If you've ever experienced a payroll discrepancy, you know how frustrating it can be. Mistakes happen, and addressing them promptly is essential to ensure you're paid accurately for your hard work. In this article, we'll explore a simple yet effective template to help you communicate your concerns clearly to your HR or payroll department. Ready to resolve your payroll issues? Let's dive in!

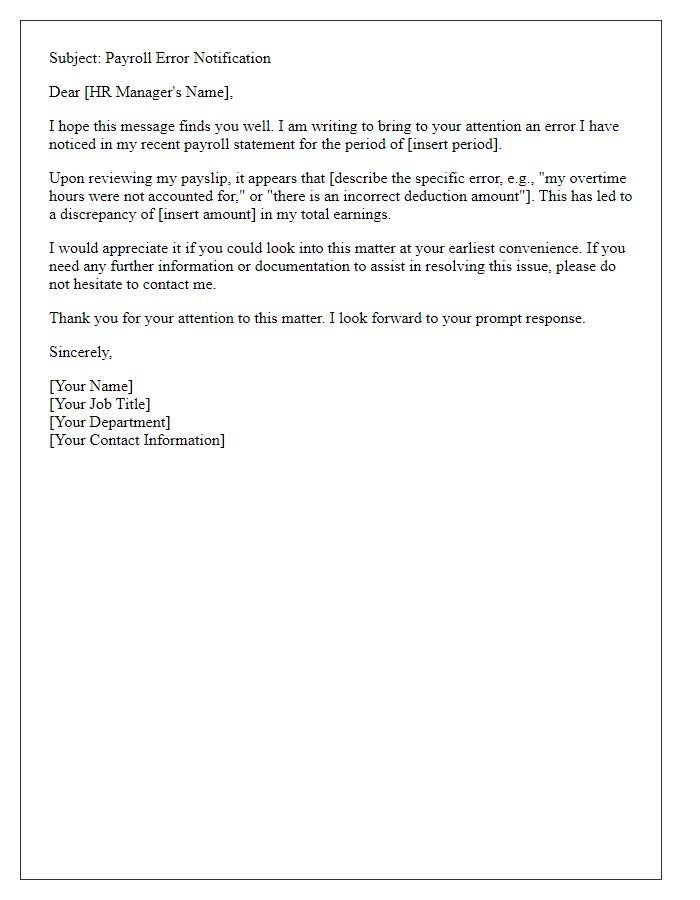

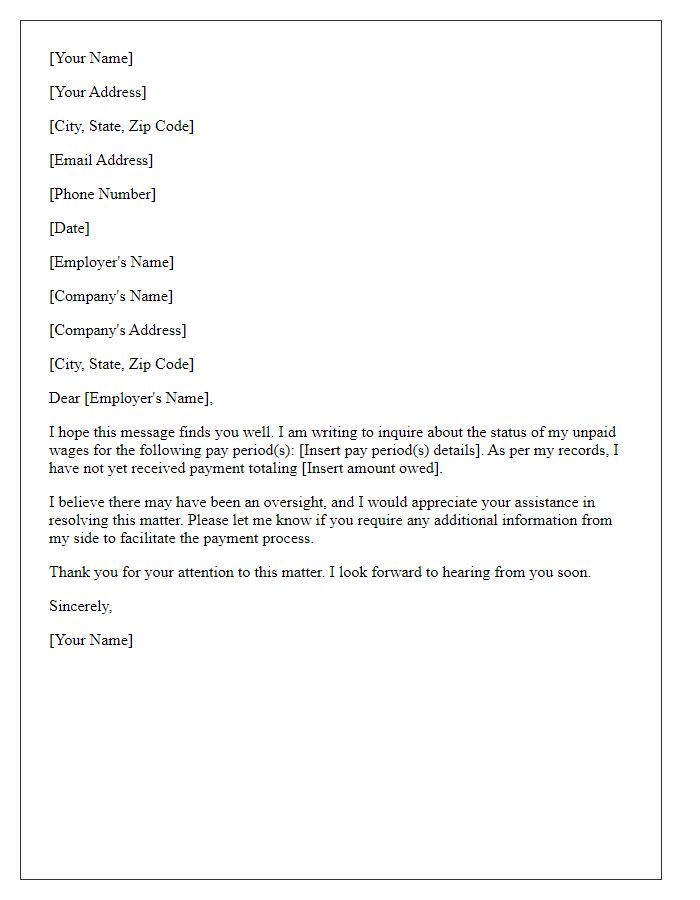

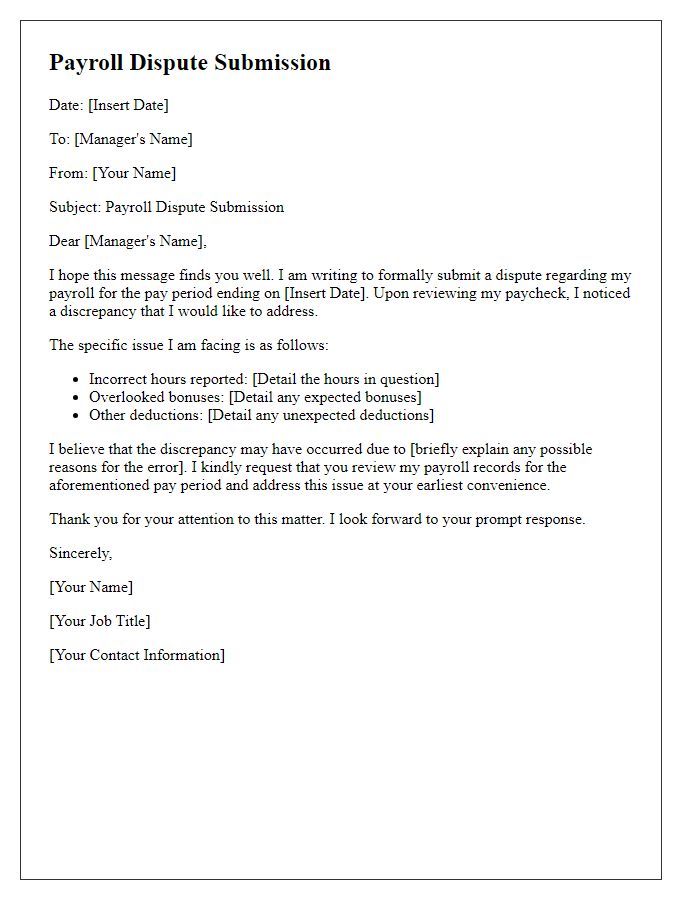

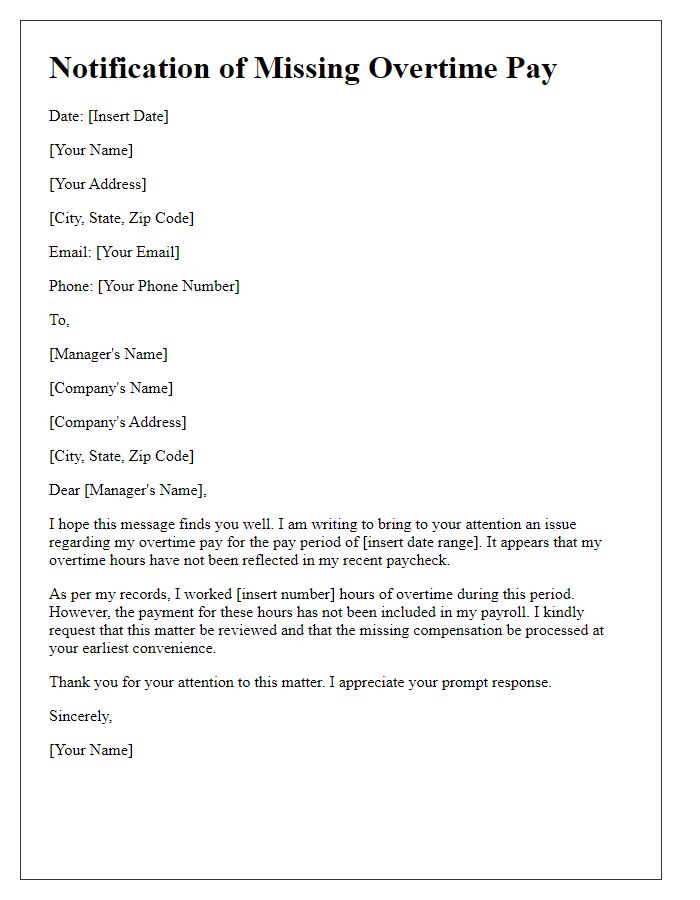

Clear Subject Line

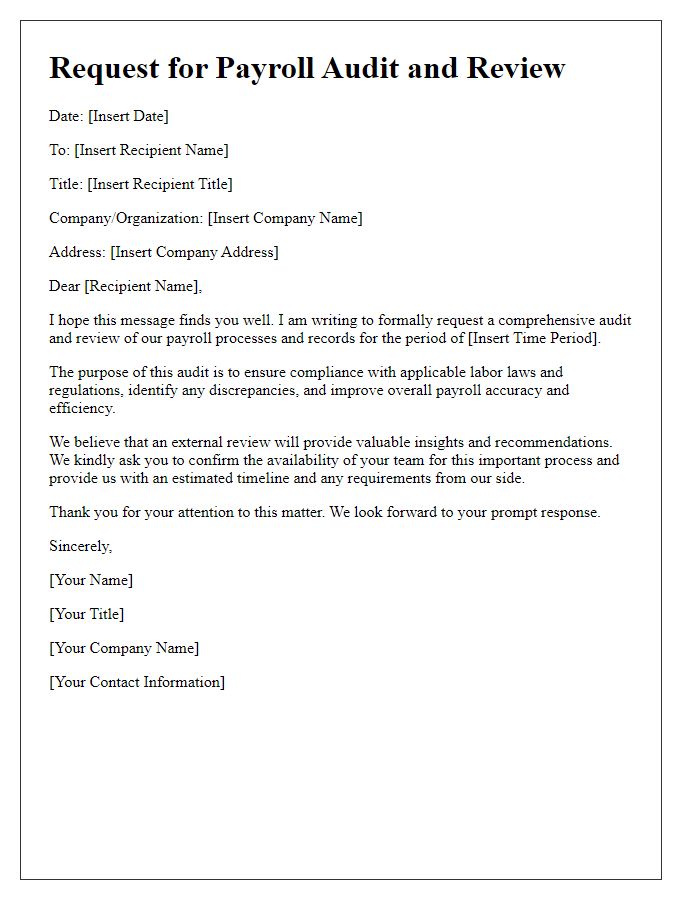

In payroll processes, discrepancies can lead to significant issues for employees. Common discrepancies include incorrect wage calculations, withheld taxes, and unpaid overtime hours. Payroll departments usually use software like ADP or Paychex for accuracy. Employees should report discrepancies promptly, ideally within the payroll cycle, to ensure corrections align with the next paycheck. Accurate documentation of hours worked (like timesheets) and pay rate agreements is crucial for resolving issues effectively. Timely resolution of payroll discrepancies not only maintains employee trust but also ensures compliance with labor regulations.

Employee Information

Employee information, including the employee's full name, employee identification number, and department code, is essential for payroll discrepancy resolution. Accurate details ensure efficient handling of errors, such as incorrect salary calculations or missing bonuses. The employee's hire date (indicating duration of service) and position title (reflecting responsibilities) further aid in context. Additionally, providing contact information, like email address and phone number, facilitates communication between the employee and the payroll department throughout the resolution process. Proper documentation and clarity in employee information can significantly expedite investigation into discrepancies, ensuring timely adjustments and maintenance of trust within the organization.

