Hey there! If you've recently taken out an insurance policy, chances are you'll receive a premium notice soon. This letter is not just a friendly reminder; it's your ticket to understanding your coverage and payments better. Navigating the world of insurance can be a bit overwhelming, but we're here to help you make sense of it all. Ready to dive deeper into what your premium notice entails? Let's explore it together!

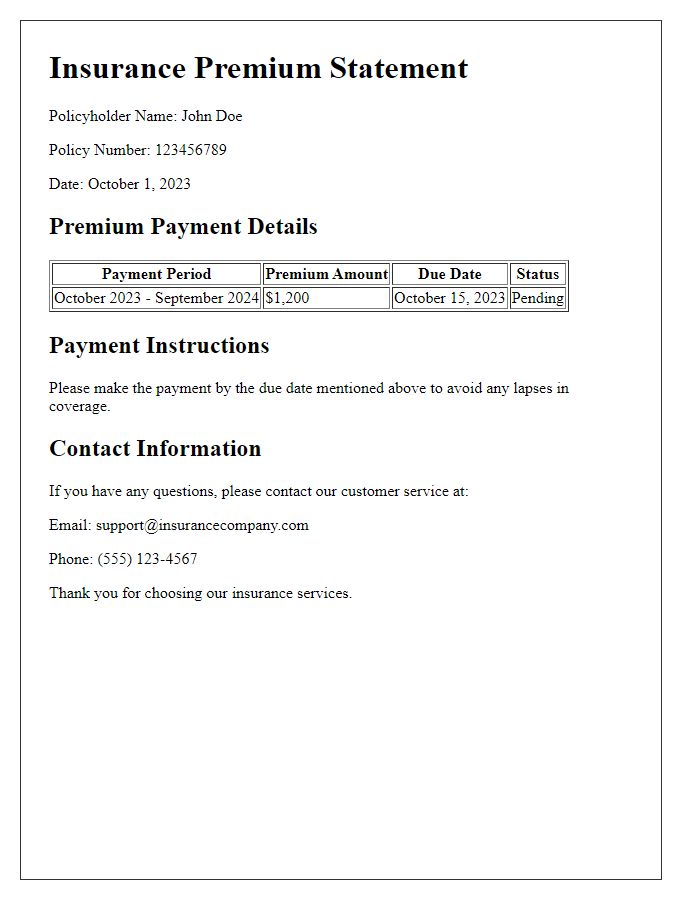

Policyholder Information

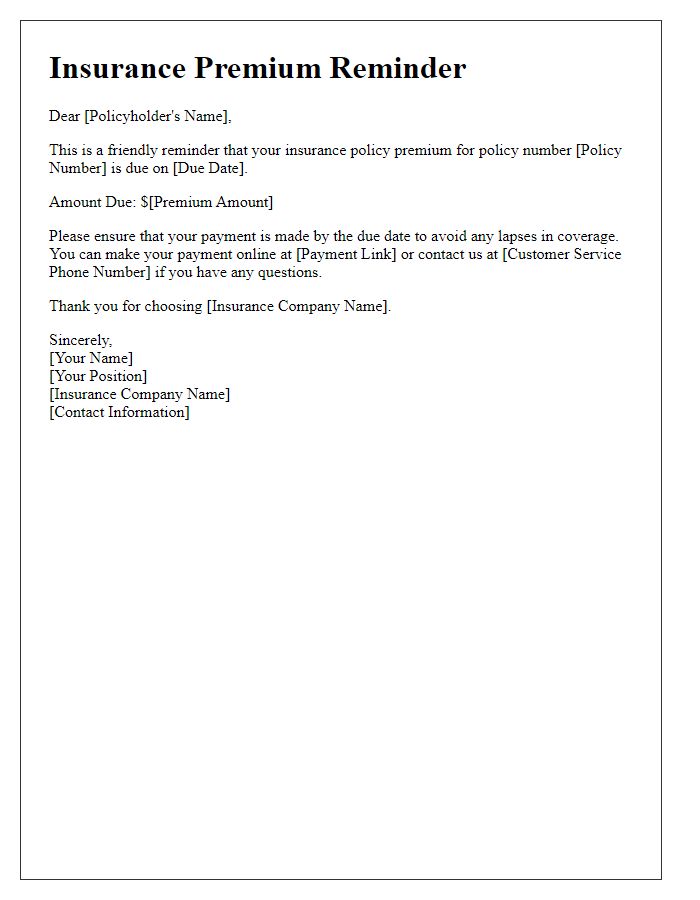

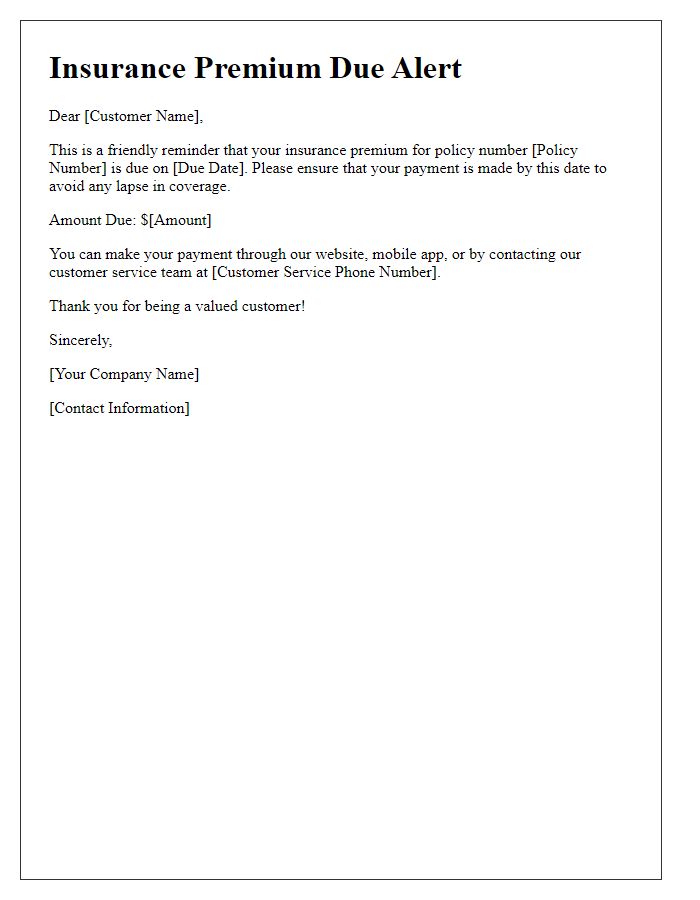

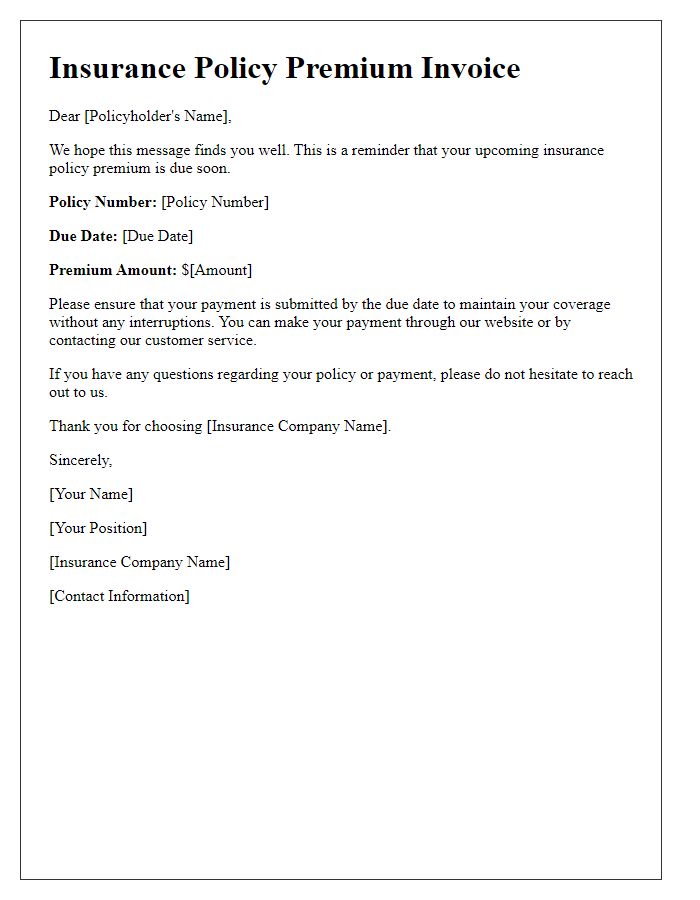

Policyholders, who have active insurance plans, receive premium notices to remind them of their upcoming premium payments. This