Have you ever stumbled upon a mistake in your accounting records and felt overwhelmed about how to address it? It's a common situation, but correcting these errors doesn't have to be a daunting task. A well-crafted letter can streamline the process and ensure clarity between you and your accountant. Stick around to discover our handy template that will make rectifying errors a breeze!

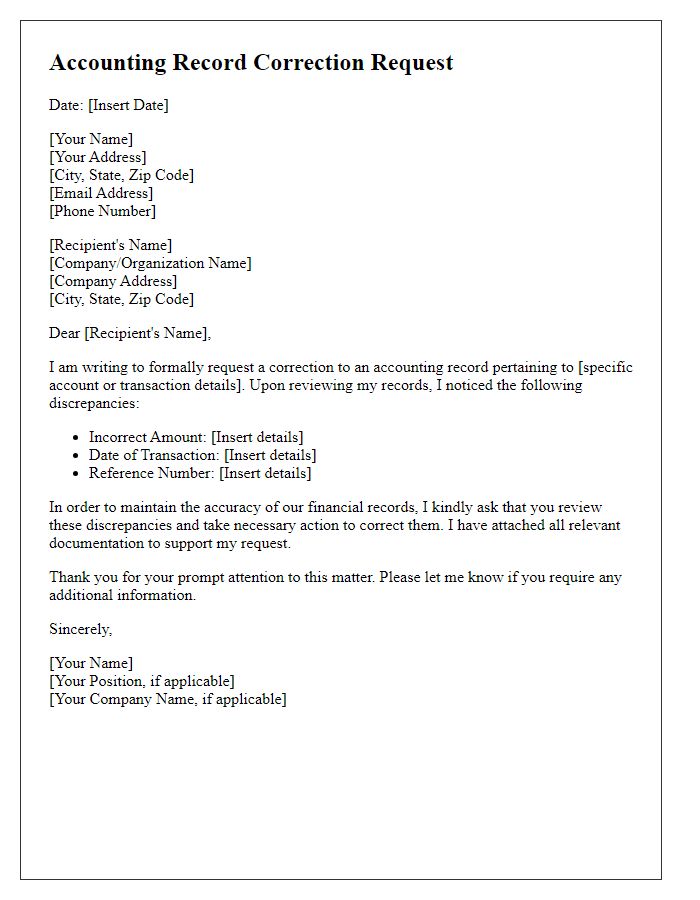

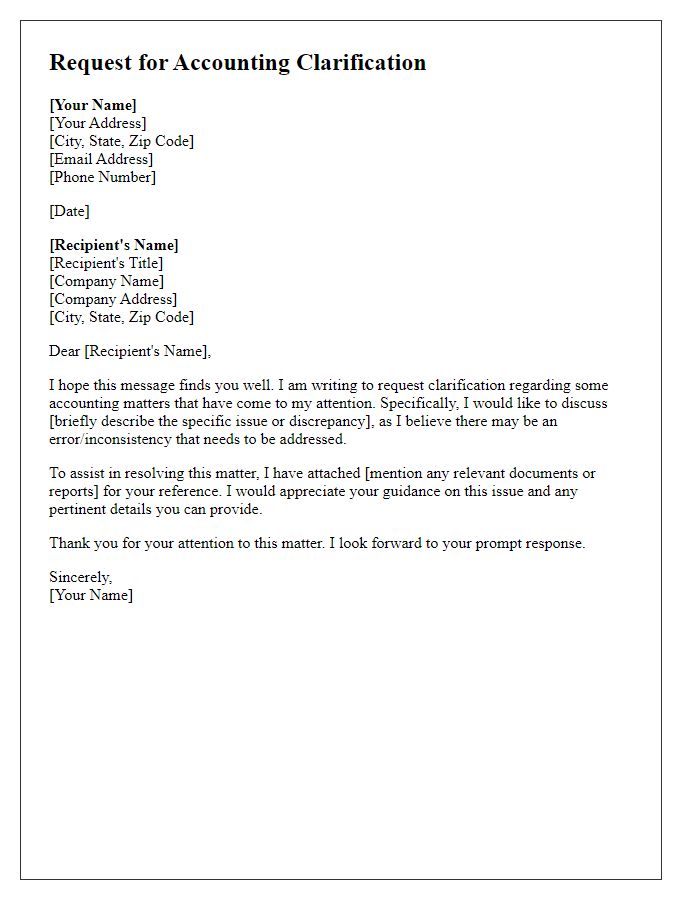

Clear Identification of Error

In accounting records, clear identification of errors is crucial for maintaining accuracy and integrity. For instance, a discrepancy in a customer invoice totaling $2,500 from July 15, 2023, may arise due to data entry mistakes, such as transposing numbers or misclassifying accounts. Notably, an error in reporting expenses under the wrong account can lead to misstatements in financial statements, impacting budgets and cash flow projections. Precise tracking of journal entries and invoices can assist in pinpointing discrepancies, ensuring prompt