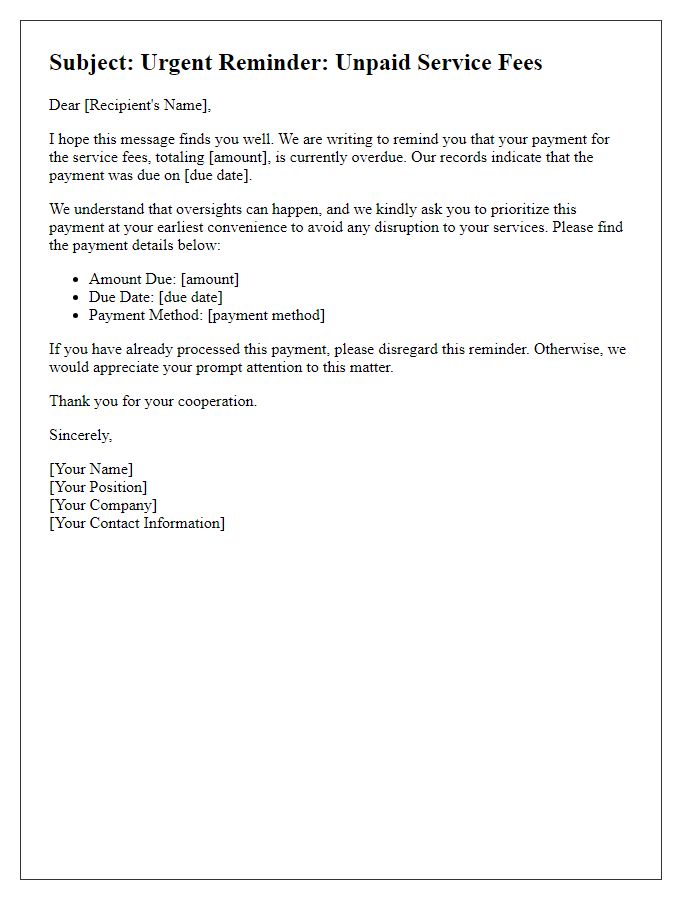

Due Date and Payment Instructions

Unpaid service fees can lead to disruptions in ongoing contracts, especially for organizations dependent on timely payments for operational sustainability. In industries such as software development or consulting services, invoices usually specify a due date, often within 30 days (for example, April 15, 2023), after which late fees may accrue. Payment instructions must be clear, including accepted methods like credit cards, bank transfers, or online payment platforms. The importance of maintaining clear communication regarding payment status can influence client relationships and cash flow management, particularly for small businesses relying on timely income to cover expenses.