information highlights crucial details such as due dates, payment amounts, and policy numbers, ensuring that coverage remains uninterrupted. Timely payment (typically within 30 days of the due date) is essential to maintain benefits and avoid lapsing policies. Insurers frequently provide various payment methods, including online options or automated bank transfers, to streamline the process. Maintaining current contact information (email addresses and phone numbers) is also vital for effective communication regarding policy changes or updates in the insurer's services.

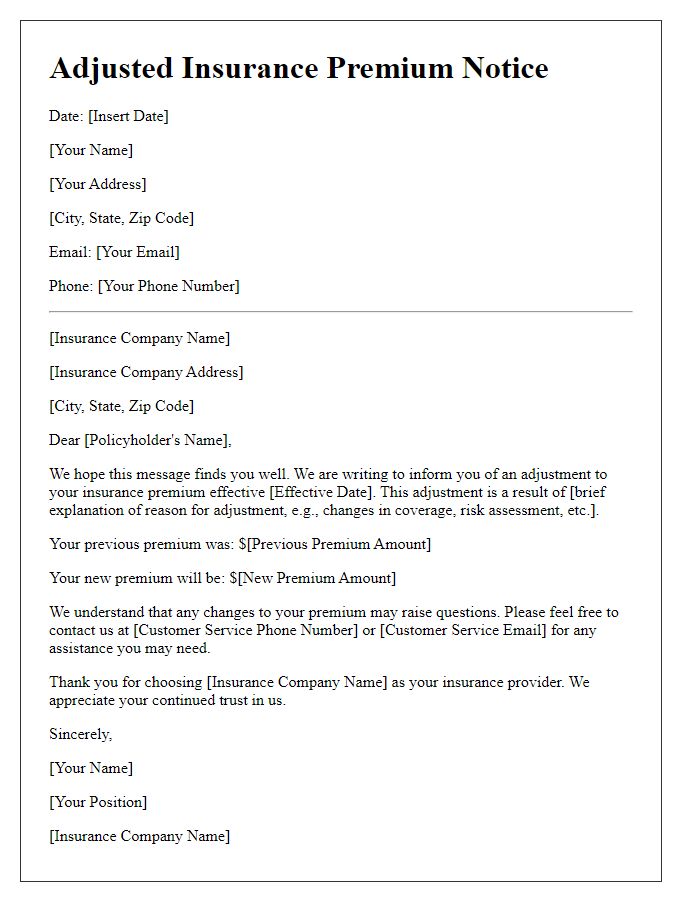

Premium Amount Due

Premium notices for insurance policies inform policyholders of the amount due for coverage. The premium, often specified as a dollar amount, serves as the periodic payment required to maintain the insurance validity. This notice typically includes details such as policy number, due date, and coverage type, including auto, home, or health insurance. In the context of auto insurance, for instance, the premium amount may vary based on factors like vehicle make, model, and driving history. Keeping payments current ensures uninterrupted coverage against risks or losses, such as theft, accidents, or property damage. Failing to make the premium payment by the due date could lead to policy lapses, resulting in potential financial exposure in the event of an incident. Monitoring payment schedules contributes to effective financial planning and risk management.

