Are you wondering how to streamline your partnership tax return filing process? Understanding the nuances of tax regulations can be daunting, but it doesn't have to be. With the right letter template in hand, you can effectively communicate with your partners and ensure everyone is on the same page regarding tax responsibilities. Dive in to discover the essential components of an effective partnership tax return letter!

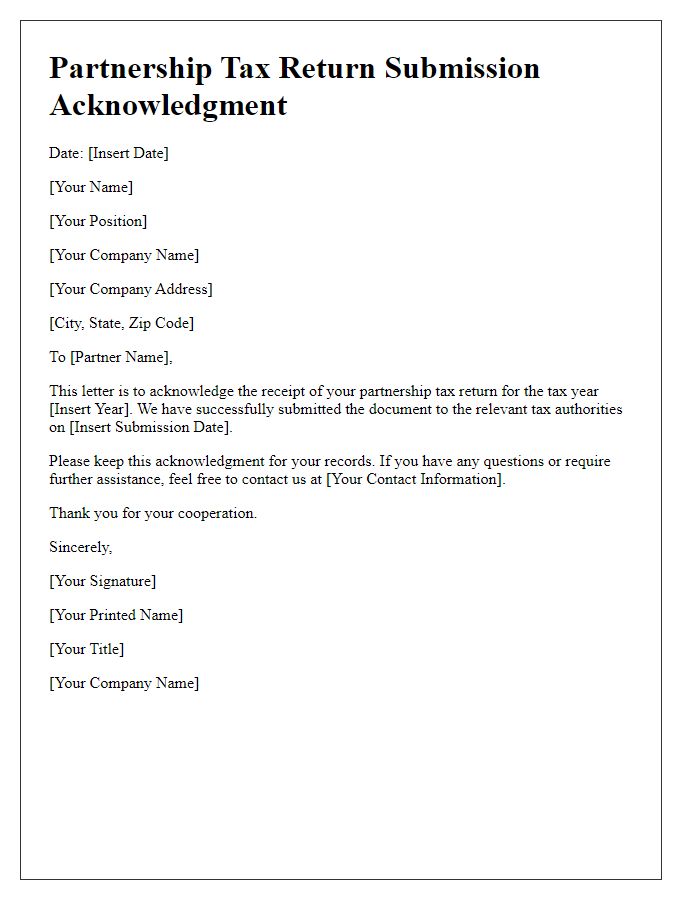

Partnership Identification Information

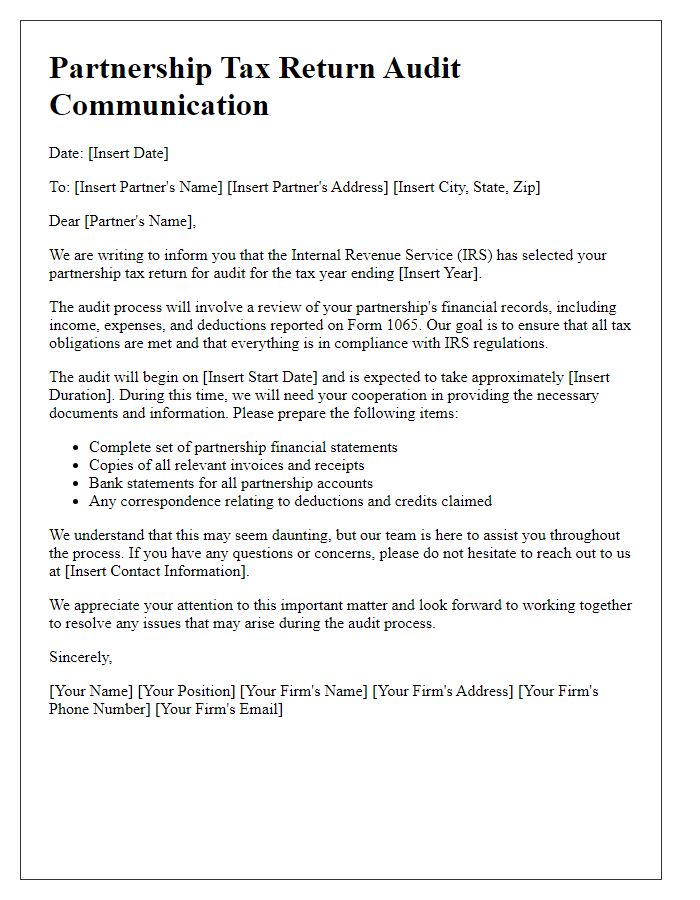

Partnership identification information plays a crucial role in filing tax returns for business structures recognized as partnerships. Each partnership must have a unique Employer Identification Number (EIN), assigned by the Internal Revenue Service (IRS), to ensure proper identification and tracking for taxation purposes. Furthermore, the partnership's legal name, as registered with state authorities, must be accurately reported, along with the principal business address, which is typically the location where business activities are conducted or headquarters are based. Additionally, it's essential to include the names and Social Security Numbers (SSNs) or EINs of all partners involved, detailing their