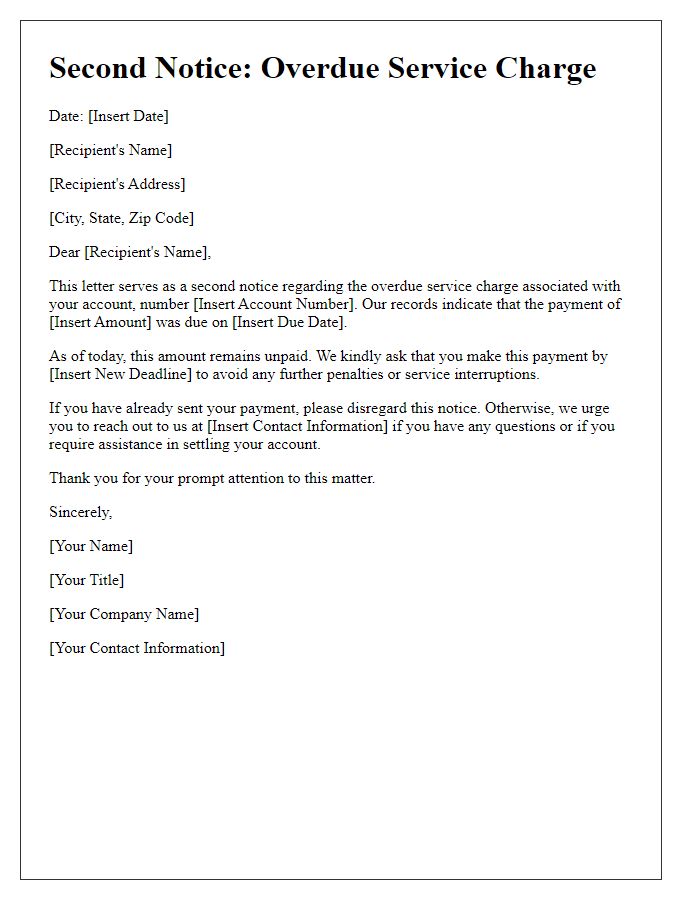

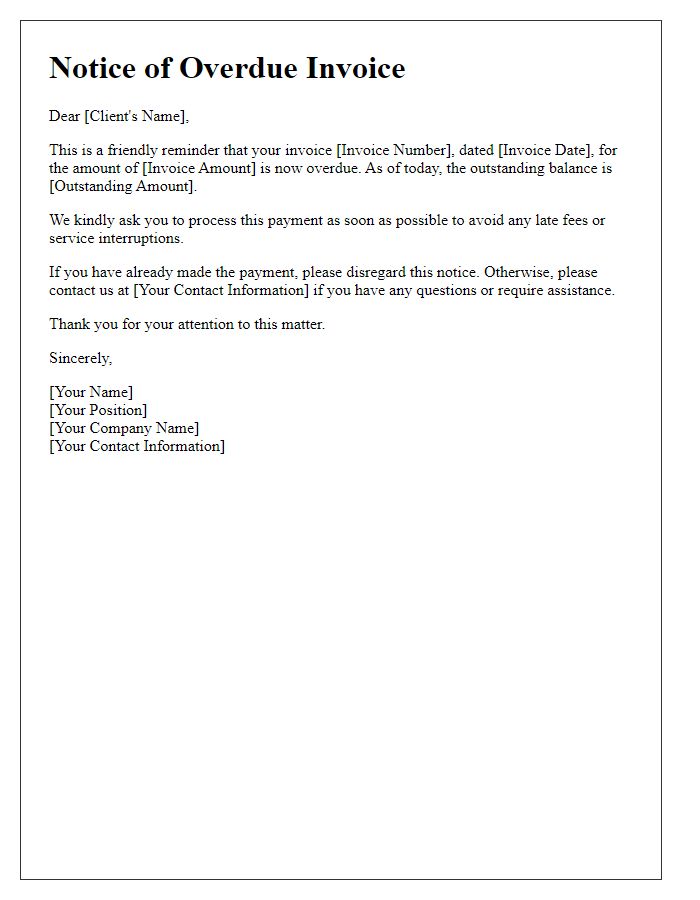

Consequences of Non-Payment

Unpaid service fees lead to significant financial consequences for businesses and service providers. Outstanding amounts, if not settled within stipulated timeframes, can result in late fees (typically 1.5% monthly in many jurisdictions) accruing on unpaid balances. Prolonged non-payment may lead to the suspension of services, affecting operational capacity. In severe cases, service providers may escalate issues to collection agencies, initiating legal proceedings, which could incur additional costs (ranging from court fees to attorney expenses). Maintaining a good credit standing becomes challenging, potentially impacting future business transactions or financing opportunities. Clear communication regarding payment timelines is essential to prevent these unfavorable outcomes.

Contact Information for Queries

Unpaid service fees can lead to disruptions in business operations. Service providers often rely on timely payments for maintaining essential services. Contact information (email, phone number) should be clearly indicated to facilitate prompt communication regarding outstanding invoices. Additionally, specifying the payment terms clearly can help in avoiding misunderstandings. Regular follow-ups, such as courteous reminders, can significantly improve payment recovery. Implementing automated reminders can also enhance efficiency in managing outstanding accounts. Businesses need to ensure that clients understand the consequences of delayed payments to avoid service interruptions.

Comments