correction and minimizing potential financial misreporting. Additionally, regular audits and reconciliations between accounts payable and receivable can further enhance the identification process, fostering more reliable accounting practices.

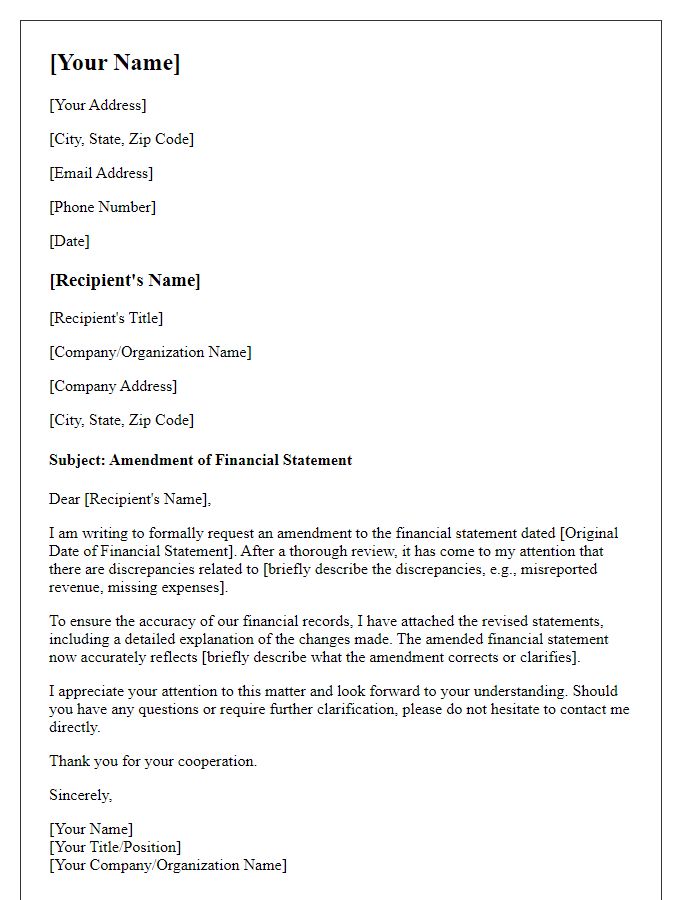

Concise Explanation of Impact

Errors in accounting records can significantly affect financial statements' accuracy, leading to potential misinterpretations of a company's financial health. For instance, an incorrect entry of $5,000 in revenue can inflate total income, misleading stakeholders like investors and creditors. Such discrepancies can also impact tax calculations, resulting in penalties of up to 25% for misreporting to the IRS. Furthermore, financial audits conducted annually can uncover these errors, risking reputational damage for organizations and decreasing stakeholder trust. Timely correction is essential to maintain integrity in reporting and compliance with financial regulations such as GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards).