percentage of ownership interest in the partnership. This information is vital for the IRS to allocate income, deductions, and credits appropriately among partners during the annual tax filing process. Accurate submission of this data ensures compliance with IRS regulations, minimizing the risk of audit or penalties.

Filing Year and Tax Period

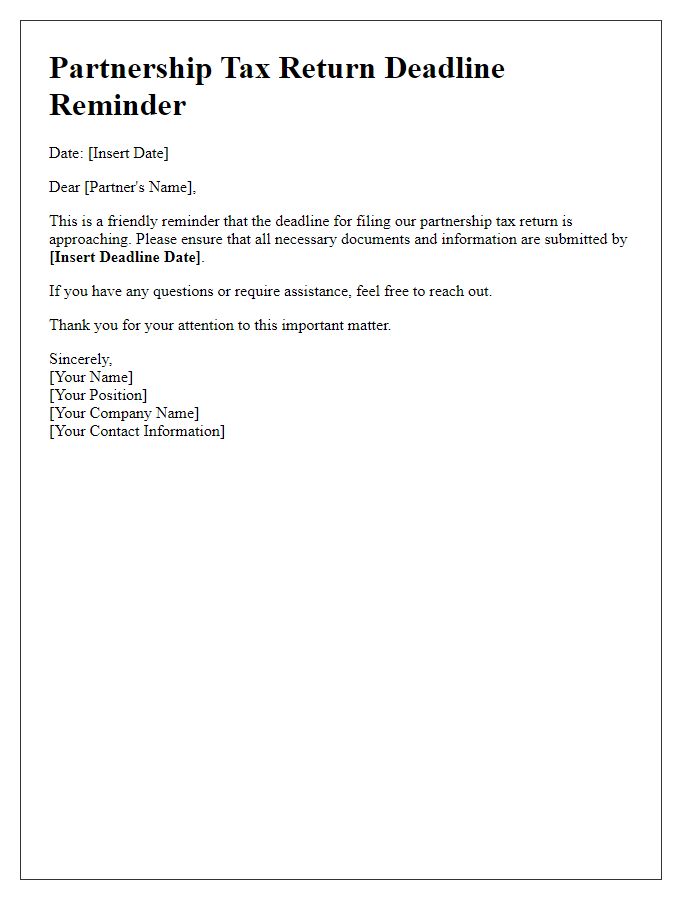

Partnership tax return filings, specifically Form 1065, require meticulous attention to detail, ensuring accurate reporting for the tax year, typically spanning from January 1 to December 31. The filing deadline for these returns is usually March 15, unless an extension is requested, allowing additional time for completion. Each partnership must include vital financial information, such as gross receipts or sales, ordinary business income, and guaranteed payments to partners. Additionally, the Form 1065 must provide K-1 schedules for each partner, detailing their share of income, deductions, and credits. Proper documentation is critical, showcasing not only the partnership's financial status but also compliance with the IRS regulations. Timely submission is essential to avoid penalties and ensure smooth processing by the Internal Revenue Service (IRS).