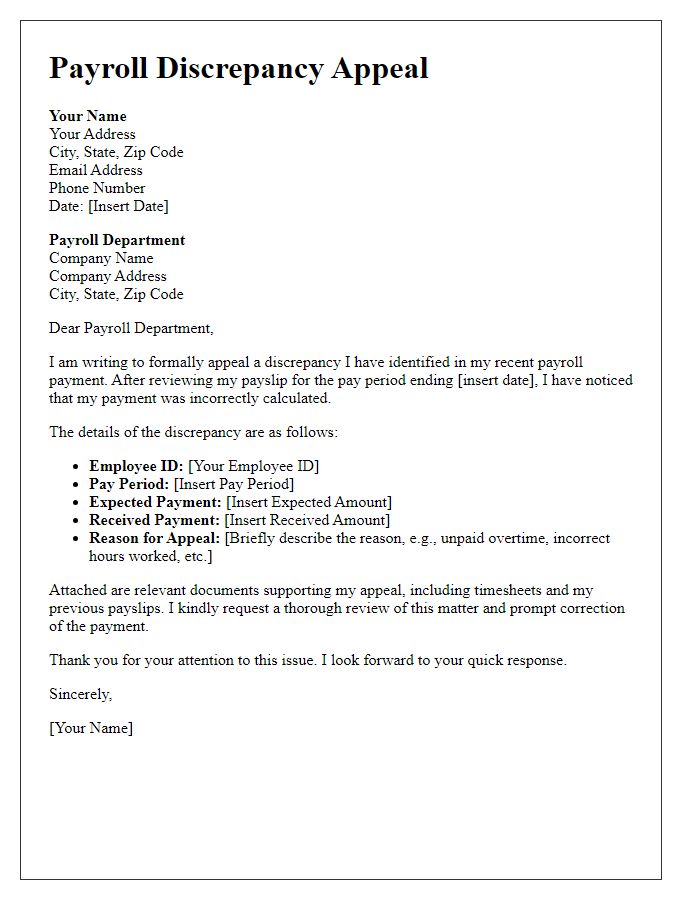

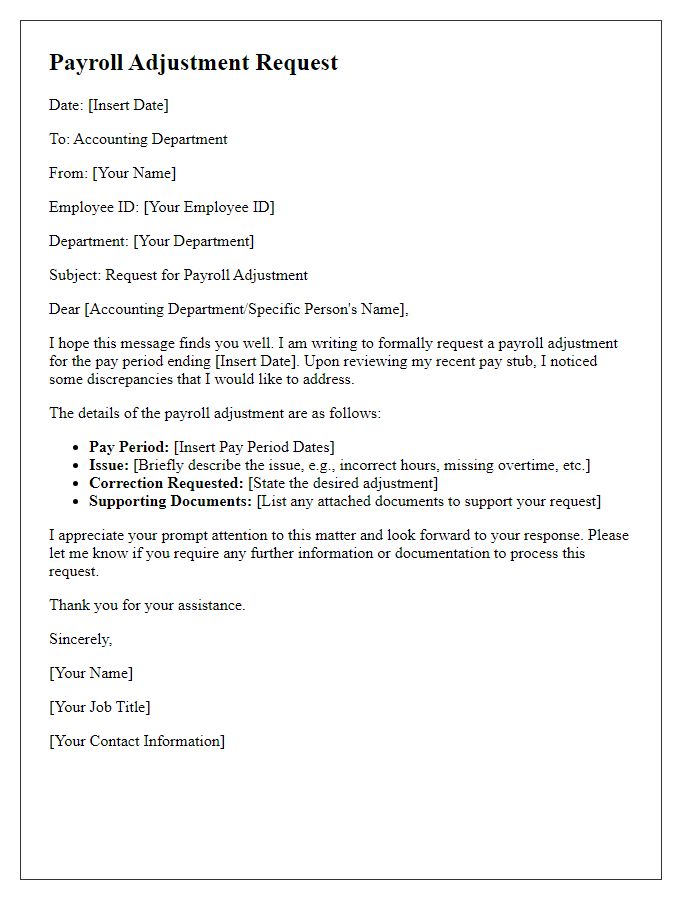

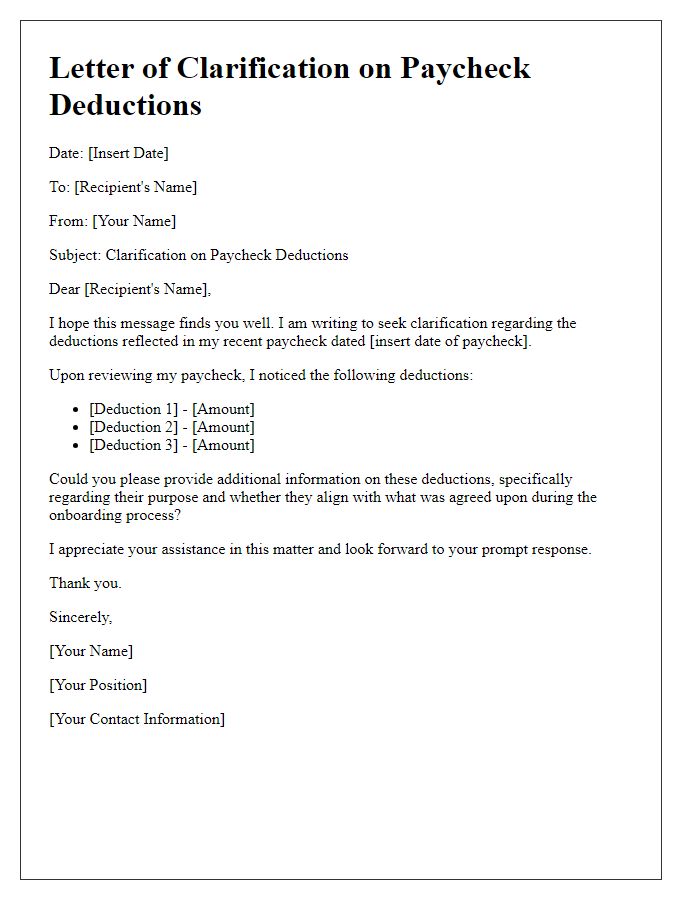

Detailed Discrepancy Description

Payroll discrepancies can significantly impact employee satisfaction and financial planning. A common issue includes underpayment, where an employee's paycheck is less than the agreed salary, often due to clerical errors in the payroll system, time-tracking inaccuracies, or misclassified pay rates. Another issue is overpayment, which may occur when bonuses or overtime are incorrectly calculated based on inaccurate hours worked or incorrect hourly rates. Benefit deductions, such as healthcare or retirement contributions, may also be misapplied, affecting net pay. These discrepancies require thorough investigation and prompt resolution to ensure compliance with labor laws and maintain trust in the payroll process, especially in large organizations where payroll processing involves multiple departments and intricate systems.