Payment Due Date

Insurance policy premium notices inform policyholders about upcoming payment deadlines, crucial for maintaining coverage. A premium notice typically includes the specific due date (often 30 days from the notice date), policy number for easy reference, and details of the premium amount, which may vary based on coverage types such as life insurance, health insurance, or auto insurance. In some instances, the notice will specify late payment penalties, interest rates, or grace periods allowing for comprehension of potential repercussions. Policies usually mention acceptable payment methods, including credit cards, direct bank transfers, or online payment portals. Reminders for additional services or benefits, often tied to timely premium payments, are also common, aiming for enhanced customer engagement and satisfaction.

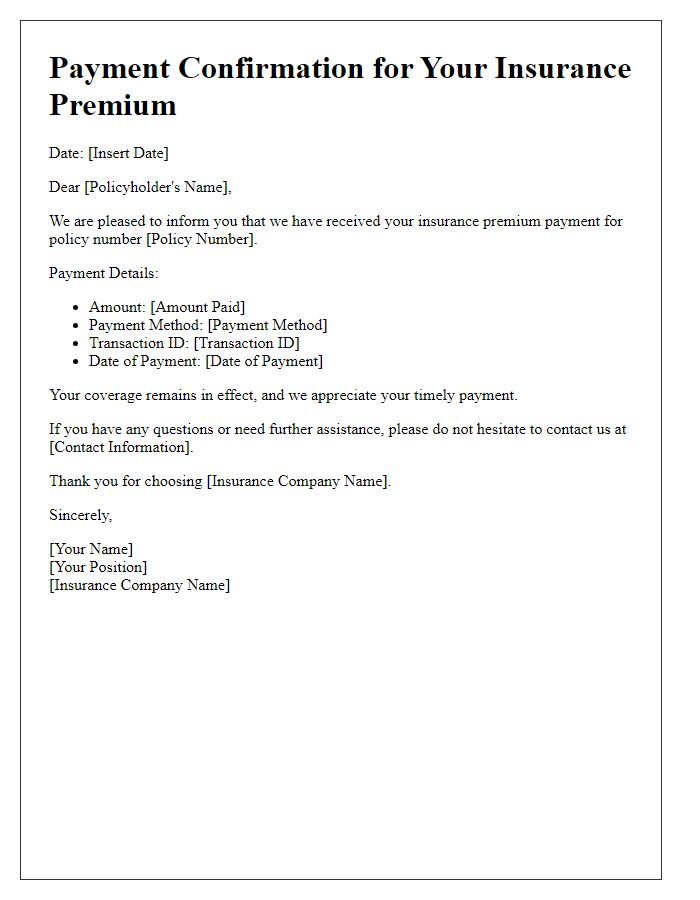

Payment Methods

Insurance policy premium notices often outline various payment methods available to policyholders. For instance, options include online payments, typically via secure websites or mobile applications, allowing immediate transactions from checking accounts or credit cards. Personal checks can be mailed to designated processing centers, ensuring timely delivery to avoid lapses. Automatic bank drafts enable recurring payments directly from a bank account, removing manual intervention. Additionally, phone payments may be facilitated through customer service representatives who process payments securely. Providers may also offer convenient payment plans, which divide the overall premium amount into manageable installments, reducing financial strain for policyholders. Each option aims to enhance customer satisfaction and maintain policy continuity.

Contact Information for Inquiries

Insurance policy premium notices serve as essential communications from insurance companies. These notices often contain critical details about payment amounts, due dates, and policy terms. Contact information for inquiries is typically included, allowing policyholders to reach customer service representatives for questions or clarification. Common contact methods may involve phone numbers, email addresses, or online chat options, ensuring convenient access to assistance. Quick responses are crucial for resolving potential payment issues or understanding policy changes. This transparency strengthens customer relationships and fosters a sense of reliability within the insurance industry.

Comments