Contact Information for Queries

Partnership tax return filings require detailed and accurate contact information to address any queries from tax authorities. Essential elements include the partnership name, which typically reflects the business's identity, and the taxpayer identification number (TIN), a unique nine-digit number assigned by the IRS for taxation purposes. Address specifics should include street name, city, state (like California or Texas), and zip code, ensuring correspondence reaches the appropriate location. Designate a point of contact within the partnership, usually a managing partner or accountant, including their name, direct phone number, and email address to facilitate timely communication and resolution of any issues. Maintaining this comprehensive contact framework supports a smooth filing process and helps navigate any potential inquiries during audits or compliance checks.

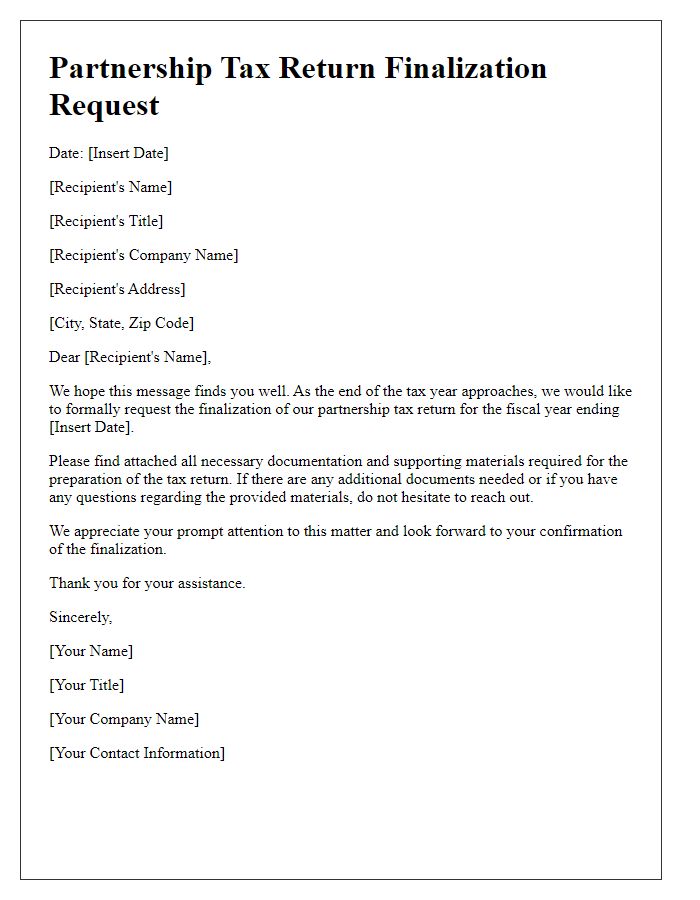

Proper Salutation and Sign-off

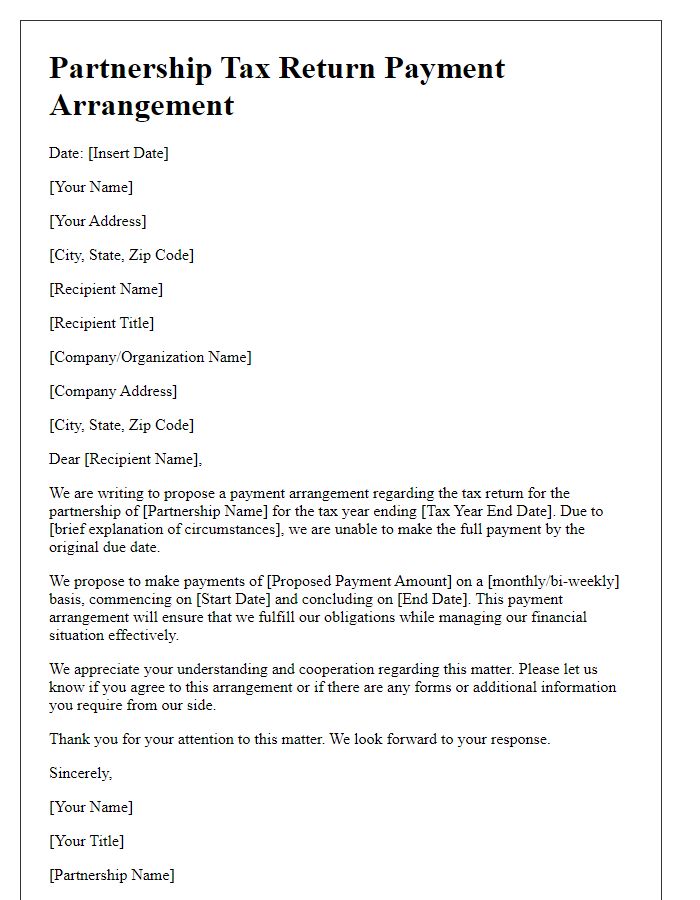

The high-stakes world of partnership tax return filing requires precise documentation and effective communication between stakeholders. Understanding your partnership structure, such as general or limited partnerships, is crucial for accurately reporting income on IRS Form 1065. Key financial metrics, including total revenue, expenses, and each partner's share of profits or losses, must be meticulously gathered and documented. Timelines for filing, typically