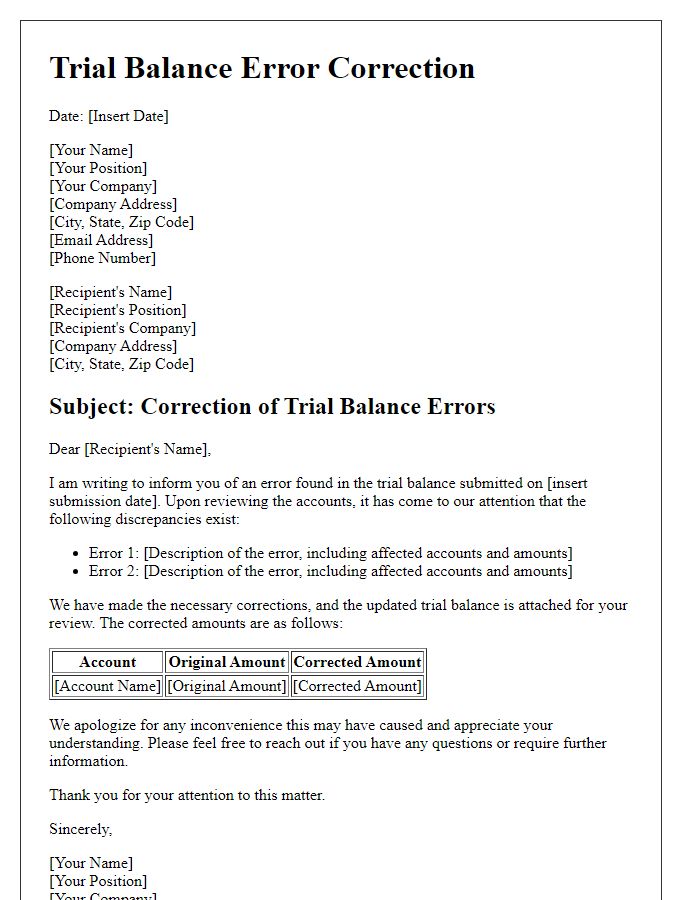

Corrective Measures and Resolution

Accurate accounting records are essential for financial integrity in organizations, with procedures in place for error correction. Common discrepancies include incorrect entries, miscalculations, or classification errors in financial statements. The process begins with identifying the specific error, often related to transactions recorded in general ledgers or subsidiary ledgers. Following identification, corrective measures involve adjusting journal entries, typically referencing original invoices or receipts dated around the transaction period. This may require a review of financial periods, such as quarterly reports or annual financial summaries, to ensure compliance with overarching standards like GAAP (Generally Accepted Accounting Principles). Proper documentation of the correction is crucial, including detailing the nature of the mistake, the individual responsible for the initial entry, and the reviewer's name. A resolution meeting may be convened involving key stakeholders like the accounting team and management to discuss the impact of the error and ensure ongoing accuracy in future financial operations.

Documentation for Reference

In accounting, maintaining accurate records is crucial for financial integrity, such as for businesses or organizations that rely on data like invoices, receipts, and transactions. Errors in these records, whether due to data entry mistakes or misclassified expenses, can significantly impact financial reporting. For instance, discrepancies in accounts payable or receivable can lead to cash flow issues, affecting operational decisions. Documentation for error correction should include a detailed description of the error, the affected accounts, and the adjustments made, ensuring compliance with regulatory standards like the Generally Accepted Accounting Principles (GAAP). Accurate documentation allows for clear references during audits or financial reviews, fostering trust and transparency in financial practices.