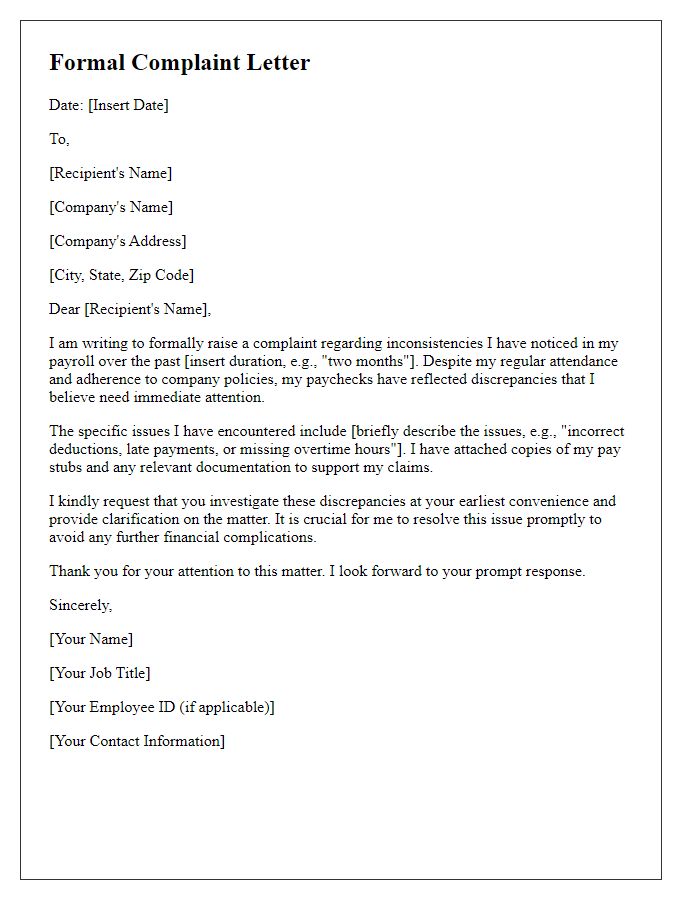

Supporting Documents

Payroll discrepancies can arise from various factors, leading to miscalculations or errors in employee compensation. Essential supporting documents include pay stubs, which outline the gross and net pay, alongside any deductions such as taxes or retirement contributions (e.g., 401(k)). Time sheets, reflecting hours worked, provide clarity on overtime and regular hours. Additionally, employment contracts stipulate salary agreements and terms of payment. Communication records, such as emails regarding pay raises or promotions, serve as evidence for expected compensation changes. Finally, government tax documents like W-2s provide a comprehensive overview of withheld taxes, essential for resolving discrepancies. Each of these documents plays a vital role in accurately addressing payroll issues within organizations.

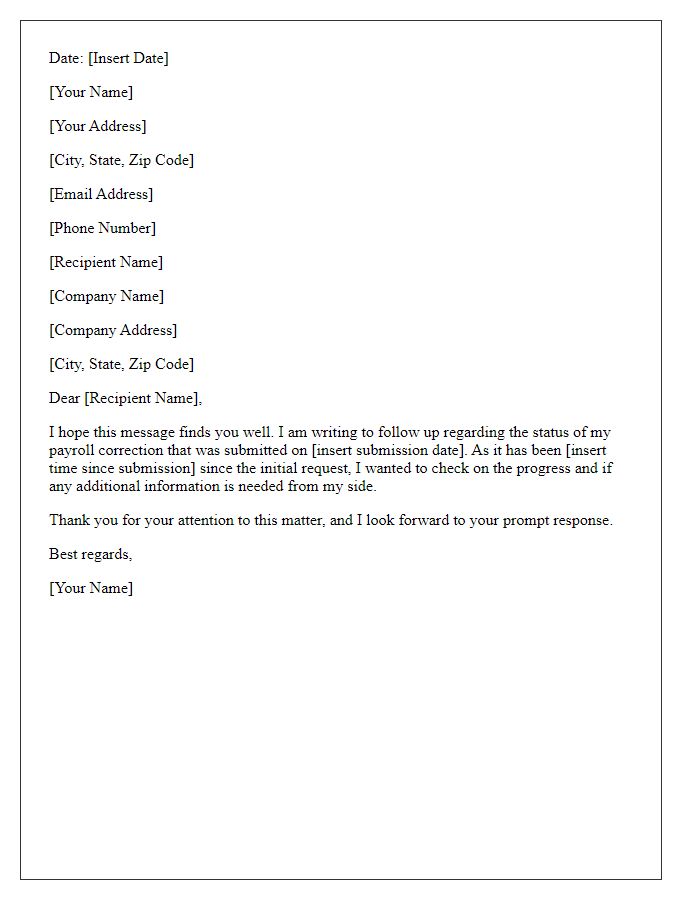

Resolution Request

Payroll discrepancies can lead to significant financial stress for employees and impact overall workplace morale. Common issues involve incorrect salary amounts, missing bonuses, or overtime discrepancies that might stem from miscalculations or data entry errors. For instance, an employee at XYZ Corporation might notice a $500 shortfall in their bi-weekly paycheck, which can create difficulties in meeting monthly financial obligations such as rent or bills. Timely resolution of these matters is crucial, often requiring submission of formal requests to human resources departments or payroll administrators, detailing the specific issue along with relevant pay period dates and documentation like pay stubs. Ensuring accurate payroll processing not only maintains trust within the workforce but also upholds the reputation of the organization as a responsible employer.

Comments