by March 15 for calendar-year partnerships, necessitate clear coordination among partners. Frequent reviews of state-specific requirements, like those in California or New York, ensure compliance and minimize penalties. Amending partnerships involves filing Form 1065X with updated financials and ensuring all partners receive Schedule K-1 documents for their respective tax returns.

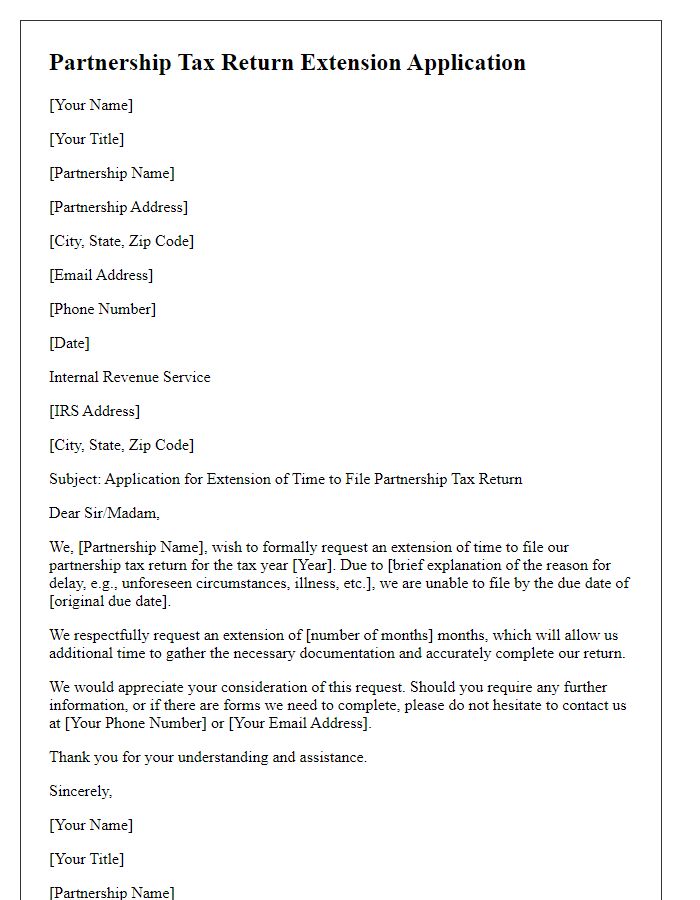

Clear Instructions for Submission

Timely submission of partnership tax returns is crucial for compliance with Internal Revenue Service (IRS) regulations. Partnerships, such as limited liability companies (LLCs) or general partnerships, must file Form 1065 (U.S. Return of Partnership Income) annually by March 15, unless an extension is requested. Essential documentation includes a complete Schedule K-1 for each partner, detailing individual income, deductions, and credits proportionate to their interests in the partnership. Supporting financial statements, such as balance sheets and profit-loss statements, should accompany the return to ensure accurate reporting of income distributions. Accurate accounting for fiscal year-end, typically December 31, is necessary to reconcile earnings and expenses. Partners should verify personal tax identification numbers (TINs) to prevent delays in processing. Electronic filing is encouraged for efficiency and security; however, paper submissions must be postmarked by the due date to avoid penalties.

Comments