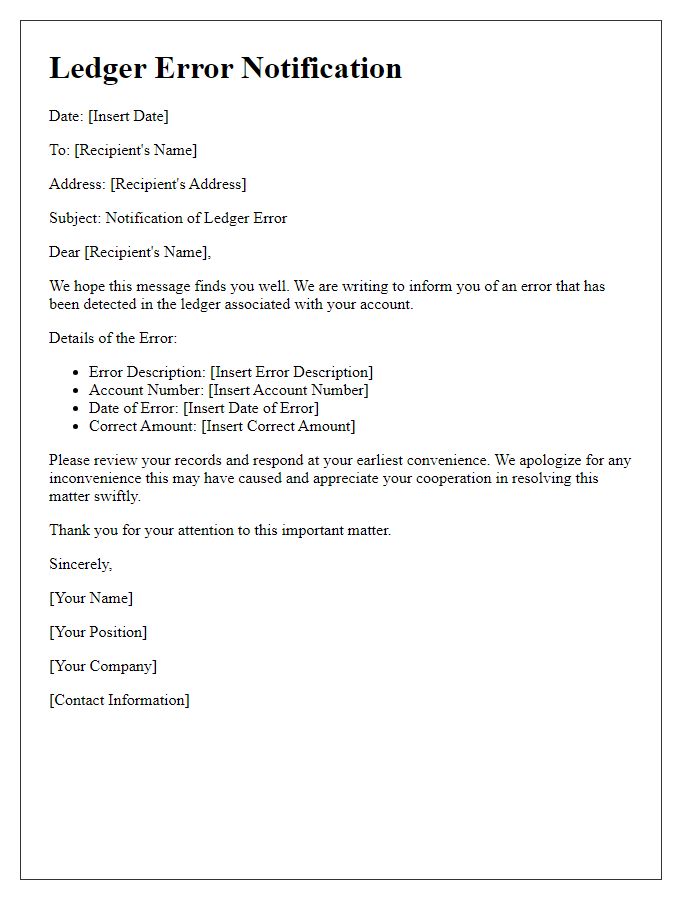

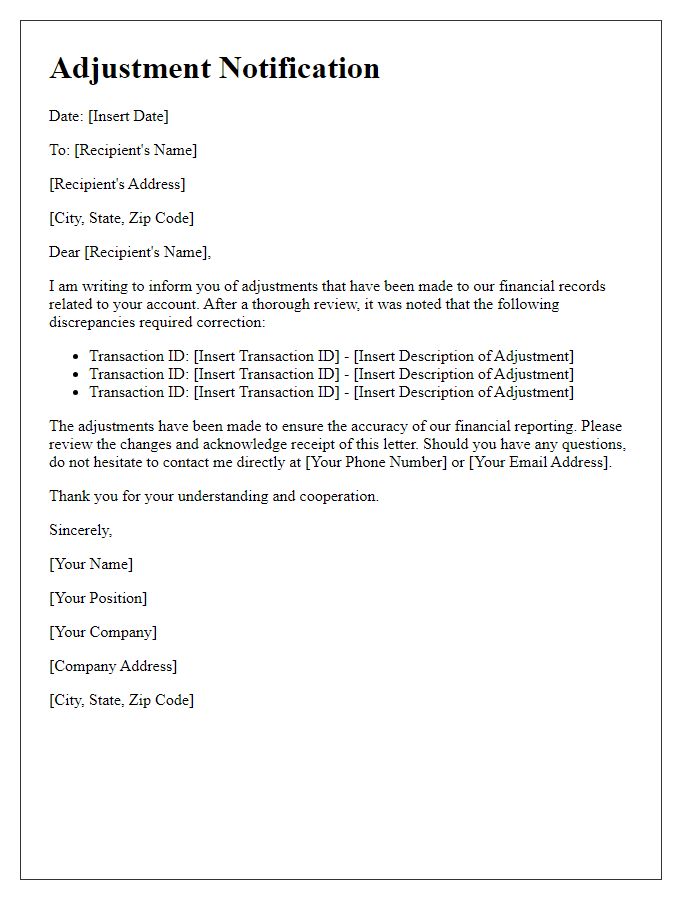

Follow-up and Confirmation Request

Inaccuracies in accounting records can significantly impact financial reporting, especially in organizations like corporations or small businesses. These discrepancies may arise from entry errors, missing invoices, or database inconsistencies. For instance, an unrecorded transaction valued at $5,000 could distort quarterly financial analysis, affecting decision-making and stakeholder trust. A follow-up and confirmation request is essential to address these errors, ensuring that all parties involved, including accountants, auditors, and financial managers, reconcile their records. Establishing clarity around these inconsistencies also facilitates compliance with regulations set forth by bodies such as the Financial Accounting Standards Board (FASB) or the International Financial Reporting Standards (IFRS).

Comments